Int'l : +1(646) 600-5072 | query@kbvresearch.com

Int'l : +1(646) 600-5072 | query@kbvresearch.com

Published Date : 20-Mar-2024 |

Pages: 81 |

Formats: PDF |

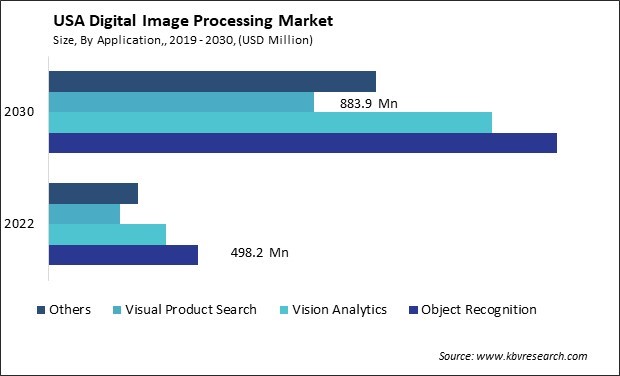

The USA Digital Image Processing Market size is expected to reach $5.1 billion by 2030, rising at a market growth of 17.6% CAGR during the forecast period.

The digital image processing market in the United States has witnessed significant growth and advancements over the years, playing a crucial role in various industries, including healthcare, entertainment, surveillance, and more. This field involves manipulating and analyzing images using algorithms and computational techniques to extract valuable information or enhance visual quality. The entertainment industry in the U.S. has also embraced digital image processing for creating visually stunning effects in movies, video games, and virtual reality experiences. The constant demand for high-quality graphics and special effects has driven continuous innovation in this field, with U.S.-based companies leading the way in developing cutting-edge solutions.

In surveillance and security, digital image processing plays a vital role in analyzing and interpreting visual data from cameras and other sensors. Facial recognition, object detection, and tracking algorithms have become essential components of modern security systems. The U.S. government and private organizations invest heavily in research and development to stay at the forefront of these technologies, ensuring the safety and security of citizens and critical infrastructure.

The retail e-commerce sector in the United States has undergone a transformative evolution, with the digital image processing market playing a pivotal role in enhancing the overall customer experience. Digital image processing, a field within computer vision, involves manipulating and analyzing visual data to extract valuable information. In retail e-commerce, this technology has been widely employed for various applications, ranging from image recognition to augmented reality.

One of the key areas where the digital image processing market has significantly impacted is in improving product search and discovery. Advanced image recognition algorithms enable e-commerce platforms to implement visual search functionality, allowing consumers to find products by uploading images rather than relying solely on text-based searches. This enhances user convenience and accelerates the decision-making process, ultimately driving sales.

Moreover, digital image processing contributes to the enhancement of product visualization through augmented reality (AR). Retailers leverage AR technologies to enable customers to try on clothing virtually, visualize furniture in their living spaces, or even see how cosmetics will appear on their faces. This immersive experience not only fosters customer engagement but also decreases the likelihood of returns, as shoppers have a more accurate perception of the products they intend to purchase

The Census Bureau of the Department of Commerce stated that the projection of U.S. retail e-commerce sales for the third quarter of 2023 was $284.1 billion, up 2.3% from the second quarter of 2023. Total retail sales for the third quarter of 2023 were estimated at $1,825.3 billion, an increase of 1.5 % from the second quarter of 2023 and the third quarter of 2023 e-commerce estimate increased by 7.6 percent % from the third quarter of 2022, while total retail sales increased 2.3 %in the same period. E-commerce sales in the third quarter of 2023 accounted for 15.6 percent of total sales.

This robust growth in e-commerce aligns with broader trends in the digital transformation of various industries, including the digital image processing market in the United States. As e-commerce expands, businesses increasingly rely on advanced technologies such as digital image processing to enhance consumer experiences and stay competitive in the evolving industry. Therefore, integrating digital image processing has revolutionized the retail e-commerce landscape in the U.S., offering enhanced search functionalities, immersive visual experiences, and optimized supply chain management.

The healthcare industry in the United States has been witnessing a significant surge in the adoption of the digital image processing market, creating a transformative shift in diagnostic and treatment approaches. As the demand for more precise and efficient medical imaging solutions continues to escalate, digital image processing has emerged as a cornerstone in enhancing the capabilities of healthcare providers. One of the primary drivers behind the increased focus on digital image processing in the U.S. healthcare sector is the growing need for advanced diagnostic tools. Digital image processing techniques enable healthcare professionals to analyze medical images with unprecedented accuracy and detail, facilitating early detection of diseases and conditions. This profoundly impacts patient outcomes, as timely and accurate diagnoses can lead to more effective treatment strategies.

Furthermore, integrating artificial intelligence (AI) and machine learning (ML) in digital image processing has opened new frontiers in medical imaging. These technologies can assist radiologists and other healthcare professionals interpret complex images, identify subtle abnormalities, and predict disease progression. The ability of AI algorithms to learn and improve over time contributes to the overall efficiency of the diagnostic process. Moreover, the ongoing emphasis on telemedicine and remote healthcare services has further accentuated the importance of digital image processing. Medical imaging technologies enable the transmission and interpretation of images in real time, allowing healthcare professionals to assess patients and provide timely recommendations remotely. Thus, the widespread adoption of digital image processing and advancements in artificial intelligence and machine learning have revolutionized diagnostic capabilities in the U.S. healthcare sector.

The digital image processing market in the United States is a dynamic and rapidly evolving sector driven by technological advancements, increasing demand for image analysis solutions, and the widespread adoption of digital imaging across various industries. Several companies play a pivotal role in shaping and leading this industry.

One of the prominent players in the U.S. digital image processing market is Adobe Inc. Known for its creative software suite, Adobe has established itself as a key player in image processing and manipulation. Adobe's products, like Photoshop and Lightroom, are widely used by professionals and enthusiasts alike for editing and enhancing digital images. The company's commitment to constant innovation ensures that its tools remain at the forefront of the industry.

Another major player in the digital image processing space is NVIDIA Corporation. Leveraging its expertise in graphics processing units (GPUs), NVIDIA has become a key provider of hardware solutions for image processing applications. Its GPUs are widely used in machine learning and artificial intelligence applications, including image recognition and analysis. NVIDIA's technology is crucial in powering advanced image processing capabilities in various industries, from healthcare to autonomous vehicles.

Google LLC is also significant in the U.S. digital image processing market. The company's expertise in machine learning and computer vision has led to the development of powerful image processing tools, such as Google Photos and Google Vision AI. These tools utilize advanced algorithms to organize, analyze, and interpret visual data, catering to consumer and enterprise needs.

A leader in medical imaging and healthcare solutions, General Electric Company (GE) is a key player in the digital image processing market. GE Healthcare offers a range of advanced imaging technologies, including computed tomography (CT), magnetic resonance imaging (MRI), and X-ray systems. These technologies leverage digital image processing to provide accurate diagnostic information, improving patient care.

By Application

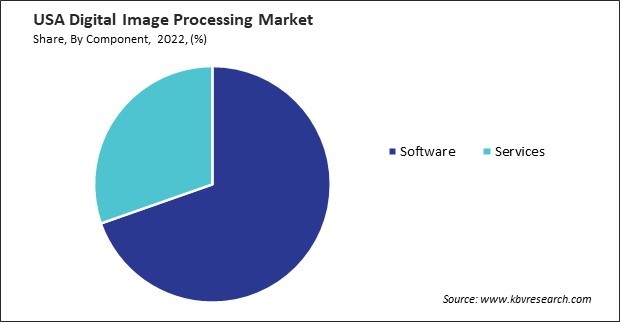

By Component

By End Use