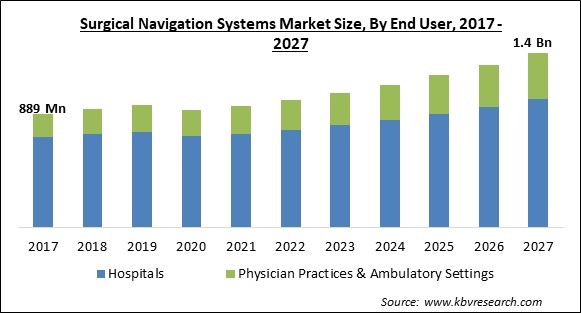

The Global Surgical Navigation Systems Market size is expected to reach $1.4 billion by 2027, rising at a market growth of 6.3% CAGR during the forecast period.

A surgical navigation system is one of the most important components of any computer-assisted surgery procedure. This is a concept that allows surgical procedures to be performed with the help of digital imaging technologies. It enables surgeons to undertake both pre-operative planning and precise surgical instrument navigation throughout the procedure. Endoscopic procedures are now possible due to the computer-assisted method of surgery. The surgeon gathers information quickly in order to determine where incisions and operations should be performed. This method results in a gentler treatment and with less pain for patients, as well as improved precision, a speedier surgical proc, and hence lower costs. The surgical navigation system was created in the mid-1980s. While task groups in neurosurgery and ENT surgery created this technique, which comprises a significant number of applications nowadays. In addition, Surgical navigation systems find applications in oral as well as maxillofacial surgery, visceral radiosurgery, orthopedic surgery, and implant dentistry. By incorporating all of the elements in the operation theatre, surgical navigation systems can be greatly advanced and supported by computers.

The surgical navigation technology enables surgeons to track tool placements precisely and then project them onto pre-operative imaging data. In addition, the GPS tracking feature allows the surgeon to monitor their location on a map. A computer workstation, as well as gear for monitoring the movement of tools, are included in the surgical navigation kit. Despite the fact that optical and electromagnetic tracking are accessible, the majority of sinus surgeons recommend electromagnetic tracking.

The growth of the market is likely to be propelled by the prevalence of target conditions such as brain tumors, osteoarthritis, and ENT problems. As per the World Health Organization, 9.6% of men along with 18% of women have arthritis in one form or another. Osteoarthritis is a disease that primarily affects elderly people. The majority of osteoarthritis patients suffer difficulty in moving and inability in conducting regular tasks.

Moreover, due to an increase in the geriatric population, increased adoption of surgical navigation systems in minimally invasive surgeries, and a high presence of chronic illnesses such as Alzheimer's, strokes, and cerebrovascular diseases, the surgical navigation systems market has seen significant growth in recent years. The demand for surgical navigation technology has grown as it makes it easier to map a patient's organs and provides a better insight of how to perform surgical procedures efficiently. Additionally, the demand for surgical navigation technology has increased due to global technological breakthroughs, complexities in medical operations, and a huge number of deaths caused by traditional methods.

The outbreak of the COVID-19 pandemic led the world economy to a steep downfall. Various businesses, irrespective of their sizes were demolished during the pandemic. In addition, governments across the world were forced to impose country-wide lockdowns across their nations, which substantially hampered the worldwide supply chain of various products. Due to the lockdown, the manufacturing units of numerous goods went under a temporary closure. However, the advent of the COVID-19 pandemic was beneficial for the surgical navigation systems market. The infection significantly targeted the lungs of people, due to which, the number of people with various cardiovascular problems substantially increased.

Surgical navigation systems scan the patient's brain so that surgeons can better understand it and execute more effective surgeries. As a result, demand for this technology is expected to increase in the future. Technological advancements have benefited various new applications, surgical procedure approaches, increased success rates, inventions, surgical procedure approaches, and other benefits. Additionally, user-friendly processes, improved outcomes, ease of operation, and improved treatment quality, among other aspects, have increased demand for this technology among healthcare professionals and patients. Surgical navigation systems comprise advanced technology, culminating more features, a higher success rate, and creative applications based on the procedures they perform.

In the orthopedic industry, there has been a steady need for improved procedures. Patients with disorders affecting the knees and hips, such as osteoarthritis, are usually weight-bearing joints. Such concerns can be addressed with a surgical navigation system. Surgical procedures are fraught with dangers. In addition, various traditional surgeries can result in post-surgical infections as well as higher blood loss, causing the healing and recovery process to take longer. Surgical navigation systems, on the other hand, provide accurate anatomical imaging. This lowers the chance of complications following surgery, enabling quicker recovery.

People across poor nations have lesser access to medical care services than wealthy countries. On the other side, impoverished people in LMICs, or low and middle-income countries, are constantly disadvantaged in all areas of access as well as their determinants. The healthcare industry in developing countries is severely underfunded, and the vast majority of these countries are unable to provide fundamental healthcare to their inhabitants. The issue is most prevalent in developing and developing countries, where government spending on public security is more than the expenditure on the enhancement of the healthcare infrastructure.

Based on End User, the market is segmented into Hospitals and Physician Practices & Ambulatory Settings. In 2020 the Ambulatory Surgical Centers segment witnessed a substantial revenue share of the surgical navigation system market. The increasing adoption of ASCs across developed countries, the scarcity of hospital beds, and the scarcity of economic resources are likely to fuel growth of the segment. Day-care surgery has several advantages, including a reduced waiting list, faster discharge, lower procedural costs, and increased efficiency. These variables are anticipated to augment the growth of the surgical navigation system market.

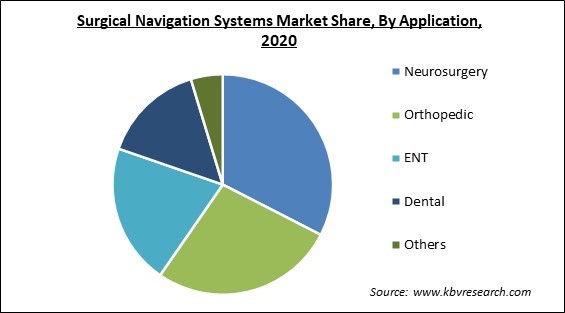

Based on Application, the market is segmented into Neurosurgery, Orthopedic, ENT, Dental, and Others. In 2020, the orthopedic segment garnered a significant revenue share of the surgical navigation systems market. The increasing growth of the segment is owing to the fact that orthopedic surgical navigation systems are commonly used for knee replacement surgeries. Therefore, the knee replacement therapeutics sector is estimated to lead this segment of the market.

Based on Technology, the market is segmented into Electromagnetic Navigation Systems, Optical Navigation Systems, CT-Based Navigation Systems, Hybrid Navigation Systems, Fluoroscopy-Based Navigation Systems and Others. In 2020, the electromagnetic navigation system segment acquired the largest revenue share of the surgical navigation system market. The rising growth of the segment is attributed to the fact that EM systems are less expensive and provide a better line of sight than other surgical navigation systems. This feature of the electromagnetic surgical navigation systems would significantly accelerate the growth of this segment over the forecast period.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 923.5 Million |

| Market size forecast in 2027 | USD 1.4 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 6.3% from 2021 to 2027 |

| Number of Pages | 247 |

| Number of Tables | 392 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Technology, Application, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. In 2020, North America accounted for the largest revenue share of the surgical navigation system market. The growth of the segment is attributed to the significant prevalence of various key market players across the region. The increased number of market players in this region is developing a cut-throat population in the market, which is encouraging players to bring enhancements across their products. Hence, the market is estimated to flourish.

Free Valuable Insights: Global Surgical Navigation Systems Market size to reach USD 1.4 Billion by 2027

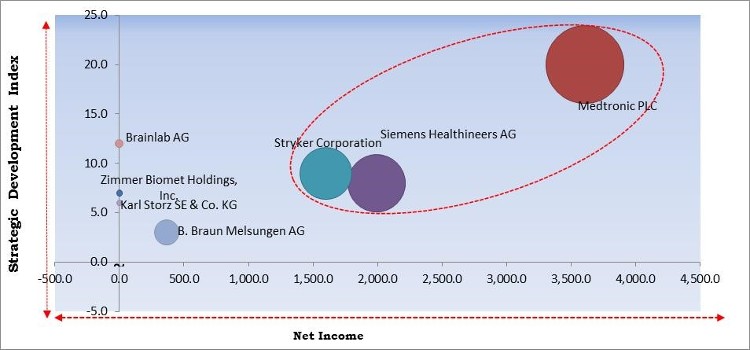

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Medtronic PLC, Siemens Healthineers AG, and Stryker Corporation are the forerunners in the Surgical Navigation Systems Market. Companies such as B. Braun Melsungen AG, Brainlab AG, and Karl Storz SE & Co. KG are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Siemens Healthineers AG, Stryker Corporation, Zimmer Biomet Holdings, Inc., Medtronic PLC, B. Braun Melsungen AG, Amplitude Surgical SAS, Karl Storz SE & Co. KG, and Brainlab AG.

By End User

By Application

By Technology

By Geography

The global surgical navigation systems market size is expected to reach $1.4 billion by 2027.

An increasing number of technological developments are driving the market in coming years, however, poor healthcare infrastructure of LMICs (Low- and middle-income countries) limited the growth of the market.

Siemens Healthineers AG, Stryker Corporation, Zimmer Biomet Holdings, Inc., Medtronic PLC, B. Braun Melsungen AG, Amplitude Surgical SAS, Karl Storz SE & Co. KG, and Brainlab AG.

The Hospitals segment is leading the Global Surgical Navigation Systems Market by End User 2020, thereby, achieving a market value of $1.0 billion by 2027.

The Neurosurgery segment acquired the maximum revenue share in the Global Surgical Navigation Systems Market by Application 2020, thereby, achieving a market value of $422.5 million by 2027.

The North America market dominated the Global Surgical Navigation Systems Market by Region 2020, and would continue to be a dominant market till 2027.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.