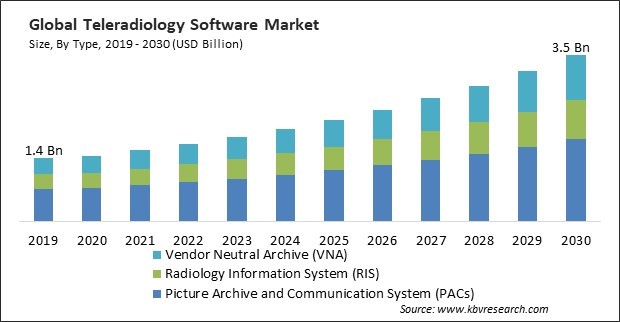

The Global Teleradiology Software Market size is expected to reach $3.5 billion by 2030, rising at a market growth of 10.2% CAGR during the forecast period.

The need for medical imaging in the Asia Pacific region is driven by a significant unmet medical need brought on by chronic diseases, including cancer and cardiovascular disease. Consequently, the APAC region accounted for $430.9 million revenue in the market in 2022. Additionally, encouraging government initiatives in the region of digital health, the increasing uptake of cutting-edge technology, and the scarcity of radiologists in several nations, including India, all contribute to the growth of this market. Some of the factors impacting the market are rising incidence of chronic diseases, improved access to specialized care, and evolving reimbursement and regulation policies.

The demand for diagnostic imaging services has surged due to the rising incidence of chronic diseases like cancer. Teleradiology provides a means to manage the resulting increase in imaging studies. Chronic diseases often require ongoing monitoring and diagnostic imaging to assess the progression and response to treatment. Conditions like cancer, cardiovascular diseases, and diabetes necessitate frequent medical imaging studies, including X-rays, MRIs, CT scans, and ultrasounds. Teleradiology allows healthcare facilities to access specialized radiologists remotely, ensuring patients receive accurate and timely diagnoses, even if these subspecialists are unavailable on-site. Additionally, Teleradiology allows patients and healthcare facilities in underserved or remote areas to access specialized radiology services. This increases the availability of expert opinions and timely diagnoses. Access to specialized radiologists via teleradiology can lead to quicker and more accurate diagnoses. This is crucial in cases where rapid diagnosis is essential for effective treatment, such as in certain types of cancer. Patients with specific conditions benefit from having access to subspecialists. Teleradiology connects patients with the right experts, even in different locations, ensuring they receive specialized care. Many teleradiology software solutions include teleconsultation features, enabling healthcare providers to consult with radiologists and specialists in real time. This enhances the quality of care and the exchange of medical knowledge. Improved access to specialized care is a significant driver in expanding the market.

To reduce the need for in-person consultations and lower the danger of infection for patients and healthcare personnel, teleradiology software enabled radiologists to evaluate medical pictures from remote places. Telemedicine saw rapid adoption during the pandemic, and teleradiology software was integrated into telehealth platforms to provide comprehensive virtual healthcare consultations. This allowed for the remote diagnosis and monitoring of patients suffering from various medical conditions, including those unrelated to COVID-19. Teleradiology helped healthcare facilities optimize resource allocation. By outsourcing or sharing radiology services with teleradiology providers, hospitals allocate their in-house staff to address the critical demands of COVID-19 care. Teleradiology played a role in preventive measures by facilitating the remote monitoring and early detection of COVID-19-related complications, such as pneumonia.

However, the evolving regulatory landscape and reimbursement policies can pose challenges for teleradiology providers. Navigating the complex healthcare reimbursement system and adapting to changing regulations require ongoing effort. Healthcare reimbursement policies can change frequently, affecting the financial viability of teleradiology services. Providers adapt to evolving reimbursement regulations, which can create uncertainty in financial planning. Teleradiology reimbursement lacks standardization, and different payers (e.g., public, and private insurers) may have different policies and requirements. This lack of uniformity complicates billing and reimbursement processes. Reimbursement and regulation challenges are significant obstacles in the market.

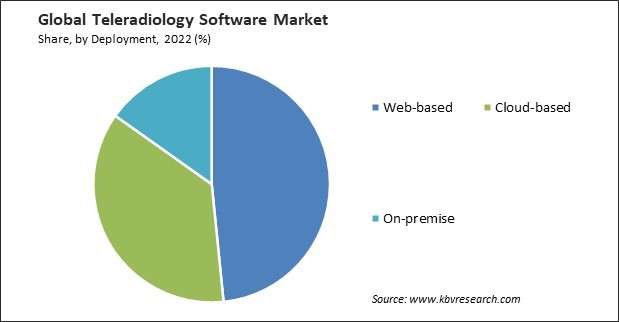

Based on deployment, the market is classified into web-based, cloud-based, and on-premise. The cloud-based segment acquired a substantial revenue share in the market in 2022. Cloud-based teleradiology software allows remote access to medical images and patient data from anywhere with an internet connection. Radiologists and healthcare professionals can interpret images and generate reports from different locations, improving accessibility and flexibility. Multiple radiologists and healthcare professionals can simultaneously review images and collaborate on complex cases, regardless of their geographic locations. This remote collaboration enhances the quality of diagnostic services. Cloud-based teleradiology software is often scalable, allowing healthcare facilities to adjust their capacity based on demand. This flexibility ensures they can accommodate fluctuations in the number of studies and cases.

By type, the market is categorized into radiology information system (RIS), picture archive and communication system (PACs), and vendor neutral archive (VNA). In 2022, the picture archive and communication system (PACs) segment held the highest revenue share in the market. PACs allow healthcare providers to electronically store and manage many medical images. In teleradiology, radiologists and healthcare professionals can access patient images remotely, providing timely and accurate diagnoses regardless of physical location. PACS integrates seamlessly with teleradiology software, creating a unified image interpretation and reporting platform. This integration reduces manual data entry, duplication of efforts, and the risk of errors, ultimately streamlining the workflow of teleradiologists.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 1.65 Billion |

| Market size forecast in 2030 | USD 3.5 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 10.2% from 2023 to 2030 |

| Number of Pages | 186 |

| Number of Table | 260 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Deployment, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region led the market by generating the highest revenue share. Increasing the target population, the incidence of chronic diseases such as cancer and bone impairments, significant market players, and a well-developed healthcare IT infrastructure are the primary elements contributing to the expansion. The primary factors influencing regional market development are favorable government efforts, technological advancements, and high healthcare expenses.

Free Valuable Insights: The Global Teleradiology Software Market size to reach USD 3.5 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Carestream Health, Inc. (Onex Corporation), Teleradiology Solutions, Inc., Comarch SA, RamSoft, Inc., Koninklijke Philips N.V., Morton and Partners Radiologists, Everrtech Software Private Limited, Pediatrix Medical Group, Inc., Siemens AG, and Radical Imaging LLC.

By Deployment

ByType

By Geography

This Market size is expected to reach $3.5 billion by 2030.

Rising incidence of chronic diseases are driving the Market in coming years, however, Evolving reimbursement and regulation policies restraints the growth of the Market.

Carestream Health, Inc. (Onex Corporation), Teleradiology Solutions, Inc., Comarch SA, RamSoft, Inc., Koninklijke Philips N.V., Morton and Partners Radiologists, Everrtech Software Private Limited, Pediatrix Medical Group, Inc., Siemens AG, and Radical Imaging LLC.

The expected CAGR of this Market is 10.2% from 2023 to 2030.

The Web-based segment is leading the Market, by Deployment in 2022 thereby achieving a market value of $1.7 Billion by 2030.

The North America region dominated the Market, by Region in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $1.3 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.