US Adhesion Promoter Market Size, Share & Trends Analysis Report By Product (Silane, Maleic Anhydride, Titanate & Zirconate, Chlorinated Polyolefins, and Others), By Application, and Forecast, 2023 - 2030

Published Date : 14-May-2024 |

Pages: 82 |

Formats: PDF |

COVID-19 Impact on the US Adhesion Promoter Market

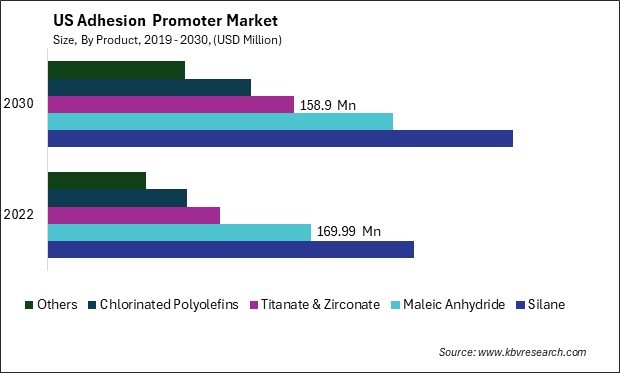

The United States (US) Adhesion Promoter Market size is expected to reach $902.89 Million by 2030, rising at a market growth of 3.8% CAGR during the forecast period. In the year 2022, the market attained a volume of 315.72 Kilo Tonnes, experiencing a growth of 2.9% (2019-2022).

The US adhesion promoter market has experienced significant growth in recent years, driven by advancements in adhesive technologies, increasing demand from end-use industries, and a growing focus on enhancing the performance of adhesives and coatings. Several key factors have shaped recent developments in the US adhesion promoter market. One such factor is the increasing demand for high-performance adhesives and coatings across various automotive, construction, packaging, and electronics industries. In an effort to enhance the durability and performance of their products, manufacturers have significantly increased the demand for adhesion promoters, which strengthen the bond between substrates and coatings.

Another significant development is the focus on sustainability and environmental regulations, which have led to the development of eco-friendly adhesion promoters that comply with stringent environmental standards. The US market has witnessed a shift towards adopting adhesion promoters free from volatile organic compounds (VOCs) and other hazardous substances, reflecting the industry's commitment to sustainable and environmentally responsible practices.

Moreover, despite the initial impact of the pandemic, the adhesion promoter market has shown resilience and is expected to recover as economic activities resume and industries adapt to the new normal. Rising technological advancements, increased infrastructure investments, and a gradual recovery in demand from key end-use sectors are anticipated to fuel market expansion.

Additionally, technological advancements in adhesion promoters have led to the introduction of novel formulations that offer improved adhesion properties, chemical resistance, and compatibility with a wide range of substrates. Thus, as the market continues to evolve, driven by technological advancements and changing industry requirements, it is expected to witness further growth and development in the coming years.

Market Trends

Increasing demand for silane as an adhesion promoter product

The demand for silane-based adhesion promoters has led to a shift in product preferences among manufacturers and formulators. Silanes offer unique advantages, such as their ability to enhance bonding strength with diverse substrates and their compatibility with different coatings and adhesives. This has resulted in an increasing preference for silane-based adhesion promoters over other types in many applications.

Additionally, the growing adoption of silane technology has expanded the application scope for adhesion promoters in the US market. Silanes are known for their effectiveness in promoting adhesion in challenging environments, such as high-moisture or high-temperature conditions, which has opened up new opportunities for their use in industries like construction, automotive, and electronics. This expansion of application areas has contributed to the overall growth of the adhesion promoter market in the US.

Moreover, the demand for silane-based adhesion promoters has stimulated innovation and product development within the industry. Manufacturers are investing in research and development to create new formulations and technologies that harness the unique properties of silanes to address specific adhesion challenges faced by different industries. This has resulted in the introduction of advanced silane-based adhesion promoter products that offer improved performance and durability, further driving their adoption in the market. In addition to their adhesion-promoting properties, silanes offer improved chemical resistance, moisture resistance, and UV stability, further expanding their applicability in the construction, aerospace, electronics, and packaging industries. Therefore, the benefits of silanes are aiding in the growth of the market.

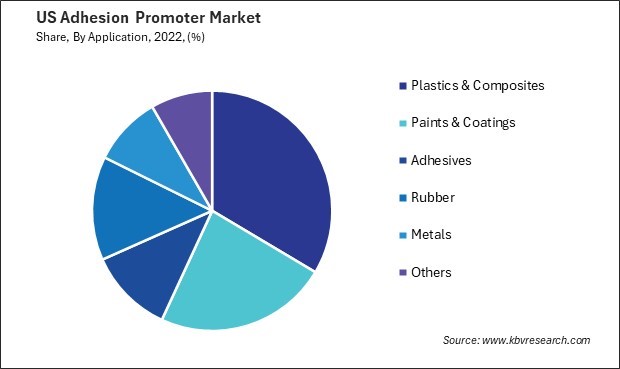

Rising demand for plastics & composites

The US has experienced a rising demand for plastics and composites in recent years, driven by diverse factors that have reshaped the manufacturing landscape and consumer preferences across industries. An important catalyst is the expanding utilization of plastics and composites across diverse end-use sectors, such as consumer goods, automotive, aerospace, construction, and packaging. Plastics and composites are corrosion-resistant, lightweight, durable, flexible, and flexible, all of which make them suitable for a vast array of applications. For instance, the widespread utilization of composites in vehicle construction within the automotive industry can be attributed to the need for lightweight materials that enhance fuel efficiency.

Furthermore, technological advancements and innovations in material science have expanded the capabilities of plastics and composites, making them more versatile and suitable for a broader range of applications. The proliferation of sophisticated manufacturing methods, including additive manufacturing (3D printing), has facilitated the fabrication of intricate structures and components from composites and plastics, augmenting their market demand.

Plastics and composites often have specific surface characteristics and chemical compositions that can pose challenges for adhesion, especially when bonding to substrates like metals or glass. As a result, there is a growing demand for adhesion promoters designed to address these challenges and ensure strong, durable bonds between plastics, composites, and other materials.

Moreover, the growing complexity and diversity of applications for plastics and composites have driven the need for adhesion promoters with versatile properties that can accommodate a wide range of substrates and environmental conditions. For example, in the automotive industry, where lightweight composites are increasingly used for structural components, adhesion promoters must withstand high mechanical loads, temperature variations, and exposure to various fluids.

Additionally, the industry's focus on sustainability and environmental performance influences the demand for adhesion promoters in the plastics and composites sector. Adhesion promoters that reduce hazardous chemicals and volatile organic compounds (VOCs) while increasing bonding efficiency are highly desirable. Thus, the rising use of plastics and composites is beneficial for the market.

Competition Analysis

The adhesion promoter market in the US is characterized by several key companies specializing in developing, manufacturing, and distributing adhesion promoter products across various industries. These corporations fulfill an essential function by providing adhesion promoters, which strengthen the bond between substrates and coatings or adhesives to meet the market's varied demands.

One prominent US adhesion promoter market player is Momentive Performance Materials Inc., a global leader in silicones and advanced materials. Momentive offers a wide range of adhesion promoter products designed to improve the adhesion properties of coatings, sealants, and adhesives in the automotive, aerospace, construction, and electronics industries. The company's innovative solutions and strong focus on research and development have contributed to its position as a leading supplier in the adhesion promoter market.

Another significant player is Evonik Industries AG, a German-based specialty chemicals company with a strong presence in the US market. Evonik's product portfolio includes adhesion promoters under its brand name, Dynasylan®, which enhance the adhesion of coatings and adhesives to various substrates. The company's expertise in surface modification and functional silanes has made it a trusted partner for manufacturers seeking high-performance adhesion promoter solutions.

Dow Inc., a leading materials science company, is also a major player in the US adhesion promoter market. Dow offers a range of adhesion promoter products that address the bonding challenges in diverse applications, including automotive, packaging, and industrial coatings. The company's focus on sustainability and innovation has led to the development of adhesion promoters that meet stringent performance requirements while minimizing environmental impact.

In addition to AkzoNobel N.V. and BASF SE, Sartomer (a subsidiary of Arkema) is a prominent player in the US adhesion promoter market. These corporations enhance the competitive environment of the adhesion promoter sector through the provision of an extensive array of products, technical proficiency, and sector-specific resolutions that cater to the changing demands of clientele in the United States and internationally.

List of Key Companies Profiled

- 3M Company

- Arkema S.A.

- Momentive Performance Materials, Inc. (Hexion, Inc.)

- Eastman Chemical Company

- Akzo Nobel N.V.

- The Dow Chemical Company

- DuPont de Nemours, Inc.

- Air Products and Chemicals, Inc.

- BASF SE

- Evonik Industries AG (RAG-Stiftung)

US Adhesion Promoter Market Report Segmentation

By Product

- Silane

- Maleic Anhydride

- Titanate & Zirconate

- Chlorinated Polyolefins

- Others

By Application

- Plastics & Composites

- Paints & Coatings

- Adhesives

- Rubber

- Metals

- Others

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 USA Adhesion Promoter Market, by Product

1.4.2 USA Adhesion Promoter Market, by Application

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

2.2.3 Market Opportunities

2.2.4 Market Challenges

2.2.5 Market Trends

2.3 Porter’s Five Forces Analysis

Chapter 3. US Adhesion Promoter Market

3.1 US Adhesion Promoter Market, by Product

3.2 US Adhesion Promoter Market, by Application

Chapter 4. Company Profiles – Global Leaders

4.1 3M Company

4.1.1 Company Overview

4.1.2 Financial Analysis

4.1.3 Segmental and Regional Analysis

4.1.4 Research & Development Expense

4.1.5 SWOT Analysis

4.2 Arkema S.A.

4.2.1 Company Overview

4.2.2 Financial Analysis

4.2.3 Segmental and Regional Analysis

4.2.4 SWOT Analysis

4.3 Momentive Performance Materials, Inc. (Hexion, Inc.)

4.3.1 Company Overview

4.3.2 SWOT Analysis

4.4 Eastman Chemical Company

4.4.1 Company Overview

4.4.2 Financial Analysis

4.4.3 Segmental and Regional Analysis

4.4.4 Research & Development Expense

4.4.5 Recent strategies and developments:

4.4.5.1 Product Launches and Product Expansions:

4.4.6 SWOT Analysis

4.5 Akzo Nobel N.V.

4.5.1 Company Overview

4.5.2 Financial Analysis

4.5.3 Segmental and Regional Analysis

4.5.4 SWOT Analysis

4.6 The Dow Chemical Company

4.6.1 Company Overview

4.6.2 Financial Analysis

4.6.3 Segmental and Regional Analysis

4.6.4 Research & Development Expenses

4.6.5 SWOT Analysis

4.7 DuPont de Nemours, Inc.

4.7.1 Company Overview

4.7.2 Financial Analysis

4.7.3 Segmental and Regional Analysis

4.7.4 Research & Development Expense

4.7.5 SWOT Analysis

4.8 Air Products and Chemicals, Inc.

4.8.1 Company Overview

4.8.2 Financial Analysis

4.8.3 Regional Analysis

4.8.4 Research & Development Expenses

4.8.5 SWOT Analysis

4.9 BASF SE

4.9.1 Company Overview

4.9.2 Financial Analysis

4.9.3 Segmental and Regional Analysis

4.9.4 Research & Development Expense

4.9.5 SWOT Analysis

4.1 Evonik Industries AG (RAG-Stiftung)

4.10.1 Company Overview

4.10.2 Financial Analysis

4.10.3 Segmental and Regional Analysis

4.10.4 Research & Development Expenses

4.10.5 Recent strategies and developments:

4.10.5.1 Product Launches and Product Expansions:

4.10.6 SWOT Analysis

TABLE 2 US Adhesion Promoter Market, 2023 - 2030, USD Million

TABLE 3 US Adhesion Promoter Market, 2019 - 2022, Kilo Tonnes

TABLE 4 US Adhesion Promoter Market, 2023 - 2030, Kilo Tonnes

TABLE 5 US Adhesion Promoter Market, by Product, 2019 - 2022, USD Million

TABLE 6 US Adhesion Promoter Market, by Product, 2023 - 2030, USD Million

TABLE 7 US Adhesion Promoter Market, by Product, 2019 - 2022, Kilo Tonnes

TABLE 8 US Adhesion Promoter Market, by Product, 2023 - 2030, Kilo Tonnes

TABLE 9 US Adhesion Promoter Market, by Application, 2019 - 2022, USD Million

TABLE 10 US Adhesion Promoter Market, by Application, 2023 - 2030, USD Million

TABLE 11 US Adhesion Promoter Market, by Application, 2019 - 2022, Kilo Tonnes

TABLE 12 US Adhesion Promoter Market, by Application, 2023 - 2030, Kilo Tonnes

TABLE 13 Key Information – 3M Company

TABLE 14 Key information – Arkema S.A.

TABLE 15 Key Information – Momentive Performance Materials, Inc.

TABLE 16 Key Information – Eastman Chemical Company

TABLE 17 Key information – Akzo Nobel N.V.

TABLE 18 Key Information – The Dow Chemical Company

TABLE 19 Key Information –DuPont de Nemours, Inc.

TABLE 20 Key Information – Air Products and Chemicals, Inc.

TABLE 21 Key Information – BASF SE

TABLE 22 Key Information – Evonik Industries AG

List of Figures

FIG 1 Methodology for the research

FIG 2 US Adhesion Promoter Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting Adhesion Promoter Market

FIG 4 Porter’s Five Forces Analysis – Adhesion Promoter Market

FIG 5 US Adhesion Promoter Market share, by Product, 2022

FIG 6 US Adhesion Promoter Market share, by Product, 2030

FIG 7 US Adhesion Promoter Market, by Product, 2019 - 2030, USD Million

FIG 8 US Adhesion Promoter Market share, by Application, 2022

FIG 9 US Adhesion Promoter Market share, by Application, 2030

FIG 10 US Adhesion Promoter Market, by Application, 2019 - 2030, USD Million

FIG 11 SWOT Analysis: 3M Company

FIG 12 SWOT Analysis: Arkema S.A.

FIG 13 SWOT Analysis: Momentive Performance Materials, Inc.

FIG 14 SWOT Analysis: Eastman Chemical Company

FIG 15 SWOT Analysis: Akzo Nobel N.V.

FIG 16 SWOT Analysis: The Dow Chemical Company

FIG 17 Swot Analysis: DuPont de Nemours, Inc.

FIG 18 SWOT Analysis: Air Products and Chemicals, Inc.

FIG 19 SWOT Analysis: BASF SE

FIG 20 SWOT Analysis: Evonik Industries AG