Int'l : +1(646) 600-5072 | query@kbvresearch.com

Int'l : +1(646) 600-5072 | query@kbvresearch.com

Published Date : 15-May-2024 |

Pages: 83 |

Formats: PDF |

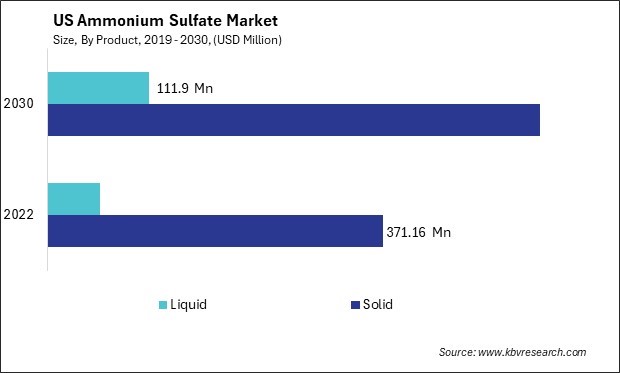

The United States (US) Ammonium Sulfate Market size is expected to reach $658.01 Million by 2030, rising at a market growth of 5.6% CAGR during the forecast period. In the year 2022, the market attained a volume of 1883.75 Kilo Tonnes, experiencing a growth of 4.9% (2019-2022).

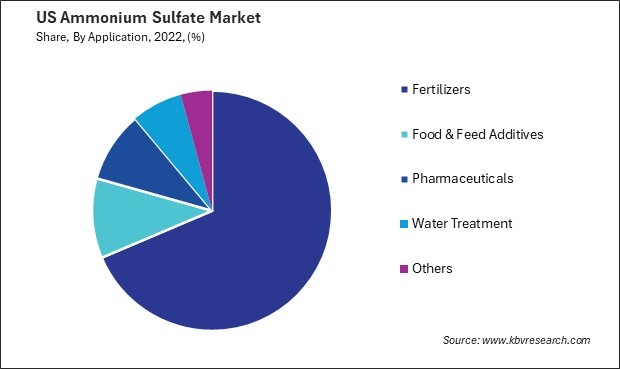

The ammonium sulfate market in the United States has witnessed steady growth over the years, propelled by its diverse applications across various industries such as agriculture, chemicals, food & beverages, pharmaceuticals, and textiles. The agriculture industry accounts for a significant portion of the demand for ammonium sulfate in the U.S., with farmers using it to improve soil fertility and increase crop yields. The increasing emphasis on sustainable agriculture practices and the rising demand for organic food products have bolstered the adoption of organic fertilizers such as ammonium sulfate.

Furthermore, the growing population and changing dietary preferences in the U.S. have fueled the demand for high-quality agricultural products, driving the need for efficient fertilizers like ammonium sulfate. Additionally, government initiatives and subsidies promoting using fertilizers to enhance agricultural productivity have supported ammonium sulfate market growth in the U.S.

The COVID-19 pandemic has had a mixed impact on the ammonium sulfate market in the United States. While the agricultural sector remained relatively resilient during the pandemic, disruptions in the supply chain and logistical challenges posed significant obstacles to the distribution of fertilizers, including ammonium sulfate. Lockdown measures and restrictions on movement implemented to curb the spread of the virus led to delays in shipments and reduced availability of labor, affecting both production and distribution operations.

The agricultural industry in the United States has witnessed significant growth in the demand for ammonium sulfate, a key fertilizer component essential for enhancing soil fertility and crop yield. One of the primary drivers of the increased demand for ammonium sulfate is the growing population, which necessitates higher agricultural productivity to meet food demand. As the population expands, so does the need for increased crop production, putting pressure on farmers to optimize their yields. Ammonium sulfate provides essential nutrients, such as nitrogen and sulfur, crucial for plant growth and development, supporting U.S. farmers in achieving higher crop yields to meet industry demands.

According to the U.S. Department of Agriculture, agriculture, food, and related industries contributed roughly $1.264 trillion to the U.S. gross domestic product (GDP) in 2021, a 5.4 % share. The output of America's farms contributed $164.7 billion—about 0.7 % of U.S. GDP. The overall contribution of agriculture to GDP is larger than 0.7 % because agricultural sectors rely on agricultural inputs to contribute added value to the economy. As the agriculture industry continues to innovate and adapt to meet the demands of a changing world, investments and advancements in areas such as the ammonium sulfate market serve as pivotal drivers of growth, reinforcing the sector's substantial contribution to the U.S. economy.

Furthermore, the shift towards sustainable agricultural practices has led to a preference for fertilizers that minimize environmental impact while maximizing crop productivity. Ammonium sulfate is favored in the U.S. for its low toxicity and minimal contribution to soil acidification compared to other nitrogen-based fertilizers like ammonium nitrate or urea. Its ability to improve soil structure and nutrient retention makes it a preferred choice for environmentally-conscious American farmers seeking to enhance long-term soil health.

Moreover, advancements in agricultural technology and research have led to innovative fertilizer formulations incorporating ammonium sulfate. Therefore, the increased demand for ammonium sulfate in the U.S. agricultural industry stems from population growth, sustainable farming preferences, and technological advancements, driven by its enhancing crop productivity while minimizing environmental impact.

In recent years, the livestock industry in the United States has experienced a surge in demand for feed additives, particularly those containing ammonium sulfate. One key driver of the increasing demand for livestock feed additives is the growing awareness among U.S. farmers and producers about optimizing animal health and performance. As Americans become more conscious of the quality and safety of meat and dairy products, there is a heightened focus on ensuring that livestock receive optimal nutrition to support their growth, immunity, and overall well-being.

Moreover, the intensification of livestock farming practices has increased pressure on animals to perform efficiently within confined environments. This has created a need for feed additives that helps alleviate stress, improve digestion, and enhance nutrient absorption in livestock. Ammonium sulfate-based additives have been shown to aid in rumen fermentation, leading to more efficient feed utilization and better feed conversion into meat, milk, or eggs.

In addition to these factors, advancements in feed additive technology and increased availability of high-quality ammonium sulfate products have contributed to the rising demand in the U.S. livestock industry. Manufacturers have developed innovative formulations that deliver precise nutrient concentrations, ensuring farmers' optimal performance and cost-effectiveness. Hence, the increasing demand for feed additives containing ammonium sulfate in the U.S. livestock industry is driven by a combination of factors, including heightened awareness of animal health, intensified farming practices, and advancements in additive technology.

The ammonium sulfate market in the United States is a vital segment of the broader chemical industry. One prominent U.S. ammonium sulfate market player is Nutrien, a leading provider of crop inputs and services. Nutrien operates multiple facilities nationwide, producing a significant portion of the nation's ammonium sulfate supply. With a focus on agricultural solutions, Nutrien plays a crucial role in meeting the fertilizer needs of American farmers. Through its extensive distribution network and commitment to innovation, Nutrien continues to strengthen its position in the U.S.

CF Industries, a global leader in nitrogen products, is also a significant player in the U.S. ammonium sulfate market. The company operates multiple production facilities in the U.S., supplying a wide range of nitrogen-based fertilizers, including ammonium sulfate. Leveraging its technical expertise and operational excellence, CF Industries ensures a reliable supply of high-quality products to meet the diverse needs of its customers across the country.

Another key player in the U.S. is Koch Industries, a conglomerate with diverse interests, including chemicals and fertilizers. Koch Industries operates several manufacturing facilities that produce ammonium sulfate, catering to agricultural and industrial customers. With its substantial resources and strategic investments, Koch Industries remains a formidable force in the U.S. chemical industry, contributing to the growth of the nation's economy.

Tessenderlo Kerley, Inc. (TKI), a subsidiary of Tessenderlo Group, is another notable participant in the U.S. ammonium sulfate market. The company provides agricultural and industrial solutions, including fertilizers and sulfur-based products. With a focus on sustainability and customer satisfaction, TKI continues to expand its presence in the U.S. ammonium sulfate market, offering innovative products and value-added services to its clientele.

Moreover, AdvanSix, a leading manufacturer of nylon and chemical intermediates, is actively involved in producing and distributing ammonium sulfate in the U.S. Through its modern manufacturing facilities and comprehensive logistics network, AdvanSix delivers high-quality ammonium sulfate products to agricultural and industrial customers nationwide. The company's commitment to operational excellence and product innovation positions it as a trusted partner in the U.S. chemical industry. Thus, the U.S. ammonium sulfate market is characterized by robust competition and innovation, driven by a diverse mix of companies ranging from industry giants to smaller enterprises.

By Product

By Application