Int'l : +1(646) 832-2886 | query@kbvresearch.com

Int'l : +1(646) 832-2886 | query@kbvresearch.com

Published Date : 17-May-2024 |

Pages: 111 |

Formats: PDF |

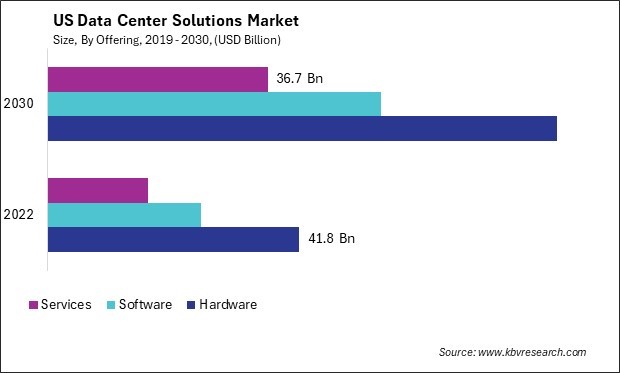

The United States (US) Data Center Solutions Market size is expected to reach $176.8 Billion by 2030, rising at a market growth of 10.0% CAGR during the forecast period.

The US data center solutions market is a dynamic and rapidly evolving sector driven by the increasing demand for advanced data infrastructure to support digital transformation initiatives across industries. In recent years, the market has witnessed significant developments propelled by technological advancements, regulatory changes, and the growing need for scalable, efficient, and secure data storage and processing capabilities. These developments have reshaped the landscape of data center solutions in the US, paving the way for innovation and growth in the industry.

Another significant development in the US data center solutions market is the rising importance of edge computing. Edge computing has become an essential element of contemporary data center architectures due to the increasing demand for real-time data processing and analytics and the proliferation of Internet of Things (IoT) devices. Data center solution providers in the US are investing in edge computing infrastructure and capabilities to enable businesses to process data closer to the source, reducing latency and improving overall performance.

Additionally, the US data center solutions market has experienced a surge in demand for colocation services. Colocation has gained popularity as businesses seek to outsource their data center infrastructure to third-party providers to reduce costs, improve reliability, and gain access to advanced technologies. As a consequence, there has been a proliferation of colocation providers and facilities in the United States, each of which now furnishes an extensive selection of services to cater to the diverse needs of organizations across all sectors.

The COVID-19 pandemic has reshaped the US data center solutions market by accelerating digital transformation, increasing demand for cloud services, emphasizing resilience and business continuity, driving remote management and automation, disrupting supply chains, and renewing focus on sustainability. These impacts are expected to influence the trajectory of the data center industry in the US in the post-pandemic era, shaping investment priorities and driving innovation in data center solutions.

Internet of Things (IoT) device proliferation, the expansion of edge computing applications, and the requirement for low-latency data processing and storage in closer proximity to the point of data generation have all contributed to an increase in demand for edge data centers in the United States. Rapid industry-wide adoption of IoT devices is a significant factor in the rising demand for edge data centers in the United States. Machine learning and analysis in real-time are necessary to extract actionable insights from the vast quantities of data generated by IoT devices. Edge data centers, located closer to the devices at the edge of the network, enable businesses to process this data locally, reducing latency and improving the performance of IoT applications.

In addition, the increasing adoption of edge computing applications—including but not limited to autonomous vehicles, smart cities, and industrial automation—has played a role in the escalating need for edge data centers within the United States. These applications require low-latency processing and high-bandwidth connectivity, best achieved through edge infrastructure that brings computing resources closer to the end-users or devices.

Moreover, the rise of edge data centers has spurred innovation in connectivity solutions as businesses seek high-speed, low-latency connectivity between edge locations and centralized data centers or cloud environments. Data center solution providers are partnering with network providers to offer advanced networking solutions, such as software-defined networking (SDN) and edge computing interconnect (ECI) services, to enable seamless connectivity and data exchange between edge and core data center environments. Therefore, as businesses continue to embrace edge computing to support their digital transformation initiatives, the demand for these specialized data center solutions is expected to grow, shaping the future of the data center solutions market.

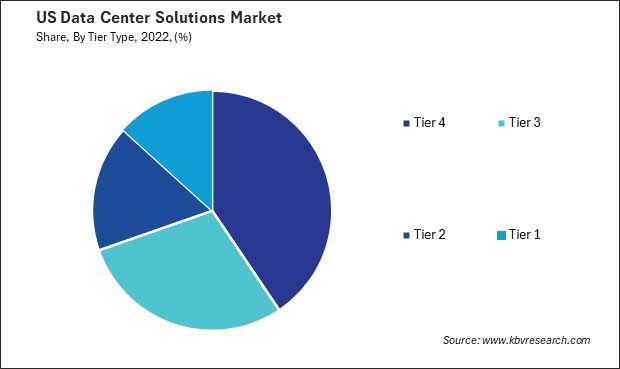

The United States has seen a rising demand for Tier 3 data centers, driven by the increasing reliance on digital infrastructure for business operations, the growing volume of data generated by various industries, and the need for high availability and reliability in data center services. As businesses across industries undergo digital transformation, there is a growing need for secure and reliable data center facilities to support the storage, processing, and management of large volumes of digital data. Tier 3 data centers, known for their high availability and redundancy features, are well-suited to meet these requirements, making them an attractive choice for businesses looking to modernize their IT infrastructure.

Additionally, the proliferation of cloud computing and adopting hybrid cloud strategies have fueled the demand for Tier 3 data centers in the US. Many businesses leverage cloud services for their scalability and flexibility benefits. Still, they also require reliable and resilient data center facilities to host their private cloud environments or support their hybrid cloud deployments. Tier 3 data centers, with their focus on uptime and redundancy, provide an ideal environment for businesses seeking to integrate cloud services into their IT infrastructure while ensuring high levels of availability for their critical workloads.

Furthermore, the increasing importance of data security and compliance regulations has contributed to the demand for Tier 3 data centers in the US. Businesses are under pressure to ensure their data's confidentiality, integrity, and availability, especially in light of evolving cybersecurity threats and regulatory requirements. By implementing sophisticated security protocols and adhering to industry norms, Tier 3 data centers provide organizations with a compliant and secure setting in which to store and process sensitive information, thus fulfilling their security and compliance requirements. Hence, the aforementioned factors will support the growth of the market.

The US data center solutions market is home to various companies offering various products and services tailored to businesses seeking robust and scalable data center infrastructure. These companies encompass a mix of global technology leaders, specialized data center providers, and infrastructure vendors, each shaping the landscape of data center solutions in the US.

Global technology giants like Microsoft, through its Azure cloud platform, and Amazon Web Services (AWS), with its AWS cloud services, are significant players in the US data center solutions market. These companies offer a comprehensive suite of data center solutions, including infrastructure as a service (IaaS), platform as a service (PaaS), and software as a service (SaaS), catering to the diverse needs of businesses looking to build, manage, and optimize their data center infrastructure in the cloud.

Another prominent player in the US data center solutions market is Google Cloud, which provides a range of cloud-based data center services and solutions under its Google Cloud Platform (GCP). Google Cloud's offerings include computing, storage, networking, and data analytics services and specialized solutions for industries such as healthcare, finance, and retail, making it a key player in the data center space.

In addition to these global cloud providers, specialized data center operators and service providers play a crucial role in the US data center solutions market. Companies like Equinix, Digital Realty, and CyrusOne are among the leading data center providers in the US, offering a variety of colocation, hosting, and managed services to businesses looking to outsource their data center infrastructure or build hybrid cloud environments.

Furthermore, infrastructure vendors such as Dell Technologies, Hewlett Packard Enterprise (HPE), and Cisco Systems are key players in the US data center solutions market, providing hardware, networking, and software solutions that form the backbone of data center infrastructure. These companies offer a wide range of products and services, including servers, storage systems, networking equipment, and management software, designed to support the diverse needs of modern data centers.

To summarise, the US data center solutions market comprises infrastructure vendors, specialized data center operators, and global cloud providers. Each of these entities offers distinct functionalities and knowledge to address the changing requirements of organizations in search of dependable, expandable, and effective data center solutions. As the demand for data center infrastructure continues to grow in the US, these companies are expected to play a crucial role in shaping the future of the data center industry in the country.

By Offering

By Tier Type

By Data Center Size

By Data Center Type

By Vertical