US Copper Sulfate Market Size, Share & Trends Analysis Report By Type (Pentahydrate, Anhydrous, and Others), By Application (Agriculture, Chemicals, Construction, Healthcare, Mining & Metallurgy, and Others), and Forecast, 2023 - 2030

Published Date : 17-May-2024 |

Pages: 45 |

Report Format: PDF + Excel |

COVID-19 Impact on the US Copper Sulfate Market

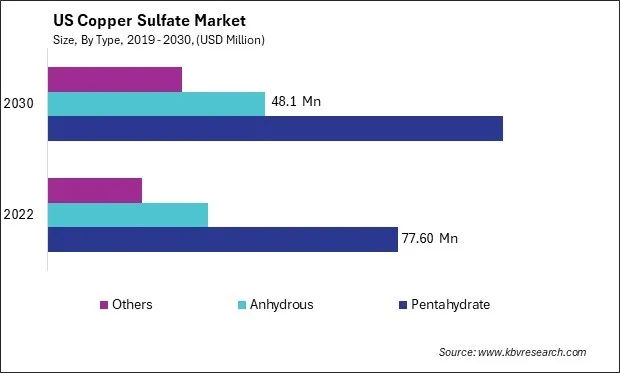

The United States (US) Copper Sulfate Market size is expected to reach $178.8 Million by 2030, rising at a market growth of 3.8% CAGR during the forecast period. In the year 2022, the market attained a volume of 556.6 Hundred Tonnes, experiencing a growth of 3.1% (2019-2022).

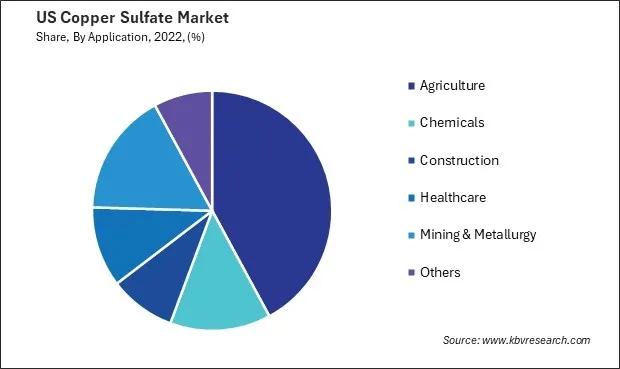

The copper sulfate market in the US is influenced by factors such as raw material availability (copper ore), environmental regulations governing its use, technological advancements in its production processes, and the overall economic conditions affecting its end-user industries. The demand for copper sulfate is driven by its diverse applications across industries such as agriculture, mining, chemicals, and others.

In the US, the demand for copper sulfate in agriculture is influenced by factors such as the prevalence of fungal diseases, pest management practices, and the overall health of the agricultural sector. The US agricultural sector is vast and diverse, encompassing various crops, livestock, and agricultural products. The country has a large amount of arable land and favorable climatic conditions in many regions, producing a diverse crop array. As agriculture continues to be a vital part of the US economy, the demand for copper sulfate in this sector remains significant.

The US produces crops such as corn, soybeans, wheat, cotton, and various fruits and vegetables. Different regions of the US specialize in producing specific crops based on climate and soil conditions. For example, the Midwest is known for its corn and soybean production, while the Southeast is known for its cotton production. These regional differences in agricultural practices and crop types can influence the demand for copper sulfate, as the usage patterns may vary based on the crops grown in each region.

According to the United States Department of Agriculture (USDA), agriculture, food, and related industries contributed roughly $1.264 trillion to U.S. gross domestic product (GDP) in 2021, a 5.4-percent share. The output of America's farms contributed $164.7 billion—about 0.7 percent of U.S. GDP. The size and significance of the agricultural sector suggest that it is a major consumer of inputs like pesticides and fungicides, including copper sulfate. As the agricultural sector contributes significantly to the US economy, the demand for products like copper sulfate for agricultural use will likely remain substantial.

Market Trends

Rising demand for anhydrous copper sulfate

In recent years, there has been a noticeable uptick in the demand for anhydrous copper sulfate in the United States, driven by several factors across different industries. One significant driver of this demand surge is the livestock industry's increasing need for copper supplements in animal feed. As livestock producers aim to optimize animal health and productivity, the demand for nutritional additives like anhydrous copper sulfate has risen, reflecting a broader trend of enhanced animal husbandry practices.

Furthermore, the industrial sector has also contributed to the rising demand for anhydrous copper sulfate. With its applications in various industrial processes, anhydrous copper sulfate is a valuable raw material for producing other copper compounds and products. As industries evolve and innovate, the demand for specific chemical components such as anhydrous copper sulfate can experience notable growth, driven by the requirements of modern manufacturing processes.

Another contributing factor to the increased demand for anhydrous copper sulfate is its role in educational and research settings. As educational institutions and research facilities continue to conduct experiments and studies involving chemical compounds, the demand for anhydrous copper sulfate as a reagent or demonstration material has risen accordingly. This trend reflects the ongoing importance of copper compounds in scientific research and educational initiatives. As these sectors evolve and expand, the demand for anhydrous copper sulfate will remain strong, driving its continued relevance in various fields nationwide.

Rapidly expanding chemical sector

Favorable regulatory policies, access to abundant and affordable feedstocks, such as shale gas, and advancements in technology have created a conducive environment for the growth of chemical manufacturing. This resurgence has increased production capacity and investment in chemical manufacturing facilities across the US, positioning the country as a global leader in chemical production.

Innovation and research and development (R&D) have also been crucial in expanding the US chemical sector. Companies in the sector are known for their focus on innovation and are continuously investing in R&D to develop new products, processes, and applications. This emphasis on innovation has not only driven growth but has also enhanced the sector's competitiveness on a global scale, allowing US chemical companies to maintain a leading position in the industry. According to the US Department of Homeland Security, the US chemical industry was a $768 billion enterprise that supported more than 25% of the total US GDP in 2019.

Copper sulfate is used in various industrial processes, including in the chemical sector, for applications such as metal surface treatment, electroplating, and the production of other copper compounds. As the chemical sector expands and diversifies its production capabilities, the demand for copper sulfate as a raw material or intermediate in these processes may increase.

Competition Analysis

In the United States, several companies are involved in producing, distributing, and selling copper sulfate, catering to various industries and applications. These companies play a crucial role in meeting the demand for copper sulfate in the US market and beyond. American Elements is a prominent company in the US involved in copper sulfate production. The company is a global manufacturer and distributor of advanced materials, including copper sulfate, serving various aerospace, automotive, electronics, and pharmaceutical industries. American Elements provides a comprehensive range of copper compounds, including copper sulfate, to meet the diverse needs of its customers.

Another key player in the US copper sulfate market is Chem One Ltd. Chem One is a chemical manufacturer and distributor specializing in various chemical products, including copper sulfate. The company supplies copper sulfate to agriculture, animal feed, water treatment, and industrial applications. Chem One's presence in the US market contributes to the availability and supply of copper sulfate for different sectors.

Moreover, companies like Jost Chemical Co. are known for their expertise in manufacturing high-quality copper compounds, including copper sulfate. Jost Chemical Co. supplies copper sulfate for pharmaceutical, nutritional, and industrial applications, adhering to strict quality standards and regulatory requirements.

Verdant Specialty Solutions is a leading supplier of copper sulfate and other agricultural chemicals in the US. The company offers a range of products for agricultural applications, including crop protection and nutrient management, catering to the needs of farmers and agribusinesses. Vanderbilt Minerals, LLC manufactures specialty minerals and chemicals, including copper sulfate, for industrial and agricultural applications. The company's products are used in diverse industries, such as animal feed additives, water treatment, and industrial processes.

These companies, among others, form a vital part of the copper sulfate supply chain in the US, ensuring the availability of this essential chemical compound for various industries and applications. Their contributions play a significant role in meeting the demand for copper sulfate and supporting the market's diverse needs.

List of Key Companies Profiled

- Beneut Enterprise

- JX Metals Corporation (Eneos Holdings)

- NOAH Technologies Corp.

- Sumitomo Metal Mining Co., Ltd.

- Univertical Corp. (Alconix Corporation)

- Jost Chemical Co.

- LAFFORT

US Copper Sulfate Market Report Segmentation

By Type

- Pentahydrate

- Anhydrous

- Others

By Application

- Agriculture

- Chemicals

- Construction

- Healthcare

- Mining & Metallurgy

- Others

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 USA Copper Sulfate Market, by Type

1.4.2 USA Copper Sulfate Market, by Application

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Opportunities

2.2.3 Market Restraints

2.2.4 Market Challenges

2.2.5 Market Trends

2.3 Porter Five Forces Analysis

Chapter 3. US Copper Sulfate Market

3.1 US Copper Sulfate Market by Type

3.2 US Copper Sulfate Market by Application

Chapter 4. Company Profiles

4.1 Beneut Enterprise

4.1.1 Company Overview

4.2 JX Metals Corporation (Eneos Holdings)

4.2.1 Company Overview

4.2.2 Financial Analysis

4.2.3 Segmental and Regional Analysis

4.2.4 Research & Development Expenses

4.3 NOAH Technologies Corp.

4.3.1 Company Overview

4.4 Sumitomo Metal Mining Co., Ltd.

4.4.1 Company Overview

4.4.2 Financial Analysis

4.4.3 Segmental and Regional Analysis

4.4.4 Research & Development Expenses

4.5 Univertical Corp. (Alconix Corporation)

4.5.1 Company Overview

4.5.2 Financial Analysis

4.6 Jost Chemical Co.

4.6.1 Company Overview

4.7 LAFFORT

4.7.1 Company Overview

4.7.2 SWOT Analysis

TABLE 2 US Copper Sulfate Market, 2023 - 2030, USD Million

TABLE 3 US Copper Sulfate Market, 2019 - 2022, Hundred Tonnes

TABLE 4 US Copper Sulfate Market, 2023 - 2030, Hundred Tonnes

TABLE 5 US Copper Sulfate Market by Type, 2019 - 2022, USD Million

TABLE 6 US Copper Sulfate Market by Type, 2023 - 2030, USD Million

TABLE 7 US Copper Sulfate Market by Type, 2019 - 2022, Hundred Tonnes

TABLE 8 US Copper Sulfate Market by Type, 2023 - 2030, Hundred Tonnes

TABLE 9 US Copper Sulfate Market by Application, 2019 - 2022, USD Million

TABLE 10 US Copper Sulfate Market by Application, 2023 - 2030, USD Million

TABLE 11 US Copper Sulfate Market by Application, 2019 - 2022, Hundred Tonnes

TABLE 12 US Copper Sulfate Market by Application, 2023 - 2030, Hundred Tonnes

TABLE 13 Key Information – Beneut Enterprise

TABLE 14 Key Information – JX Metals Corporation

TABLE 15 Key Information – NOAH Technologies Corp.

TABLE 16 Key Information – Sumitomo Metal Mining Co., Ltd.

TABLE 17 Key Information – Univertical Corp.

TABLE 18 Key Information – Jost Chemical Co.

TABLE 19 Key Information – LAFFORT

List of Figures

FIG 1 Methodology for the research

FIG 2 US Copper Sulfate Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting Copper Sulfate Market

FIG 4 Porter’s Five Forces Analysis – Copper Sulfate Market

FIG 5 US Copper Sulfate Market share by Type, 2022

FIG 6 US Copper Sulfate Market share by Type, 2030

FIG 7 US Copper Sulfate Market by Type, 2019 - 2030, USD Million

FIG 8 US Copper Sulfate Market share by Application, 2022

FIG 9 US Copper Sulfate Market share by Application, 2030

FIG 10 US Copper Sulfate Market by Application, 2019 - 2030, USD Million

FIG 11 SWOT Analysis: LAFFORT