USA Electric Shavers Market Size, Share & Trends Analysis Report By End User (Male, and Female), By Product Type (Trimmers / Clippers, Foil Shavers, and Rotary Shavers), By Distribution Channel, Outlook and Forecast, 2023 - 2030

Published Date : 20-Mar-2024 |

Pages: 81 |

Formats: PDF |

COVID-19 Impact on the US Electric Shavers Market

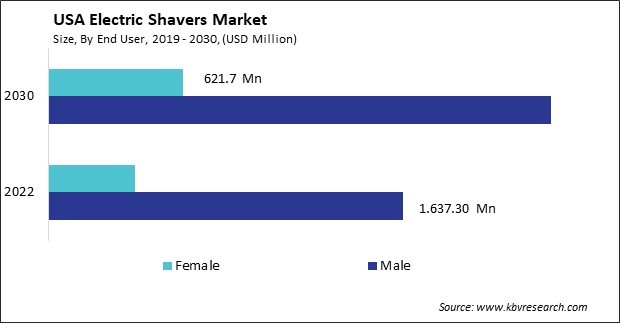

The USA Electric Shavers Market size is expected to reach $2.9 billion by 2030, rising at a market growth of 4.8% CAGR during the forecast period. In the year 2022, the market attained a volume of 29,261.8 thousand units, experiencing a growth of 4.8% (2019-2022).

The electric shavers market in the United States has experienced significant growth and evolution in recent years, driven by technological advancements, changing consumer preferences, and a growing emphasis on grooming and personal care. The industry is characterized by diverse products catering to various consumer needs and preferences.

Technological advancements play a pivotal role in shaping the electric shavers landscape. Modern electric shavers have cutting-edge features such as multiple cutting elements, adjustable settings, and advanced blade technologies. Cordless and rechargeable models have gained popularity, allowing users to shave anywhere without being tethered to a power source. Smart features like digital displays, personalized settings, and connectivity options further enhance the user experience.

Advertising campaigns, celebrity endorsements, and online presence play crucial roles in brand visibility and consumer trust. Additionally, the rise of e-commerce platforms has facilitated easy access for consumers to explore and purchase electric shavers, contributing to the industry's expansion. The electric shavers market in the U.S. is also influenced by sustainability trends, with an increasing number of consumers seeking eco-friendly and energy-efficient grooming solutions. Manufacturers are responding by incorporating sustainable materials and energy-efficient technologies into their products.

Market Trends

Rise in the cosmetic industry

The electric shavers market in the United States is witnessing a significant surge, propelled in part by the rising influence of the cosmetic industry. The cosmetic industry's impact on the electric shavers market is evident in integrating advanced technologies and design elements focused on enhancing the overall grooming experience. Manufacturers have recognized the importance of functional efficacy and aesthetic appeal in their products. This has led to the development of sleek, stylish, and user-friendly electric shavers that cater to the discerning tastes of U.S. consumers, prioritizing grooming performance and visual aesthetics.

Moreover, the cosmetic industry's emphasis on personal care and grooming routines in the U.S. has heightened awareness about the importance of using specialized tools for different purposes. Electric shavers, once considered useful devices, are now considered key components of a comprehensive grooming kit. Manufacturers are capitalizing on this trend by introducing multifunctional electric shavers equipped with features such as precision trimming, adjustable settings, and various grooming attachments, aligning with the diverse needs of consumers in the cosmetic realm.

The rise of social media influencers and beauty bloggers further amplifies the intersection of the cosmetic and electric shavers markets in the U.S. These influencers play a crucial role in shaping consumer perceptions and preferences, driving the demand for specific grooming products that align with the latest beauty trends.

According to the International Trade Administration, from 2017 to 2019, the U.S. experienced a steady annual growth of two percent in its exports, culminating in a total of $15.02 billion within the cosmetics industry. The dynamic and rapidly evolving nature of the U.S. cosmetics sector is characterized by the active involvement of numerous small and medium-sized enterprises dedicated to various aspects such as product and ingredient research, development, manufacturing, marketing, distribution, and retail sales through traditional and online channels.

In a parallel context, the electric shavers market in the U.S. mirrors this vibrancy, with many businesses engaged in diverse facets ranging from research and development to sales through various channels. Thus, the convergence of the cosmetic and electric shavers market in the U.S. has given rise to a transformative era where grooming products seamlessly blend cutting-edge technology with aesthetic appeal. This synergy, driven by consumer preferences and influencer trends, underscores the ongoing surge in the electric shavers market, establishing it as an integral part of modern grooming rituals.

Growing living standards and increased urbanization

In recent years, the United States has witnessed a significant uptick in living standards, driven by a robust economy and changing societal preferences. As disposable income levels rise, consumers increasingly invest in personal grooming products that offer convenience and efficiency. This shift in consumer behavior has notably impacted the electric shavers market, with a growing demand for high-quality grooming devices. The increased urbanization in the United States plays a pivotal role in the surge of the electric shavers market. As more individuals migrate to urban centers for employment opportunities and modern amenities, the pace of life accelerates, necessitating products that align with the fast-paced urban lifestyle.

Electric shavers, known for their speed, precision, and ease of use, have become an essential grooming tool for urban dwellers. Additionally, the compact and portable nature of electric shavers makes them well-suited for individuals on the go, further contributing to their popularity in urban settings. Moreover, the electric shavers market has witnessed technological innovations, offering features such as cordless operation, advanced blade systems, and ergonomic designs that cater to the evolving needs of consumers in urbanized areas. This convergence of growing living standards and increased urbanization creates a favorable environment for expanding the American electric shavers market, with manufacturers capitalizing on the demand for sophisticated grooming solutions that complement the contemporary lifestyle of urban residents. Therefore, as the trend continues, the electric shavers market is poised for sustained growth, driven by rising disposable incomes and the dynamic preferences of consumers in urban environments.

Competition Analysis

The electric shavers market in the United States is highly competitive, with several players dominating the industry. Braun, a subsidiary of Procter & Gamble, is a renowned player in the electric shavers market in the United States. The company is known for its cutting-edge technology and ergonomic designs. Braun's electric shavers often feature advanced shaving elements and intelligent sensor technology, providing users with a precise and comfortable shaving experience.

Philips Norelco, a division of Royal Philips, is another major player in the U.S. electric shavers market. The brand is recognized for its high-quality rotary shavers and innovative features such as multiple shaving heads and contour adaptation. Philips Norelco caters to a broad consumer base, offering products ranging from entry-level models to premium, feature-rich shavers.

Panasonic is a global electronics giant, and its presence in the electric shavers market is significant. The company produces various electric shavers with cutting-edge technology, including high-performance motors and precision blades. Panasonic electric shavers are known for their durability and versatility.

While well-established global brands largely dominate the electric shaver market in the United States, some local manufacturers contribute to the industry. Oster, a brand under the Sunbeam Products umbrella, is known for its range of grooming appliances, including electric shavers. Based in Tennessee, Oster has a long history of producing reliable and durable products. The brand's electric shavers often feature powerful motors and ergonomic designs, targeting both professional and individual consumers.

List of Key Companies Profiled

- Conair LLC (American Securities LLC)

- Koninklijke Philips N.V.

- The Procter & Gamble Company

- Panasonic Holdings Corporation

- Spectrum Brands Holdings, Inc.

- Havells India Ltd.

- Wahl Clipper Corporation

- Xiaomi Corporation

- Sakar International, Inc.

- Helen of Troy Limited

US Electric Shavers Market Report Segmentation

By End User

- Male

- Female

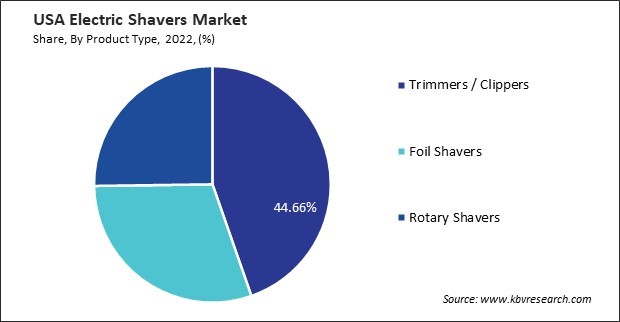

By Product Type

- Trimmers / Clippers

- Foil Shavers

- Rotary Shavers

By Distribution Channel

- Supermarkets & Hypermarkets

- Health & Beauty Stores

- Online

- Others

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 USA Electric Shavers Market, by End User

1.4.2 USA Electric Shavers Market, by Product Type

1.4.3 USA Electric Shavers Market, by Distribution Channel

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

Chapter 3. Competition Analysis - Global

3.1 Market Share Analysis, 2022

3.2 Porter Five Forces Analysis

Chapter 4. US Electric Shavers Market

4.1 US Electric Shavers Market by End User

4.2 US Electric Shavers Market by Product Type

4.3 US Electric Shavers Market by Distribution Channel

Chapter 5. Company Profiles – Global Leaders

5.1 Conair LLC (American Securities LLC)

5.1.1 Company Overview

5.1.2 SWOT Analysis

5.2 Koninklijke Philips N.V.

5.2.1 Company Overview

5.2.2 Financial Analysis

5.2.3 Segmental and Regional Analysis

5.2.4 Research & Development Expense

5.2.5 Recent strategies and developments:

5.2.5.1 Product Launches and Product Expansions:

5.2.6 SWOT Analysis

5.3 The Procter & Gamble Company

5.3.1 Company Overview

5.3.2 Financial Analysis

5.3.3 Segmental and Regional Analysis

5.3.4 Research & Development Expense

5.3.5 SWOT Analysis

5.4 Panasonic Holdings Corporation

5.4.1 Company Overview

5.4.2 Financial Analysis

5.4.3 Segmental and Regional Analysis

5.4.4 Research & Development Expenses

5.4.5 Recent strategies and developments:

5.4.5.1 Partnerships, Collaborations, and Agreements:

5.4.5.2 Product Launches and Product Expansions:

5.4.6 SWOT Analysis

5.5 Spectrum Brands Holdings, Inc.

5.5.1 Company Overview

5.5.2 Financial Analysis

5.5.3 Segmental and Regional Analysis

5.5.4 Research & Development Expenses

5.5.5 Recent strategies and developments:

5.5.5.1 Acquisition and Mergers:

5.5.6 SWOT Analysis

5.6 Havells India Ltd.

5.6.1 Company Overview

5.6.2 Financial Analysis

5.6.3 Segmental Analysis

5.6.4 SWOT Analysis

5.7 Wahl Clipper Corporation

5.7.1 Company Overview

5.7.2 SWOT Analysis

5.8 Xiaomi Corporation

5.8.1 Company Overview

5.8.2 Financial Analysis

5.8.3 Segmental and Regional Analysis

5.8.4 Research & Development Expense

5.8.5 SWOT Analysis

5.9 Sakar International, Inc.

5.9.1 Company Overview

5.9.2 SWOT Analysis

5.10. Helen of Troy Limited

5.10.1 Company Overview

5.10.2 Financial Analysis

5.10.3 Segmental and Regional Analysis

5.10.4 Research & Development Expenses

5.10.5 SWOT Analysis

TABLE 2 US Electric Shavers Market, 2023 - 2030, USD Million

TABLE 3 US Electric Shavers Market, 2019 - 2022, Thousand Units

TABLE 4 US Electric Shavers Market, 2023 - 2030, Thousand Units

TABLE 5 US Electric Shavers Market by End User, 2019 - 2022, USD Million

TABLE 6 US Electric Shavers Market by End User, 2023 - 2030, USD Million

TABLE 7 US Electric Shavers Market by End User, 2019 - 2022, Thousand Units

TABLE 8 US Electric Shavers Market by End User, 2023 - 2030, Thousand Units

TABLE 9 US Electric Shavers Market by Product Type, 2019 - 2022, USD Million

TABLE 10 US Electric Shavers Market by Product Type, 2023 - 2030, USD Million

TABLE 11 US Electric Shavers Market by Product Type, 2019 - 2022, Thousand Units

TABLE 12 US Electric Shavers Market by Product Type, 2023 - 2030, Thousand Units

TABLE 13 US Electric Shavers Market by Distribution Channel, 2019 - 2022, USD Million

TABLE 14 US Electric Shavers Market by Distribution Channel, 2023 - 2030, USD Million

TABLE 15 US Electric Shavers Market by Distribution Channel, 2019 - 2022, Thousand Units

TABLE 16 US Electric Shavers Market by Distribution Channel, 2023 - 2030, Thousand Units

TABLE 17 Key Information – Conair LLC

TABLE 18 Key Information – Koninklijke Philips N.V.

TABLE 19 Key Information – The Procter & Gamble Company

TABLE 20 Key Information – Panasonic Holdings Corporation

TABLE 21 Key Information – Spectrum Brands Holdings, Inc.

TABLE 22 Key Information – Havells India Ltd.

TABLE 23 Key Information – Wahl Clipper Corporation

TABLE 24 Key Information – Xiaomi Corporation

TABLE 25 Key Information – Sakar International, Inc.

TABLE 26 Key Information – Helen of Troy Limited

List of Figures

FIG 1 Methodology for the research

FIG 2 US Electric Shavers Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting Electric Shavers Market

FIG 4 Market Share Analysis, 2022

FIG 5 Porter’s Five Forces Analysis – Electric Shavers Market

FIG 6 US Electric Shavers Market Share by End User, 2022

FIG 7 US Electric Shavers Market Share by End User, 2030

FIG 8 US Electric Shavers Market by End User, 2019 - 2030, USD Million

FIG 9 US Electric Shavers Market Share by Product Type, 2022

FIG 10 US Electric Shavers Market Share by Product Type, 2030

FIG 11 US Electric Shavers Market by Product Type, 2019 - 2030, USD Million

FIG 12 US Electric Shavers Market Share by Distribution Channel, 2022

FIG 13 US Electric Shavers Market Share by Distribution Channel, 2030

FIG 14 US Electric Shavers Market by Distribution Channel, 2019 - 2030, USD Million

FIG 15 SWOT Analysis: Conair LLC

FIG 16 SWOT Analysis: Koninklijke Philips N.V.

FIG 17 SWOT Analysis: The Procter & Gamble Company

FIG 18 Recent strategies and developments: Panasonic Holdings Corporation

FIG 19 SWOT Analysis: Panasonic Holdings Corporation

FIG 20 SWOT Analysis: Spectrum Brands Holdings, Inc.

FIG 21 SWOT Analysis: Havells India Ltd.

FIG 22 SWOT Analysis: Wahl Clipper Corporation

FIG 23 SWOT Analysis: Xiaomi Corporation

FIG 24 SWOT Analysis: Sakar International, Inc.

FIG 25 SWOT Analysis: Helen of Troy Limited