The USA Dental Chair Market size is expected to reach $360.4 million by 2030, rising at a market growth of 3.7% CAGR during the forecast period. In the year 2022, the market attained a volume of 95.5 thousand units, experiencing a growth of 3.2% (2019-2022).

In recent years, there has been a noticeable increase in the focus on dental care in America. There are multiple factors that have contributed to this transition, one of which is an increasing recognition of the significance of oral health and its influence on holistic welfare. With the increasing body of research emphasizing the correlation between oral health and ailments like diabetes and heart disease, individuals are exhibiting greater concern for their dental hygiene and attending routine dental examinations.

Additionally, social media and the pursuit of a flawless smile have contributed to a cultural shift in which aesthetics and cosmetic dentistry are increasingly valued. Specialized dental equipment, including dental chairs, is required for procedures such as orthodontics, teeth whitening, and dental implants, which have seen an increase in demand as a result of this trend.

Technological advances have transformed cosmetic dentistry, which has rendered procedures more efficient, accessible, and minimally invasive. An increase in the affordability and accessibility of orthodontic treatments such as clear aligners, veneers, teeth whitening, and dental bonding has caused a surge in demand for these services. Additionally, the development of digital smile design software allows dentists to provide patients with a preview of their potential results, enhancing patient satisfaction and confidence in undergoing cosmetic procedures.

The popularity of aesthetics and cosmetic dentistry in the U.S. is a reflection of evolving societal values, technological advancements, and the desire for improved self-image and oral health. As this trend continues, the demand for cosmetic dental procedures and the associated dental equipment, including dental chairs and tools, is expected to grow, further shaping the landscape of modern dentistry.

Moreover, the pandemic highlighted the importance of infection control in healthcare settings, including dental offices. This has led to an increased focus on equipment that facilitates infection prevention, potentially driving the demand for newer dental chairs with enhanced infection control features in America.

America's aging population significantly impacts the demand for dental chairs due to the unique dental care needs of older adults. The susceptibility to dental problems such as gum disease, tooth decay, and tooth loss increases with age; therefore, routine dental care and treatment are required. This demographic trend has led to an increased demand for dental services, including the need for dental chairs that can accommodate the specific needs of older patients.

Certain health conditions or limitations of mobility may necessitate special accommodations for older adults during dental visits. Dental chairs designed with features such as adjustable height, easy access, and comfortable seating can significantly improve the experience for older patients and enable dental practitioners to provide quality care to this demographic.

According to the United States Census Bureau data, as per the 2020 Census, the population of Americans aged 65 and older grew nearly five times faster than the total population during the century-long period from 1920 to 2020. In 2020, approximately one in every six Americans was 65 or older. This percentage was below 1 in 20 in 1920. In 2020, the elderly comprised 15.8% of the total population of the United States or 55.8 million individuals. As the population continues to age, the demand for dental chairs and other specialized dental equipment is expected to grow, creating opportunities for innovation and development in the field of geriatric dentistry.

With greater awareness of the importance of oral health in overall well-being, more people are seeking regular dental check-ups and treatments to address issues early, which can reduce the need for more invasive procedures later on. Furthermore, changes in insurance coverage and payment models have made dental surgeries more accessible to a broader segment of the population. As dental insurance plans increasingly cover surgical procedures, more people can afford necessary treatments, leading to a higher demand for surgical services. An estimated 62.7% of adults visited the dentist within the previous twelve months in 2020.

The National Institute of Dental and Craniofacial Research reports that approximately 57% of adolescents aged 12 to 19 have experienced dental caries in their permanent teeth. According to the aforementioned source, total periodontitis affected 42.2% (± 1.4) of adults aged 30 years or older in the United States. Of this percentage, 7.8% had severe periodontitis, and 34.4% had nonsevere periodontitis.

Therefore, the rising number of dental surgeries in America is driven by a combination of factors, including demographic changes, technological advancements, changes in healthcare delivery, and patients' evolving priorities towards better oral health. This trend is expected to continue, shaping the future of dental healthcare and driving further innovation in dental surgical procedures and equipment.

Numerous companies in the United States are industry leaders in producing and distributing dental chairs, catering to the varied requirements of dental practices with an extensive selection of products. Some companies are known for their innovative designs, ergonomic features, and advanced technology, making them leaders in the dental equipment industry.

A-dec is a well-established American company known for its high-quality dental chairs and equipment. With a strong focus on ergonomic design and patient comfort, A-dec has built a reputation for providing reliable and durable dental chairs that meet the needs of modern dental practices. Midmark Corporation is another prominent player in the American dental equipment market, offering a wide range of dental chairs and operatories. Midmark is known for its commitment to innovation and has developed several proprietary technologies to enhance the dental care experience for patients and practitioners.

Pelton & Crane, a subsidiary of KaVo Kerr, is recognized for its long history of manufacturing high-quality dental equipment, including dental chairs. Pelton & Crane's chairs are known for their durability, reliability, and advanced features, making them popular among dental professionals. Planmeca USA is a leading provider of dental equipment, including dental chairs, known for its advanced technology and integration capabilities. Planmeca's dental chairs are designed to offer exceptional comfort for patients while providing dentists with the flexibility and functionality they need to deliver high-quality care.

DentalEZ Group is a company that offers numerous types of dental products, including dental chairs. They focus on providing ergonomic solutions that enhance the comfort and efficiency of dental procedures. Dentsply Sirona, Boyd Industries, Engle Dental Systems, DCI (Dental Components Incorporated), etc., are some other prominent companies in the nation. These companies are among the key players in the American dental chair market, offering a variety of options to meet the needs of dental practices across the country.

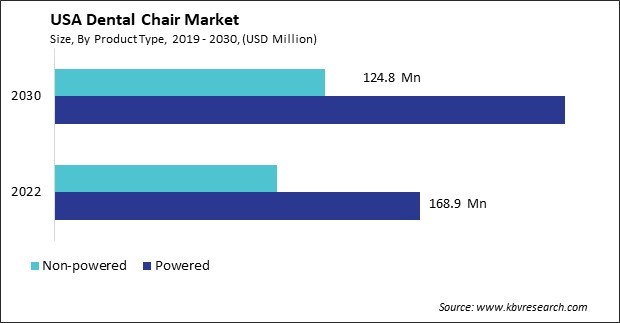

By Product Type

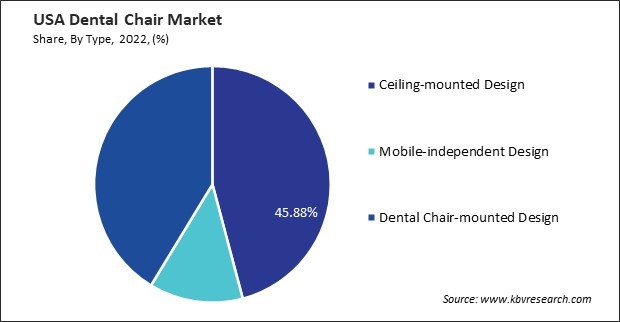

By Type

By Component

by End User

By Application

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.