The Unites States (US) Artificial Intelligence In Banking Market size is expected to reach $32.4 Billion by 2030, rising at a market growth of 29.5% CAGR during the forecast period.

The US artificial intelligence in banking market has experienced significant growth and evolution in recent years, driven by technological advancements, changing consumer expectations, and regulatory developments. AI has emerged as a powerful tool for banks and financial institutions, offering capabilities that range from customer service automation to risk management and fraud detection. Recent developments in the US artificial intelligence in banking market reflect a growing emphasis on leveraging AI to improve operational efficiency, enhance customer experience, and stay competitive in an increasingly digital financial landscape.

Another significant trend in the US artificial intelligence in banking market is the use of AI for risk management and compliance. Banks increasingly use AI-powered analytics and predictive modeling to assess and mitigate risks effectively. AI algorithms can analyze large volumes of data in real-time to identify potential risks, detect anomalies, and enhance fraud detection capabilities, helping banks improve their security posture and regulatory compliance.

Moreover, the US artificial intelligence in banking market has seen a surge in the adoption of AI for personalized marketing and customer segmentation. Banks leverage AI to analyze customer data and behavior patterns to tailor marketing campaigns and product offerings to individual preferences. This personalized approach has proven more effective in attracting and retaining customers in an increasingly competitive market.

Furthermore, advancements in AI technology, including machine learning and natural language processing, have expanded the scope of AI applications in banking. Banks use AI to automate back-office operations, optimize credit underwriting processes, and develop more sophisticated investment strategies, improving operational efficiency and decision-making.

The demand for artificial intelligence (AI) in US banks has been steadily increasing in recent years, particularly in financial advisory services. This surge in demand is driven by several factors reshaping how banks deliver personalized financial guidance to their customers. One key factor is the growing emphasis on leveraging AI to analyze vast customer data and provide tailored financial advice based on individual needs, preferences, and risk profiles. By harnessing AI algorithms, banks can offer more personalized and targeted financial advisory services, enhancing the overall customer experience.

Efficiency and scalability are also driving the adoption of AI in financial advisory services. AI-powered tools can automate repetitive tasks like portfolio analysis and investment monitoring, allowing human advisors to focus on higher-value client interactions. Furthermore, AI is crucial in enhancing risk management and compliance in financial advisory services. AI algorithms can analyze market data in real-time, identify potential risks, and help advisors make informed decisions to mitigate these risks.

The increasing demand for AI in US banks for financial advisory services is also driven by a desire to enhance the customer experience. AI-powered advisory tools can provide customers 24/7 access to personalized financial insights and recommendations, improving engagement and satisfaction. By leveraging AI, banks can offer a more proactive and responsive advisory experience, addressing customer needs in real-time and building stronger relationships with their clients. For example, Bank of America introduced Erica, an AI-powered virtual financial assistant, to help customers with various financial tasks, including managing accounts, paying bills, and setting financial goals. Similarly, JP Morgan Chase has integrated AI algorithms into its investment platforms to provide clients with personalized investment insights and recommendations. Such developments cement the role of AI in financial advisory services and, thus, aid in market growth.

The shift in consumer behavior towards digital banking and mobile financial services is driving the expansion of the US BFSI sector. Consumers increasingly demand seamless and convenient digital banking experiences, prompting financial institutions to invest in digital transformation initiatives. This includes the development of mobile banking apps, online account management tools, and personalized digital services to meet the evolving needs of tech-savvy consumers. The rise of fintech startups and digital disruptors has further accelerated the pace of innovation in the BFSI sector, spurring incumbents to innovate and adapt to stay competitive in the rapidly evolving digital landscape.

According to the Federal Deposit Insurance Corporation (FDIC), in the third quarter of 2023, the total number of FDIC-insured institutions was 4614, withholding a total of $23409 billion in assets. Out of this, 4049 were commercial banks. With a significant number of assets under management, the demand for AI in banking is driven by the need to effectively manage and analyze the vast volumes of data generated by these institutions. AI-powered analytics can help banks extract valuable insights from this data, such as customer behavior patterns, market trends, and risk indicators, which can inform strategic decision-making and product development. Thus, the scale and complexity of the US banking sector, as indicated by the number of FDIC-insured institutions and their assets, profoundly impact the demand in artificial intelligence in banking market.

In the US, the market for artificial intelligence in banking is characterized by several leading companies offering innovative AI-powered solutions tailored specifically for the banking sector. These companies leverage AI technologies such as machine learning, natural language processing, and predictive analytics to address banks' challenges, including customer engagement, risk management, fraud detection, and operational efficiency.

One prominent US artificial intelligence in banking market player is IBM, which offers its IBM Watson platform. IBM Watson is a cognitive computing system that enables banks to harness the power of AI for tasks such as customer service automation, personalized financial advice, and risk assessment. Microsoft is another key player in the US artificial intelligence in banking market, providing a range of AI and machine learning tools through its Azure cloud platform. These tools enable banks to develop and deploy AI-powered applications for various functions, including customer relationship management, fraud detection, and compliance monitoring. Microsoft's AI solutions are known for their scalability, security, and integration capabilities, making them popular for banks looking to adopt AI technologies.

Google Cloud is also a significant player in the US artificial intelligence in banking market, offering AI and machine learning services that banks can use to develop intelligent applications for customer insights, risk assessment, and operational efficiency. Google Cloud's AI solutions are known for their advanced natural language processing and image recognition capabilities, making them well-suited for a wide range of banking applications.

Amazon Web Services (AWS) is another major player in the US artificial intelligence in banking market, providing a comprehensive suite of AI and machine learning services that banks can use to build and deploy AI-powered applications. AWS's AI solutions are known for their scalability, flexibility, and cost-effectiveness, making them attractive options for banks looking to leverage AI technologies.

These companies and others such as Salesforce, SAS, DataRobot, and NICE Actimize drive innovation in the US artificial intelligence in banking market. Their AI-powered solutions are helping banks transform their operations, enhance customer experiences, and stay competitive in an increasingly digital and data-driven industry landscape. As the demand for AI in banking continues to grow, these companies are expected to play a pivotal role in shaping the future of banking with AI technologies.

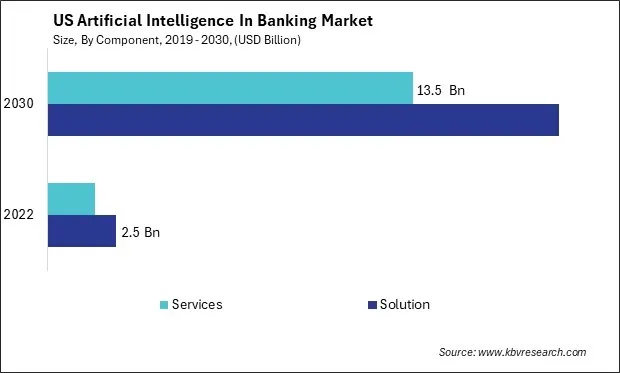

By Component

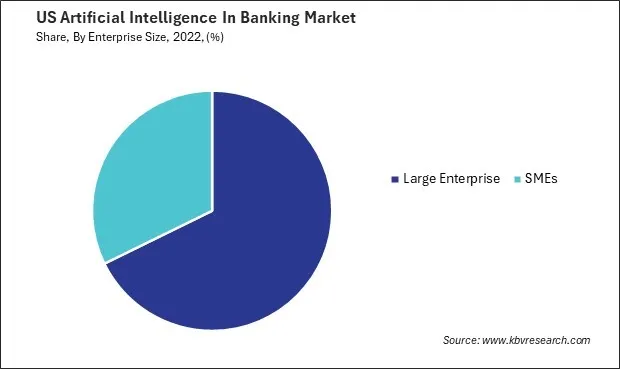

By Enterprise Size

By Technology

By Application

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.