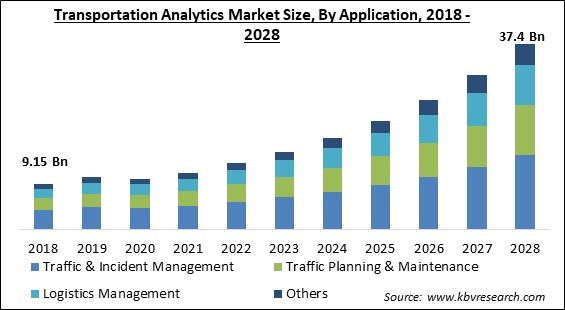

The Global Transportation Analytics Market size is expected to reach $37.4 billion by 2028, rising at a market growth of 18.7% CAGR during the forecast period.

The term "Transportation Analytics" refers to the process of doing predictive analysis on transportation data with the goal of simplifying commercial and individual modes of travel. The goals of the Transportation Analytics project are to improve cost efficiency, boost productivity, and optimize fuel use.

Transportation analytics involves predicting the daily levels of traffic, optimizing delivery routes, allocating resources for the effective delivery of services, and improving the customer experience and level of satisfaction. Sensors are utilized to gather the data that is then analyzed and used to anticipate which components are likely to underperform. Components that are predicted to underperform are identified.

Additionally, enterprises are able to do preventative maintenance owing to transportation analytics. Within the context of the distribution operation, the enormous volume of route data is dealt with by transportation analytics. It doesn't matter how big it is; it can still help you make better choices for your company, which will eventually be to your advantage.

Additionally, at each and every step of the delivery process, significant metrics may be derived from transportation analytics. Not only does it support learning about the company's weakest and strongest parts, but it also gives the organization with reliable data and deliverables that it can share with customers. These advantages provide potentially profitable prospects for the expansion of the market.

In addition, supply chain management makes extensive use of big data analytics in order to assess operational risks, enhance communication, better protect proprietary information, and broaden the scope of supply chain accessibility. This data is put to use by companies in a number of ways, including the development of more effective cloud-based platforms and predictive analytics. Data mining, statistics, and machine learning are the three main components of predictive analytics.

The pandemic caused by COVID-19 has had a significant impact on enterprises all across the globe. The study of the market for transportation analytics has seen significant development over the last few years; however, owing to the breakout of the COVID-19 pandemic, it is anticipated that it would create profitable chances for the expansion of the industry. This may be linked to the fact that governments in the vast majority of nations have implemented a lockdown, and travel restrictions have been imposed all across the globe in an effort to stop the spread of the virus. This has caused disruptions in the supply networks of several different businesses. On the other hand, when the COVID-19 epidemic has been contained, it is anticipated that the market for transportation analytics will see growth in the years to come.

The spread of smart cars on smart roads largely contributes to the improvement of communication, the enhancement of safety, and the development of sophisticated infrastructure which automates the whole administration of control systems. The increasing awareness among travelers of how to efficiently manage, monitor, and streamline their own travel, as well as the reduction of congestion and improvement of traffic management, may have a positive effect on transportation systems and result in the growth of the market for transportation analytics in the years to come.

Embracing modern digital technologies in the logistics and transportation industry may increase operational efficiency and transparency in the sector. This can be accomplished by restructuring current operations and developing a model of business that is more proactive. Businesses will be able to better compete in today's market if they adopt modern digital logistics and transportation trends, such as implementing technologies such as machine learning (ML), artificial intelligence (AI), the internet of things (IOT), big data, and blockchain. These technologies will help them keep pace with the increasing amount of competition. During the period covered by this research, these trends are anticipated to act as a driver of growth for the transportation analytics market.

The data that have been acquired from such a wide variety of systems and so many different sources are extremely noisy, high-dimensional, and heterogeneous, and their interdependencies are complicated. It is difficult to digest such a vast and varied quantity of data in real-time, and turning that data into actionable knowledge for near-real operations or even for a long-term process is exceedingly difficult. Additionally, low latency and data dependability are needed to be turned into actionable information, which is necessary to increase safety and collision avoidance. This is predicted to be a factor that would hinder the development of the market during the projected period. It is possible that the development of the market for transportation analytics would slow down throughout the time covered by this prediction because of these privacy concerns.

Based on the type, the transportation analytics market is segmented into Predictive, descriptive, and prescriptive. In the transportation analytics industry in the year 2021, the predictive category was able to earn a considerable revenue share. Data mining, statistics, and machine learning are the three main pillars of predictive analytics. These pillars are used to estimate future supply needs, inventory levels, and consumer behavior. Organizations are combining predictive analytics with machine learning to forecast future financial, customer, and other operational risks in the supply chain, in addition to predicting future physical risks in the supply chain (i.e., risks with fleets, drivers, and cargo). This allows organizations to predict future physical risks in the supply chain.

Based on the applications, the transportation analytics market is segmented into traffic & incident management, transit planning & maintenance, logistics management, and others. Within the transportation analytics market in 2021, the transit planning and maintenance category generated a significant revenue share of the total revenue. Planning, management, and maintenance of assets are becoming more important tasks in the transportation sector as a long-term strategy for improving both the company's operational and financial health.

Based on the mode of transport, the transportation analytics market is categorized into roadways, railways, airways, and waterways. In the transportation analytics market in 2021, the highway segment achieved the highest revenue share. As a consequence of rising e-commerce and industrial operations, the number of commercial fleets throughout the globe is expanding, which is prompting many companies in the logistics industry to install effective asset monitoring and management systems. Organizations like GE Capital and AT&T have deployed telematics fleet systems for continuous fleet monitoring and real-time location status.

Based on the components, the transportation analytics market is segmented into solutions and services. The solutions segment garnered the highest revenue share in the transportation analytics market in 2021. The use of transportation analytics offers various advantages to the sector, such as the simplification of business processes, the elimination of manual processes, and a reduction in both time and costs, which further fuels the expansion of the market. In addition to this, a number of countries are adopting initiatives to encourage the development of smart cities, which would lead to an increase in the usage of transportation analytics solutions.

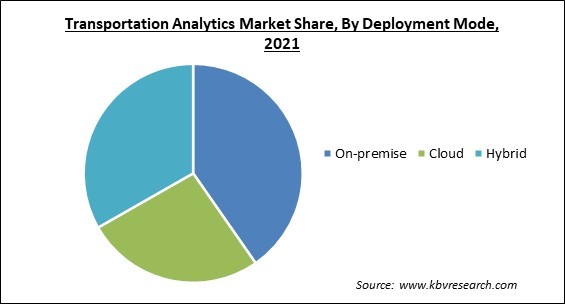

Based on the deployment mode, the transportation analytics market is categorized into on-premise, cloud, and hybrid. In the transportation analytics market in 2021, the on-premise segment retained the dominant position while gaining the highest revenue share. This may be attributable to the several benefits that the on-premise deployment provides, one of which is a high degree of data protection and safety. Another advantage is cost savings. The demand for on-premise deployment models within the sectors is being driven further by the fact that industries prefer on-premise models since they provide a higher level of data protection and a lower risk of the data breach when compared to cloud-based deployment models.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 11.5 Billion |

| Market size forecast in 2028 | USD 37.4 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 18.7% from 2022 to 2028 |

| Number of Pages | 306 |

| Number of Tables | 540 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Market Share Analysis, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Type, Deployment Mode, Mode of Transport, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on geography, the transportation analytics market is segmented into North America, Europe, Asia Pacific, and LAMEA. The Europe region registered the highest revenue share in the transportation analytics market worldwide. This is because there has been a rise in investments in transportation analytics solutions for the purpose of enhancing business performance and the quality of the customer experience. It is anticipated that this will provide lucrative growth opportunities for the transportation analytics market in the Europe region.

Free Valuable Insights: Global Transportation Analytics Market size to reach USD 37.4 Billion by 2028

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The below illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include IBM Corporation, INRIX, Inc., Indra Sistemas, S.A., Cubic Corporation (Veritas Capital Fund Management, LLC), TomTom N.V., Siemens AG, Alteryx, Inc., Kapsch TrafficCom AG (Datax Handelsgmbh), Trimble, Inc., and Cellint Traffic Solutions Ltd.

By Application

By Deployment Mode

By Type

By Component

By Mode of Transport

By Geography

The global Transportation Analytics Market size is expected to reach $37.4 billion by 2028.

Increase in understanding among travelers and improvements in traffic management are driving the market in coming years, however, Integration of data presents a number of challenges restraints the growth of the market.

IBM Corporation, INRIX, Inc., Indra Sistemas, S.A., Cubic Corporation (Veritas Capital Fund Management, LLC), TomTom N.V., Siemens AG, Alteryx, Inc., Kapsch TrafficCom AG (Datax Handelsgmbh), Trimble, Inc., and Cellint Traffic Solutions Ltd.

The Traffic & Incident Management segment acquired maximum revenue share in the Global Transportation Analytics Market by Application in 2021 thereby, achieving a market value of $15.1 billion by 2028.

The Descriptive segment is leading the Global Transportation Analytics Market by Type in 2021 thereby, achieving a market value of $18.6 billion by 2028.

The Europe market dominated the Global Transportation Analytics Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $12.9 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.