US Biopolymers Market Size, Share & Trends Analysis Report By End-use), By Application, By Product (Biodegradable Polyesters, Bio-PE, Bio-PET, Polylactic Acid (PLA), Polyhydroxyalkanoate (PHA), and Others), and Forecast, 2023 - 2030

Published Date : 15-May-2024 |

Pages: 70 |

Formats: PDF |

COVID-19 Impact on the US Biopolymers Market

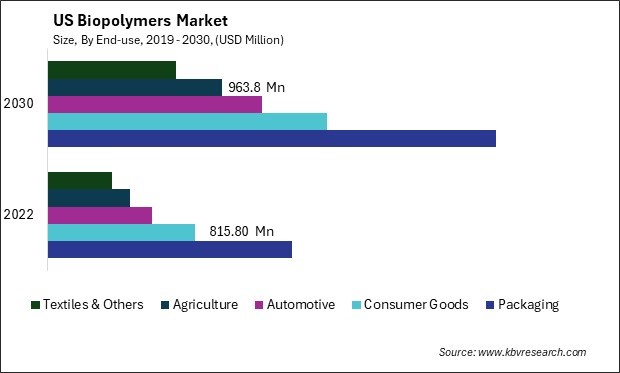

The United States (US) Biopolymers Market size is expected to reach $6.9 Billion by 2030, rising at a market growth of 8.7% CAGR during the forecast period. In the year 2022, the market attained a volume of 1308.6 Kilo Tonnes, experiencing a growth of 7.2 % (2019-2022).

The US biopolymers market is experiencing significant growth and innovation, driven by recent developments in technology, sustainability initiatives, and a growing demand for eco-friendly alternatives to traditional plastics. Recent developments in the US biopolymers market reflect a shift towards sustainable materials and circular economy principles. This includes advancements in biopolymer manufacturing processes, such as improved efficiency and scalability, as well as the development of new biopolymer formulations with enhanced properties and functionality. Environmental regulations are gaining increasing attention from the federal and state governments of the United States in an effort to reduce plastic waste as well as promote sustainable alternatives. This includes measures to restrict single-use plastics and promote biodegradable and compostable materials, which could create a favorable regulatory environment for biopolymers.

In the United States, there is increasing support for the circular economy concept, which entails the reuse, recycling, or composting of materials at the conclusion of their life cycle. Biopolymers fit into this framework as they can be designed to be compostable or biodegradable, aligning with the principles of a circular economy. Additionally, the US is a party to various international agreements and standards related to environmental protection and sustainability. Compliance with these agreements may influence the adoption of biopolymers as part of broader efforts to reduce the environmental impact of plastics.

One key trend in the US biopolymers market is the increasing adoption of biodegradable and compostable biopolymers in packaging applications. The environmental consequences of plastic pollution are becoming increasingly recognized, leading to a surge in the need for packaging materials that are biodegradable or compostable once their useful life has expired. Biopolymers offer a viable alternative to traditional plastics in this regard, aligning with the growing emphasis on sustainability and environmental responsibility.

Additionally, the US biopolymers market is witnessing investments in research and development to expand the range of applications for biopolymers. This includes efforts to improve biopolymers' mechanical and barrier properties, making them suitable for a wider range of packaging, consumer goods, and industrial applications. As a result, biopolymers are increasingly being used in sectors such as agriculture, automotive, textiles, and medical devices, among others.

Market Trends

Rapidly expanding consumer goods industry

The consumer goods industry in the United States is undergoing rapid expansion, driven by a confluence of factors reshaping the market landscape. One of the primary drivers of this growth is the changing nature of consumer demand. In light of evolving consumer preferences, there is an increasing focus on convenience, personalized products, and sustainable alternatives. As a consequence of this change in consumer behavior, the sector has experienced a notable upswing in innovation as enterprises endeavor to fulfill the ever-changing demands of their customers.

An additional pivotal element driving the growth of the consumer goods sector is the ascent of electronic commerce. The manner in which consumers acquire products has been revolutionized by the proliferation of online shopping, resulting in heightened competition among manufacturers of consumer goods. To remain competitive in this digital landscape, companies are investing heavily in digital marketing, e-commerce platforms, and data analytics to better understand and cater to their online customer base.

Additionally, technological developments contribute significantly to the growth of the consumer goods sector. Utilizing technologies such as automation, machine learning, and artificial intelligence, supply chain efficiency is enhanced, manufacturing processes are optimized, and consumer products and services are personalized. These technological innovations drive operational efficiencies and enable companies to create more tailored and responsive consumer experiences.

Furthermore, the expansion of the consumer goods industry in the US is leading to increased innovation and investment in sustainable packaging solutions. Companies are exploring new materials and technologies to reduce the environmental footprint of their products, with biopolymers being a key area of focus. As a result, there is a growing demand for biopolymer-based packaging solutions that can meet the performance requirements of the consumer goods industry while offering improved environmental credentials. Therefore, as consumer goods companies seek to address environmental concerns and meet changing consumer preferences, biopolymers are becoming integral to the industry's efforts to create more sustainable products and packaging.

Increasing demand for vehicle components

The United States is witnessing a significant uptick in the demand for vehicle components, driven by a variety of factors that are reshaping the automotive industry. One of the primary drivers is the continued growth in vehicle sales and production. Despite occasional fluctuations, the overall trend has expanded, leading to a heightened need for a wide range of components to meet the demand for new vehicles and aftermarket parts.

The automotive industry in the United States is among the most expansive in the world. In 2020, 14.5 million light vehicles (LVs) were sold in the United States. In 2020, international automakers manufactured 5 million vehicles in the United States, according to Autos Drive America. The United States exported 108,754 medium and heavy trucks and 1.4 million new light vehicles (equivalent to over $52 billion) to over 200 international markets in 2020. Furthermore, the country exported automotive parts worth an additional $66.7 billion.

Additionally, technological developments are significantly contributing to the heightened need for vehicle components. The automotive industry is profoundly transforming, shifting towards electric and hybrid vehicles, advanced driver-assistance systems (ADAS), and connected car technologies. These innovations require sophisticated components such as electric drivetrains, battery systems, sensors, and communication modules, all in high demand to support the development of next-generation vehicles.

Furthermore, evolving consumer preferences are driving the demand for more advanced and feature-rich vehicles. Consumers are increasingly seeking vehicles with enhanced safety features, improved performance, and greater connectivity. The aforementioned pattern has generated a notable upswing in the need for components associated with sophisticated infotainment systems, adaptive lighting, collision avoidance systems, and other cutting-edge attributes that augment the safety and driving experience of vehicles.

Competition Analysis

The US biopolymers market is home to several prominent companies that play key roles in producing, developing, and commercializing biopolymer products. These corporations are leading the way in promoting sustainability and innovation in the biopolymers sector, serving a wide range of industries, including packaging, automotive, consumer goods, and others.

One notable company in the US biopolymers market is NatureWorks LLC, a leading manufacturer of biopolymers, particularly polylactic acid (PLA). NatureWorks is known for its innovative approach to biopolymer production, focusing on renewable and sustainable raw materials derived from plants like corn. The company's PLA products are widely used in packaging, textiles, 3D printing, and other applications, contributing to the market's growth and adoption of sustainable materials.

Another significant player in the US biopolymers market is DuPont Biomaterials, a division of DuPont de Nemours, Inc. DuPont Biomaterials specializes in the development and production of a range of biopolymer solutions, including bio-based polymers and elastomers. The company's products are used in various industries, including packaging, textiles, and automotive, where sustainability and performance are key considerations.

Yield10 Bioscience, formerly Metabolix, is an organization whose primary objective is the development and commercialization of biopolymer technologies with broad applicability. While initially known for its work on producing biodegradable plastics from plant-based sources, Yield10 Bioscience has expanded its scope to include the development of novel biopolymer materials with applications in agriculture, food, and other sectors.

NatureWorks, DuPont Biomaterials, and Yield10 Bioscience are just a few examples of the companies that are driving innovation and growth in the US biopolymers market. These companies, along with others in the industry, are contributing to advancing sustainable materials and adopting biopolymers as viable alternatives to traditional plastics in various applications. As the demand for sustainable materials continues to rise, these companies are likely to play a crucial role in shaping the future of the biopolymers market in the US and beyond.

List of Key Companies Profiled

- BASF SE

- Archer Daniels Midland Company

- DuPont de Nemours, Inc.

- bio-tec Biologische Naturverpackungen GmbH & Co. KG

- Novamont S.p.A. (Versalis S.p.A.)

- BioLogiQ Inc.

- BioPolymer GmbH & Co KG

- Solanyl Biopolymers Inc.

- BioPolymer Industries, Inc.

US Biopolymers Market Report Segmentation

By End-use

- Packaging

- Consumer Goods

- Automotive

- Agriculture

- Textiles & Others

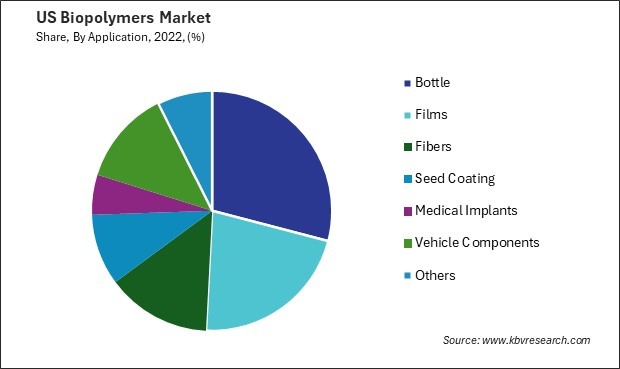

By Application

- Bottle

- Films

- Fibers

- Seed Coating

- Medical Implants

- Vehicle Components

- Others

By Product

- Biodegradable Polyesters

- Bio-PE

- Bio-PET

- Polylactic Acid (PLA)

- Polyhydroxyalkanoate (PHA)

- Others

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 USA Biopolymers Market, by End-use

1.4.2 USA Biopolymers Market, by Application

1.4.3 USA Biopolymers Market, by Product

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Opportunities

2.2.3 Market Restraints

2.2.4 Market Challenges

2.2.5 Market Trends

2.3 Porter’s Five Forces Analysis

Chapter 3. Strategies Deployed in Biopolymers Market

Chapter 4. US Biopolymers Market

4.1 US Biopolymers Market by End-use

4.2 US Biopolymers Market by Application

4.3 US Biopolymers Market by Product

Chapter 5. Company Profiles – Global Leaders

5.1 BASF SE

5.1.1 Company Overview

5.1.2 Financial Analysis

5.1.3 Segmental and Regional Analysis

5.1.4 Research & Development Expense

5.1.5 Recent strategies and developments:

5.1.5.1 Product Launches and Product Expansions:

5.1.5.2 Geographical Expansions:

5.1.6 SWOT Analysis

5.2 Archer Daniels Midland Company

5.2.1 Company Overview

5.2.2 Financial Analysis

5.2.3 Segmental and Regional Analysis

5.2.4 Research & Development Expense

5.2.5 Recent strategies and developments:

5.2.5.1 Partnerships, Collaborations, and Agreements:

5.3 DuPont de Nemours, Inc.

5.3.1 Company Overview

5.3.2 Financial Analysis

5.3.3 Segmental and Regional Analysis

5.3.4 Research & Development Expense

5.3.5 SWOT Analysis

5.4 bio-tec Biologische Naturverpackungen GmbH & Co. KG

5.4.1 Company Overview

5.5 Novamont S.p.A. (Versalis S.p.A.)

5.5.1 Company Overview

5.5.2 Financial Analysis

5.5.3 Segmental and Regional Analysis

5.5.4 Research & Development Expenses

5.5.5 Recent strategies and developments:

5.5.5.1 Partnerships, Collaborations, and Agreements:

5.5.5.2 Geographical Expansions:

5.5.6 SWOT Analysis

5.6 BioLogiQ Inc.

5.6.1 Company Overview

5.6.2 Recent strategies and developments:

5.6.2.1 Partnerships, Collaborations, and Agreements:

5.6.2.2 Product Launches and Product Expansions:

5.6.3 SWOT Analysis

5.7 BioPolymer GmbH & Co KG

5.7.1 Company Overview

5.8 Solanyl Biopolymers Inc.

5.8.1 Company Overview

5.9 BioPolymer Industries, Inc.

5.9.1 Company Overview

TABLE 2 US Biopolymers Market, 2023 - 2030, USD Million

TABLE 3 US Biopolymers Market, 2019 - 2022, Kilo Tonnes

TABLE 4 US Biopolymers Market, 2023 - 2030, Kilo Tonnes

TABLE 5 US Biopolymers Market by End-use, 2019 - 2022, USD Million

TABLE 6 US Biopolymers Market by End-use, 2023 - 2030, USD Million

TABLE 7 US Biopolymers Market by End-use, 2019 - 2022, Kilo Tonnes

TABLE 8 US Biopolymers Market by End-use, 2023 - 2030, Kilo Tonnes

TABLE 9 US Biopolymers Market by Application, 2019 - 2022, USD Million

TABLE 10 US Biopolymers Market by Application, 2023 - 2030, USD Million

TABLE 11 US Biopolymers Market by Application, 2019 - 2022, Kilo Tonnes

TABLE 12 US Biopolymers Market by Application, 2023 - 2030, Kilo Tonnes

TABLE 13 US Biopolymers Market by Product, 2019 - 2022, USD Million

TABLE 14 US Biopolymers Market by Product, 2023 - 2030, USD Million

TABLE 15 US Biopolymers Market by Product, 2019 - 2022, Kilo Tonnes

TABLE 16 US Biopolymers Market by Product, 2023 - 2030, Kilo Tonnes

TABLE 17 Key Information – BASF SE

TABLE 18 Key Information – Archer Daniels Midland Company

TABLE 19 Key Information –DuPont de Nemours, Inc.

TABLE 20 Key Information – bio-tec Biologische Naturverpackungen GmbH & Co. KG

TABLE 21 Key Information – Novamont S.p.A.

TABLE 22 Key Information – BioLogiQ Inc.

TABLE 23 Key Information – BioPolymer GmbH & Co KG

TABLE 24 Key Information – Solanyl Biopolymers Inc.

TABLE 25 Key Information – BioPolymer Industries, Inc.

List of Figures

FIG 1 Methodology for the research

FIG 2 US Biopolymers Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting Biopolymers Market

FIG 4 Porter’s Five Forces Analysis - Biopolymers Market

FIG 5 US Biopolymers Market share by End-use, 2022

FIG 6 US Biopolymers Market share by End-use, 2030

FIG 7 US Biopolymers Market by End-use, 2019 - 2030, USD Million

FIG 8 US Biopolymers Market share by Application, 2022

FIG 9 US Biopolymers Market share by Application, 2030

FIG 10 US Biopolymers Market by Application, 2019 - 2030, USD Million

FIG 11 US Biopolymers Market sharee by Product, 2022

FIG 12 US Biopolymers Market share by Product, 2030

FIG 13 US Biopolymers Market by Product, 2019 - 2030, USD Million

FIG 14 SWOT Analysis: BASF SE

FIG 15 SWOT Analysis: Archer Daniels Midland Company

FIG 16 SWOT Analysis: DuPont de Nemours, Inc.

FIG 17 SWOT Analysis: Novamont S.p.A.

FIG 18 SWOT Analysis: BioLogiQ Inc.