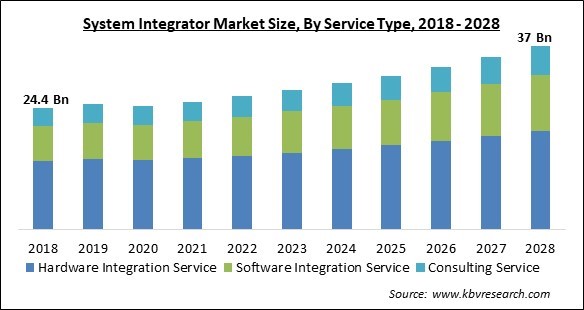

The Global System Integrator Market size is expected to reach $37 billion by 2028, rising at a market growth of 5.4% CAGR during the forecast period.

Companies or individuals who implement, plan, coordinate, test, schedule, improve, and maintain a computing operation are known as system integrators. System integrators are experts at connecting component subsystems into a whole and making sure that they work well together. In order to eliminate the traditional trade-off in dependability and quality, industrial businesses are developing Flexible Manufacturing Systems (FMS) in the modern era.

FMS consists of multiple manufacturing, computer control modules, and material handling and lowers labor and process variability while enhancing product quality. The need for extremely adaptable control software makes it easier to link the machines with a system like the PLC system and database, which places even more pressure on system integrators.

The market is driven by the demand for low-cost, energy-efficient production methods. In terms of ultimate energy demand and greenhouse gas emissions, the industrial sector is among the greatest end-use sectors. System integrators have already been involved in a variety of traditional efficiency improvement projects, such as the installation of inverters and other solely energy-related projects like replacing motors.

However, by optimizing operations, system integrators can also assist a business in lessening its environmental impact. In contrast to having all the information separate, connecting the data from the production facility and combining it with data on energy use and point-of-sale (POS) details will produce reports that can help find potential efficiencies. Participating in the system integrator program also entails receiving free development tools, the required instruction, and assistance.

COVID-19 affected numerous significant market participants' earnings. Additionally, the pandemic led to the closure of several factories and the suspension of production across a variety of global industries. During the post-pandemic phase, a number of end-user industry operations, such as those in the oil and gas, power generation, and automotive sectors, among many others, experienced major change. Due to the COVID-19 pandemic, there is a noticeable market slowdown in the first half of 2020 compared to the increase in 2019. This is because manufacturing facilities, infrastructure construction, etc., have been stopped. The oil and gas business was unprepared for a significantly transformed environment since the COVID-19 outbreak took them off guard.

Since the advent of Industry 4.0, the usage of AI and IoT capabilities in the industrial sector has increased. AI and IoT-enabled systems make it possible to optimize the production process, provide early warnings, support quality assurance, and anticipate machine malfunction. By gathering precise data, businesses may differentiate themselves from the competition by developing cutting-edge AI applications. The COVID-19 pandemic breakout in 2020 is now posing a challenge to the manufacturing sector.

Over the past few decades, robots have changed from being unaffordable gadgets with constrained capabilities to being affordable machines capable of doing a wide range of tasks. People all across the world utilize robots, especially industrial ones, frequently. Industrial robots are being utilized more and more frequently in production centers, which is accelerating progression, innovation, and industrial development, as per the latest trends in the robotics industry. The market for system integrators is therefore driven by the high deployment of industrial robots.

The investment cost integration systems, which also include acquisition, consultation, installation, adjustment, and running costs, will increase a company's expenses. These systems require significant capital investments because they include a variety of related services whose implementation differs by sector. The costs involved, which mostly consist of the installation and operating expenses, drive up a company's costs. Due to the complexity of the program and other expenses like custom integration, it may be fairly expensive. Because of this, it is challenging for small businesses to implement such cutting-edge technology and solutions as MES.

Based on Service type, the System Integrator Market is classified into consulting, software integration, and hardware integration. Software integration services recorded a significant revenue share in 2021. For greater efficacy and efficiency, system integration services make sure that all software components communicate with one another without any interruptions. Professional developers labor to produce a solution that improves application control and optimizes business processes.

Based on technology, the market is categorized into Human-Machine Interface (HMI), Supervisory Control and Data Acquisition (SCADA), Manufacturing Execution System (MES), Functional Safety System, Machine Vision, Industrial Robotics, Industrial PC, Industrial Internet of Things (IIoT), Machine Condition Monitoring, Plant Asset Management, Distribute Control System (DCS), and Programmable Logic Controller (PLC). The human-machine interface (HMI) segment contributed a substantial revenue share in 2021. In industrial applications, a human-machine interface (HMI) is merely an interface that makes use of both software and parts of a specific Manufacturing Execution System (MES) in order to maximize information transmission between a machine and a human operator.

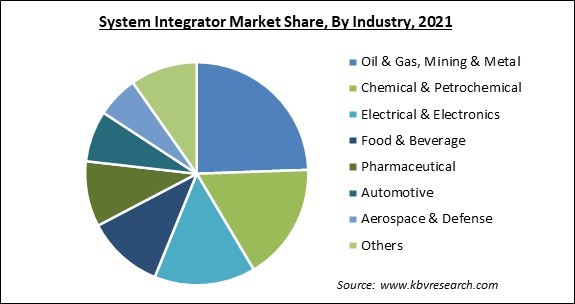

Based on industry vertical, the market is classified into Oil & Gas, Chemical & Petrochemical, Food & Beverage, Automotive, Pulp & Paper, Pharmaceutical, Aerospace & Defense, Electrical & Electronics, Mining & Metal, and Others (textile, water & wastewater, printing, and packaging). The automotive market produced a sizable portion of revenue in 2021. MES is in charge of ensuring the highest degree of manufacturing quality in the automotive sector. In reality, the automotive industry is made up of a close-knit network of manufacturers, suppliers, and consumers.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 25.8 Billion |

| Market size forecast in 2028 | USD 37 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 5.4% from 2022 to 2028 |

| Number of Pages | 311 |

| Number of Tables | 480 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Market Share Analysis, Companies Strategic Developments, Company Profiling |

| Segments covered | Technology, Service Type, Industry, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on region, the market is classified as North America, Europe, Asia Pacific, and LAMEA. Asia Pacific garnered a significant revenue share in 2021 globally. The advancement of the region is attributed to the rising use of industrial automation technologies, especially in China and India. The process of automating large contract manufacturers of electrical products has already started. In addition, a sizable battery manufacturing infrastructure is being constructed to meet the rising demand for hybrid and electric automobiles. This demand for industrial automation is anticipated to fuel the market for system integrators.

Free Valuable Insights: Global System Integrator Market size to reach USD 37 Billion by 2028

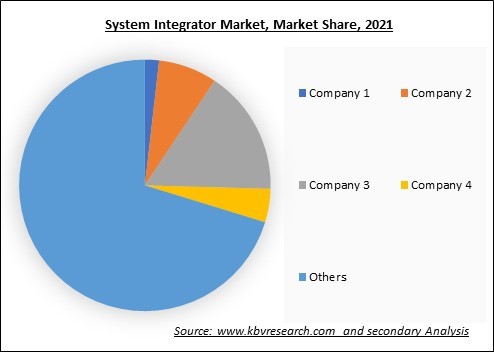

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The below illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include ATS Automation Tooling Systems, Inc., Barry-Wehmiller Group, Inc., John Wood Group PLC, Avanceon limited, JR Automation (Hitachi, Ltd.), Tesco Controls, Inc. (United Flow Technologies), Burrow Global, LLC, Prime Controls, LP, Rockwell Automation, Inc. (MAVERICK Technologies, LLC), and INTECH Process Automation Inc.

By Technology

By Service Type

By Industry

By Geography

The global System Integrator Market size is expected to reach $37 billion by 2028.

IoT and AI are widely used in the manufacturing sector are driving the market in coming years, however, High Cost Of Automation Installation And Repair restraints the growth of the market.

ATS Automation Tooling Systems, Inc., Barry-Wehmiller Group, Inc., John Wood Group PLC, Avanceon limited, JR Automation (Hitachi, Ltd.), Tesco Controls, Inc. (United Flow Technologies), Burrow Global, LLC, Prime Controls, LP, Rockwell Automation, Inc. (MAVERICK Technologies, LLC), and INTECH Process Automation Inc.

The Oil & Gas, Mining & Metal segment acquired maximum revenue share in the Global System Integrator Market by Industry in 2021 thereby, achieving a market value of $8 billion by 2028.

The Industrial Internet of Things (IIoT) segment is leading the Global System Integrator Market by Technology in 2021 thereby, achieving a market value of $8.9 billion by 2028.

The North America market dominated the Global System Integrator Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $13.2 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.