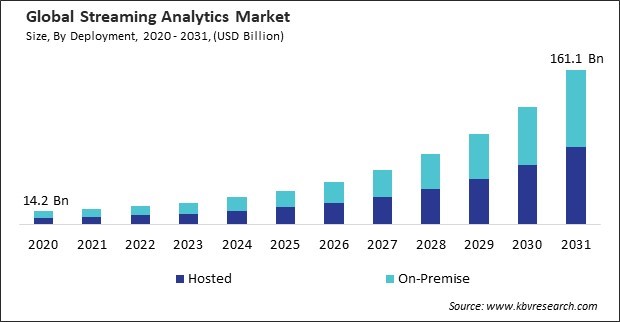

“Global Streaming Analytics Market to reach a market value of USD 161.1 Billion by 2031 growing at a CAGR of 28.0%”

The Global Streaming Analytics Market size is expected to reach $161.1 billion by 2031, rising at a market growth of 28.0% CAGR during the forecast period.

Streaming analytics solutions enable organizations to analyze large volumes of transactional data in real time, identifying suspicious patterns and anomalies that could indicate fraudulent behavior, thereby enhancing security measures and reducing financial losses. In 2023, the fraud detection segment registered 26% revenue share in the Streaming Analytics Market . This can be attributed to the growing need for real-time monitoring and analysis to detect and prevent fraudulent activities across various industries such as banking, financial services, insurance (BFSI), retail, and e-commerce.

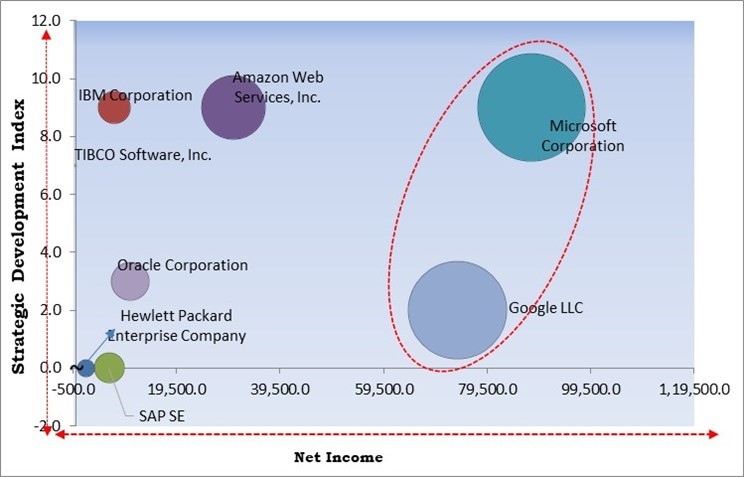

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In June, 2024, Amazon partnered with Omnicom, a global marketing and communications holding company, to integrate Amazon Ads’ browsing, shopping, and streaming insights into Omnicom's media solutions. This collaboration aims to enhance advertising effectiveness by linking linear and CTV investments to Amazon purchases, enabling clients like Clorox to better understand consumer behavior and optimize marketing ROI across various media channels. Additionally, In October, 2024, Microsoft partnered with Databricks, a company that provides an open-source platform for data engineering, to enhance the Microsoft Intelligent Data Platform. This collaboration enables unified cloud-native analytics, including real-time streaming analytics, business intelligence, and machine learning capabilities. By integrating tools like Azure Synapse Analytics and Databricks, the solution supports efficient data governance, democratizing analytics, and accelerating digital transformation.

Based on the Analysis presented in the KBV Cardinal matrix; Microsoft Corporation and Google LLC are the forerunners in the Streaming Analytics Market . Companies such as Amazon Web Services, Inc., Oracle Corporation, IBM Corporation are some of the key innovators in Streaming Analytics Market . In September, 2023, Google expanded its collaboration with Salesforce, a leading customer relationship management (CRM) company, to integrate generative AI into business productivity tools. This integration will enable users to seamlessly work across platforms like Salesforce Customer 360 and Google Workspace, generating customized content, updating records, and triggering workflows. The partnership aims to enhance productivity by leveraging AI technologies, including Google’s Vertex AI, to create connected AI experiences and streamline business operations.

Real-time data processing enables organizations to analyze and act upon data instantly as it is generated. This capability is essential for retail, healthcare, finance, and manufacturing industries, where timely decision-making is critical. For example, retail businesses use real-time analytics to personalize customer offers based on browsing and purchasing behavior.

Additionally, the global shift toward digital transformation fuels the demand for streaming analytics as businesses increasingly prioritize real-time data processing to stay competitive. As organizations across industries modernize their infrastructure, they are turning to cloud-based solutions, IoT devices, and artificial intelligence (AI) to improve operational efficiency and agility.

One of the major obstacles to the widespread adoption of streaming analytics is the high cost associated with implementing and maintaining the necessary infrastructure. Setting up a streaming analytics system requires investment in specialized hardware, software, and cloud resources. This cost burden is a key factor holding back some companies from fully embracing streaming analytics solutions.

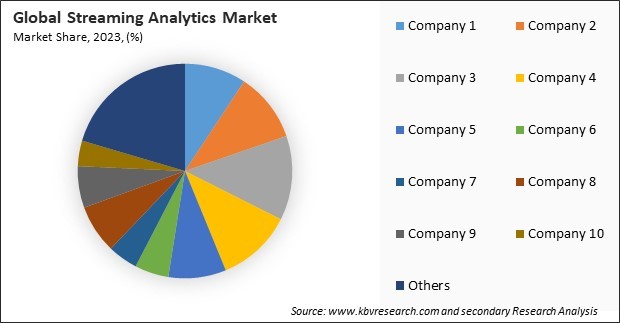

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

Based on application, the market is categorized into fraud detection, marketing & sales, risk management, predictive asset management, network management & optimization, location intelligence, supply chain management, and others. In 2023, the risk management segment held 14% revenue share in the market. Finance, healthcare, and energy organizations are adopting streaming analytics to identify and mitigate risks in real time.

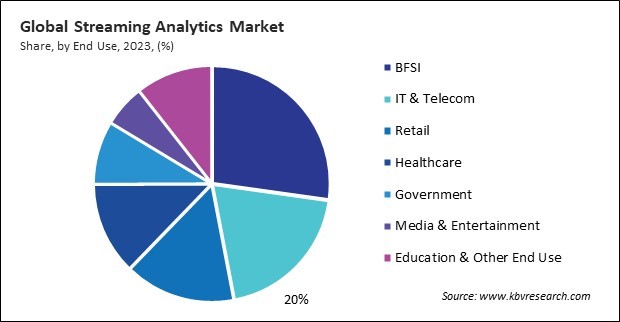

By end use, the market is divided into BFSI, IT & telecom, retail, healthcare, government, media & entertainment, education, and others. In 2023, the BFSI segment registered 27% revenue share in the market. This dominance can be attributed to the sector's critical need for real-time data processing and analysis to enhance decision-making, improve customer service, and mitigate risks. Financial institutions, including banks, insurance companies, and investment firms, leverage streaming analytics to monitor real-time transactions, detect fraud, comply with regulatory requirements, and personalize customer interactions.

Based on deployment, the market is divided into hosted and on-premise.The on-premise segment attained 49% revenue share in the market in 2023. Many organizations prefer on-premise deployments due to concerns about data security, privacy, and compliance with regulatory requirements.

On the basis of component, the market is segmented into software and services. In 2023, the services segment attained 37% revenue share in the market. Services include professional services such as consulting, implementation, support, and managed services.

The services segment is further subdivided into professional services, managed services, and others. The managed services service segment held 30% revenue share in the market in 2023. Managed services provide ongoing management, monitoring, and maintenance of streaming analytics solutions, allowing businesses to focus on their core activities while ensuring their analytics systems operate optimally.

Free Valuable Insights: Global Streaming Analytics Market size to reach USD 161.1 Billion by 2031

The Streaming Analytics Market is highly competitive, driven by the growing need for real-time data processing across industries such as finance, healthcare, retail, and manufacturing. Key market attributes include scalability, low-latency processing, seamless integration with existing data ecosystems, and advanced machine learning capabilities. The adoption of cloud-based solutions and edge computing has further fueled competition, with vendors emphasizing robust security features, ease of use, and support for diverse data formats to meet the evolving demands of real-time analytics applications.

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific region generated 26% revenue share in the market in 2023. Countries like China, India, and Japan are at the forefront of adopting streaming analytics to manage large volumes of data from extensive internet and mobile usage. In the BFSI sector, streaming analytics helps in fraud detection, risk management, and personalized customer services.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 23.1 Billion |

| Market size forecast in 2031 | USD 161.1 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 28.0% from 2024 to 2031 |

| Number of Pages | 371 |

| Number of Tables | 603 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Deployment, Component, End Use, Application, Region |

| Country scope |

|

| Companies Included | Amazon Web Services, Inc. (Amazon.com, Inc.), Microsoft Corporation, Hewlett Packard Enterprise Company, IBM Corporation, Google LLC, SAS Institute, Inc., Oracle Corporation, Software AG, SAP SE, and TIBCO Software, Inc. (Vista Equity Partners Management, LLC) |

By Deployment

By Component

By End Use

By Application

By Geography

This Market size is expected to reach $161.1 billion by 2031.

Rising interest in predictive maintenance and operational efficiency are driving the Market in coming years, however, High cost of implementing and maintaining streaming analytics infrastructure restraints the growth of the Market.

Amazon Web Services, Inc. (Amazon.com, Inc.), Microsoft Corporation, Hewlett Packard Enterprise Company, IBM Corporation, Google LLC, SAS Institute, Inc., Oracle Corporation, Software AG, SAP SE, and TIBCO Software, Inc. (Vista Equity Partners Management, LLC)

The expected CAGR of this Market is 28.0% from 2024 to 2031.

The Hosted segment is leading the Market by Deployment in 2023, thereby, achieving a market value of $81.4 billion by 2031.

The North America region dominated the Market by Region in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $56,355.9 million by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges