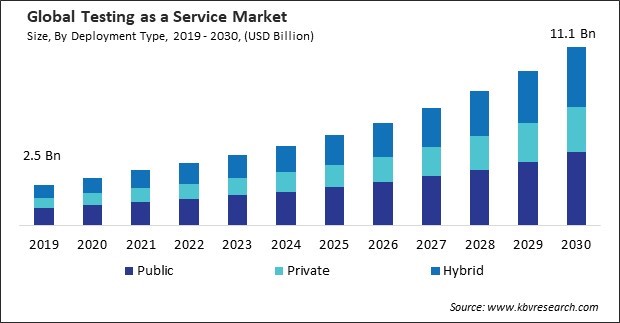

“Global Testing as a Service Market to reach a market value of USD 11.1 Billion by 2030 growing at a CAGR of 14.3%”

The Global Testing as a Service Market size is expected to reach $11.1 billion by 2030, rising at a market growth of 14.3% CAGR during the forecast period.

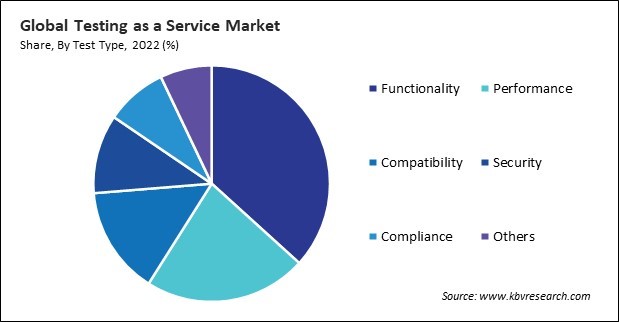

The increase in cyberattacks emphasizes the critical need for robust security measures as organizations become more aware of vulnerabilities and potential consequences of data breaches. Therefore, the security segment captured $416.8 million revenue in the market in 2022. Due to the growing utilization of cloud technologies, IoT devices, and complex software applications, the shifting IT landscape introduces new attack surfaces and security challenges that traditional testing methods may need to address more effectively. As businesses aim to safeguard against cyber threats and ensure compliance, the security segment is poised for substantial growth.

Modern software applications often leverage diverse architectures, including microservices, serverless computing, and containerization. Additionally, various technologies such as APIs, cloud services, and databases add to the complexity. TaaS provides a versatile testing environment capable of handling these diverse architectures and technologies. Software applications must often run across different operating systems, browsers, and devices. TaaS facilitates cross-platform testing, ensuring that applications behave consistently and provide a uniform user experience across various platforms. This is particularly crucial in the age of mobile applications and diverse device ecosystems. Additionally, the rapid utilization of emerging techniques, such as AI, ML, blockchain, and the IoT, introduces new complexities and challenges in software development. TaaS providers innovate by incorporating testing methodologies and tools tailored to these emerging technologies, ensuring that applications leveraging them are thoroughly tested for reliability, security, and performance. Continuous innovation in AI and ML enables the development of intelligent testing tools and solutions. TaaS providers integrate AI-driven testing capabilities, such as test automation, predictive analytics, and intelligent test case generation. This enhances the testing process's efficiency and enables organizations to identify patterns and potential issues more effectively. This includes validation of data exchange between services, compatibility testing, and ensuring the overall reliability of distributed systems. Due to the continuous innovation and technology adoption will be intrinsic to the growth of the market.

However, Legacy systems often use outdated technologies and may lack support for modern testing tools and frameworks. This creates compatibility issues when trying to integrate TaaS solutions, as the testing tools used in TaaS may not be compatible with the legacy technologies employed by the existing systems. Legacy systems may have limited support for test automation, making it challenging to leverage the full benefits of automated testing offered by TaaS. The absence of APIs, scripting capabilities, or standardized interfaces in legacy applications can hinder the automation of test cases and scripts. Legacy systems often have complex interdependencies, making isolating components for testing purposes challenging. TaaS relies on isolating and testing individual components independently, which can be hindered by the intricacies of legacy system architectures. This can hinder the seamless data exchange between the legacy systems and the TaaS environment, affecting the effectiveness of integration and collaboration. As a result, the above aspects will cause the market growth to decline.

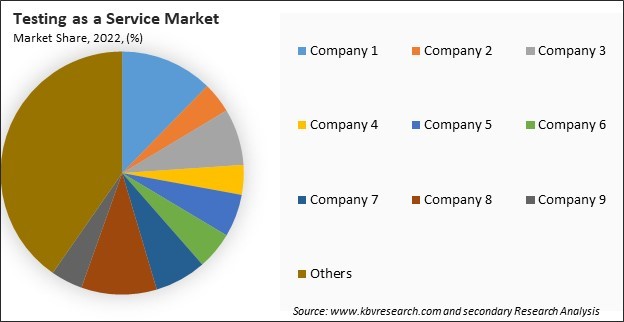

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

By deployment type, the market is classified into public, private, and hybrid. In 2022, the public segment registered the highest revenue share in the market. The pay-as-you-go model of public cloud eliminates the necessity for upfront investments in expensive hardware and software, specifically advantageous for startups and small to medium-sized enterprises (SMEs). Public cloud infrastructure's scalability and flexibility seamlessly align with the dynamic requirements of agile development, allowing businesses to adapt testing resources as needed effortlessly. The accessibility of testing tools and environments, accessible from anywhere with an internet connection, facilitates remote work and collaboration.

On the basis of test type, the market is segmented into functionality, performance, compatibility, security, compliance, and others. The performance segment projected a prominent revenue share in the market in 2022. Load testing involves assessing an application's performance under expected user loads. TaaS provides the infrastructure to simulate many virtual users accessing the application simultaneously. This helps identify bottlenecks, evaluate response times, and ensure the application can endure the expected load without degradation in performance. Real User Monitoring (RUM) involves collecting performance data directly from the end-users' interactions with the application. TaaS solutions can integrate RUM capabilities, allowing organizations to analyze real-time user experiences, identify performance issues, and optimize the application for improved user satisfaction.

Based on application, the market is fragmented into IT & telecommunication, healthcare, BFSI, automotive, manufacturing, retail & consumer goods, energy & utilities, and others. In 2022, the IT & telecommunication segment held the highest revenue share in the market. The escalating demand for digital transformation in the IT sector places businesses under constant pressure to innovate and embrace new technologies. TaaS emerges as a solution by offering access to a skilled pool of testing professionals and resources, eliminating the need for substantial internal testing infrastructure investments. The increasing complexity of IT systems further emphasizes the role of TaaS providers, who provide specialized expertise and tools to test intricate systems that are challenging and expensive to test in-house effectively.

Free Valuable Insights: Global Testing as a Service Market size to reach USD 11.1 Billion by 2030

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific region acquired a substantial revenue share in the market in 2022. The region's increasing adoption of cloud computing drives the demand for TaaS. Additionally, there is a growing awareness among businesses in the region about the benefits of outsourcing testing activities, including cost reduction, improved quality, and accelerated time. Government initiatives in some Asia Pacific countries, such as China and Japan, to promote the adoption of cloud computing and digital technologies create a strong demand for TaaS in the region.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 3.9 Billion |

| Market size forecast in 2030 | USD 11.1 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 14.3% from 2023 to 2030 |

| Number of Pages | 282 |

| Number of Tables | 430 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Market Share Analysis, Regional and Country Breakdown, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Test Type, Deployment Type, Application, Region |

| Country scope |

|

| Companies Included | Accenture PLC, Atos Group, Capgemini SE, Deloitte Touche Tohmatsu Limited, DXC Technology Company, Infosys Limited, TATA Consultancy Services Ltd., Qualitest Group, IBM Corporation, Wipro Limited |

By Deployment Type

By Test Type

By Application

By Geography

This Market size is expected to reach $11.1 billion by 2030.

Increasing complexity of software applications are driving the Market in coming years, however, Integration challenges with legacy systems restraints the growth of the Market.

Accenture PLC, Atos Group, Capgemini SE, Deloitte Touche Tohmatsu Limited, DXC Technology Company, Infosys Limited, TATA Consultancy Services Ltd., Qualitest Group, IBM Corporation, Wipro Limited

The expected CAGR of this Market is 14.3% from 2023 to 2030.

The Functionality segment is leading the Market by Test Type in 2022; there by, achieving a market value of $3.8 billion by 2030.

The North America region dominated the Market by Region in 2022, and would continue to be a dominant market till 2030; there by, achieving a market value of $4 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges