USA Aloe Vera Drinks Market Size, Share & Trends Analysis Report By Flavor, By Type (RTD Juice, Juice Concentrates, and Others), By Distribution Channel (Hypermarkets & Supermarkets, Pharmacy, Online, and Others), and Forecast, 2023 - 2030

Published Date : 19-Apr-2024 |

Pages: 59 |

Formats: PDF |

COVID-19 Impact on the US Aloe Vera Drinks Market

The USA Aloe Vera Drinks Market size is expected to reach $45.3 Million by 2030, rising at a market growth of 9.4% CAGR during the forecast period. In the year 2022, the market attained a volume of 2107.4 thousand litres, experiencing a growth of 9.6% (2019-2022).

The aloe vera drinks market in the United States has experienced a significant surge in popularity in recent years. The COVID-19 pandemic has accelerated the at-home consumption. With lockdowns, social distancing measures, and the rise of remote work, many U.S. consumers turned to purchasing beverages for consumption at home. Aloe vera drinks, packaged conveniently in bottles and cartons, catered well to this trend. The availability of aloe vera drinks in supermarkets, online platforms, and through food delivery services allowed consumers to access these products without leaving their homes.

The U.S. aloe vera drinks market is characterized by a diverse range of flavors and formulations, catering to consumers' evolving preferences. This includes variations with added natural sweeteners, flavors, and even functional ingredients to enhance the overall health appeal. The emphasis on transparency in labeling and sourcing has further bolstered the credibility of organic aloe vera beverage brands in the U.S.

Market Trends

Adoption of organic beverage brands

The adoption of organic beverage brands within the aloe vera drinks market in the United States has experienced a notable surge in recent years. As consumers increasingly prioritize health and wellness, there has been a growing interest in beverages that offer refreshments and natural and organic ingredients. Aloe vera drinks, with their purported health benefits, have become a focal point of this trend in the United States.

Organic aloe vera beverage brands have gained traction as consumers seek products free from synthetic additives, pesticides, and genetically modified organisms (GMOs). A broader societal movement towards cleaner and more sustainable lifestyles fuels this shift. As consumers become more health-conscious, they are willing to invest in beverages that align with their values, and organic aloe vera drinks fit the bill.

In the U.S., where dietary trends often set the tone for global industries, the demand for organic options has translated into a significant industry share for organic aloe vera drinks. Major players in the beverage industry have responded to this demand by introducing and promoting organic variations of their aloe vera products. Consumers are drawn to these offerings for the perceived health benefits of aloe vera and the assurance that comes with organic certification.

According to the U.S. Department of Agriculture, the organic food product industry in the United States experienced significant growth, with sales estimated at $26.9 billion in 2010 (adjusted for inflation to 2021 dollars) and reaching $52.0 billion in 2021. This upward trend reflects a substantial increase in consumer interest and adoption of organic choices. This shift towards organic preferences extends to various product categories, including the aloe vera drinks market, where consumers increasingly embrace organic beverage brands. Hence, the surge in organic food sales serves as a broader context for understanding U.S. consumers' rising popularity of organic options, including aloe vera drinks.

Rising demand due to growing awareness of vitamin-deficiency conditions

In the ever-evolving landscape of health and wellness trends, the U.S. aloe vera drinks market is experiencing a notable surge in demand, primarily attributed to a growing consciousness among consumers towards vitamin-deficiency conditions. This paradigm shift in consumer preferences reflects an increasing awareness of the nutritional benefits offered by aloe vera beverages, particularly in addressing vitamin deficiencies prevalent in the American population.

As more individuals become attuned to maintaining a balanced and nutrient-rich diet, aloe vera drinks have become popular for health-conscious Americans. The rise in demand for aloe vera drinks can be attributed to the convenience and accessibility of these beverages cater to the fast-paced lifestyle prevalent in the U.S. Consumers looking for on-the-go solutions are turning to aloe vera drinks as a convenient and refreshing source of essential vitamins.

Furthermore, the U.S. population's increasing awareness of vitamin-deficiency-related health issues, such as weakened immune systems, skin disorders, and fatigue, has fueled the demand for products that offer a natural and holistic approach to addressing these concerns. Aloe vera drinks, with their inherent nutritional richness, have positioned themselves as a viable solution to bridge the nutrient gap in American diets. Therefore, the escalating demand for aloe vera drinks market in the U.S. underscores a shift towards nutritional awareness driven by a desire to address vitamin deficiencies conveniently and holistically.

Competition Analysis

The aloe vera drinks market in the United States has experienced significant growth in recent years, driven by consumer awareness of the health benefits of aloe vera and the increasing demand for natural and functional beverages. Several key players dominate this industry, offering a variety of aloe vera-infused drinks to cater to the diverse preferences of American consumers.

One of the leading companies in the U.S. aloe vera drinks market is ALO Drink. ALO has established itself as a prominent brand known for its wide range of aloe vera-based beverages. The company offers diverse flavors, combining aloe vera with various fruit juices to create refreshing and hydrating drinks. ALO Drink has successfully capitalized on the growing trend of functional beverages, positioning itself as a key player in the U.S.

Another significant player in the U.S. aloe vera drinks industry is OKF Corporation. OKF is a global beverage company with a strong presence in the United States, offering aloe vera drinks in various flavors. The company emphasizes premium aloe vera gel in its beverages, promoting its products' natural and health-conscious aspects. With a focus on innovation and quality, OKF has gained a substantial share of the U.S. industry.

Lily of the Desert is a U.S.-based company that has been a pioneer in producing aloe vera products, including drinks. The company is committed to providing organic and natural options, appealing to consumers seeking clean-label and sustainable choices. Lily of the Desert's aloe vera drinks are often positioned as both refreshing and functional drinks with potential health benefits.

Forever Living Products International, Inc. is a global company in the U.S. aloe vera drinks market. Forever Living strongly focuses on wellness and offers a range of aloe vera-based drinks, positioning them as part of a healthy lifestyle. The company's direct-selling business model has helped it establish a significant presence in the U.S., with a dedicated customer base looking for aloe vera beverages.

Aloe Gloe, owned by LA Aloe, LLC, is a U.S.-centric brand that has gained popularity in the aloe vera drinks market. Aloe Gloe focuses on providing organic and non-GMO aloe vera drinks in various flavors, appealing to consumers looking for clean and transparent ingredient lists. The brand's commitment to sustainability and environmental responsibility aligns with the values of environmentally conscious consumers in the U.S. These companies operate in a competitive landscape where product innovation, quality, and marketing strategies are crucial for success.

List of Key Companies Profiled

- Shree Baidyanath Ayurved Bhawan Pvt. Ltd.

- Patanjali Ayurved Limited

- Nature's Way Products LLC (Dr. Willmar Schwabe GmbH & Co. KG)

- Aloe Farms, Inc.

- Tulip International Inc.

- OKF Corporation

- AloeCure (American Global Health Group, LLC)

- Akiva Superfoods

- ALO Drink (SPI West Port Group)

- Nam Viet Foods & Beverage Co., LTD

US Aloe Vera Drinks Market Report Segmentation

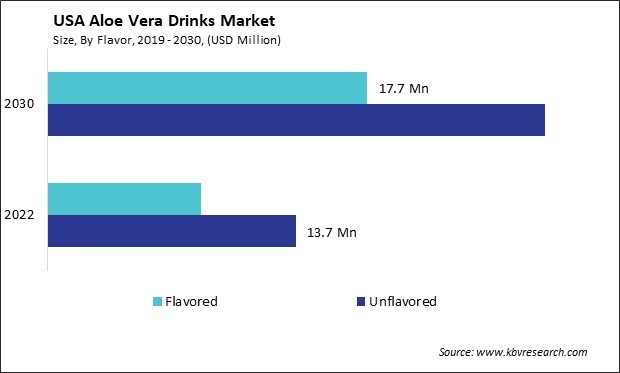

By Flavor

- Unflavored

- Flavored

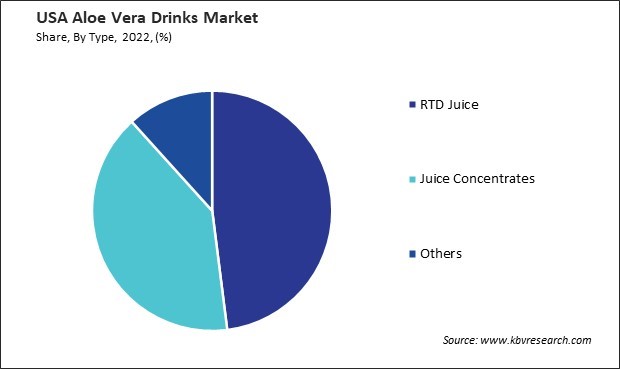

By Type

- RTD Juice

- Juice Concentrates

- Others

By Distribution Channel

- Hypermarkets & Supermarkets

- Pharmacy

- Online

- Others

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 US Aloe Vera Drinks Market, by Flavor

1.4.2 US Aloe Vera Drinks Market, by Type

1.4.3 US Aloe Vera Drinks Market, by Distribution Channel

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

2.2.3 Market Opportunities:

2.2.4 Market Challenges

2.2.5 Market Trends

2.3 Porter’s Five Forces Analysis

Chapter 3. US Aloe Vera Drinks Market

3.1 US Aloe Vera Drinks Market by Flavor

3.2 US Aloe Vera Drinks Market by Type

3.3 US Aloe Vera Drinks Market by Distribution Channel

Chapter 4. Company Profiles – Global Leaders

4.1 Shree Baidyanath Ayurved Bhawan Pvt. Ltd.

4.1.1 Company Overview

4.1.2 SWOT Analysis

4.2 Patanjali Ayurved Limited

4.2.1 Company Overview

4.2.2 SWOT Analysis

4.3 Nature's Way Products LLC (Dr. Willmar Schwabe GmbH & Co. KG)

4.3.1 Company Overview

4.3.2 SWOT Analysis

4.4 Aloe Farms, Inc.

4.4.1 Company Overview

4.4.2 SWOT Analysis

4.5 Tulip International Inc.

4.5.1 Company Overview

4.6 OKF Corporation

4.6.1 Company Overview

4.6.2 SWOT Analysis

4.7 AloeCure (American Global Health Group, LLC)

4.7.1 Company Overview

4.8 Akiva Superfoods

4.8.1 Company Overview

4.9 ALO Drink (SPI West Port Group)

4.9.1 Company Overview

4.9.2 SWOT Analysis

4.10. Nam Viet Foods & Beverage Co., LTD

4.10.1 Company Overview

4.10.2 SWOT Analysis

TABLE 2 US Aloe Vera Drinks Market, 2023 - 2030, USD ThoUSnds

TABLE 3 US Aloe Vera Drinks Market, 2019 - 2022, ThoUSnd Litres

TABLE 4 US Aloe Vera Drinks Market, 2023 - 2030, ThoUSnd Litres

TABLE 5 US Aloe Vera Drinks Market by Flavor, 2019 - 2022, USD ThoUSnds

TABLE 6 US Aloe Vera Drinks Market by Flavor, 2023 - 2030, USD ThoUSnds

TABLE 7 US Aloe Vera Drinks Market by Flavor, 2019 - 2022, ThoUSnd Litres

TABLE 8 US Aloe Vera Drinks Market by Flavor, 2023 - 2030, ThoUSnd Litres

TABLE 9 US Aloe Vera Drinks Market by Type, 2019 - 2022, USD ThoUSnds

TABLE 10 US Aloe Vera Drinks Market by Type, 2023 - 2030, USD ThoUSnds

TABLE 11 US Aloe Vera Drinks Market by Type, 2019 - 2022, ThoUSnd Litres

TABLE 12 US Aloe Vera Drinks Market by Type, 2023 - 2030, ThoUSnd Litres

TABLE 13 US Aloe Vera Drinks Market by Distribution Channel, 2019 - 2022, USD ThoUSnds

TABLE 14 US Aloe Vera Drinks Market by Distribution Channel, 2023 - 2030, USD ThoUSnds

TABLE 15 US Aloe Vera Drinks Market by Distribution Channel, 2019 - 2022, ThoUSnd Litres

TABLE 16 US Aloe Vera Drinks Market by Distribution Channel, 2023 - 2030, ThoUSnd Litres

TABLE 17 Key Information – Shree Baidyanath Ayurved Bhawan Pvt. Ltd.

TABLE 18 Key Information – Patanjali Ayurved Limited

TABLE 19 Key Information – Nature's Way Products LLC

TABLE 20 Key Information – Aloe Farms, Inc.

TABLE 21 Key Information – Tulip International Inc.

TABLE 22 Key Information – OKF Corporation

TABLE 23 Key Information – AloeCure

TABLE 24 Key Information – Akiva Superfoods

TABLE 25 Key Information – ALO Drink

TABLE 26 Key Information – Nam Viet Foods & Beverage Co., LTD

List of Figures

FIG 1 Methodology for the research

FIG 2 US Aloe Vera Drinks Market, 2019 - 2030, USD ThoUSnds

FIG 3 Key Factors Impacting Aloe Vera Drinks Market

FIG 4 Porter’s Five Forces Analysis - Aloe Vera Drinks Market

FIG 5 US Aloe Vera Drinks Market share by Flavor, 2022

FIG 6 US Aloe Vera Drinks Market share by Flavor, 2030

FIG 7 US Aloe Vera Drinks Market by Flavor, 2019- 2030, USD ThoUSnds

FIG 8 US Aloe Vera Drinks Market share by Type, 2022

FIG 9 US Aloe Vera Drinks Market share by Type, 2030

FIG 10 US Aloe Vera Drinks Market by Type, 2019 - 2030, USD ThoUSnds

FIG 11 US Aloe Vera Drinks Market share by Distribution Channel, 2022

FIG 12 US Aloe Vera Drinks Market share by Distribution Channel, 2030

FIG 13 US Aloe Vera Drinks Market by Distribution Channel, 2019 - 2030, USD ThoUSnds

FIG 14 SWOT Analysis: Shree Baidyanath Ayurved Bhawan Pvt. Ltd.

FIG 15 SWOT Analysis: Patanjali Ayurved Limited

FIG 16 SWOT Analysis: Nature's Way Products, LLC

FIG 17 SWOT Analysis: Aloe Farms, Inc.

FIG 18 SWOT Analysis: OKF Corporation

FIG 19 SWOT Analysis: ALO Drink

FIG 20 SWOT Analysis: Nam Viet Foods & Beverage Co., LTD