US Carbon Dioxide Market Size, Share & Trends Analysis Report By Application, By Form, By Source (Ethyl Alcohol, Hydrogen, Ethylene Oxide, Substitute Natural Gas, and Others), and Forecast, 2023 - 2030

Published Date : 02-Sep-2024 |

Pages: 63 |

Formats: PDF |

COVID-19 Impact on the US Carbon Dioxide Market

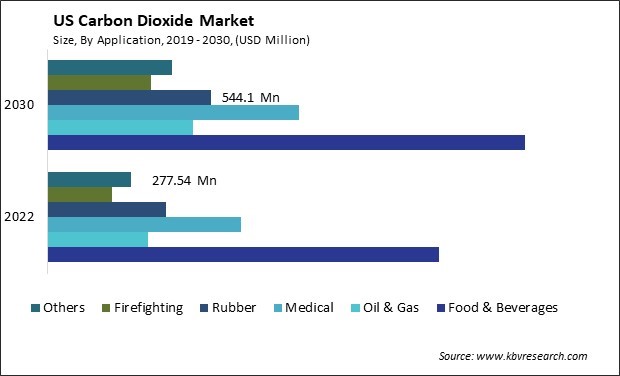

The US Carbon Dioxide Market size is expected to reach $4.2 billion by 2030, rising at a market growth of 3.7% CAGR during the forecast period. In the year 2022, the market attained a volume of 8,137.65 Kilo Tonnes, experiencing a growth of 1.6% (2019-2022).

The carbon dioxide market in the United States is a significant segment of the global economy, shaped by various factors including industrial processes, environmental regulations, and technological advancements. One of the primary drivers of the carbon dioxide market in the U.S. is its extensive use in the food and beverage industry. CO2 is commonly used as a refrigerant, preservative, and carbonation agent to produce carbonated beverages. Additionally, it is essential for freezing, chilling, and packaging applications in the food industry.

In addition to these key sectors, CO2 is used in diverse applications such as welding and metal fabrication, water treatment, and fire suppression systems. The regulatory landscape also influences the dynamics of the carbon dioxide market in the United States. Government policies aimed at reducing greenhouse gas emissions, such as the Clean Air Act and various state-level initiatives, have increased scrutiny of CO2 emissions from industrial facilities. This has prompted many companies to invest in carbon capture and storage (CCS) technologies to capture and store CO2 emissions, thereby creating additional revenue streams and complying with regulatory requirements.

Moreover, the energy sector plays a significant role in carbon capture and storage (CCS) technologies in the carbon dioxide market. As the U.S. continues to explore cleaner energy alternatives and address climate change concerns, CCS has emerged as a potential solution for reducing CO2 emissions from fossil fuel-based power plants and industrial facilities. The development and implementation of CCS projects have the potential to create a new industry for captured CO2, driving innovation and investment in the sector.

The COVID-19 pandemic has significantly impacted the carbon dioxide market in the United States. The widespread lockdowns and restrictions imposed to curb the spread of the virus resulted in disruptions to industrial activities and supply chains. Reduced production levels in key sectors such as manufacturing, food and beverage, and transportation led to a decline in the demand for carbon dioxide. However, the pandemic highlighted the importance of resilience and sustainability in supply chains. As the economy gradually recovers from the pandemic, the carbon dioxide market is expected to rebound, driven by ongoing investments in sustainability initiatives and the resumption of industrial activities.

Market Trends

Increasing Adoption in The Chemical Industry

The chemical industry in the United States plays a significant role in the carbon dioxide market, with implications for environmental sustainability and economic growth. Carbon dioxide (CO2) is a byproduct of various industrial processes, including those within the chemical sector. Recently, there has been a growing emphasis on reducing CO2 emissions to mitigate climate change.

According to Select USA, in 2019, the United States demonstrated its prowess in the chemical industry by exporting over $208 billion of chemicals, showcasing its leadership in global chemical production. The U.S. contributes over 15% of the world's total chemical output. This shift has prompted the chemical industry to explore innovative ways to minimize carbon footprints while maximizing production efficiency.

Moreover, the chemical industry is investing in research and development to develop new technologies for CO2 utilization. For example, researchers are investigating catalytic processes to convert CO2 into valuable chemicals and fuels, such as methanol or synthetic hydrocarbons. Government regulations and incentives also significantly shape the carbon dioxide market within the chemical industry.

Policies such as carbon pricing or tax credits for carbon capture and utilization incentivize companies to invest in low-carbon technologies and practices. Additionally, collaborations between government agencies, research institutions, and private sector stakeholders facilitate knowledge sharing and accelerate the development and adoption of carbon mitigation technologies. Hence, the chemical industry's efforts to reduce CO2 emissions and develop innovative CO2 utilization technologies are pivotal in addressing climate change and fostering sustainable economic growth in the U.S.

Rising Demand for Ethyl Alcohol

The United States is experiencing a significant surge in the demand for ethyl alcohol within the carbon dioxide market. One of the primary drivers behind the escalating demand for ethyl alcohol is its versatile application in carbon dioxide production. Ethanol is a feedstock for fermentation processes, where microorganisms metabolize sugars to produce ethanol and carbon dioxide. This carbon dioxide is then captured, purified, and utilized in numerous industries, ranging from beverages' carbonation to food products' preservation.

In the food and beverage industry, ethyl alcohol-derived carbon dioxide is extensively used to carbonate soft drinks, beer, and other carbonated beverages. With the growing consumption of carbonated drinks in the U.S., propelled by shifting consumer preferences towards convenience and ready-to-drink options, the demand for ethyl alcohol as a precursor for carbon dioxide production has witnessed a notable uptick.

Moreover, the pharmaceutical sector relies on ethyl alcohol-derived carbon dioxide for various applications, including as a solvent in extracting medicinal compounds and as a fuel in aerosol drug delivery systems. Therefore, the surge in demand for ethyl alcohol, driven by its versatile use in carbon dioxide production, reflects shifting consumer preferences towards carbonated beverages and pharmaceutical applications in the United States.

Competition Analysis

The United States, being one of the largest economies globally, has a significant presence in the carbon dioxide market, driven by various industries and sectors. One prominent player in the U.S. CO2 market is Air Products and Chemicals, Inc. The company operates across various industrial gas sectors, including CO2 production. It supplies CO2 to various industries, including food and beverage, pharmaceuticals, chemicals, and manufacturing. With a strong infrastructure and distribution network, Air Products is a significant supplier of CO2 for diverse applications, such as refrigeration and pH control, and as a raw material in various chemical processes.

Another notable company in the U.S. carbon dioxide market is Praxair, Inc., now part of Linde plc following a merger. Praxair/Linde is a leading industrial gas company globally, with a substantial presence in CO2 production and distribution within the U.S. The company serves a diverse customer base, providing CO2 for food processing, water treatment, welding, and more applications. Leveraging its extensive network and technological expertise, Praxair/Linde plays a crucial role in meeting the growing demand for CO2 across industries.

In the energy sector, companies like ExxonMobil and Chevron also have a stake in the carbon dioxide market. These energy giants are involved in various processes that produce CO2 as a byproduct, such as oil refining and natural gas processing. Additionally, they invest in carbon capture and storage (CCS) technologies to mitigate CO2 emissions from their operations. These efforts align with their broader sustainability goals and regulatory requirements, driving their participation in the carbon dioxide market.

Furthermore, agricultural companies like Archer Daniels Midland (ADM) are significant players in the U.S. carbon dioxide market. ADM operates ethanol production facilities that emit CO2 as a byproduct of fermentation. The company captures and purifies this CO2, selling it for various applications, including carbonation in beverages, food processing, and greenhouse agriculture. By monetizing CO2 emissions, ADM enhances the sustainability and economic viability of its ethanol production operations.

In addition to these major players, several smaller companies specialize in niche segments of the carbon dioxide market. For example, Matheson Tri-Gas, Inc. focuses on specialty gases, including CO2, serving industries like healthcare, electronics, and research laboratories. Similarly, Messer Americas, a subsidiary of the Messer Group, supplies CO2 and other industrial gases to diverse sectors, including food and beverage, metal fabrication, and healthcare. These companies explore opportunities in carbon utilization, transforming CO2 into valuable products such as fuels, chemicals, and building materials. By leveraging advancements in synthetic biology, catalysis, and materials science, these startups aim to create a more sustainable and circular economy while addressing climate change challenges.

List of Key Companies Profiled

- SOL Group

- India Glycols Limited

- Linde PLC

- Taiyo Nippon Sanso Corporation (Mitsubishi Chemical Group Corporation)

- Messer SE & Co. KGaA (Messer Industrie GmbH)

US Carbon Dioxide Market Report Segmentation

By Application

- Food & Beverages

- Oil & Gas

- Medical

- Rubber

- Firefighting

- Others

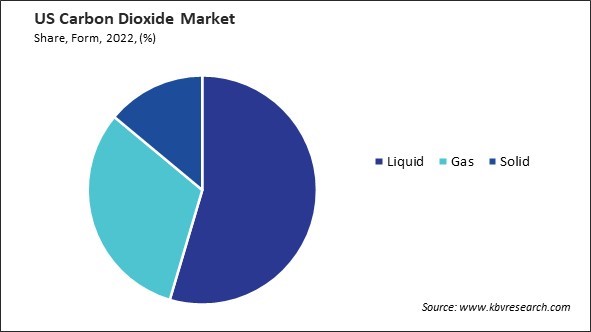

By Form

- Liquid

- Gas

- Solid

By Source

- Ethyl Alcohol

- Hydrogen

- Ethylene Oxide

- Substitute Natural Gas

- Others

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 US Carbon Dioxide Market, by Application

1.4.2 US Carbon Dioxide Market, by Form

1.4.3 US Carbon Dioxide Market, by Source

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Opportunities

2.2.3 Market Restraints

2.2.4 Market Challenges

2.2.5 Market Trends

2.3 Porter’s Five Forces Analysis

Chapter 3. Strategies Deployed in Carbon Dioxide Market

Chapter 4. US Carbon Dioxide Market

4.1 US Carbon Dioxide Market by Application

4.2 US Carbon Dioxide Market by Form

4.3 US Carbon Dioxide Market by Source

Chapter 5. Company Profiles – Global Leaders

5.1 SOL Group

5.1.1 Company Overview

5.1.2 Financial Analysis

5.1.3 Regional Analysis

5.1.4 Recent strategies and developments:

5.1.4.1 Partnerships, Collaborations, and Agreements:

5.1.4.2 Geographical Expansions:

5.1.5 SWOT Analysis

5.2 India Glycols Limited

5.2.1 Company Overview

5.2.2 Financial Analysis

5.2.3 Segmental and Regional Analysis

5.2.4 Research & Development Expenses

5.2.5 SWOT Analysis

5.3 Linde PLC

5.3.1 Company Overview

5.3.2 Financial Analysis

5.3.3 Segmental Analysis

5.3.4 Research & Development Expenses

5.3.5 Recent strategies and developments:

5.3.5.1 Partnerships, Collaborations, and Agreements:

5.3.6 SWOT Analysis

5.4 Taiyo Nippon Sanso Corporation (Mitsubishi Chemical Group Corporation)

5.4.1 Company Overview

5.4.2 Financial Analysis

5.4.3 Segmental Analysis

5.4.4 Research & Development Expenses

5.4.5 SWOT Analysis

5.5 Messer SE & Co. KGaA (Messer Industrie GmbH)

5.5.1 Company Overview

5.5.2 Financial Analysis

5.5.3 Regional Analysis

5.5.4 Recent strategies and developments:

5.5.4.1 Geographical Expansions:

5.5.5 SWOT Analysis

TABLE 2 US Carbon Dioxide Market, 2023 - 2030, USD Million

TABLE 3 US Carbon Dioxide Market, 2019 - 2022, Kilo Tonnes

TABLE 4 US Carbon Dioxide Market, 2023 - 2030, Kilo Tonnes

TABLE 5 US Carbon Dioxide Market by Application, 2019 - 2022, USD Million

TABLE 6 US Carbon Dioxide Market by Application, 2023 - 2030, USD Million

TABLE 7 US Carbon Dioxide Market by Application, 2019 - 2022, Kilo Tonnes

TABLE 8 US Carbon Dioxide Market by Application, 2023 - 2030, Kilo Tonnes

TABLE 9 US Carbon Dioxide Market by Form, 2019 - 2022, USD Million

TABLE 10 US Carbon Dioxide Market by Form, 2023 - 2030, USD Million

TABLE 11 US Carbon Dioxide Market by Form, 2019 - 2022, Kilo Tonnes

TABLE 12 US Carbon Dioxide Market by Form, 2023 - 2030, Kilo Tonnes

TABLE 13 US Carbon Dioxide Market by Source, 2019 - 2022, USD Million

TABLE 14 US Carbon Dioxide Market by Source, 2023 - 2030, USD Million

TABLE 15 US Carbon Dioxide Market by Source, 2019 - 2022, Kilo Tonnes

TABLE 16 US Carbon Dioxide Market by Source, 2023 - 2030, Kilo Tonnes

TABLE 17 Key Information – SOL Group

TABLE 18 Key Information – India Glycols Limited

TABLE 19 Key Information – Linde PLC

TABLE 20 Key Information – Taiyo Nippon Sanso Corporation

TABLE 21 Key Information – Messer SE & Co. KGaA

List of Figures

FIG 1 Methodology for the research

FIG 2 US Carbon Dioxide Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting Carbon Dioxide Market

FIG 4 Porter’s Five Forces Analysis - Carbon Dioxide Market

FIG 5 US Carbon Dioxide Market Share by Application, 2022

FIG 6 US Carbon Dioxide Market Share by Application, 2030

FIG 7 US Carbon Dioxide Market by Application, 2019 - 2030, USD Million

FIG 8 US Carbon Dioxide Market Share by Form, 2022

FIG 9 US Carbon Dioxide Market Share by Form, 2030

FIG 10 US Carbon Dioxide Market by Form, 2019 - 2030, USD Million

FIG 11 US Carbon Dioxide Market Share by Source, 2022

FIG 12 US Carbon Dioxide Market Share by Source, 2030

FIG 13 US Carbon Dioxide Market by Source, 2019 - 2030, USD Million

FIG 14 SWOT Analysis: SOL Group

FIG 15 Swot Analysis: India Glycols Limited

FIG 16 SWOT Analysis: Linde plc

FIG 17 SWOT Analysis: Taiyo Nippon Sanso Corporation

FIG 18 SWOT Analysis: Messer SE & Co. KGaA