Int'l : +1(646) 600-5072 | query@kbvresearch.com

Int'l : +1(646) 600-5072 | query@kbvresearch.com

Published Date : 02-Sep-2024 |

Pages: 74 |

Formats: PDF |

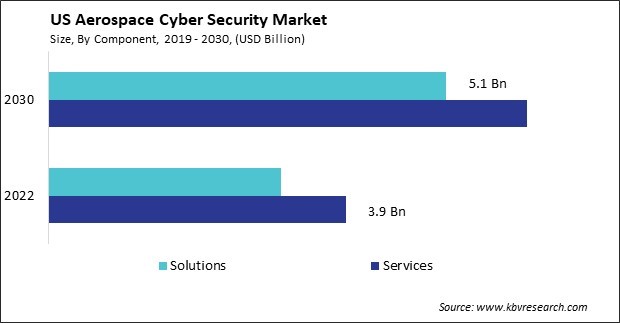

The US Aerospace Cyber Security Market size is expected to reach $11.3 Billion by 2030, rising at a market growth of 6.6% CAGR during the forecast period.

The aerospace cyber security market in the United States has witnessed significant growth in recent years. As the aerospace sector becomes more interconnected and reliant on digital infrastructure, the need to secure critical systems and data from cyber threats has become paramount. One of the primary drivers of growth in the aerospace cyber security market is the rapid expansion of connected systems within aircraft and satellite networks. Modern aircraft have sophisticated avionics, communication systems, and in-flight entertainment systems that rely on network connectivity.

Another factor fueling the demand for aerospace cyber security solutions is the evolving threat landscape. Cyber-attacks targeting aerospace systems have devastating consequences, ranging from data theft and disruption of operations to physical damage and loss of life. As a result, aerospace companies and government agencies in the U.S. are investing heavily in cybersecurity to mitigate these risks and ensure the integrity and reliability of their systems.

Furthermore, regulatory requirements and industry standards play a significant role in driving the adoption of cyber security solutions within the aerospace sector. Regulatory bodies such as the Federal Aviation Administration (FAA) and the Department of Defense (DoD) impose stringent cyber security standards on aerospace manufacturers, suppliers, and operators to protect against cyber threats. Compliance with these regulations helps organizations avoid costly fines and penalties and enhances their industry reputation and competitiveness.

However, the COVID-19 pandemic has profoundly impacted the aerospace cyber security market. The widespread adoption of remote working arrangements and virtual collaboration tools has expanded the attack surface for cyber threats, making aerospace companies more vulnerable to attacks. Furthermore, the economic downturn resulting from the pandemic has forced many aerospace companies in the U.S. to prioritize cost-cutting measures, potentially leading to reduced investments in cybersecurity. However, the pandemic has also highlighted the importance of resilient and secure digital infrastructure, driving increased awareness and demand for cybersecurity solutions in the aerospace sector.

The aerospace industry in the United States faces a growing threat from cyber-attacks. As the industry increasingly relies on digital technologies for operations, communication, and data management, it becomes more vulnerable to sophisticated cyber threats. According to the FBI's Internet Crime Complaint Center (IC3), in 2022, the U.S. experienced a significant rise in cyber threats within cyber security, as evidenced by an overwhelming number of reported complaints reaching 800,944, causing financial damages exceeding $10.3 billion. These threats jeopardize sensitive information and compromise the safety and reliability of aerospace systems, including aircraft, satellites, and ground control systems.

One of the primary concerns in the aerospace cyber security market is the potential for cyber-attacks to exploit vulnerabilities in critical infrastructure. Aircraft systems, for example, rely heavily on interconnected networks to function efficiently. Moreover, the aerospace sector is a prime target for state-sponsored cyber espionage and sabotage. Foreign adversaries seek to infiltrate aerospace companies to steal sensitive technology or gather intelligence on military aircraft capabilities. These threats not only threaten the economic competitiveness of U.S. aerospace firms but also undermine national security interests.

Furthermore, the interconnected nature of the aerospace supply chain amplifies the cyber risk, as attackers exploit weaknesses in third-party vendors or subcontractors to infiltrate larger systems. This highlights the need for comprehensive cybersecurity measures within individual companies and the entire ecosystem. Hence, safeguarding the aerospace industry against cyber threats demands a concerted effort to fortify defenses, enhance collaboration, and prioritize cybersecurity across the supply chain.

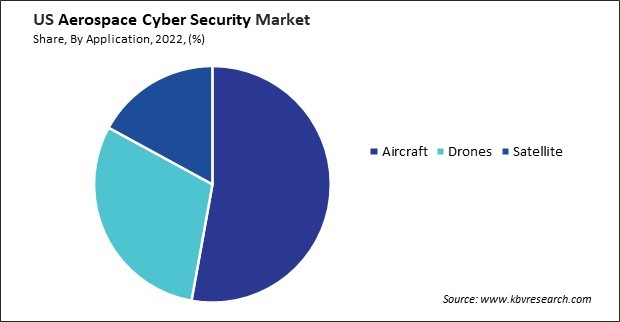

The aerospace cyber security market in the United States is experiencing a significant impact from the increasing proliferation of unmanned aerial vehicles (UAVs). These UAVs, also known as drones, have rapidly expanded their presence across various military, commercial, and recreational sectors. As their numbers continue to rise, so do the challenges and vulnerabilities of securing their operations and data. One of the primary concerns with the widespread use of UAVs is the potential for cyber-attacks targeting their control systems and data transmissions. For military UAVs, such breaches compromise national security by providing adversaries with access to classified data or the ability to interfere with mission-critical operations.

To address these threats, the U.S. aerospace cyber security market focuses on developing advanced technologies and strategies specifically tailored to UAVs. This includes implementing robust encryption methods to protect communication links between ground control stations and UAVs and secure data storage solutions to safeguard sensitive information onboard. Additionally, there is a growing emphasis on enhancing the resilience of UAVs against cyber-attacks by integrating intrusion detection systems and anomaly detection algorithms.

Furthermore, collaboration between government agencies, defense contractors, and cybersecurity firms is essential to address the evolving threat landscape facing UAVs. Therefore, the aerospace cyber security market in the United States is intensifying efforts to counter the escalating risks posed by the proliferation of unmanned aerial vehicles through tailored technological advancements and collaborative strategies.

The aerospace industry increasingly relies on digital technologies to enhance efficiency, safety, and communication. With this reliance comes the need for robust cybersecurity measures to protect sensitive data, critical systems, and intellectual property. One prominent player in the aerospace cyber security market is Lockheed Martin Corporation. As one of the world's largest defense contractors, Lockheed Martin has extensive experience providing cybersecurity solutions for aerospace and defense applications. The company offers a comprehensive suite of cybersecurity services, including threat detection, vulnerability assessment, and incident response. Lockheed Martin's cybersecurity solutions leverage advanced technologies such as artificial intelligence and machine learning to identify and mitigate cyber threats proactively.

Boeing Company is also a significant player in the aerospace cyber security market. As one of the world's leading aerospace manufacturers, Boeing recognizes the importance of cybersecurity in safeguarding its aircraft, spacecraft, and related systems. The company provides various cybersecurity solutions for aerospace applications, including secure communications, intrusion detection, and secure software development. Boeing's cybersecurity offerings are backed by its deep industry expertise and commitment to innovation, ensuring that its aerospace customers are protected against evolving cyber threats.

Another major player in the U.S. aerospace cyber security market is Northrop Grumman Corporation. Northrop Grumman is known for its expertise in developing and integrating complex aerospace systems, and it has expanded its capabilities to include cybersecurity services. The company offers a range of cybersecurity solutions tailored to the aerospace industry, including network security, data protection, and secure communications. Northrop Grumman's cybersecurity offerings are designed to meet the stringent requirements of aerospace customers, ensuring the integrity and security of critical systems and data.

Raytheon Technologies Corporation is another key player in the U.S. aerospace cyber security market. The company's technologies are diversified aerospace and defense companies with a strong focus on cybersecurity. Raytheon offers a comprehensive suite of cybersecurity solutions for aerospace and defense applications, including threat intelligence, security analytics, and incident response. The company's cybersecurity offerings are designed to help aerospace customers detect, deter, and defend against cyber threats, ensuring the resilience of their critical systems and operations.

Hence, the aerospace cyber security market in the U.S. is characterized by a diverse range of companies offering innovative solutions and services to meet the evolving needs of the industry. With the increasing digitization of aerospace systems and the growing threat of cyber-attacks, cybersecurity has become a top priority for aerospace companies, driving demand for advanced cybersecurity solutions and expertise.

By Component

By Application

By Deployment

By Type