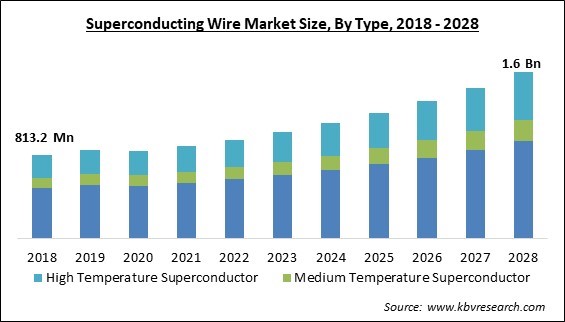

The Global Superconducting Wire Market size is expected to reach $1.6 billion by 2028, rising at a market growth of 9.1% CAGR during the forecast period.

Electrical cables consisting of superconductive material are known as superconducting wires. These wires have no electrical resistance when cooled past their transition temperatures. Although traditional superconductors like niobium-titanium are most frequently used, high-temperature superconductors like yttrium barium copper oxide (YBCO) are starting to gain popularity. Its primary use is in superconducting magnets applications generally utilized in medical and scientific equipment where strong magnetic fields are required. The market for superconducting wire is primarily driven by the increasing use of superconducting wire in place of conventional wires and the development of offshore wind farms that use superconducting technologies.

Niobium-titanium, as well as other superconductors, make up the superconducting wire. YBCO, a high-temperature superconductor, currently offers numerous advantages over copper and aluminum, including significantly greater current densities as well as zero power dissipation. Superconducting cables are used in the smart grid, electric motors, transformers, and power storage devices. High-temperature superconducting wires, low-temperature superconducting wires, and the medium-temperature superconducting wire are the three main varieties of superconducting wires, respectively, based on the temperature at which the conductor must be chilled to become a superconductor.

The development of the superconducting wire market is primarily being driven by rising demand for MRI systems based on superconductors and improvements in the technology for creating computer chips, which has increased demand for superconductors. Moreover, these superconducting wires are small and have a high-power transfer capacity. High-field magnet applications, magnetic resonance imaging (MRI), and nuclear magnetic resonance (NMR) magnets are just a few of the uses for superconducting wires. In addition, superconducting wire, a component of computer chip design technology, is also undergoing significant technical improvement.

The COVID-19 pandemic severely hampered business operations in the market for superconducting wire, the adoption of 5G technologies, the growing digitization of the world's economies, and significant investments in data centers opened up new business opportunities. The need for semiconductor devices is rising as organizations rapidly shift into digital enterprises. As a result, market participants must overcome the uncertainty caused by international macroeconomic issues and geopolitical trade disputes. Therefore, it is evident that the pandemic initially had a negative impact on the market, but the simultaneous shift of various industries toward digitalization presented growth opportunities for the market.

Superconductivity has been demonstrated to reduce energy losses for transporting a significant quantity of energy over vast distances with less infrastructure development than traditional wire configurations. Compared to normal wires, high-temperature superconducting wires can assure minimal power transmission losses through cables, transformers, fault current limiters, and generators. In addition, since high-temperature superconducting wires are buried or laid on the ground instead of overhead, superconductors also reduce the need for electromagnetic disruptions, which are necessary for normal wires. Therefore, the increased usage of superconducting wires across industries for various purposes is propelling the expansion of the market.

Toshiba Energy Systems & Solutions Company (Toshiba ESS) announced the creation of a prototype superconducting motor employing superconducting wires to address the needs of the mobility sector. Large mobility applications can benefit from the lightweight, high-output density, and high-speed rotation of this superconducting motor, which has the highest capacity of 2 MW. Throughout the projection period, it is also projected that additional magnetic levitation research and development projects for the healthcare and transportation industries would provide market participants with lucrative chances.

The majority of applications, such as maglev, airborne generators, fusion reactors, rocket propulsion, generators, and high-field magnets, are still in the early stages of product development, and significant investments are being made in the search for new superconducting materials. Insufficient participation from end users is another factor that reduces the dependability of superconducting wires. All these factors significantly hamper the expansion of the superconducting wires market during the forecasted period.

Based on type, the superconducting wire market is categorized into low temperature superconductor (LTS), medium temperature superconductor (MTS), and high temperature superconductor (HTS). The high temperature semiconductor (HTS) segment procured a considerable growth rate in the superconducting wire market in 2021. The demand for high temperature superconductors is anticipated to be driven by the expansion of offshore wind farms that use superconducting technology. One form of superconducting wire, known as a high temperature superconductor, is made primarily of ceramic materials and is created using the First Generation (1G HTS) as well as Second Generation methods (2G HTS).

On the basis of end user, the superconducting wire market is divided into medical, energy, transportation, research, and others. The medical segment acquired the largest revenue share in the superconducting wire market in 2021. The use of superconducting wires in nuclear magnetic resonance (NMR) as well as magnetic resonance imaging (MRI) apparatus are propelling the growth of the segment. Medical experts can examine and diagnose conditions with the help of non-invasive biomagnetic equipment. A superconductor compound with a reasonably high critical temperature is magnesium diboride (MgB2).

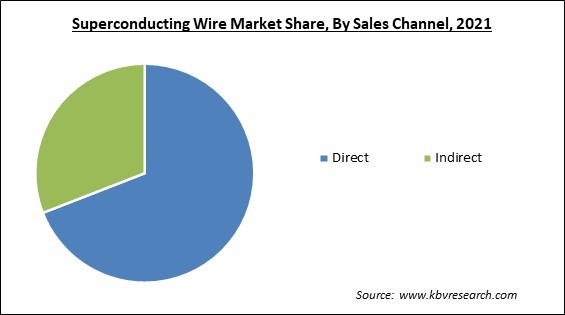

Based on sales channel, the superconducting wire market is segmented into direct and indirect. The indirect segment garnered a remarkable growth rate in the superconducting wire market in 2021. A third party, like an associate or sales partner, indirectly sells a company's goods or services. In order to combine their resources and boost profits, businesses frequently combine indirect sales alongside direct sales. For example, businesses selling to other countries make software or hardware and may employ indirect sales techniques. Since most market participants are multinational companies or export most of their superconducting wires, they use indirect sales. The segment would grow further as more companies emerge in the market.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 896.4 Million |

| Market size forecast in 2028 | USD 1.6 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 9.1% from 2022 to 2028 |

| Number of Pages | 208 |

| Number of Table | 360 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Sales Channel, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

On the basis of region, the superconducting wire market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Europe segment procured the highest revenue share in the superconducting wire market in 2021. The market in this region is being driven by rising investments in nuclear fusion-based research and rising attempts to decarbonize the transportation sector. Furthermore, due to their capacity to boost a vehicle's speed at very high velocities with less interference from the atmosphere, superconductors are also anticipated to see an increase in automobile use.

Free Valuable Insights: Global Superconducting Wire Market size to reach USD 1.6 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Bruker Corporation, Furukawa Electric Co., Ltd., Fujikura Ltd., Eaton Corporation PLC, FUJI ELECTRIC CO., LTD., Phoenix Contact GmbH & Co. KG, Sumitomo Electric Industries, Ltd., Nexans SA, LS Cable & System Ltd., and MetOx Technologies, Inc.

By Type

By Sales Channel

By End User

By Geography

The global Superconducting Wire Market size is expected to reach $1.6 billion by 2028.

Expanding research spending on superconducting wires are driving the market in coming years, however, A shortage of technical skills in areas connected to superconductivity restraints the growth of the market.

Bruker Corporation, Furukawa Electric Co., Ltd., Fujikura Ltd., Eaton Corporation PLC, FUJI ELECTRIC CO., LTD., Phoenix Contact GmbH & Co. KG, Sumitomo Electric Industries, Ltd., Nexans SA, LS Cable & System Ltd., and MetOx Technologies, Inc.

The Low Temperature Superconductor segment acquired maximum revenue share in the Global Superconducting Wire Market by Type in 2021 thereby, achieving a market value of $948.3 Million by 2028.

The Direct segment is leading the Global Superconducting Wire Market by Sales Channel in 2021 thereby, achieving a market value of $1,073.1 Million by 2028.

The Europe market dominated the Global Superconducting Wire Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $542.2 Million by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.