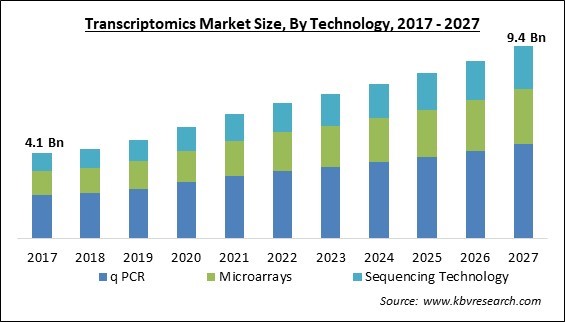

The Global Transcriptomics Market size is expected to reach $9.4 billion by 2027, rising at a market growth of 7.6% CAGR during the forecast period.

Transcriptomics is the study of RNA transcripts that depends on knowledge of next-generation sequencing technologies, which need RNA to be transcribed into complementary DNA before being sequenced. Microarrays and q PCR are among the technologies used. In addition, Microarrays are one of the most widely used tools in research labs. Quantitative reverse transcription, or q PCR, is a technique for detecting the presence and quantity of RNA by turning it into cDNA. It is named reverse transcription since it is carried out with the help of a polymerase chain reaction.

Microarrays, RNA sequencing, real-time polymerase chain reaction, RNA interference, expressed sequence tag (EST)-based technologies, SAGE, and other methods have been developed for transcriptome study. To study the quantity and sequences of RNA in a sample, RNA sequencing employs next-generation sequencing. Additionally, Microarray is a technique that detects gene expression in thousands of samples at once. The primary difference between RNA-sequencing and microarray is that RNA-sequencing recognizes every transcript in a sample, whereas microarray uses hybridization to detect just pre-set transcripts or genes. To identify and analyze a short sequence of RNA or DNA, the polymerase chain reaction method is used to create various copies of a single gene. Moreover, scientists can study diseases at the genome level using these tools. It also aids in the development of new clinical biomarkers, the identification of various molecular disorders, and the evaluation of various medications.

Some of the growth catalysts for the overall industry are a surge in demand for personalized medicine, increased pharmaceutical and biotechnology R&D expenditure, government investment for omics, rise in RNA sequencing applications, and development of new transcriptomics products by a large number of key players. In addition, the increased focus on biomarker identification and the massive demand for transcriptome in R&D activities has resulted in a spike in transcriptome output. According to the National Human Genome Research Institute, which is part of the National Institutes of Health (NIH), the Mammalian Gene Collection Initiative and the Mouse Transcriptome Project were two programs that generated transcriptome resources for researchers all over the world. These two models are critical for the study of human biology, which would drive market expansion.

The transcriptomics market is expected to grow positively as a result of the COVID-19 pandemic. The increased use of transcriptomics is due to the increased manufacture of vaccines like Covishield and Covaxin for COVID-19. NanoString Technologies Inc., for example, launched new technologies to evaluate the immune response in COVID-19 disease research in June 2020. As a result, the transcriptomics market is expected to grow throughout the projected period due to an increase in the development of novel medications and instruments. The outbreak of the COVID-19 pandemic has opened new avenues for market players. NanoString Technologies, Inc., for example, released the nCounter Host Response Gene Expression Panel in June 2020 for the investigation of immune system response during COVID-19 viral research.

Personalized medicine has entered conventional clinical practice and is transforming how many diseases are detected, classified, and treated. In addition, it has become a fundamental focus of research in the healthcare business. Oncology is one area where these gains are particularly noticeable. The number of tailored medications, therapies, and diagnostic items has grown since 2006, according to the Personalized Medicine Coalition report (2017), and this trend is projected to continue in the coming years. In addition, the demand for tailored treatment and RNA sequencing applications in transcriptomics is constantly growing. The expanding interest in outsourcing services, as well as the growing focus on biomarker research and toxicogenomic, are the key trends of the overall market.

The identification of biomarkers, as well as their clinical uses, has improved drug discovery and development techniques for assessing medication toxicity and efficacy. In addition, biomarkers for diseases such as cancer, cardiovascular disease, and neurological diseases are crucial in gaining a better knowledge of the disease route and progression. The microarray technology employed in transcriptome analysis holds the possibility of allowing for widespread genetic disease research. Moreover, it also aids in the development of novel clinical biomarkers, the identification of novel molecular abnormalities, and therapeutic efficacy research. Tuberculosis is a global issue that affects millions of people, necessitating more efficient diagnosis, treatment response monitoring, and the development of more effective pharmacological therapies and vaccines.

For transcriptomic research, microarray experiments generate massive volumes of data. As a result, researchers frequently confront difficulties in interpreting results and utilizing available computational resources to handle data. In addition, transcriptomics data from RNA sequencing has low genome coverage and strong amplification bias, making data interpretation difficult, particularly without effective bioinformatics tools. Many of the methods that have been developed for bulk cell sequencing have not proven successful in analyzing transcriptomics data. This presents a number of obstacles, including difficulty in calling copy number changes, identifying mutant genes in tumor samples, rebuilding cell lineages, recovering low abundant transcripts, and enhancing the accuracy of transcript quantitative analysis.

Based on Technology, the market is segmented into q PCR, Microarrays, and Sequencing Technology. In 2020, the q PCR segment acquired the maximum revenue share of the Transcriptomics Market. This is due to an increase in the number of COVID-19 cases, increased usage of genetic testing, and increased demand for transcriptomics for drug discovery. Moreover, due to the growing use of PCR for COVID-19 diagnostic across the globe, real-time-PCR (qPCR) technology would continue to be a major segment. The technology is thought to be extremely sensitive and quantitative, making it one of the best ways for examining a small number of transcripts in a large number of samples. In addition, PCR allows for the identification of SARS-CoV-2 with a high degree of sensitivity, as well as the evaluation of viral RNA in a variety of clinical samples, the detection of SARS-CoV-2 mutations, and the evaluation of anti-SARS-CoV-2 medications.

Based on Application, the market is segmented into Drug Discovery, Diagnostics & Disease Profiling, and Others. The Diagnostics and Disease Profiling segment collected a significant revenue share of the Transcriptomics Market in 2020. This is because the transcriptome records all RNA transcribed by the genome in a certain tissue or cell type, at a specific developmental stage, and under a specific physiological or pathological environment. As a result, transcriptome analysis not only allows to comprehend the human genome at the transcriptional level, but also gene structure and function, gene expression regulation, and genome plasticity. More crucially, it may reveal the essential changes in biological processes that cause human diseases, resulting in fresh instruments valuable not only for understanding their underlying mechanisms but also for molecular diagnosis and clinical treatment.

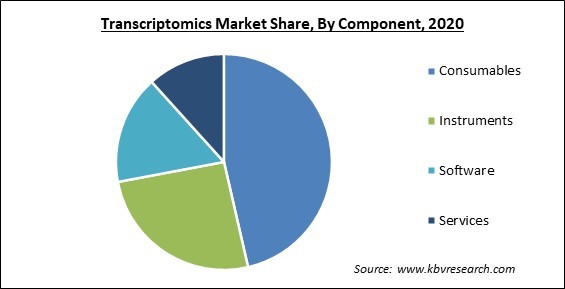

Based on Component, the market is segmented into Consumables, Instruments, Software, and Services. In 2020, the Consumables segment procured the largest revenue share of the Transcriptomics Market. This is due to increased pharmaceutical R&D activities, increased need for drug development, and increased usage of transcriptomics products. Moreover, the growth of the segment can be attributed to the ongoing technological breakthroughs and the increasing availability of novel and cost-effective sequencing platforms.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 5.4 Billion |

| Market size forecast in 2027 | USD 9.4 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 7.6% from 2021 to 2027 |

| Number of Pages | 219 |

| Number of Tables | 363 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Technology, Component, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. In 2020, the North American region emerged as the leading region in the overall Transcriptomics Market by procuring the maximum revenue share. The high revenue share of the regional market is due to the rise in the number of different types of disease diagnoses, the presence of key players, the advancements in the healthcare industry, and the presence of new transcriptomics products in the region.

Free Valuable Insights: Global Transcriptomics Market size to reach USD 9.4 Billion by 2027

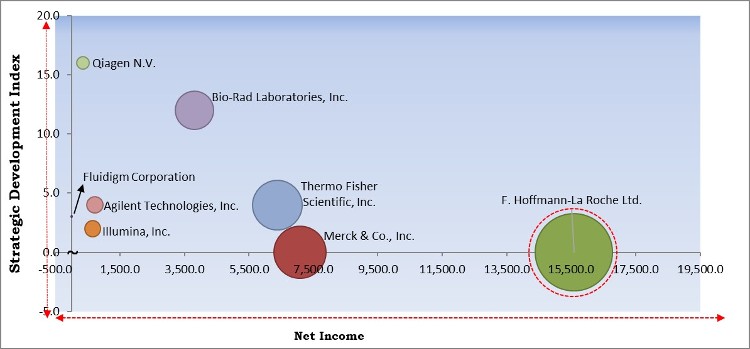

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; F. Hoffmann-La Roche Ltd. is the major forerunner in the Transcriptomics Market. Companies such as Qiagen N.V., Bio-Rad Laboratories, Inc., Thermo Fisher Scientific, Inc. are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Fluidigm Corporation, Promega Corporation, General Electric (GE) Co., Merck & Co., Inc., Thermo Fisher Scientific, Inc., Illumina, Inc., Bio-Rad Laboratories, Inc., Agilent Technologies, Inc., F. Hoffmann-La Roche Ltd., and Qiagen N.V.

By Technology

By Application

By Component

By Geography

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.