Int'l : +1(646) 600-5072 | query@kbvresearch.com

Int'l : +1(646) 600-5072 | query@kbvresearch.com

Published Date : 15-Jul-2024 |

Pages: 78 |

Formats: PDF |

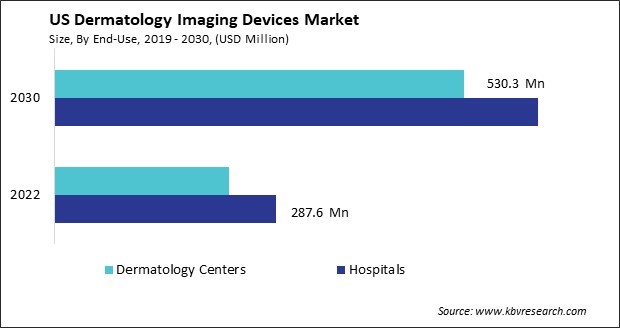

The US Dermatology Imaging Devices Market size is expected to reach $1.5 billion by 2030, rising at a market growth of 11.0% CAGR during the forecast period.

The dermatology imaging devices market in the U.S. has grown significantly over the past few years. One of the key factors driving the growth of the dermatology imaging devices market is the rising incidence of skin cancer and other skin-related disorders. According to the American Academy of Dermatology, skin cancer is the most common form of cancer in the United States, with over 9,500 people diagnosed every day. This has increased demand for early detection and diagnosis, boosting the adoption of dermatology imaging devices.

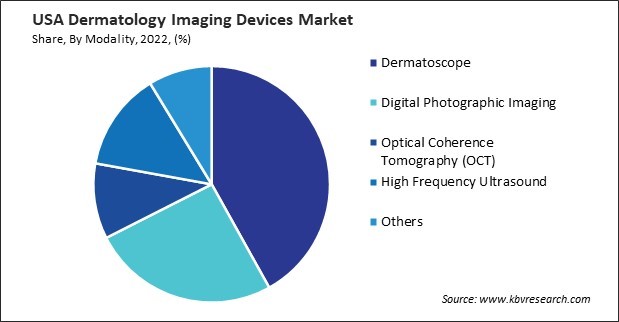

Moreover, technological advancements in imaging modalities, such as optical coherence tomography (OCT), dermoscopy, and confocal microscopy, have enhanced the efficiency and accuracy of dermatological diagnosis. Furthermore, the growing emphasis on aesthetic procedures and cosmetic dermatology has expanded the dermatology imaging devices market. With the rising demand for minimally invasive cosmetic procedures, such as laser therapy, chemical peels, and injectables, dermatologists require advanced imaging tools to assess skin conditions and plan personalized treatment regimens.

The COVID-19 pandemic has impacted the dermatology imaging devices market in the U.S. The temporary closure of dermatology clinics and elective procedure postponements during the initial phases of the pandemic led to a decline in device sales and procedural volumes. However, the increased focus on telemedicine and remote consultations has spurred the adoption of teledermatology solutions, including dermatology imaging devices with telemedicine capabilities. As dermatologists sought alternative ways to provide care to patients while minimizing in-person visits, there was a growing interest in portable and handheld dermatology imaging devices that is used for remote consultations.

The United States is witnessing a concerning trend in the increasing incidence of skin disorders, leading to a parallel rise in the demand for advanced dermatology imaging devices. Skin disorders encompass many conditions, ranging from common ailments like acne and eczema to more serious diseases like melanoma and psoriasis. Environmental factors play a significant role, with pollution levels escalating in urban areas and exposure to harmful UV radiation becoming more prevalent due to ozone layer depletion. Lifestyle changes, including stress, unhealthy dietary habits, and sedentary routines, contribute to skin issues like acne and premature aging.

In response to this escalating demand for dermatological care, the dermatology imaging devices market in the United States is experiencing significant growth. These devices play a crucial role in diagnosing and monitoring various skin disorders, enabling healthcare professionals to accurately assess the skin's condition and formulate appropriate treatment plans.

The aging population adds another dimension to the scenario, as elderly individuals are more prone to developing skin disorders such as skin cancer and dermatitis. Additionally, advancements in medical treatments have increased survival rates among patients with chronic diseases, resulting in a higher prevalence of skin manifestations associated with these conditions.

According to the United States Census Bureau, the aging demographic trend in the United States has been remarkable, with the older population swelling from 4.9 million (4.7% of the total population) in 1920 to a staggering 55.8 million individuals, constituting 16.8% of the population in 2020. This increase of 50.9 million over a century underscores significant societal shifts and advancements in healthcare leading to longer life expectancy. As the older population grows, so does the demand for dermatology imaging devices in the United States, reflecting the need for innovative solutions to address the evolving healthcare needs of this demographic.

Furthermore, integrating artificial intelligence (AI) algorithms into dermatology imaging systems holds promise for enhancing diagnostic accuracy and efficiency. Therefore, the increasing incidence of skin disorders in the United States is driving significant growth in the dermatology imaging devices market, with AI integration promising to enhance diagnostic precision and efficiency further.

The dermatology imaging devices market in the United States is experiencing a notable surge in demand for light therapy devices. One of the primary drivers fueling the rising demand for light therapy devices is the increasing prevalence of skin disorders across the U.S. population. Conditions such as psoriasis and acne affect millions of Americans, leading to a growing need for safe and efficacious treatment options. Light therapy offers a compelling solution, delivering targeted phototherapy to affected areas of the skin, thereby reducing inflammation, promoting healing, and improving overall skin health.

Furthermore, technological advancements have led to developing more sophisticated and user-friendly light therapy devices. Manufacturers in the U.S. are incorporating features such as adjustable intensity levels, customizable treatment protocols, and ergonomic designs to enhance the patient experience and treatment outcomes. Additionally, integrating smart technology and connectivity features allows for remote monitoring and personalized treatment management, further driving the adoption of these devices in dermatology practices.

Moreover, the growing awareness among healthcare professionals and patients about the benefits of light therapy is contributing to its increased adoption. Clinical studies and research findings continue to validate the efficacy of phototherapy for various dermatological conditions, instilling confidence in its use among medical professionals. Thus, the surge in demand for light therapy devices in the United States is driven by technological advancements enhancing device efficacy and usability and growing awareness among healthcare professionals and patients about the benefits of phototherapy.

The dermatology imaging devices market in the United States has experienced significant growth in recent years. One of the prominent players in the U.S. dermatology imaging devices market is Canfield Scientific, Inc. Founded in 1987, Canfield Scientific is a leading provider of imaging solutions for medical and aesthetic applications, including dermatology. The company offers dermatology imaging devices, including dermoscopes, polarized light cameras, and multispectral imaging systems. These devices enable healthcare professionals to capture high-resolution images of the skin, allowing for detailed analysis and diagnosis of skin conditions.

Carl Zeiss Meditec AG is also a key player in the U.S. dermatology imaging devices market. The company's dermatology imaging devices include confocal laser scanning microscopes (CLSM) and optical coherence tomography (OCT) systems, which enable non-invasive, high-resolution imaging of skin lesions and abnormalities. Carl Zeiss Meditec's imaging solutions are known for their precision, reliability, and versatility, making them valuable tools for dermatologists and researchers in the United States.

Furthermore, with the increasing adoption of telemedicine and remote patient monitoring, there is a growing demand for dermatology imaging devices compatible with digital health platforms. Companies like MetaOptima Technology Inc. are addressing this need by offering integrated dermatology imaging solutions that enable healthcare providers to securely capture, store, and analyze dermatology images. MetaOptima's flagship product, the MoleScope system, combines a smartphone-based dermoscope with cloud-based software for remote image management and analysis, facilitating efficient dermatology consultations and patient care in the United States.

In addition to these established players, several emerging companies are also making a mark in the U.S. dermatology imaging devices market. For example, 3Gen, Inc. is known for its DermLite line of handheld dermatoscopes, which visualize skin lesions and moles. 3Gen's DermLite devices are lightweight and portable and offer high-resolution imaging capabilities, making them popular choices among dermatologists and primary care physicians for skin cancer screening and diagnosis. With the increasing emphasis on early detection and personalized treatment approaches in dermatology, the demand for advanced imaging solutions is expected to continue to rise, driving further growth and expansion in the dermatology imaging devices market.

By End-use

By Modality

By Application