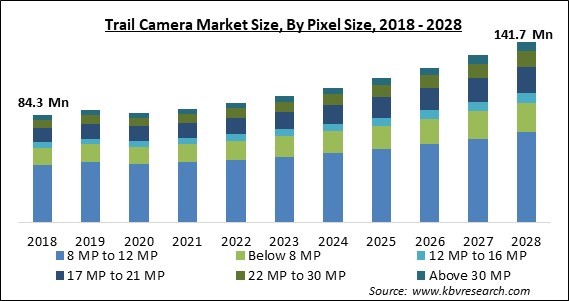

The Global Trail Camera Market size is expected to reach $141.7 million by 2028, rising at a market growth of 7.1% CAGR during the forecast period.

A trail camera is a device used by photographers in remote regions where they cannot be physically present to trigger the shutter. Trail cameras are launched by the subject's body heat and movement, and therefore, it is not required to be available at the spot to control a trail camera. Some trail cameras have infrared illumination with a wavelength that cannot be detected by the target.

These cameras can capture images in two different formats: videos and still photos. The advantage of adding a video option is that the viewer can see how the targeted animals behave through the video. This can frequently give more information than a single picture fixed in time. Businesses now provide cameras that can capture both concurrently, allowing users to have maximum information.

Trigger time or trigger speed is the amount of time it requires a camera to capture a photograph after detecting a subject, such as a deer. Camera recovery time is the time it takes for a camera to restart or recycle after capturing a photo. Sluggish trigger times and slow camera recovery times can result in missed opportunities.

The detection zone of a trail camera is limited to an invisible area that begins at the camera's face and stretches outward in a V-shape, increasing in size with distance. Within this zone, the camera detects motion. Once motion is detected, the camera activates and takes an image or begins video recording. High values in both length and width enable the camera to detect more motion and take more photographs, and vice versa. Some high-quality trail cameras offer the option to digitally incorporate GPS coordinates of the camera's location onto maps, which facilitates tracking targeted animals' movement and camera placement.

The COVID-19 pandemic had a detrimental impact on the trail camera market. During the pandemic, most countries' economies went into recession, which pushed a negative effect on the financial aspects of photography. In modern times, photography has become more of leisure than a requirement, with demand fluctuating according to consumers' incomes. As the pandemic developed, a general decline in interest in photography services was observed. Since its primary applications were in the fields of hunting and wildlife photography, which were not allowed during the lockdown, it subsequently affected the manufacturers.

Standard trail cameras generate images with greater clarity and contrast and have two sensors for both day and night use. Trail cameras record high-quality images since they upload pictures and movies immediately to an SD card that has been inserted. The camera can be placed in regions where it may be readily concealed without creating a scent or trace. Most typical game cameras have a no-glow or low-glow infrared option for low-light or night-time photography that is animal-friendly. Animals will not discover them and will be frightened.

Similar to cell phones, cellular trail cameras use radio waves to connect with the closest cell tower and electromagnetic fields to relay data. Once the trail camera begins capturing pictures, it transfers them to the smartphone over a wireless provider's cellular network. Trail cameras can stream videos to the users' smartphone. These cameras also have significantly reduced, generally about a one-second trigger rate for capturing fast-moving photos.

Due to a limited consumer base trail camera remain underutilized. Lack of public awareness is a significant barrier to the widespread deployment of trail cameras. In most underdeveloped nations’ people still, adhere to traditional methods of poaching. Similarly, animal monitoring organizations use GPS tags over trail cameras as they turn out to be more affordable than installing trail cameras. Although these trail cameras are capable of long-term recording and wildlife capture, they only cover a set area of land.

Based on pixel size, the trail camera market is categorized into below 8 MP, 8 to 12 MP, 12 to 16 MP, 17 to 21 MP, 22 to 30 MP, and above 30 MP. The 17 to 21 MP camera segment procured a significant revenue share in the trail camera market in 2021. Wildlife enthusiasts choose trail cameras with maximum quality of 1296p and 20 megapixels, allowing them to observe wildlife from a considerable distance.

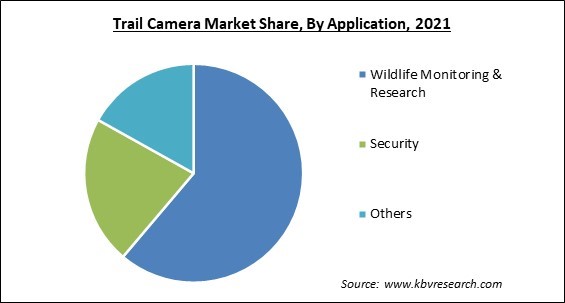

On the basis of application, the trail camera market is divided into wildlife monitoring & research, security, and others. The wildlife monitoring and research segment recorded the largest revenue share in the trail camera market in 2021. Trail cameras are becoming an increasingly common means of observing animals and are employed in wildlife research to investigate animal behavior and activities.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 89.3 Million |

| Market size forecast in 2028 | USD 141.7 Million |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 7.1% from 2022 to 2028 |

| Number of Pages | 164 |

| Number of Tables | 290 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Pixel Size, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on region, the trail camera market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment acquired the maximum revenue share in the trail camera market in 2021. North America has developed as the most profitable industry for trail cameras and would continue to dominate during the projection period. Trail cameras have become more dependable, versatile, and convenient as a result of continual technological advances. The product demand in the region is driven by consumers, notably hunters and outdoor enthusiasts, who rely on trail cameras for gaming, wildlife observation & photography, and residential security.

Free Valuable Insights: Global Trail Camera Market size to reach USD 141.7 Million by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Vista Outdoor, Inc., FeraDyne Outdoors LLC, Wildgame Innovations LLC (Good Sportsman Marketing, LLC), Cuddeback, Blaser Group GmbH (MINOX), Browning Trail Cameras, SPYPOINT, Boly Media Communications Co., Ltd., RECONYX, Inc. and Easy Storage Technologies Co., Ltd.

By Pixel Size

By Application

By Geography

The global Trail Camera Market size is expected to reach $141.7 million by 2028.

High Efficiency and Workability of Trail Cameras are driving the market in coming years, however, Lack of Awareness and Subsequent Lack of Installation Ability restraints the growth of the market.

Vista Outdoor, Inc., FeraDyne Outdoors LLC, Wildgame Innovations LLC (Good Sportsman Marketing, LLC), Cuddeback, Blaser Group GmbH (MINOX), Browning Trail Cameras, SPYPOINT, Boly Media Communications Co., Ltd., RECONYX, Inc. and Easy Storage Technologies Co., Ltd.

The expected CAGR of the Trail Camera Market is 7.1% from 2022 to 2028.

The 8 MP to 12 MP market is leading the Global Trail Camera Market by Pixel Size in 2021; thereby, achieving a market value of $70.5 million by 2028.

The North America market dominated the Global Trail Camera Market by Region in 2021; thereby, achieving a market value of $50.1 million by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.