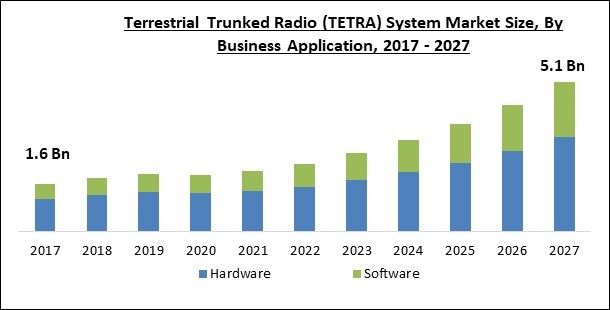

The Global Terrestrial Trunked Radio (TETRA) System Market size is expected to reach $5.1 billion by 2027, rising at a market growth of 16.3% CAGR during the forecast period.

The Terrestrial Trunked Radio (TETRA) system was designed in order to meet the requirement of professional mobile radio (PMR), walkie-talkies as well as public access mobile radio (PAMR). The TETRA standard was created with a range of conventional PMR user organizations in mind, including public safety, transportation, military, utilities, government, PAMR, commercial, and the oil and gas industry. It contains a lot of safety and emergency features. Its scalable architecture enables implementation in networks ranging from single-site local area coverage to multiple-site nationwide coverage.

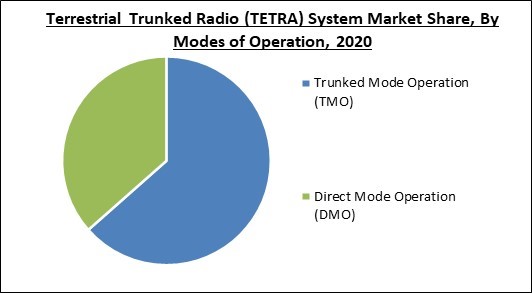

With four different channels over one radio carrier and 25 kHz spacing across carriers, TETRA utilizes time-division multiple access (TDMA). It is possible to use both point-to-points as well as point-to-multipoint transfer. The standard also includes digital data transmission, however at a modest data rate. TETRA Mobile Stations (MS) can interact via switching and management infrastructure (SwMI) made up of TETRA base stations in direct-mode operation (DMO) or trunked-mode operation (TMO) (TBS). DMO includes the ability to use a sequence of one or multiple TETRA terminals as relays, in addition to permitting direct communications in instances where network coverage is not available. This feature is referred as a DMO gateway from DMO to TMO or a DMO repeater from DMO to DMO.

The sudden emergence of the COVID-19 pandemic provoked the imposition of strict lockdown laws in several countries, causing delays in the import and export of Terrestrial Trunked Radio (TETRA) System equipment. Both consumers and the market have been harmed by COVID-19. To minimize the spread of COVID-19 among persons, electronic manufacturing hubs were temporarily shut down. This factor had a significant impact on the terrestrial trunked radio (TETRA) system market's supply chain, resulting in a scarcity of materials, components, and final products in the market.

Due to a lack of company continuity, revenue and shareholder returns have suffered considerable declines, resulting in financial disruptions to the market. Moreover, the market for terrestrial trunked radio (TETRA) systems is also hampered by a significant drop in infrastructure construction and installation projects.

Clarity, distortion, noise, and end-to-end transmission delay are all features of speech quality. Due to the fact that PMR or professional mobile radio, is a narrow spectral wireless technology, low bit rate voice coder/decoders (Codecs) with a bit rate of around 4kbits/s are often used to convert voice signals into a digital code for transmission, and then to convert the digital code into a representation of the original voice signal at the receiving end. The specific qualities of voice quality can vary depending on the type of codec utilized. All codecs should deliver continual high-quality voice communications throughout the service region, regardless of the strength of the RF signal.

The emitted RF power and receiver sensitivity, as well as the propagation properties of the radio frequency in use, define the extent of RF coverage. The variation in RF coverage performance between analog and digital should be negligible if these determining criteria are the same. The way receiver sensitivity is specified in analog differs from how it is specified in digital. The RF signal level required to create a 20dB signal-to-noise ratio is the acknowledged method of specifying analog receiver sensitivity, whereas the RF signal level at which a specified Bit Error Rate (BER) is displayed is the acceptable method of specifying digital receiver sensitivity.

Due to the fact that TETRA was developed in order to address the PAMR market with every possible function, complexity and development costs appeared as the most significant contributions to the higher cost of the final product. Multiple user interactions in a TETRA infrastructure necessitate fast and specialized switch nodes which are costly. The number of sites necessary to cover the same area as an existing analog system could be two or more times than that. With a set cost of site rent, maintenance, frequency license, and backbone links, more sites necessitate a larger initial investment. Liner modulation necessitates the use of expensive technology.

Based on Component, the market is segmented into Hardware and Software. In 2020, the software segment acquired a significant revenue share of the terrestrial trunked radio market. There is a rising demand for software components due to the development of software applications that are majorly facilitating various features such as automatic location messages, remoting radio monitors, accessing voice, and data information.

Based on Device, the market is segmented into Portable and Vehicular. In 2020, the portable segment garnered the maximum revenue share of the terrestrial trunked radio systems market. As the portable devices are compact and handy, they are more convenient to use. In addition, when there is no network, mobiles and portables can use 'direct mode,' which allows them to share channels directly. This feature is also called walkie-talkie mode.

Based on Modes of Operation, the market is segmented into Trunked Mode Operation (TMO) and Direct Mode Operation (DMO). The direct mode operation accounted for the second-largest revenue share of the terrestrial trunked radio systems in 2020. Direct Mode Operation refers to the capability of TETRA radio terminals to connect with one another while operating independently of the network, much like walkie-talkies. In addition, it can also be employed in specific professional settings, such as accidents or unusual conditions. During a chase, for example, two patrol cars may exit the coverage area, but two police units must still communicate. Both units will be able to continue the interaction and exchange of information in direct mode.

Based on End User, the market is segmented into Military & Defense, Government & Public Safety, Commercial, Industrial, Transportation, Utilities, and Others. In 2020, the military and defense segment garnered the highest revenue share in the terrestrial trunked radio systems market. The increased growth of this segment is attributed to the rising adoption of terrestrial trunked radio systems across the defense sector. TETRA services are widely being employed in this sector for multiple purposes such as, to communicate with other security authorities and command and control of military police activities, security of crucial objects, and defense material deployment.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 1.9 Billion |

| Market size forecast in 2027 | USD 5.1 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 16.3% from 2021 to 2027 |

| Number of Pages | 259 |

| Number of Tables | 448 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Device, Modes of Operation, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. In 2020, North America procured a significant revenue share of the terrestrial trunked radio systems market. The rising utilization of TETRA technology across the region is due to the rising investment by the government of the US in order to strengthen the defense infrastructure of the nation. The increased penetration of the technologies and advancements across the defense sector of the US is driving the growth of the market across North America.

Free Valuable Insights: Global Terrestrial Trunked Radio (TETRA) System Market size to reach USD 5.1 Billion by 2027

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include DAMM Cellular Systems A/S, Hytera Communications Corporation Limited, Rohill Engineering B.V., Rolta India Limited, JVCKENWOOD Corporation, Simoco Wireless Solutions, Airbus SE, and Motorola Solutions, Inc.

By Component

By Device

By Modes of Operation

By End User

By Geography

The terrestrial trunked radio (TETRA) system market size is projected to reach USD 5.1 billion by 2027.

The enhanced voice quality of the TETRA system are driving the market in coming years, however, the increased cost of the service limited the growth of the market.

DAMM Cellular Systems A/S, Hytera Communications Corporation Limited, Rohill Engineering B.V., Rolta India Limited, JVCKENWOOD Corporation, Simoco Wireless Solutions, Airbus SE, and Motorola Solutions, Inc.

Yes, COVID-19 pandemic provoked the imposition of strict lockdown laws in several countries, causing delays in the import and export of Terrestrial Trunked Radio (TETRA) System equipment. Both consumers and the market have been harmed by COVID-19.

The Hardware segment shows high market share in the Global Terrestrial Trunked Radio (TETRA) System Market by Component 2020, and would continue to be a dominant market till 2027; thereby, achieving a market value of $3.2 billion by 2027.

The Asia Pacific market dominated the Global Terrestrial Trunked Radio (TETRA) System Market by Region 2020, and would continue to be a dominant market till 2027.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.