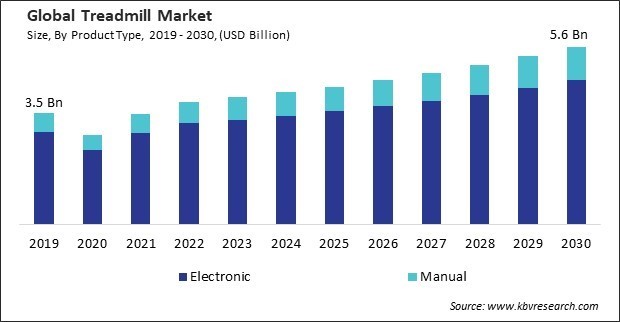

“Global Treadmill Market to reach a market value of USD 5.6 Billion by 2030 growing at a CAGR of 4.9%”

The Global Treadmill Market size is expected to reach $5.6 billion by 2030, rising at a market growth of 4.9% CAGR during the forecast period. In the year 2022, the market attained a volume of 7,927.7 thousand units, experiencing a growth of 4.4% (2019-2022).

There is a widespread awareness of health and wellness in North America, with individuals actively seeking ways to maintain an active lifestyle. Therefore, the North America region captured $1,282.5 million revenue in the market in 2022. Users in North America can access virtual classes, track their workouts, and participate in challenges, creating a sense of community and motivation and contributing to the growing regional market. The region's awareness of obesity-related health concerns and the desire for effective weight management solutions have fueled the demand for fitness equipment.

The promotion of fitness apparatus, such as treadmills, has been enormously impacted by celebrity endorsements and the influence of fitness influencers on social media platforms. Recommendations and endorsements from well-known figures impact consumer purchasing decisions. Celebrities and influencers often serve as sources of inspiration for their followers. Their commitment to fitness and healthy lifestyles, which may include these, inspires others to adopt similar habits. The aspirational aspect of following in the footsteps of admired figures drives the market growth. Influencers, particularly those active on social media platforms such as Instagram, YouTube, and TikTok, directly and widely impact consumer behavior. Additionally, treadmills are widely used in rehabilitation and physical therapy settings. The emphasis on rehabilitation as part of the healthcare system has contributed to the adoption of these in clinical environments. These are widely used in gait training, allowing therapists to analyze and correct walking patterns. Real-time observation of a patient's gait on a it enables precise adjustments, helping individuals relearn and improve their walking or running mechanics after surgery, injury, or neurological conditions. These are frequently used in orthopedic rehabilitation to aid in the recovery from musculoskeletal injuries, surgeries, or joint replacements. Thus, because of the growing focus on rehabilitation and physical therapy, the market is anticipated to increase significantly.

However, Quality treadmills with advanced features and technology can be expensive. The high initial cost may deter budget-conscious consumers, limiting the market penetration of premium models. Consumers with high upfront costs may opt for lower-cost alternatives, such as outdoor activities, basic exercise equipment, or gym memberships. This shift away from these purchases can hinder market growth. High initial costs may prompt potential buyers to delay or reconsider their purchase decisions. Consumers may postpone buying it until they can allocate sufficient funds, contributing to a slower adoption rate. Other fitness equipment with lower upfront costs, such as resistance bands, dumbbells, or basic exercise mats, may gain preference over these among budget-conscious consumers. This competitive disadvantage can impact the market growth. The perception of high costs can create reluctance and resistance among potential buyers. Even if individuals acknowledge the health benefits of these workouts, the financial barrier may deter them from purchasing. Thus, high initial cost of these is a significant challenge that hampers the growth of market.

Based on end use, the market is classified into residential, institutional, and commercial. The residential segment acquired a substantial revenue share in the market in 2022. Residential drive treadmills allow users to exercise at home, eliminating the need to travel to a gym or fitness center. This accessibility allows individuals to integrate regular workouts into their daily routines without the constraints of time or weather conditions. Exercising at home on a residential drive treadmill offers a private and comfortable workout environment. Users can work out at their own pace without feeling self-conscious, providing a more relaxed and enjoyable experience than public fitness settings.

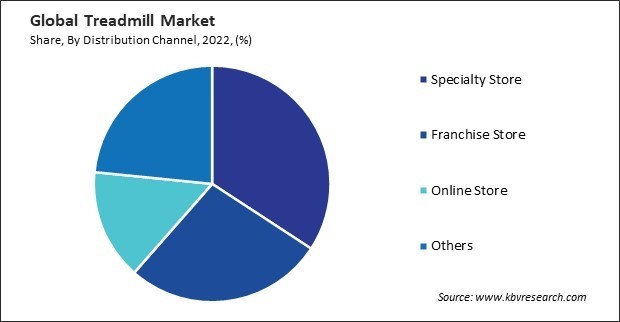

On the basis of distribution channel, the market is divided into specialty store, franchise store, online store, and others. In 2022, the specialty store segment dominated the market with maximum revenue share. Specialty stores are staffed by knowledgeable and trained professionals who can allow expert guidance on selecting the right treadmill based on individual fitness goals, preferences, and budget. Their expertise adds value to the customer experience and helps users make informed purchasing decisions. Fitness enthusiasts often have specific preferences and requirements for their workout equipment. Specialty stores cater to this audience by offering these with advanced features, customizable options, and specialized functionalities that may not be readily available in general retail outlets.

By product type, the market is categorized into manual and electronic. In 2022, the electronic segment held the highest revenue share in the market. Motorized treadmills provide the convenience of variable speeds and pre-programmed workout routines. Based on their goals and level of fitness, users can effortlessly modify the speed and incline settings. Additionally, built-in programs offer diverse workout options, such as interval training, hill climbs, and target heart rate exercises. Electric motors in motorized treadmills ensure a smooth and consistent belt operation. This feature offers a more comfortable and natural walking or running experience, reducing impact on joints compared to some manual treadmills.

Free Valuable Insights: Global Treadmill Market size to reach USD 5.6 Billion by 2030

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the Asia Pacific region acquired a significant revenue share in the market. The Asia Pacific region is experiencing a significant growth in health consciousness, with people becoming more aware of the significance of regular exercise for overall well-being. Urbanization and the adoption of sedentary lifestyles are prevalent in many Asian cities. The fitness industry in the Asia Pacific is experiencing significant growth, with increased fitness centers, gyms, and wellness facilities. Advancements in technology, such as interactive displays, connectivity features, and virtual training programs, have made these more appealing to consumers in Asia Pacific.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 3.8 Billion |

| Market size forecast in 2030 | USD 5.6 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 4.9% from 2023 to 2030 |

| Number of Pages | 300 |

| Number of Table | 690 |

| Quantitative Data | Volume in Thousand Units, Revenue in USD Billion, and CAGR from 2019 to 2030 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Product Type, Distribution Channel, End Use, Region |

| Country scope |

|

| Companies Included | Icon Health & Fitness, Inc. (IHF Holding, Inc.), Nautilus, Inc., True Fitness Technology, Inc., Life Fitness, Technogym S.p.A., Impulse (Qingdao) Health Tech Ltd. Co., LANDICE, Inc., Woodway USA, Inc., Johnson Health Tech Co., Ltd., TrueForm Runner |

By Product Type (Volume, Thousand Units, USD Billion, 2019-2030)

By End Use (Volume, Thousand Units, USD Billion, 2019-2030)

By Distribution Channel (Volume, Thousand Units, USD Billion, 2019-2030)

By Geography (Volume, Thousand Units, USD Billion, 2019-2030)

The Market size is projected to reach USD 5.6 billion by 2030.

Celebrity endorsements and influencer impact are driving the Market in coming years, however, High initial cost of treadmills restraints the growth of the Market.

Icon Health & Fitness, Inc. (IHF Holding, Inc.), Nautilus, Inc., True Fitness Technology, Inc., Life Fitness, Technogym S.p.A., Impulse (Qingdao) Health Tech Ltd. Co., LANDICE, Inc., Woodway USA, Inc., Johnson Health Tech Co., Ltd., TrueForm Runner

In the year 2022, the market attained a volume of 7,927.7 thousand units, experiencing a growth of 4.4% (2019-2022).

The Commercial segment is generating highest revenue in the Market by End Use in 2022; there by, achieving a market value of $2.5 billion by 2030.

The North America region dominated the Market by Region in 2022, and would continue to be a dominant market till 2030; there by, achieving a market value of $1.7 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges