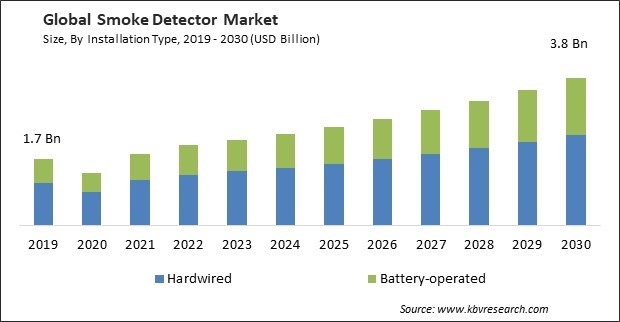

The Global Smoke Detector Market size is expected to reach $3.8 billion by 2030, rising at a market growth of 8.1% CAGR during the forecast period. In the year 2022, the market attained a volume of 67,514.4 thousand Units experiencing a growth of 8.0% (2019-2022).

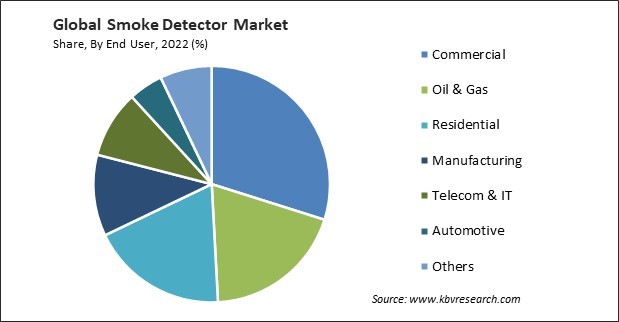

Regulations governing commercial and industrial spaces often require fire safety systems, including smoke detectors. These requirements address the risks associated with larger spaces, valuable assets, and complex operations. Therefore, Commercial segment generated $619.4 million revenue in the market in 2022. Some governments provide incentives, grants, or subsidies to support the implementation of safety measures, including installing smoke detectors. As a result, these initiatives contribute to the positive impact of regulations on market growth.

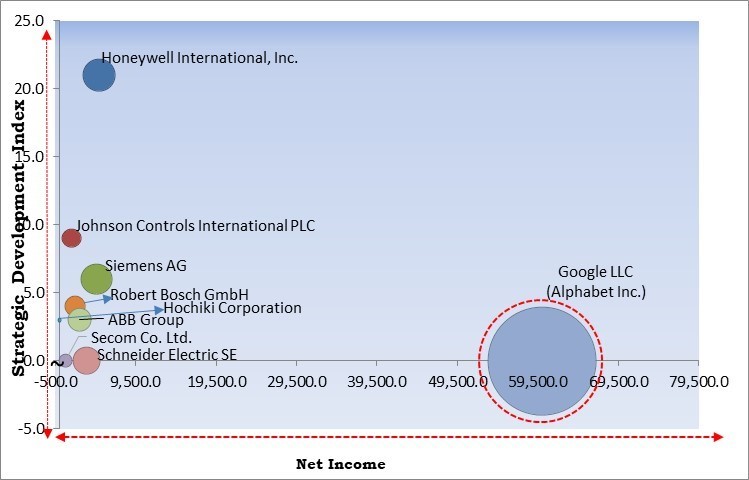

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In March, 2022, Hochiki Corporation launched the SOC-E3N, a new generation conventional photoelectric smoke detector. The launched product would include Hochiki’s unique High-Performance photoelectric smoke chamber eliminating the need to use Ionisation Detectors in the majority of applications. Moreover, In September, 2019, ABB Group introduced a new Alarm-Stick, which combines ABB’s smoke, heat, and carbon monoxide detectors into ABB-free@home. The launched product would connect to the ABB-free@home System Access Point via USB and communicate wirelessly to the detectors, using the VdS 3515 certified detector protocol, making the integration process extremely easy.

Based on the Analysis presented in the KBV Cardinal matrix; Google LLC (Alphabet Inc.) is the major forerunner in the Market. Companies such as Honeywell International, Inc., Johnson Controls International PLC and Siemens AG are some of the key innovators in the Market. In March, 2023, Honeywell International, Inc. released NOTIFIER INSPIRE, a fire alarm system with UL-approved self-testing smoke detectors. The launched product would be created to create a safer building environment by increasing facility managers' awareness of system needs while equipping service providers with digital self-testing tools that streamline maintenance and help regulatory compliance and system uptime.

Rapid urbanization often leads to increased infrastructure development, including residential buildings, commercial complexes, and industrial facilities. As urban areas expand, there is a heightened demand for fire safety solutions, including smoke detectors, to protect both lives and property. Urbanization is associated with higher population density in cities, leading to the construction of multifamily residences, office buildings, and commercial establishments. The concentrated presence of people and valuable assets necessitates installing effective fire detection systems. Thus, the increasing population and rapid urbanization have created a conducive environment for the growth of the market.

Wireless smoke detectors offer easier installation and flexibility in placement. These devices can convey with each other wirelessly, forming a network that provides comprehensive coverage. Wireless connectivity also simplifies integration with broader smart home or building automation systems. Technological advancements enable smoke detectors to be interconnected, meaning that if one detector in a system detects smoke, all interconnected detectors sound alarms. This feature improves the speed of response and ensures that occupants throughout a building are alerted, enhancing overall safety. Thus, technological advancements expand the market growth in the coming years.

Integrating smoke detectors with existing building infrastructure can be complicated, especially in older structures. Retrofitting systems to meet modern safety standards may involve significant modifications, impacting the cost and complexity of installation. Ensuring a stable and reliable power supply for smoke detectors is crucial. Complications may arise if frequent power outages or battery-operated detectors are not properly maintained and monitored. Due to such factors, market growth is expected to decline.

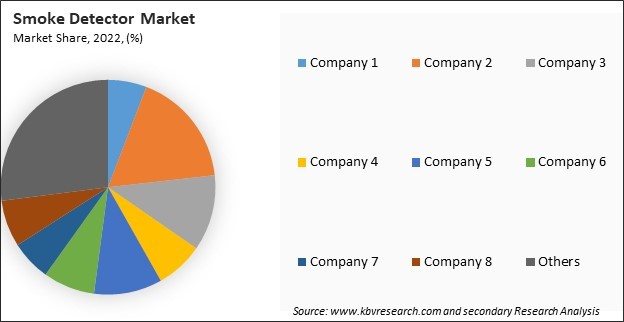

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships Collaborations.

Based on end user, the market is fragmented into commercial, oil gas, telecom IT, automotive, manufacturing, residential, and others. In 2022, the commercial segment registered the highest revenue share in the market. Many jurisdictions and building codes mandate the installation of smoke detectors in commercial buildings. Compliance with these rules is not only a legal requirement but also essential for ensuring the safety of occupants and minimizing liability for property owners and managers. Advanced smoke detection systems often come with 24/7 monitoring capabilities. This allows for continuous surveillance, immediate detection of any anomalies, and rapid response to potential fire threats, even when the commercial space is unoccupied.

On the basis of product type, the market is further divided into photoelectric, ionization, dual sensor, and other. The dual sensor smoke detector segment acquired a substantial revenue share in the market in 2022. The dual-sensor approach allows the detector to cross-verify signals from both sensors, making the alarm more reliable and less prone to false positives. The adaptability of dual-sensor detectors makes them suitable for addressing the diverse nature of fire risks in different spaces, providing a flexible solution for comprehensive fire protection. Using dual-sensor detectors can offer assurance that various fire risks are adequately addressed, aligning with regulatory requirements and safety guidelines.

By installation type, the market is segmented into battery-operated and hardwired. In 2022, the hardwired segment dominated the market with the maximum revenue share. Hardwired smoke detectors are connected to the building's electrical wiring, which provides a continuous power supply. This eliminates the need for periodic battery replacements, ensuring the smoke detector is always operational. Hardwired smoke detectors can be integrated into broader fire alarm and security systems. Integration permits centralized monitoring and control, providing a comprehensive approach to building safety. Modern hardwired smoke detectors may come with advanced components, such as differentiating between smoke and steam, wireless connectivity for remote monitoring, and voice alerts.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 2.1 Billion |

| Market size forecast in 2030 | USD 3.8 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 8.1% from 2023 to 2030 |

| Number of Pages | 395 |

| Number of Table | 773 |

| Quantitative Data | Volume in Thousand Units, Revenue in USD Billion, and CAGR from 2019 to 2030 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Installation Type, Product Type, End User, Region |

| Country scope |

|

| Companies Included | Hochiki Corporation, Honeywell International, Inc., Ceasefire Industries Pvt. Ltd., Johnson Controls International PLC, Google LLC (Alphabet Inc.), ABB Group, Robert Bosch GmbH, Secom Co. Ltd., Schneider Electric SE, and Siemens AG |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region witnessed the largest revenue share in the market. Governments are taking several steps in the form of various stringent policies to curb the number of accidental fires, especially in the residential sector; as per the National Fire Protection Association (NFPA), U. S., approximately three out of every five home fire deaths were caused by fires in homes with no working smoke alarms (16%) or no smoke alarms (41%). These statistics encourage customers to opt for the smoke and fire alarm procedure in their residential and commercial premises.

Free Valuable Insights: The Global Smoke Detector Market size to reach USD 3.8 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Hochiki Corporation, Honeywell International, Inc., Ceasefire Industries Pvt. Ltd., Johnson Controls International PLC, Google LLC (Alphabet Inc.), ABB Group, Robert Bosch GmbH, Secom Co. Ltd., Schneider Electric SE, and Siemens AG.

By Installation Type (Volume, Thousand Units, USD Billion, 2019-2030)

By Product Type (Volume, Thousand Units, USD Billion, 2019-2030)

By End User (Volume, Thousand Units, USD Billion, 2019-2030)

By Geography (Volume, Thousand Units, USD Billion, 2019-2030)

This Market size is expected to reach $3.8 billion by 2030.

Increasing population and rapid urbanization are driving the Market in coming years, however, Complications associated with the installation of smoke detector restraints the growth of the Market.

Hochiki Corporation, Honeywell International, Inc., Ceasefire Industries Pvt. Ltd., Johnson Controls International PLC, Google LLC (Alphabet Inc.), ABB Group, Robert Bosch GmbH, Secom Co. Ltd., Schneider Electric SE, and Siemens AG.

In the year 2022, the market attained a volume of 67,514.4 thousand Units experiencing a growth of 8.0% (2019-2022).

The Photoelectric segment is generating the highest revenue in the Market by Product Type in 2022; thereby, achieving a market value of $1.4 billion by 2030.

The North America region dominated the Market by Region in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $1.2 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.