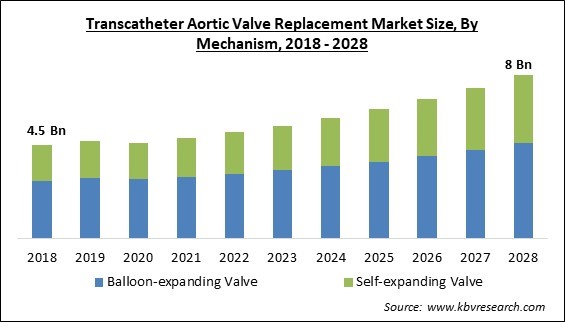

The Global Transcatheter Aortic Valve Replacement Market size is expected to reach $8 billion by 2028, rising at a market growth of 7.5% CAGR during the forecast period.

Open heart surgery, called transcatheter aortic valve replacement, uses a far less invasive technique to replace an enlarged aortic valve. Aortic stenosis is managed with its help. The aortic valve's partial closure, which restricts blood flow, is known as aortic stenosis. Blood is transported from the heart to the body's many organs via the enormous aorta artery. The surgical replacement of the aortic valve (SAVR) is not an option for these high-risk individuals, and it cannot be performed. Due to the significant risk of open heart surgery for the elderly, they fall within the category of high-risk patients.

New aortic valves are implanted during a transcatheter aortic valve replacement (TAVR) procedure to restore the aortic valve's blood-flow capabilities. Transcatheter aortic valve implantation becomes more necessary as aortic stenosis grows more widespread. The rise in aortic stenosis prevalence, the rise in demand for different TAVR operations, and improvements in transcatheter aortic valve implantation technology are the main reasons behind the expansion of the transcatheter aortic valve replacement market.

Also, the geriatric population is growing, which drives the market for TAVR because older people are more susceptible to aortic stenosis. In addition, the market is growing due to improvements in TAVR valve technology and increased awareness of early diagnosis. The spike in interest in minimally or non-invasive procedures due to the multiple advantages these surgeries offer is one of the major drivers accelerating market growth in the upcoming years.

As the surgical procedure was temporarily delayed and was not an emergency, the COVID-19 outbreak has had a significant negative impact on the market for aortic valve replacement devices. This resulted from the significant infection risk in the healthcare sector, which patients with heart-related diseases were susceptible to. However, the need for heart disease diagnostics and treatment will certainly increase due to the elimination of COVID-19 restrictions and an increase in patient visits to hospitals and clinics, driving the TAVR procedure market growth over the projection period. Additionally, market innovation keeps improving the growth prospects.

The main benefit of transcatheter valve replacement surgery is that it may be performed through tiny incisions, preserving all of the chest bones. Patients who have not been given the choice of a valve replacement procedure can also benefit from this course of treatment. Compared to surgical valve replacement, these procedures necessitate a shorter hospital stay for the patients. The market for transcatheter aortic valve replacement is anticipated to expand in the near future as a result of the rising demand for minimally invasive procedures.

The demand for AVR devices is increasing as AS, and valvular disorders become more prevalent. These ailments have the potential to cause fatal complications like heart failure, stroke, and death. To stop these disorders from getting worse and lower the risk of consequences, early diagnosis and treatment are essential. The transcatheter aortic valve replacement market's sales revenue is therefore being driven by a rise in awareness of the significance of early detection and treatment of AS and valvular disorders.

Over 25% of patients experience irregular heartbeat (arrhythmia) following an aortic valve replacement, but this condition typically disappears over time. However, 1% to 2% of people will require the fitting of a pacemaker to regulate their heartbeat. Up to 5% of persons with kidney issues experience short-term kidney dysfunction following surgery. Temporary dialysis could be required in a few situations. A major procedure, replacing the aortic valve, can occasionally result in deadly consequences. These issues with the aortic valve replacement may restrict the patients from undergoing the procedure, restraining market growth over the forecast period.

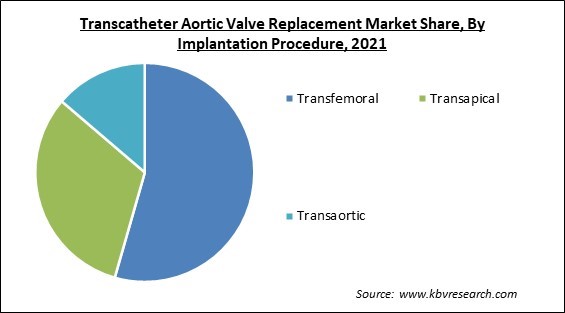

By Implantation procedure, the transcatheter aortic valve replacement market is segmented into transfemoral, transapical, and transaortic. The transapical segment garnered a significant revenue share in the transcatheter aortic valve replacement market in 2021. The transapical approach's proximity to the aortic valve and left ventricular apex enhances operator mobility while device implantation and permits the use of sheaths with larger diameters. Innovative transapical devices have been created and developed by several companies.

On the basis of material, the transcatheter aortic valve replacement market is bifurcated into stainless steel, nitinol, cobalt chromium, and others. In 2021, the nitinol segment witnessed the highest revenue share in the transcatheter aortic replacement market. Nickel and titanium are almost equally distributed in the alloy known as titanium. Due to its unique qualities, which include its lack of magnetism, biocompatibility, flexibility, and fatigue resistance, it is frequently used in most TAVR devices. This enables medical devices in minimally invasive surgeries, as well as implants, to provide improved outcomes, thereby boosting segment growth.

Based on mechanism, the transcatheter aortic valve replacement market is fragmented into balloon-expanding valve and self-expanding valve. In 2021, the balloon-expanding valve segment dominated the transcatheter aortic valve replacement. Balloon-expanding valves make it simpler to access the coronary arteries since they are intra-annular, non-repositionable, and have a reduced stent frame profile. A horizontal aorta (aortic angulation >60°), for example, makes it easier to implant a valve in patients with difficult vascular architecture since the delivery mechanism is more steerable than that of the self-expanding device. Also, the segment's expansion is being fueled by new product launches.

By end-use, the transcatheter aortic valve replacement market is categorized into hospitals, ambulatory surgical centers, others. The ambulatory surgery centers segment recorded a remarkable revenue share in the transcatheter aortic valve replacement market in 2021. Since the TAVR is a novel procedure replacing open surgery, the number of ambulatory surgery facilities is increasing in developed regions. In addition, because TAVR is a less difficult procedure that takes less time to recuperate, it can be performed in surgery centers. This supports the segment's growth.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 4.9 Billion |

| Market size forecast in 2028 | USD 8 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 7.5% from 2022 to 2028 |

| Number of Pages | 264 |

| Number of Table | 439 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Material, Implantation Procedure, Mechanism, End-use, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the transcatheter aortic valve replacement market is analyzed across North America, Europe, Asia Pacific and LAMEA. The North America region led the transcatheter aortic valve replacement market by generating the highest revenue share in 2021. The market is expanding rapidly in North America due to several factors, including the rising prevalence of valvular illnesses and greater public awareness of the advantages of transcatheter aortic valve replacement over traditional surgical methods. In addition, an important factor in the market's growth is the region's growing geriatric population.

Free Valuable Insights: Global Transcatheter Aortic Valve Replacement Market size to reach USD 8 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Abbott Laboratories, Medtronic PLC, Boston Scientific Corporation, Edwards Lifesciences Corporation, MicroPort Scientific Corporation, LivaNova PLC, TTK Healthcare Limited, Meril Life Science Private Limited, JenaValve Technology, Inc., and Bracco S.p.A.

By Material

By Implantation Procedure

By Mechanism

By End-use

By Geography

The global Transcatheter Aortic Valve Replacement Market size is expected to reach $8 billion by 2028.

Grown occurrence of aortic valve stenosis & valvular diseases are driving the market in coming years, however, Risks involved in aortic valve replacement restraints the growth of the market.

Abbott Laboratories, Medtronic PLC, Boston Scientific Corporation, Edwards Lifesciences Corporation, MicroPort Scientific Corporation, LivaNova PLC, TTK Healthcare Limited, Meril Life Science Private Limited, JenaValve Technology, Inc., and Bracco S.p.A.

The expected CAGR of the Transcatheter Aortic Valve Replacement Market is 7.5% from 2022 to 2028.

The Transfemoral segment is leading the Global Transcatheter Aortic Valve Replacement Market by Implantation Procedure in 2021 thereby, achieving a market value of $4.2 billion by 2028.

The North America market dominated the Global Transcatheter Aortic Valve Replacement Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $3 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.