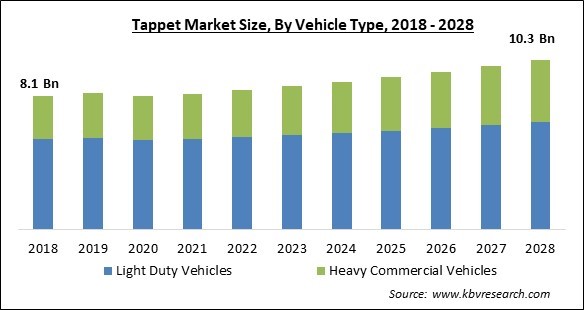

The Global Tappet Market size is expected to reach $10.3 billion by 2028, rising at a market growth of 3.3% CAGR during the forecast period.

A vital component of an internal combustion engine is the tappet, which converts the camshaft's rotational motion or speed into either direct or indirect linear motion of the valves. In other terms, a tappet is a projecting arm or a lever that moves when it comes into touch with a valve or a driving mechanism for traversing motion or when an external force moves it. It is essential because it transmits a signal between machine elements using internal combustion engines.

A key driver boosting the development of the tappet market is the rising rate of automotive production and sales globally, which is expected to persist throughout the projected period. The usage of tappets in engines is growing due to the rising demand for high-power engines like the V-6 and V-8, where the number of tappets is proportionate to the number of cylinders. The market for high-speed engine cars has been strengthened by the economy's growth and the increase in disposable income, which has also benefited the tappet market.

Automakers have created cutting-edge valve technology, like Variable Valve Timing (VVT) by Toyota, VTech by Honda, and MIVEC by Mitsubishi, to preserve vehicle fuel efficiency. To ensure optimal combustion in the cylinder, reduce emissions, and boost fuel economy, the ECU regulates the tappets to change the valve timing and delay or hold the valve action. Pumps with hydraulic tappets are more effective, quieter, and preserve valve clearance. In the future, the market will become more interested in the self-adjusting tappet technology and design to maintain excellent valve clearance.

The rising demand for electric and hybrid cars is one of the main things preventing the automotive tappet market from expanding further. The usage of electric vehicles has the potential to drastically lower emissions of dangerous gases, greenhouse gases, and air pollutants. To increase engine performance in these electric cars, valve and tappet assembly is unnecessary. Due to decreased pollution and improved vehicle economy, customers place a high value on electric and hybrid cars.

The COVID-19 pandemic has severely slowed down several businesses, including the automotive, aerospace & military, manufacturing, and other sectors. Some key issues that put much pressure on the tappet market were the nationwide lockout, disruptions in supply chain analyses, and a lack of automotive parts and components. Tappet demand decreased significantly worldwide since it is heavily employed in the production of automobiles. China is the top producer and exporter of the raw materials needed to make automobiles. Sales of tappets are intimately correlated with demand from many end-use sectors, including the automobile industry.

VVT technology is extensively used in these racing cars and high-performance vehicles. By altering the timing of the valves and the length of the valves while the engine is running, it improves performance. Furthermore, multiple camshafts may be integrated via electronic or mechanical connecting systems thanks to the sophisticated automotive technology known as VVT and lift electronic control (VTEC). Boosting the Revolutions Per Minute, also improves the engines' effectiveness and performance (RPM). Due to its use in camshafts, rising VTEC or VVT use is anticipated to propel market development throughout the projection period.

The sales of commercial vehicles surged due to the rise in building and e-commerce activities, which boosted the need for material transportation. The demand for material transportation has increased due to the expansion of construction and e-commerce businesses. This is anticipated to accelerate the growth of commercial vehicles shortly. High productivity, significant carrying capacity, and fuel economy are the main factors driving the need for heavy commercial vehicles. Over the anticipated period, the tappet market will see considerable expansion in line with the rising demand for commercial vehicles worldwide.

One of the main factors impeding the development of the automotive tappet market is the rising demand for electric and hybrid cars. The need for traction motors is expected to grow due to the increasing demand for EVs and significant R&D expenditures targeting enhancing electric vehicles' effectiveness and operational performance. These traction motors are a necessary part of fully electric vehicles. Furthermore, it is anticipated that the industry will grow and be driven by governments from other countries imposing regulatory norms. In addition, incentives for EV purchases and greater fuel efficiency than conventional cars are anticipated to increase demand for EVs. Therefore, it is anticipated that these issues would restrain the tappet market's expansion.

By end user, the tappet market is segmented into economic passenger car, luxury passenger car, and mid-priced passenger car. In 2021, the economic passenger car segment dominated the tappet market with maximum revenue share. A road motor vehicle intended for passenger transportation that seats no more than nine people and is neither a moped or a motorbike is referred to as an economy passenger car (including the driver). An economy passenger automobile in the US is built with low initial and ongoing costs in mind. Small (compact or subcompact), light, and affordable to make and buy, economy automobiles are the norm.

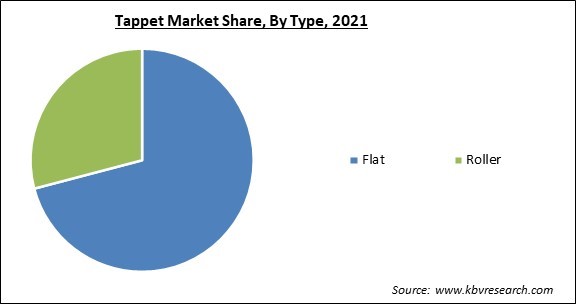

Based on the type, the tappet market is divided into flat tappets and roller tappets. The flat tappet market category had the highest revenue share in 2021. A flat tappet is an engine item used in the automotive industry that regulates the flow of oil from the reservoir to all other components of an engine. It is also referred to as a fixed or closed valve since it prevents oil from passing through its ports. Most current engines employ this kind of valve since it beats poppet valves in terms of performance and dependability. They are also expected to be the key variables influencing the tappet market size during the forecast period.

Based on engine capacity, the tappet market is bifurcated into <4 cylinders engine, 4-6 cylinders engine, and >6 cylinder engine. In 2021, the 4-6 Cylinders engine segment covered a considerable revenue share in the tappet market. The need for high-performance automobiles with smaller engines and strict emission restrictions in certain places are the main reasons behind the development of the 4-6 cylinders category. Additionally, the manufacturing of passenger cars and commercial trucks has increased, ascribed to the better business climate for fleet operators, which is driving the market expansion.

By vehicle type, the tappet market is categorized into heavy commercial vehicle and light duty vehicles. In 2021, the heavy commercial vehicles segment recorded a remarkable revenue share in the tappet market. In the area, there is an increasing need for high-performance heavy commercial vehicles due to the growing logistics and transportation sectors. During the forecast period, this would further increase demand for automobile tappets.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 8.2 Billion |

| Market size forecast in 2028 | USD 10.3 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 3.3% from 2022 to 2028 |

| Number of Pages | 220 |

| Number of Table | 420 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Engine Capacity, Type, Vehicle Type, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the tappet market is analyzed across North America, Europe, Asia Pacific and LAMEA. The Asia Pacific region led the tappet market by generating largest revenue share in 2021. The area is anticipated to develop significantly due to growing consumer disposable income levels and increased automobile manufacturing and sales. China is expected to continue to play a prominent role in the regional market due to its sizable vehicle manufacturing industry and other advantageous economic factors, including its cheap labor costs and easy access to funding.

Free Valuable Insights: Global Tappet Market size to reach USD 10.3 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Eaton Corporation PLC, NSK Ltd., Schaeffler AG, Otics Corporation, Tenneco, Inc. (Federal-Mogul Holdings), Rane Engine Valve Limited (Rane Holdings Limited), Wuxi Xizhou Machinery Co. Ltd., GM Holden Ltd (ACDelco), ZF Friedrichshafen AG (TRW), and COMP Cams (Edelbrock Group).

By End User

By Engine Capacity

By Type

By Vehicle Type

By Geography

The global Tappet Market size is expected to reach $10.3 billion by 2028.

Rising demand for high-powered vehicles and fuel efficiency are driving the market in coming years, however, Rising sales of hybrid and electric automobiles restraints the growth of the market.

Eaton Corporation PLC, NSK Ltd., Schaeffler AG, Otics Corporation, Tenneco, Inc. (Federal-Mogul Holdings), Rane Engine Valve Limited (Rane Holdings Limited), Wuxi Xizhou Machinery Co. Ltd., GM Holden Ltd (ACDelco), ZF Friedrichshafen AG (TRW), and COMP Cams (Edelbrock Group).

The expected CAGR of the Tappet Market is 3.3% from 2022 to 2028.

The <4 Cylinders segment is generating highest revenue share om the Global Tappet Market by Engine Capacity 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $4.85 billion by 2028.

The Europe market dominated the Global Tappet Market by Region 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $3.4 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.