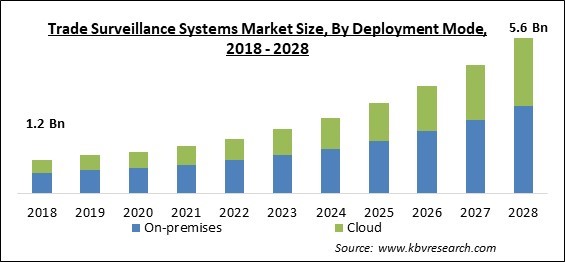

The Global Trade Surveillance Systems Market size is expected to reach $5.6 Billion by 2028, rising at a market growth of 18.9% CAGR during the forecast period.

The establishment of a surveillance system to examine manipulative or unlawful trading practices in the security markets is known as trade surveillance. By monitoring & detecting trading actions, trade surveillance aids in the maintenance of orderly markets. Cross-market, market manipulation, trade violence, cross-asset research, & pre- and post-trade checks to ensure the fairness & accuracy of transactions in an organization are just a few examples.

A trade surveillance system is a sophisticated software solution that monitors and detects suspected market manipulation & other financial crimes. It detects illegal or immoral trading practices like fraud, behavioral patterning, market manipulation, unauthorized disclosure, insider trading, money laundering, & unsuitable investments by gathering & analyzing trade data.

It is vital to have the right trade surveillance systems in place to make sure the prevention & investigation of abusive, manipulative, or criminal trading practices. The full depth of the order book, market and cross asset-class views of trades entered by the business under investigation, and examination of complete audit trails of orders & trades in suspected cases are just a few of the primary application areas for such a system.

Trading has become more complicated in financial businesses as the number of financial instruments has grown. The increased number of transactions necessitates the requirement for financial service organizations to monitor transactions under rules like MiFID II, MAR, and Dodd-Frank. Financial firms must adopt trade monitoring systems, according to SteelEye, not only to guarantee that they are complying with legislation but also to limit the danger of fraudulent misconduct and defend their brand. Compliance officers are also responsible for monitoring and evaluating the company's trading behavior under the Markets Abuse Regulation (MAR).

The COVID-19 pandemic has had a moderate impact on the trade surveillance system industry, due to high pressure on businesses to preserve essential data in the event of a pandemic and a drop in end-user spending. Moreover, there is a lot of volatility in the market as a result of the worldwide shutdown, and corporations are having a hard time monitoring numerous questionable trading activities. As a result, many companies are using trade surveillance systems to monitor multiple questionable actions during the pandemic condition and to regulate skyrocketing market volumes, which is supporting market growth. In addition, some market players are investing extensively in increasing product quality, which is assisting them in gaining market share in developing countries around the world. As a result, the market for trade surveillance systems is developing due to an increasing number of such advances among the market's main competitors.

Voice, video, and other forms of technological communication must be monitored in order to detect fraudulent behavior among traders. To disclose genuine intent, AI-based systems can contextualize information based on tone, jargon, slang, idioms, and code words. Risk scores are assigned automatically for individual transactions, market actors, asset classes, and marketplaces based on this surveillance. Nasdaq, for instance, employs AI-based systems to spot complex correlations and patterns, as well as new sorts of market manipulations, across roughly 60 marketplaces and over 160 global participants. AI-based solutions assign risk rankings based on a variety of factors, allowing for better event prioritization and grouping.

Insider trading is a criminal offense in the United States that involves both monetary & jail penalties. After receiving critical information, the Securities and Exchange Commission's (SEC) enforcement section conducts a thorough investigation into a possible securities violation. The SEC builds a case through interviewing witnesses, reviewing trade records & data, subpoenaing phone records, and other means. In recent years, the SEC has employed a diverse set of instruments and techniques to combat insider trading. In the landmark Galleon Group case, wiretaps were used for the first time to incriminate numerous people in a wide-ranging insider-trading conspiracy.

The government organizations and relevant authorities from various countries have worked to enforce severe regulations to reduce financial fraud and cybercrime. Advances in cybercrime have prompted authorities to update their legislation regularly. Regulators in different regions are always changing and evolving, posing problems for trade surveillance management suppliers to cope with and improve their solutions to adhere to the various requirements. Advances in the trading technology, as well as cross-border trading, have prompted the financial institution to keep a tight check on every transaction to avoid the incurring hefty fines as a result of regulatory violations.

Based on Deployment Mode, the market is segmented into On-premises and Cloud. The Cloud-based segment procured a substantial revenue share in the trade surveillance market in 2021. Because of the convenience of digitalization and quick accessibility, cloud-based trading surveillance systems are fast evolving. However, as the number of cloud-based trading activities grows, so does the requirement for trading surveillance. Owing to the many advantages it provides, cloud-based trade surveillance solutions are gaining a lot more traction currently. Since it encourages digitalization, cloud-based trading activity is emerging as a new emerging trend in trade. In addition, the market for cloud-based trade surveillance systems is growing due to increased use among small, medium, and big businesses as well as freelancers. The cloud-based trade surveillance solution aids in the transformation of these businesses' application development, infrastructure, deployment, and delivery processes, while also enhancing efficiency and reducing storage costs drastically.

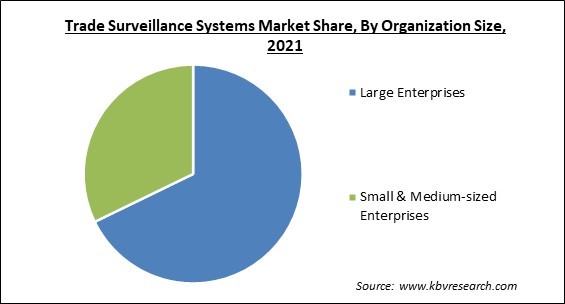

Based on Organization Size, the market is segmented into Large Enterprises and Small & Medium-sized Enterprises. The Large Enterprises acquired the highest revenue share in the trade surveillance market in 2021. Large firms are defined as businesses with more than a thousand employees. Due to the need for a modern, holistic approach to trade surveillance, as well as extensive functional and regulatory coverage and the flexibility to fulfill the needs of today's complex business environment, large enterprises have adopted trade surveillance systems at a faster rate.

Based on Vertical, the market is segmented into Banking, Capital Markets, and Others. The capital market segment garnered a substantial revenue share in the trade surveillance market in 2021. As the capital/security markets have developed, traders have discovered new ways to manipulate prices, resulting in a loss of investor confidence and a deterioration of market integrity. Trade surveillance in the financial sector is defined as the process of monitoring & investigating an organization's trading conduct that directly or indirectly involves market abuse or market manipulation, which could result in legal action, criminal charges, or even corporate closure.

Based on Component, the market is segmented into Solutions and Services. Based on Solutions Type, the market is segmented into Reporting & Monitoring, Surveillance & Analytics, Risk & Compliance, Case Management, and Others. The solutions segment acquired the highest revenue share in the trade surveillance market in 2021. This is due to an increase in the demand for upgrading firm performance and analyzing large volumes of data from multiple locations, both of which improve the efficiency of trade surveillance systems. Trade surveillance systems can help businesses in a variety of ways, involving data optimization, better compliance management, and easier case management. Enterprises are also using trade surveillance systems solutions to automate, improve, and manage the surveillance process to improve capabilities and efficiency.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 1.7 Billion |

| Market size forecast in 2028 | USD 5.6 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 18.9% from 2022 to 2028 |

| Number of Pages | 298 |

| Number of Tables | 523 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Deployment Mode, Organization Size, Component, Vertical, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. Europe emerged as the leading region in the trade surveillance systems market with the highest revenue share in 2021. The existence of the bulk of telecom system integrators is one of the primary reasons driving the growth of the trade surveillance system market in this region. Additionally, technological developments in security systems, as well as a rise in strict rules and regulatory compliance, all lead to the enhancement of the European trade surveillance system market.

Free Valuable Insights: Global Trade Surveillance Systems Market size to reach USD 5.6 Billion by 2028

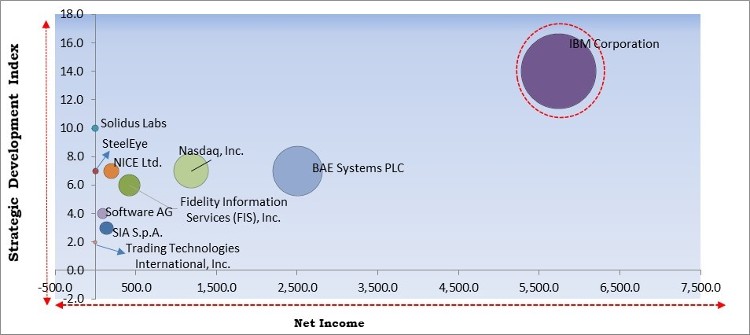

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; IBM Corporation are the forerunners in the Trade Surveillance Systems Market. Companies such as BAE Systems PLC, Nasdaq, Inc., Fidelity Information Services (FIS), Inc. are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include IBM Corporation, Software AG, NICE Ltd., Nasdaq, Inc., Fidelity Information Services (FIS), Inc., BAE Systems PLC, SIA S.p.A. (Nexi Group), SteelEye Limited, Solidus Labs, Inc., and Trading Technologies International, Inc.

By Deployment Mode

By Organization Size

By Vertical

By Component

By Geography

The global trade surveillance systems market size is expected to reach $5.6 Billion by 2028.

Increased government regulations & laws to limit insider trading are increasing are driving the market in coming years, however, concerns about compliance non-standardization, worldwide regulations, and cost-benefit ratio growth of the market.

IBM Corporation, Software AG, NICE Ltd., Nasdaq, Inc., Fidelity Information Services (FIS), Inc., BAE Systems PLC, SIA S.p.A. (Nexi Group), SteelEye Limited, Solidus Labs, Inc., and Trading Technologies International, Inc.

The expected CAGR of the trade surveillance systems market is 18.9% from 2022 to 2028.

The On-premises segment is dominating the Global Trade Surveillance Systems Market by Deployment Mode in 2021; thereby, achieving a market value of $3.1 billion by 2028.

The Europe market dominated the Global Trade Surveillance Systems Market by Region in 2021, and would continue to be a dominant market till 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.