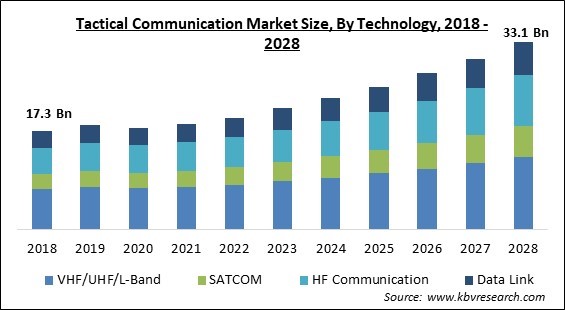

The Global Tactical Communication Market size is expected to reach $33.1 billion by 2028, rising at a market growth of 9.0% CAGR during the forecast period.

Tactical communication refers to the transmission of different types of information in military through one person to another in various parts of the world via orders or codes. Different verbal, written, visual, and auditory communications are used in tactical communication. Data transfer and voice-over communications are two possible forms of communication. Typically, it relies on a complex and diverse network of hardware as well as protocols to send data between people and places.

The demand in the tactical communication market is also anticipated to be fueled by the development of equipment and technological developments like the manufacture of ear canal earphones, active and passive noise cancelling equipment, and improved communication technologies. Currently, the military must enhance its tactical communication capabilities due to the swift transition to asymmetric warfare.

The development of the tactical communication industry is being driven by the worldwide armed forces' focus on improving the network-based communication capabilities of the military platforms across the land, air, and sea domains. Additionally, it is expected that the leading participants in the tactical communication business will have plenty of chances due to the integration of cellphones and software into the field of battle and the increase in government spending on military applications.

Also, due to increased investments in integrating cutting-edge battlefield technology as well as rising demand for network-centric warfare and satellite-based communication, the tactical communication industry has seen considerable expansion in recent years. Additionally, it is expected that an increase in the number of projects aimed at enhancing public safety in developing economies, technological advancements related to the miniaturization of technology, an increase in the frequency of criminal activity and terrorism, and a shift in emphasis toward ensuring the safety of the nation's soldiers will all contribute to the market's growth.

The COVID-19 pandemic has had a negative impact on the production of all communications equipment, which has then had an impact on the tactical communication market. Due to a significant increase in demand for consumer electronics, there was a worldwide scarcity of semiconductors prior to the pandemic. Chip shortages in industrial manufacturing had already gotten worse due to international trade restrictions and the COVID-19 crisis. Production cycles were noticeably delayed as a result of the supply chain disruption, prompting businesses to suffer losses.

For military operations, satellite communication (SATCOM) is important because it offers communications that are not limited by a satellite's line of sight and can reach up to one-third of the planet. An aircraft can interact with air traffic control and other ground-based facilities while in the air owing to satellite communications. Voice and ground services are both possible. The introduction of internet protocol (IP)-based apps and new data-hungry cockpits has allowed SATCOM to offer vital safety information while also enhancing operational performance for the fleets of military aircraft that are now in use.

Unsurprisingly, the military of China, India, as well as the United States are the among the largest militaries all around the world. Military duty is mandated in several countries. Of all countries, the United States spends the most on its armed forces. All of the Department of Defense's routine operations, wartime expenditures, the nuclear weapons program, overseas military support, and other expenditures associated with the Pentagon are included in its military budget.

In establishing commercial potential inside the tactical communication market, semiconductors are essential. The requirement for electronics chips as well as semiconductors within the tactical communication business has grown over the past several years because of the rise in demand of satellite communication and data-driven operations. Moreover, a sudden increase in consumer electronics demand on the commercial front followed by restrictions on international trade and travel as a result of the COVID-19 pandemic, resulted in a worldwide shortage of semiconductors, which had an effect on the production of tactical communication systems.

By component, the tactical communication market is bifurcated into hardware and software. In 2021, the hardware segment dominated the tactical communication market with the maximum revenue share. The dominance is a result of the growing need for sophisticated communication systems in a variety of military applications, including intelligence, surveillance, and reconnaissance (ISR), combat, and logistical supply route tracking.

On the basis of technology, the tactical communication market is segmented into SATCOM, VHF/UHF/L-Band, HF communication and data link. In 2021, SATCOM procured a prominent revenue share in the tactical communication market. The growth is due to SATCOM technology's expanded use in military operations all around the world coupled with the advancement of communication infrastructure for naval, airborne, and space platforms.

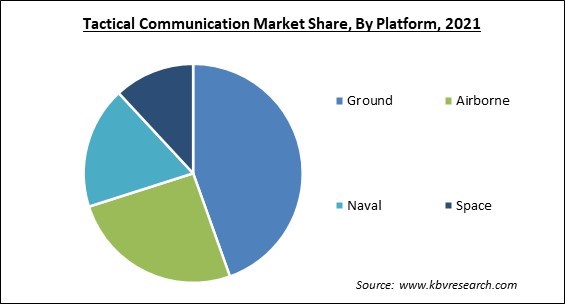

Based on platform, the tactical communication market is fragmented into airborne, ground, naval and space. In 2021, the airborne segment procured a substantial revenue share in the tactical communication market. This is due to the importance of sophisticated aerial communications to the security of all military aircraft operations. High frequency, satellite, and software-defined radio technology solutions are all part of it.

By application, the tactical communication market is divided into command & control; intelligence, surveillance & reconnaissance (ISR); situational awareness; and routine operations. In 2021, the ISR segment acquired a significant revenue share in the tactical communication market. Experts in intelligence, surveillance, and reconnaissance (ISR) observe the enemy's conduct and follow their movements to know more about them.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 18.6 Billion |

| Market size forecast in 2028 | USD 33.1 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 9% from 2022 to 2028 |

| Number of Pages | 267 |

| Number of Tables | 460 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Technology, Platform, Component, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Australia, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the tactical communication market is analyzed across North America, Europe, Asia Pacific and LAMEA. In 2021, the North America region accounted the highest revenue share in the tactical communication market. The United States' high spending on tactical military communications equipment is the main driver of market expansion in the region. Besides this, the presence of major manufacturers providing communication systems in the region is also supporting market growth.

Free Valuable Insights: Global Tactical Communication Market size to reach USD 33.1 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Thales Group S.A., Raytheon Technologies Corporation, General Dynamics Corporation, BAE Systems PLC, L3Harris Technologies, Inc. (L3Harris WESCAM), Lockheed Martin Corporation, Northrop Grumman Corporation, Cobham Limited (Eaton Corporation PLC), Rohde & Schwarz GmbH & Co. KG, and Viasat, Inc.

By Technology

By Platform

By Component

By Application

By Geography

The Tactical Communication size is projected to reach USD 33.1 billion by 2028.

Increased Incorporation Of Satcom In Military Communication are driving the market in coming years, however, Limited Supply Of Semiconductors In The Industry restraints the growth of the market.

Thales Group S.A., Raytheon Technologies Corporation, General Dynamics Corporation, BAE Systems PLC, L3Harris Technologies, Inc. (L3Harris WESCAM), Lockheed Martin Corporation, Northrop Grumman Corporation, Cobham Limited (Eaton Corporation PLC), Rohde & Schwarz GmbH & Co. KG, and Viasat, Inc.

The Ground segment acquired maximum revenue share in the Global Tactical Communication Market by Platform in 2021 thereby, achieving a market value of $14.2 billion by 2028.

The Command & Control segment is leading the Global Tactical Communication Market by Application in 2021 thereby, achieving a market value of $13.7 billion by 2028.

The North America market dominated the Global Tactical Communication Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $12.5 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.