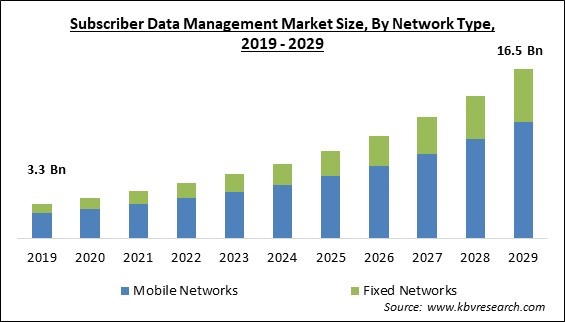

The Global Subscriber Data Management Market size is expected to reach $16.5 billion by 2029, rising at a market growth of 17.6% CAGR during the forecast period.

Subscriber data management (SDM) is a unified network service that stores and maintains all subscriber data, i.e., all subscription data associated with a customer using any services in traditional and next-gen mobile and fixed networks. It offers a single point of administration and a 360-degree view of the whole subscriber database, along with a real-time view of each subscriber. The combined data is kept in a geo-redundant and highly accessible unified data repository (UDR) and divided into subscriber profiles that contain all the data required to allow users to access services and stop unauthorized users from abusing services.

SDM uses a network data layer technique to interact separately with many applications. It reduces duplication by gathering data into a centralized, single, highly scalable, reliable, and affordable repository. In order to enable roaming services in places without 5G, most 5G networks will coexist alongside existing 4G networks. Even 5G networks that are purely 5G will need to interoperate with legacy networks.

Subscriber data management is among the most crucial tasks in telecommunications networks. The proper management of all subscriber data and services is now more important than ever to maintain an operator's economic success with the advent of 5G and the development of cloud architectures. The transition of telecommunications services from 4G to 5G has resulted in redesigning the network's architecture, forcing operators to reconsider how they manage data entering, leaving, and flowing across the network. In addition, more database capacity is now necessary as communication services develop, which raises the total cost of ownership (TCO) and causes silo-based networks to have a more fragmented picture of client data.

The COVID-19 pandemic had a significant impact on enterprises all around the world. The development of SDM solutions benefited from it. The growing trend of individualized company operations to improve the customer experience also led to firms spending more money on SDM solutions. Also, technology offers businesses a variety of advantages, such as the capacity to manage budgets and aid in improving financial revenue management. Moreover, possibilities for the market are anticipated to emerge in the future due to corporate migration to the cloud and international initiatives for digital transformation. Therefore, the pandemic had a positive impact on the market.

By dividing their resources among several contexts, businesses are increasingly embracing cloud-based models. Because of its benefits of scalability, flexibility, and low cost, cloud based SDM solutions have become more and more popular. Also, it makes it simple to collect and analyze data for enterprises to centrally evaluate data produced from many places and collect data from various applications or platforms. Moreover, SDM service providers like Nokia Corporation and Optiva Inc., among others, have introduced SDM products to meet the demand for SDM from businesses in various regions due to the move to the cloud. During the projected period, these factors are anticipated to increase demand for subscriber data management and hence the market's growth.

Subscriber data management (SDM) unifies subscriber data management across several network domains. In unified data repositories, the SDM solution integrates and administers the subscriber data of various network carriers, like access preferences, locations, authentication, identities, services, and presence. It also enhances carrier networks by bringing down operating expenses while maintaining a stable level of service for subscribers. In addition, operators can more effectively monetize their subscriber data owing to its consolidated subscriber data analysis capabilities. Reduced network complexity, the total cost of ownership, as well as time to market for additional services, are further benefits of SDM for telecom operators. As a result, the market is growing rapidly due to telecommunication companies' increasing usage of SDM solutions.

Data security concerns remain a significant barrier for subscriber data management organizations. Piracy costs SDM software service companies a lot of customers and money. Some pirates breach accounts to take real users' login information. Confidential user data is then uploaded utilizing peer-to-peer file or document-sharing protocols or a VPN to access video content, and these stolen credentials are sold. Pirated files are subsequently made available for free download for various devices. Therefore, such strong SDM privacy concerns are anticipated to limit the subscriber data management market's growth in the coming years.

On the basis of network type, the subscriber data management market is divided into mobile networks and fixed networks. The mobile networks segment acquired the largest revenue share in the subscriber data management market in 2022. The elements that contribute to the segment's expansion are the worldwide penetration of mobile users and the increasing demand for mobile access in areas lacking terrestrial infrastructure. Mobile broadband depends on a cellular network for devices such as tablets and smartphones to have internet access. Therefore, it is a suitable replacement for broadband services (such as DSL or cable) and a substitute for conventional cellular phone service.

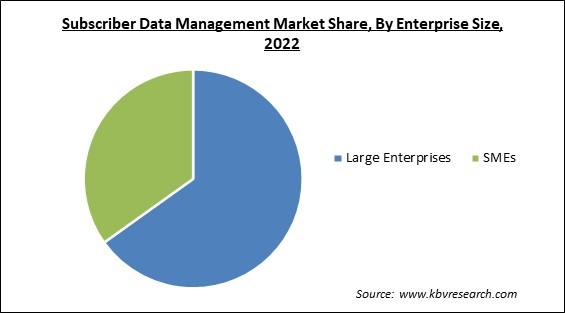

On the basis of enterprise size, the subscriber data management market is bifurcated into large enterprises and SMEs. The small and medium enterprises (SMEs) segment acquired a substantial revenue share in the subscriber data management market in 2022. By switching from conventional SDM systems to next-generation SDM platforms, small and medium-sized businesses are gaining considerable market share. To manage their subscriber data with the best possible resource utilization, they are more inclined to turn to cloud-based solutions.

Based on solution, the subscriber data management market is categorized into subscriber data repository, subscriber policy management, subscriber identity management, and subscriber location & device information management. The subscriber policy management segment procured a considerable growth rate in the subscriber data management market in 2022. Critical applications must be given priority over non-critical applications, according to policy-based data differentiation requirements. It emphasizes the proper size allocation of resources with the equitable size of billing for networks because subscriber-centric policy management allows service providers to adapt to the distribution of network resources according to subscribers' payments. Supplying service providers with high-quality IT services and effective administration helps to improve the business model.

Based on deployment, the subscriber data management market is segmented into on-premise and cloud. The on-premise segment witnessed the maximum revenue share in the subscriber data management market in 2022. The growth can be linked to the many benefits that come with on-premise deployments, such as the high level of data protection and safety. Industries like on-premise deployment models because they offer greater data security and are less likely to experience data breaches than cloud-based deployment models, which increases demand for on-premise deployment within the sectors.

Based on application, the subscriber data management market is classified into mobile, voice over internet protocol (VoIP) and others. The mobile segment recorded the largest revenue share in the subscriber data management market in 2022. Its rise is anticipated to be fueled by the popularity of smartphones, dongles, iPhones, tablets, and iPads throughout the projection period. However, it depends on the accessibility of the network, the data, the fees associated with using the data, and any ancillary services offered by companies in the cellular network subscription industry.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 4.6 Billion |

| Market size forecast in 2029 | USD 16.5 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2029 |

| Revenue Growth Rate | CAGR of 17.6% from 2023 to 2029 |

| Number of Pages | 313 |

| Number of Table | 513 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Network Type, Enterprise Size, Solution, Deployment, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the subscriber data management market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment garnered the maximum revenue share in the subscriber data management market in 2022. Due to its initial implementation of cutting-edge innovations and the presence of significant international SDM players in countries like the United States and Canada, North America is predicted to dominate the market over the projection period. In addition, voLTE demand has been growing due to the proliferation of cloud-based monetization platforms and the availability of multiple telecommunications companies in the region, which is projected to positively affect the North America market.

Free Valuable Insights: Global Subscriber Data Management Market size to reach USD 16.5 Billion by 2029

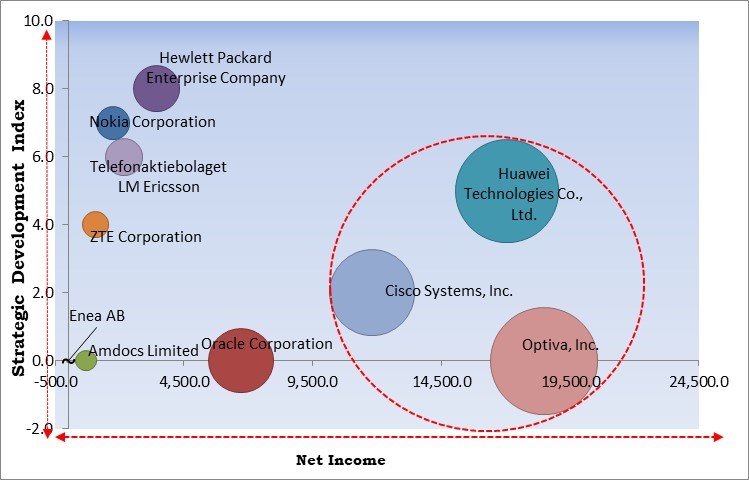

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Optiva, Inc., Huawei Technologies Co., Ltd., and Cisco Systems, Inc. are the forerunners in the Subscriber Data Management Market. Companies such as Hewlett Packard Enterprise Company, Nokia Corporation, and Telefonaktiebolaget LM Ericsson are some of the key innovators in Subscriber Data Management Market.

The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include Hewlett Packard Enterprise Company, Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Nokia Corporation, Oracle Corporation, Cisco Systems, Inc., ZTE Corporation, Telefonaktiebolaget LM Ericsson, Optiva, Inc., Amdocs Limited, and Enea AB.

By Network Type

By Enterprise Size

By Solution

By Deployment

By Application

By Geography

The Market size is projected to reach USD 16.5 billion by 2029.

Rising use of SDM solutions by the telecommunication sector are driving the Market in coming years, however, Increasing data security and privacy concerns restraints the growth of the Market.

Hewlett Packard Enterprise Company, Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Nokia Corporation, Oracle Corporation, Cisco Systems, Inc., ZTE Corporation, Telefonaktiebolaget LM Ericsson, Optiva, Inc., Amdocs Limited, and Enea AB.

The Voice over Internet Protocol (VoIP) market has shown a high growth rate of 17.9% during (2023 - 2029).

The Subscriber Data Repository market is leading the Market by Solution in 2022, thereby achieving a market value of $6.2 billion by 2029.

The North America market dominated the Market by Region in 2022 and would continue to be a dominant market till 2029; thereby, achieving a market value of $5,426.2 million by 2029.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.