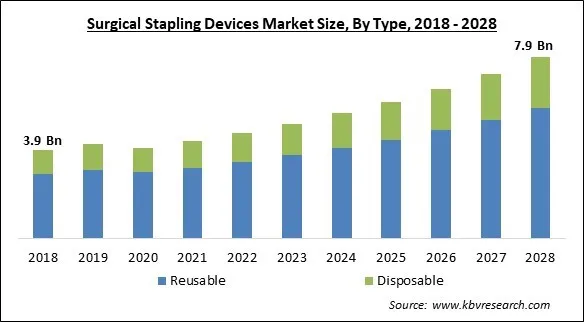

The Global Surgical Stapling Devices Market size is expected to reach $7.9 billion by 2028, rising at a market growth of 9.4% CAGR during the forecast period.

Surgical stapling devices apply surgical staples instead of sutures to heal skin wounds or keep tissue together. When operating time is an issue and aesthetic closure is not a top priority, surgical staples may help close injuries quickly. There are now three main categories of mechanical staplers for open and endoscopic surgery: linear, circular, and endoscopic surgical staplers.

Several novel surgical equipment and gadgets are now available because of technological advancements in various scientific fields. To enhance patient outcomes, surgeons can create novel surgical procedures due to the constant introduction of new instruments and the ongoing technological advances in already-existing technologies.

In many instances, surgeons may need to learn the scientific or clinical foundation for the best use of these technologies or how to benefit from any particular advantages a specific technology may have. So, even if the devices work well, surgeons may often depend on their expertise, judgment, or anecdotal evidence for better results.

Equipment that is often employed during surgical operations and is also undergoing a nearly continual state of technological evolution is the surgical stapler. While these tools are adaptable and practical, there have been well-reported instances of staple line leaks that resulted in postoperative difficulties, many of which were caused by problems unrelated to ischemia.

In operations, particularly challenging ones like gynecologic, gastrointestinal, & bariatric procedures, surgical stapling instruments are becoming more and more crucial. In addition, the use of surgical stapling devices facilitates the development of novel surgical techniques, the alteration of existing procedures, and the enhancement of clinical results. The increasing demand for less invasive treatments globally drives the expansion of the surgical stapling devices market.

The lockdown compelled many hospitals to stop their outpatient departments for situations other than emergencies, which had a significant impact on the market for surgical stapling devices. Social exclusion, population control, and restricted clinic access substantially influenced the market. However, the market is anticipated to grow significantly after the lockdown restrictions are lifted as significant manufacturers are concentrating on introducing technologically cutting-edge items to increase their market share. Also, with production getting back on track, and the resume in surgical procedures which is increasing the demand, the surgical stapling devices market will start to expand again after the pandemic.

Technological developments in surgical staples and related staples have significantly impacted the acceptance of surgical stapling devices by healthcare practitioners. With the introduction of powered surgical staplers, the time needed to seal the wound after surgery has decreased, minimizing problems and blood loss. In clinical testing, the powered surgical stapler performed better in the speed of healing and decreased discomfort. Hence, it is anticipated that the technical benefits offered by surgical stapling devices will drive market growth.

Due to the rise in chronic illnesses like cancer during the last several years, there has also been an increase in the number of visits to ambulatory surgical facilities. Moreover, it is predicted that the market for surgical staplers will grow throughout the projection years due to the rise in laparoscopic treatments chosen by patients. The decreasing cost, shorter hospital stays, and increasing popularity of laparoscopic operations are all due to these factors. Hence with the high prevalence of chronic cases and the rising popularity of laparoscopic operations, the market growth for surgical stapling devices will surge.

Opening of the staple line at a wound site, faulty staples that result in insufficient sealing, defective or jammed staplers, failing to shoot a staple from a stapler, staples that were improperly positioned on the wrong tissue spot using a staple that is the incorrect size for a particular application are some of the common issues associated with the usage of stapling devices. These frequent issues may result in surgical staple wounds, lengthening healing time and exposing the patient to higher medical and rehabilitation expenses. These issues with the stapling devices are expected to restrict their market expansion.

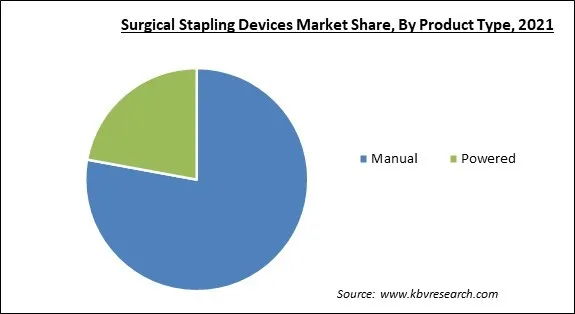

Based on product type, the surgical stapling devices market is segmented into powered and manual. The powered segment acquired a significant revenue share in the surgical stapling devices market in 2021. This is due to their simplicity of wound closure without requiring physical effort. Medical professionals now have more options due to the availability of powered surgical stapling devices in various sizes. In addition, the escalating technical advancements, product launches, and firms' increased emphasis on developing powered stapling devices are among other factors which are anticipated to boost the segment growth.

On the basis of type, the surgical stapling devices market is divided into disposable and reusable. The reusable segment held the highest revenue share in the surgical stapling devices market in 2021. This is because reusable surgical stapling instruments may be used on several patients after sterilizing. Due to the product's low cost, the category is expected to have a bigger share in developing countries. Furthermore, the introduction of surgical stapling devices combined with absorbable staplers is projected to boost the segment expansion in the projected period.

By end-use, the surgical stapling devices market is classified into hospitals and ambulatory surgical centers. The hospitals segment witnessed the largest revenue share in the surgical stapling devices market in 2021. This is because hospitals are seeing a significant trend that points to a move towards clinical efficiency models, including robotic surgery. Minimally invasive procedures benefit from robotic surgery. The hospitals have well-trained staff and high-tech devices, which ensures a safe and successful procedure. Also, the hospital category is anticipated to maintain its dominance due to favorable reimbursement conditions for different methods during the projection period.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 4.3 Billion |

| Market size forecast in 2028 | USD 7.9 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 9.4% from 2022 to 2028 |

| Number of Pages | 193 |

| Number of Table | 325 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Product Type, End-use, Type, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the surgical stapling devices market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region registered the highest revenue share in the surgical stapling devices market in 2021. This is owing to the employment of cutting-edge technology and minimally invasive procedures with the rising number of total operations. In addition, the greatest obesity prevalence in the world, the local presence of multinational corporations, and the government's clearance for minimally invasive operations are other factors contributing to the large market share.

Free Valuable Insights: Global Surgical Stapling Devices Market size to reach USD 7.9 Billion by 2028

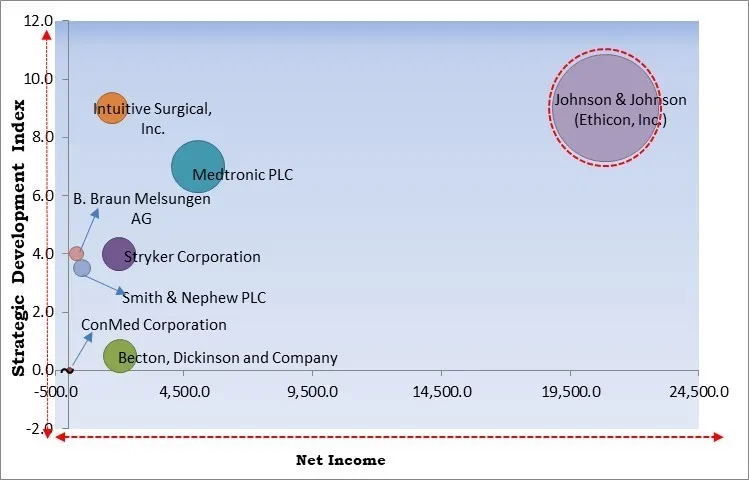

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Johnson & Johnson (Ethicon, Inc.) is the forerunner in the Surgical Stapling Devices Market. Companies such as Intuitive Surgical, Inc., Medtronic PLC, and Stryker Corporation are some of the key innovators in Surgical Stapling Devices Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Stryker Corporation, Medtronic PLC, BioPro, Inc., ConMed Corporation, Smith & Nephew PLC, Intuitive Surgical, Inc., Johnson & Johnson (Ethicon, Inc.), B. Braun Melsungen AG, Becton, Dickinson and Company and Meril Life Science Private Limited.

• May-2022: Intuitive teamed up with Creo Medical Group, a UK-based medical device company. The collaboration includes optimizing Creo's products to make them consistent with Intuitive's robotic technology.

By Type

By Product Type

By End-use

By Geography

The global Surgical Stapling Devices Market size is expected to reach $7.9 billion by 2028.

The technological betterment of surgical stapling devices are driving the market in coming years, however, Common issues with surgical staplers restraints the growth of the market.

Stryker Corporation, Medtronic PLC, BioPro, Inc., ConMed Corporation, Smith & Nephew PLC, Intuitive Surgical, Inc., Johnson & Johnson (Ethicon, Inc.), B. Braun Melsungen AG, Becton, Dickinson and Company and Meril Life Science Private Limited.

The Manual segment acquired maximum revenue share in the Global Surgical Stapling Devices Market by Product Type in 2021 thereby, achieving a market value of $6.1 billion by 2028.

The North America market dominated the Global Surgical Stapling Devices Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $2.9 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.