Int'l : +1(646) 832-2886 | query@kbvresearch.com

Int'l : +1(646) 832-2886 | query@kbvresearch.com

Published Date : 20-Mar-2024 |

Pages: 102 |

Formats: PDF |

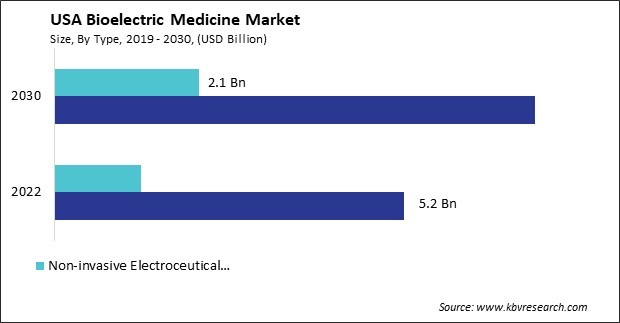

The USA Bioelectric Medicine Market size is expected to reach $9.2 billion by 2030, rising at a market growth of 4.8% CAGR during the forecast period.

In recent years, the bioelectric medicine market in the United States has witnessed substantial expansion and advancement. This field has gained attention due to its potential to offer alternative or complementary therapies to traditional pharmaceuticals in the U.S. An important determinant in the expansion of the bioelectric medicine market is the rising incidence of chronic ailments, including neurological disorders, cardiovascular diseases, and chronic pain. The increasing elderly population in the United States has generated a growing need for non-invasive and efficacious treatment alternatives, which has accelerated the integration of bioelectric medicine technological advances.

Furthermore, the bioelectric medicine market in the U.S. is attracting attention from established healthcare companies and startups. Startups bring innovative ideas and technologies to the industry, while larger companies invest in strategic acquisitions to strengthen their portfolios and expand their presence in this emerging field.

Private-sector investment has also been instrumental in driving the progress of the bioelectric medicine market in the United States. Venture capital firms, biotechnology companies, and major players in the healthcare industry are actively contributing to developing novel bioelectronic devices and therapies. The potential for groundbreaking medical interventions, such as bioelectric implants and electroceuticals, has fueled enthusiasm and attracted substantial capital to propel research initiatives forward.

According to the Centers for Medicare and Medicaid Services, spending on the healthcare industry in the United States increased by 4.1% in 2022 to $4.5 trillion, or $13,493 per person. Health spending made up 17.3 percent of the country's gross domestic product. Healthcare spending figures reflect the substantial financial commitment to individual health and the healthcare industry's integral role within the nation's broader economic landscape.

In recent years, the U.S. has become a global bioelectric medicine market research hub, attracting significant funding from government agencies, private investors, and pharmaceutical companies. The National Institutes of Health (NIH) and other federal organizations have supported foundational research projects. This financial backing has allowed scientists and researchers to delve into the intricate details of bioelectric pathways, furthering our understanding of how electrical signals can be harnessed to regulate physiological functions. The field is poised to witness transformative breakthroughs as the U.S. continues to invest heavily in the bioelectric medicine market. The integration of advanced technologies and a deep understanding of the body's electrical signaling promises personalized and targeted treatments for various diseases. The ongoing commitment to the research and development industry ensures that bioelectric medicine remains at the forefront of medical innovation, offering hope for improved therapeutic outcomes and enhanced quality of life for patients nationwide. According to the National Science Board, after $407 billion in 2010, the U.S. research and development industry's expenditures reached $667 billion in 2019 and were projected to reach $708 billion in 2020. These most recent increases in the performance total, which totaled at least $50 billion annually in 2018 and 2019, are significantly greater than the average yearly growth of $19 billion for 2010–16. This has increased the country's R&D intensity, which peaked in 2016 at 2.79%. From there, it increased to 2.95% in 2018 and 3.12% in 2019 (the first time the U.S. topped 3.0%). Thus, in the dynamic landscape of the bioelectric medicine market, the U.S. stands as a beacon of innovation and research, with sustained investments fostering a promising future of personalized treatments and improved patient well-being.

The United States has experienced a significant upswing in incorporating wearable bioelectric devices within its bioelectric medicine market, signifying a pivotal shift in patient care and monitoring strategies. Notable examples of these wearables, including neurostimulators and electroceutical patches, epitomize a non-invasive and patient-centric approach to administering therapeutic electrical stimulation. Tailored for on-body wear, these devices enable real-time monitoring and targeted intervention across various medical conditions prevalent in the U.S., such as chronic pain, neurological disorders, and inflammatory diseases. These wearables' inherent convenience and portability bolster patient compliance and contribute substantially to the growing preference for personalized and home-based healthcare solutions in the U.S.

The ascendance of wearable bioelectric devices in the U.S. resonates with the broader trend toward patient empowerment and the decentralization of healthcare. Integrating cutting-edge sensors, wireless connectivity, and data analytics within these devices facilitates continuous monitoring and allows for personalized adjustments in treatment plans, thereby optimizing health outcomes. As technological progress continues and the need for patient-centered care rises, wearable bioelectric devices are expected to play a more significant role in determining the course of bioelectric medicine in the United States. These devices offer accessible and innovative solutions for a wide range of medical conditions. Therefore, the surge in wearable bioelectric devices marks a transformative era in patient care, aligning with the overarching shift toward personalized, on-body solutions in the U.S.

The bioelectric medicine market in the United States is witnessing fierce competition as leading companies vie for prominence in this rapidly advancing field. Medtronic, a global leader in medical technology, stands out as a major player, spearheading innovations in neuromodulation and implantable bioelectric devices. With an extensive portfolio, including spinal cord stimulators and deep brain stimulators, Medtronic is at the forefront of addressing neurological disorders and chronic pain. The company's strategic focus on research and development, coupled with its comprehensive industry reach, positions it as a formidable competitor in shaping the trajectory of the bioelectric medicine market.

Boston Scientific, another key player in the U.S., is making substantial contributions to the field, particularly in neuromodulation and cardiac rhythm management. Known for its spinal cord stimulators and implantable cardioverter-defibrillators (ICDs), Boston Scientific caters to patients with chronic pain and cardiac conditions. Similarly, Abbott Laboratories, a diversified healthcare company boasting a comprehensive portfolio of cardiac and neuromodulation devices, is a significant contender. Abbott's implantable cardioverter-defibrillators and neuromodulation devices, such as dorsal root ganglion (DRG) stimulators, contribute to its competitive standing. The company's emphasis on technological innovation and patient-centric solutions further solidifies its position as a key player in the industry.

Emerging players also make their mark, injecting dynamism into the competitive landscape. Nevro Corporation, for instance, has gained recognition for its high-frequency spinal cord stimulation technology, offering an alternative for chronic pain management. The company's focus on refining spinal cord stimulation techniques and exploring new avenues positions it as a key innovator, contributing to the diversity of approaches within the bioelectric medicine market in the United States.

Strategic collaborations and partnerships play an important role in shaping the competitive dynamics of the U.S. bioelectric medicine market. Companies are forming alliances to leverage complementary expertise, share resources, and expedite technological advancements. Medtronic's collaboration with IBM Watson Health exemplifies this trend, utilizing artificial intelligence to enhance diabetes management through advanced data analytics. These collaborations highlight companies' strategic moves to stay ahead in a competitive landscape where technological innovation and cross-industry synergies are crucial.

By Type

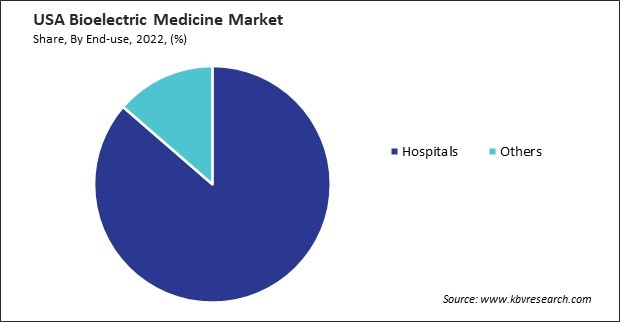

By End-use

By Product

By Application