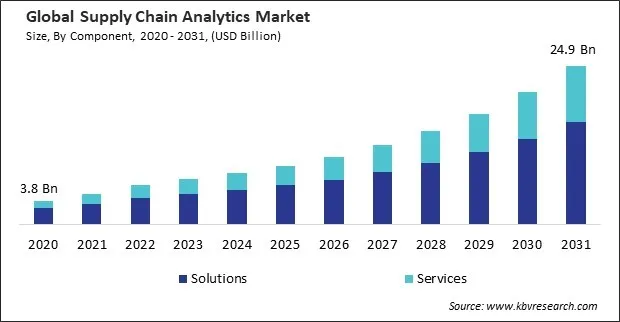

“Global Supply Chain Analytics Market to reach a market value of USD 24.9 Billion by 2031 growing at a CAGR of 17.5%”

The Global Supply Chain Analytics Market size is expected to reach $24.9 billion by 2031, rising at a market growth of 17.5% CAGR during the forecast period.

The increasing complexity of healthcare supply chains, coupled with the urgent need for efficient resource allocation and timely delivery of medical supplies, has driven healthcare organizations to adopt robust analytics solutions. By utilizing supply chain analytics, healthcare providers can optimize their operations to ensure that essential medications and equipment are available when needed, improving patient care and outcomes. Furthermore, analytics can help healthcare organizations identify inefficiencies and reduce waste, significantly saving costs. Thus, In 2023, the healthcare segment procured 18% revenue share in the supply chain analytics market.

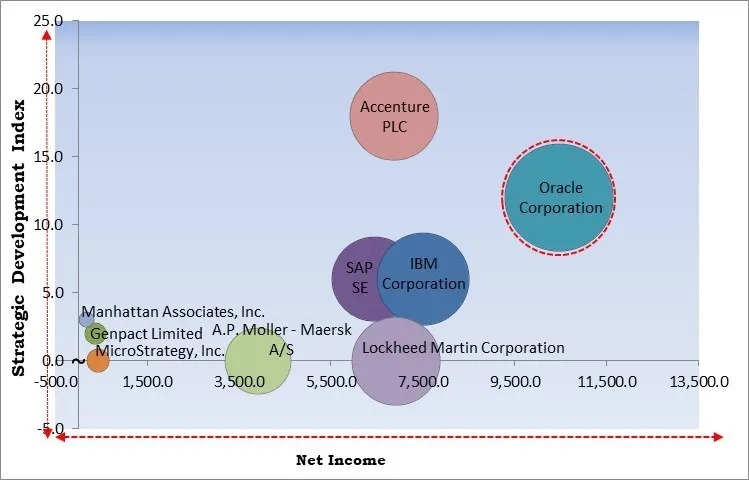

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In 2024, August, SAP SE unveiled its AI vision to transform supply chains from digital to adaptive, and ultimately autonomous, using AI-driven intelligence, system recommendations, and predictive insights. Additionally, In 2024, May, Manhattan Associates, Inc. unveiled Manhattan Active Supply Chain Planning, the first unified platform that integrates supply chain planning and execution systems. This solution enables real-time collaboration across inventory, labor, transportation, and warehouse operations, eliminating silos and optimizing resources for a shared business objective.

Based on the Analysis presented in the KBV Cardinal matrix; Oracle Corporation is the forerunner in the Supply Chain Analytics Market. In March, 2024, Oracle Corporation unveiled Oracle Smart Operations, new AI-powered capabilities within Oracle Fusion Cloud Manufacturing and Maintenance. These enhancements help organizations boost factory efficiency, improve productivity, enhance quality, reduce unplanned downtime, and increase operational visibility, addressing challenges like labor shortages, supply chain disruptions, and fluctuating demand. Companies such as IBM Corporation, Lockheed Martin Corporation, and Accenture PLC are some of the key innovators in Supply Chain Analytics Market.

Data-driven decision-making relies on quantitative insights from historical and real-time data, leading to more accurate and reliable decisions. Supply chain analytics enables organizations to analyze vast amounts of data from various sources, providing insights that help eliminate guesswork. This precision is crucial for making informed decisions regarding inventory management, demand forecasting, and supplier performance, ultimately driving efficiency and reducing risks.

Additionally, as e-commerce continues to grow, supply chains become more complex. Businesses now operate globally, requiring intricate logistics networks to manage the flow of goods across borders. Supply chain analytics provides the necessary insights to manage this complexity effectively, helping organizations track shipments, optimize routing, and ensure timely deliveries. Hence, the expansion of e-commerce and global trade propels the market's growth.

Supply chain analytics often involves collecting and analyzing sensitive data, including customer information, supplier details, and proprietary business processes. This sensitive nature heightens the risk of data exposure, making organizations wary of adopting analytics solutions that may compromise confidentiality. The fear of exposing sensitive information can deter businesses from fully leveraging supply chain analytics, thus restraining market growth.

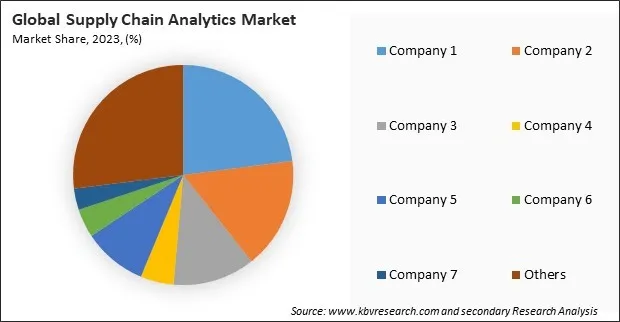

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches and Product Expansions.

The services segment is further subdivided into professional service and support & maintenance. In 2023, the support & maintenance segment attained 37% revenue share in the market. This segment includes services such as ongoing technical support, software updates, and system maintenance. The significant revenue share of the support & maintenance segment highlights the importance of continuous support to ensure the reliability and performance of supply chain analytics solutions.

Based on deployment, the market is categorized into cloud and on-premise. In 2023, the cloud segment registered 66% revenue share in the market. The cloud segment emerged as the frontrunner, capturing the highest revenue share within the market. This dominance can be attributed to several factors, including cloud-based solutions' scalability, flexibility, and cost-effectiveness.

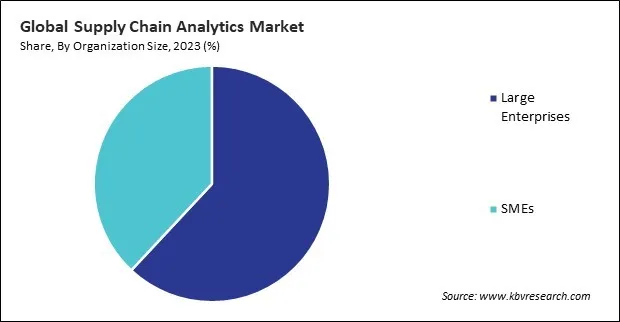

By Organization size, the market is divided into small & medium enterprises and large enterprises. The SMEs segment procured 38% revenue share in the market in 2023. SMEs garnered a notable revenue share, reflecting a growing acknowledgment of analytics’ critical role in optimizing supply chain operations. Many SMEs increasingly recognize the importance of technology in maintaining competitiveness against larger industry players.

By component, the market is bifurcated into solutions and services. The services segment held 32% revenue share in the market in 2023. This segment includes a broad array of offerings such as consulting, implementation, and ongoing support services. These services are crucial for organizations to effectively integrate and utilize supply chain analytics solutions.

The solutions segment is further subdivided into logistics analytics, manufacturing analytics, planning & procurement, sales & operations analytics, and visualization & reporting. In 2023, the planning and procurement segment held 19% revenue share in the market. This segment encompasses strategic sourcing, procurement processes, and inventory management solutions.

Based on end use, the market is divided into retail & consumer goods, healthcare, manufacturing, transportation, aerospace & defense, high technology products, and others. In 2023, the transportation segment held 14% revenue share in the market. The growth of e-commerce and the rising demand for efficient logistics and delivery systems have prompted transportation companies to invest in analytics solutions.

Free Valuable Insights: Global Supply Chain Analytics Market size to reach USD 24.9 Billion by 2031

The Supply Chain Analytics market is characterized by intense competition driven by the increasing demand for data-driven decision-making and operational efficiency. Key attributes include a diverse range of solutions that cater to various aspects of supply chain management, such as demand forecasting, inventory optimization, and logistics management. The market features a mix of established players and emerging startups, fostering innovation and differentiation through advanced analytics, machine learning, and cloud-based platforms. Collaborations and partnerships are common as companies seek to enhance their offerings and provide comprehensive analytics solutions.

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region witnessed 39% revenue share in the market in 2023. This dominance can be attributed to established technology companies and advanced infrastructure, which facilitate the rapid adoption of analytics solutions.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 7.1 Billion |

| Market size forecast in 2031 | USD 24.9 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 17.5% from 2024 to 2031 |

| Number of Pages | 373 |

| Number of Tables | 643 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Component, Organization Size, Deployment, End Use, Region |

| Country scope |

|

| Companies Included | SAP SE, Oracle Corporation, IBM Corporation, SAS Institute Inc., Manhattan Associates, Inc., MicroStrategy, Inc., Lockheed Martin Corporation, Accenture PLC, Genpact Limited, and A.P. Moller - Maersk A/S |

By Component

By End Use

By Organization Size

By Deployment

By Geography

This Market size is expected to reach $24.9 billion by 2031.

Increasing demand for operational efficiency and cost reduction are driving the Market in coming years, however, High implementation and maintenance costs restraints the growth of the Market.

SAP SE, Oracle Corporation, IBM Corporation, SAS Institute Inc., Manhattan Associates, Inc., MicroStrategy, Inc., Lockheed Martin Corporation, Accenture PLC, Genpact Limited, and A.P. Moller - Maersk A/S

The expected CAGR of this Market is 17.5% from 2024 to 2031.

The Solutions Segment is leading the Market by Component in 2023, achieving a market value of $16.1 billion by 2031.

The North America region dominated the Market by Region in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $9.3 billion by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges