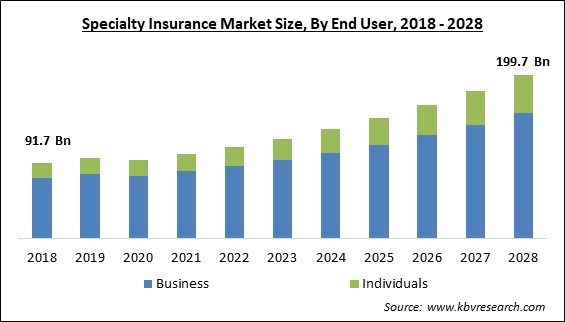

The Global Specialty Insurance Market size is expected to reach $199.7 billion by 2028, rising at a market growth of 10.2% CAGR during the forecast period.

Specialty insurance is a category of insurance that protects distinctive or exceptional things that are ordinarily excluded from other insurance plans. In response to altering risks, market factors, and opportunities, small and medium-sized businesses frequently look for non-standard policy alternatives to handle their specialty. As a result, SMEs have substantial growth prospects for the international specialized insurance industry.

In addition, specialty insurance providers are concentrating on utilizing Application Programming Interfaces (APIs) and digital services platforms to gain access to various tasks and data throughout the policy lifecycle, including further integrating third-party services. These types of insurances are made to cover companies with unusual requirements, defend against negligence lawsuits, and enable the payment of judgments and attorneys' costs.

Also, this insurance is acquired for things or occasions that are considered exceptional and infrequently covered by conventional insurance policies. The healthcare, environmental, construction, and energy industries all have a high need for specialty insurance. Due to the rise in demand for specialized knowledge throughout the forecast period, the market for specialty insurance globally is predicted to expand.

The greater incorporation of technology into specialty insurance solutions is another factor projected to propel the specialty insurance market's expansion. Also, it is now possible to accurately estimate both current and future threats in the specialty insurance market because of the usage of technologies, including the internet of things (IoT) as well as blockchain.

The pandemic's suspension of international trade, new development, and travel had a negative impact on industries like marine, construction, and aviation. However, due to shifting business trends, major market participants embraced technologies like cognitive automation for real-time communication with companies & individuals, as well as solutions based on artificial intelligence (AI) for the claim processing. As a result, the market suffered from the early restrictions placed on several industries due to the pandemic. Still, it is anticipated that things will improve when COVID-19 prevalence declines and new technology is adopted. Therefore, in the coming years, the specialty insurance market will grow despite the negative impact of the pandemic.

The need for specialized knowledge is growing due to the specialty insurance programs' ability to provide comprehensive and personalized solutions to satisfy the requirements of business segments with distinctive risk profiles. Program administrators (PAs), one of the key distributors of specialized insurance, also have a significant impact on the market. These administrators perform the function of specific expertise, actively engaged in comprehending target market exposures. In order to offer specialized coverages in the market, several specialty brokers, policyholders, and insurers increasingly rely on this knowledge.

Artificial intelligence (AI) is being used increasingly, and AI-capable gadgets are now prevalent in households worldwide. When buying something as significant as P&C insurance, consumers are especially looking for individualized experiences. To satisfy the quick-paced demands of contemporary customers, AI gives insurers the flexibility to design these distinctive experiences. The solution is to utilize AI's skills to use the vast amounts of consumer data currently available to build customized experiences based on a person's behavior and habits. Thus, the expansion of the specialty insurance market is being driven by these significant benefits and technical advancements in the products.

The insurance sector is currently running at a deficit. Significant weather catastrophes are causing extreme property damage, but the professional indemnity and liability industry has also experienced rising claims and subpar financial underwriting performance. As a result, insurance companies will demand higher prices to make up for this. In more extreme situations, insurers may stop covering the businesses or occupations that have fared poorly. Thus, it is anticipated that the unstable insurance market will hinder the adoption of specialty insurance and thereby restrain the market growth.

Based on type, the specialty insurance market is segmented into political risk & credit insurance, entertainment insurance, art insurance, livestock & aquaculture insurance, marine, aviation & transport (MAT) insurance, and others. The art insurance segment garnered a promising growth rate in the specialty insurance market in 2021. In most cases, specialty insurance offers flexibility in terms of creating the policy based on selective or whole loss as well as various supplemental coverages like exhibition coverage. This freedom to select a personalized policy fuels the specialty insurance market's expansion. Any unforeseen physical loss or damage to the asset insured is covered by the art insurance policy.

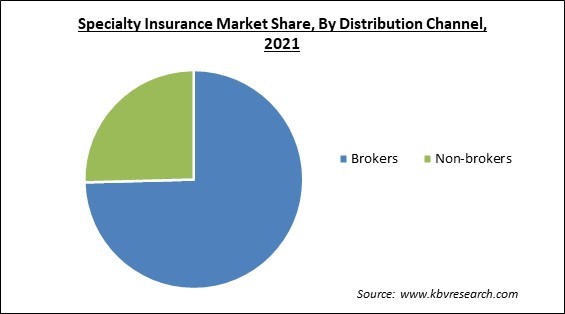

On the basis of distribution channel, the specialty insurance market is divided into brokers and non-brokers. The non-broker segment witnessed a significant revenue share in the specialty insurance market in 2021. Direct selling, also known as non-broker distribution, is a practical method for delivering specialized insurance to clients without incurring overhead expenditures and lowering advertising costs. For specialized insurance direct sales, these are the main growth drivers. In this form of distribution used in the insurance sector, insurer staff, rather than independent brokers, advertise insurance plans and coverages.

By end user, the specialty insurance market is classified into business and individuals. The business segment garnered the largest revenue share in the specialty insurance market in 2021. This is due to the quick market expansion and growing commercial danger to various trades. Furthermore, the specialty insurance market is anticipated to benefit greatly from corporate growth with the goal of delivering goods and services globally. Many businesses, especially SMEs, consider specialty insurance for every step of their workflows to ensure the availability of finances in case of any contingencies or emergencies.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 102.5 Billion |

| Market size forecast in 2028 | USD 199.7 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 10.2% from 2022 to 2028 |

| Number of Pages | 224 |

| Number of Table | 364 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | End User, Distribution Channel, Type, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the specialty insurance market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Europe region procured the highest revenue share in the specialty insurance market in 2021. This is due to a rise in political risk associated with commerce, like counterparty non-payment, non-delivery of products paid for in advance, embargo, and license revocation. One of the key trends in the industry in this region is the rise in the use of voice assistants and chatbots to help businesses and individuals that need specialty insurance.

Free Valuable Insights: Global Specialty Insurance Market size to reach USD 199.7 Billion by 2028

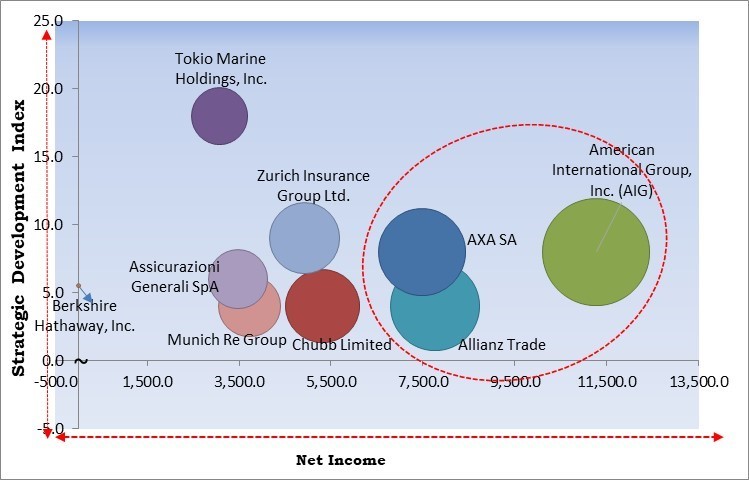

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; American International Group, Allianz Trade, and AXA SA is the major forerunner in the Specialty Insurance Market. Companies such as Tokio Marine Holdings, Inc., Zurich Insurance Group Ltd. are some of the key innovators in Specialty Insurance Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Tokio Marine Holdings, Inc., Allianz Trade (Allianz Group), AXA SA, Chubb Limited, Zurich Insurance Group Ltd., Berkshire Hathaway, Inc., Assicurazioni Generali SpA, Munich Re Group, American International Group, Inc. (AIG), and PICC Property and Casualty Company Limited.

By End User

By Distribution Channel

By Type

By Geography

The Specialty Insurance Market size is projected to reach USD 199.7 billion by 2028.

A rise in the need for professional expertise are driving the market in coming years, however, Decrease in risk capacity and volatile insurance sector restraints the growth of the market.

Tokio Marine Holdings, Inc., Allianz Trade (Allianz Group), AXA SA, Chubb Limited, Zurich Insurance Group Ltd., Berkshire Hathaway, Inc., Assicurazioni Generali SpA, Munich Re Group, American International Group, Inc. (AIG), and PICC Property and Casualty Company Limited.

The Brokers segment acquired maximum revenue share in the Global Specialty Insurance Market by Distribution Channel in 2021 thereby, achieving a market value of $146.5 billion by 2028.

The Europe market dominated the Global Specialty Insurance Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $72.2 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.