Int'l : +1(646) 600-5072 | query@kbvresearch.com

Int'l : +1(646) 600-5072 | query@kbvresearch.com

Published Date : 02-Sep-2024 |

Pages: 95 |

Formats: PDF |

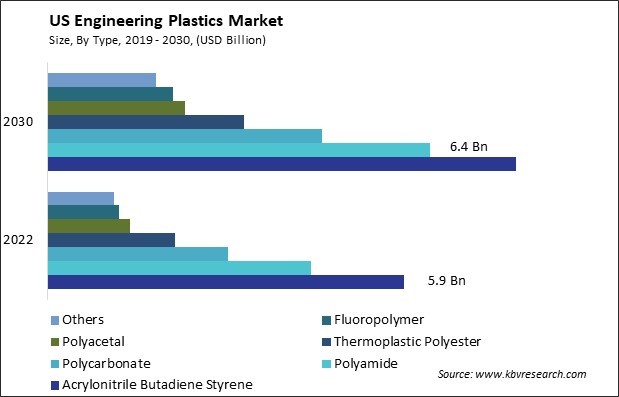

The US Engineering Plastics Market size is expected to reach $28.2 Billion by 2030, rising at a market growth of 4.5% CAGR during the forecast period. In the year 2022, the market attained a volume of 5,702.6 Kilo Tonnes, experiencing a growth of 1.8% (2019-2022).

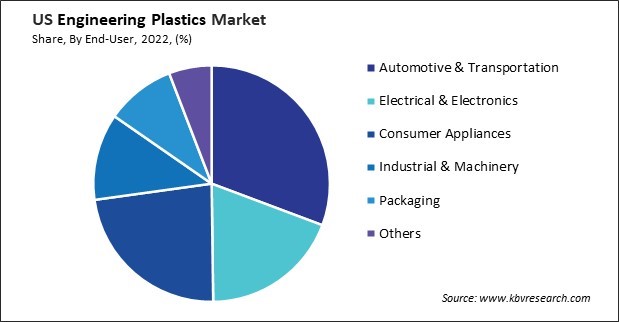

The engineering plastics market in the United States is dynamic and rapidly evolving. Engineering plastics are a group of polymers with superior mechanical, thermal, and chemical properties, making them suitable for a wide range of applications across automotive, electrical and electronics, consumer goods, healthcare, and construction sectors, among others. In recent years, the automotive industry has emerged as one of the largest consumers of engineering plastics in the United States.

According to Select USA, international automakers produced 5 million vehicles in the United States in 2020. In 2020, the United States exported 1.4 million new light vehicles and 108,754 medium and heavy trucks (worth a combined value of over $52 billion) to more than 200 industries around the world, with additional exports of automotive parts valued at $66.7 billion. The demand for lightweight, fuel-efficient vehicles has led to the widespread adoption of engineering plastics in automotive components such as bumpers, body panels, interior trim, and under-the-hood applications.

Additionally, the consumer goods segment is another key driver of the engineering plastics market in the U.S. With increasing consumer preference for lightweight, durable, and aesthetically appealing products, manufacturers in the U.S. are increasingly utilizing engineering plastics in the production of items such as appliances, sporting goods, toys, and packaging materials. Moreover, the healthcare industry relies on engineering plastics for medical device components, drug delivery systems, surgical instruments, and packaging due to their biocompatibility, sterilizability, and chemical resistance.

However, the COVID-19 pandemic has profoundly impacted the engineering plastics market in the United States, disrupting supply chains, dampening demand from key end-use industries, and causing fluctuations in raw material prices. The automotive sector, in particular, experienced a sharp decline in production and sales as lockdown measures and economic uncertainties led to reduced consumer spending and disrupted manufacturing operations. Similarly, the slowdown in construction activities and disruptions in global trade further exacerbated the challenges faced by the engineering plastics industry.

The construction industry in the United States has long been a vital sector driving economic growth and development. Within this industry, the utilization of engineering plastics has been steadily increasing, revolutionizing the way structures are built and offering a myriad of benefits ranging from enhanced durability to improved sustainability. One significant factor contributing to the rising utilization of engineering plastics in the construction sector is their versatility. These materials encompass a wide range of polymers engineered to possess specific properties suitable for various construction applications.

According to the U.S. Census Bureau, construction spending during November 2023 was estimated at a seasonally adjusted annual rate of $2,050.1. The November figure is 11.3 % above the November 2022 estimate of $1,842.2 billion. During the first eleven months of this year, construction spending amounted to $1,817.1 billion, 6.2 % above the $1,711.1 billion for the same period in 2022. The increasing focus on sustainable construction practices has driven the demand for engineering plastics with recyclability and eco-friendly attributes.

Moreover, the increasing emphasis on sustainability and eco-friendly construction practices has propelled the adoption of engineering plastics in the construction industry. Many engineering plastics are recyclable and are manufactured from renewable sources, aligning with the growing demand for sustainable building materials. Additionally, the lightweight nature of these materials translates to reduced transportation costs and energy consumption during construction in the U.S., further contributing to environmental conservation efforts.

Innovation and technological advancements have also played a pivotal role in driving the utilization of engineering plastics in construction. Manufacturers in the U.S. continue developing novel formulations and processing techniques, enhancing engineering plastic products' performance, aesthetics, and cost-effectiveness. Hence, the increasing utilization of engineering plastics in the construction industry in the United States is driven by their versatility, sustainability benefits, and ongoing innovation.

The engineering plastics market in the United States has witnessed a notable surge in demand for lightweight materials. One of the primary drivers behind this trend is the growing emphasis on sustainability and fuel efficiency across various industries, such as automotive, aerospace, and electronics. Lightweight materials, particularly in engineering plastics, play a pivotal role in helping American manufacturers meet stringent regulatory requirements to reduce greenhouse gas emissions and improve fuel economy. For instance, lightweight plastics enable automakers to design better fuel-efficient vehicles, thereby addressing environmental concerns and consumer demands for eco-friendly transportation solutions.

Furthermore, advancements in manufacturing technologies have facilitated the development of innovative lightweight engineering plastics that offer superior strength-to-weight ratios compared to traditional materials like metals. This has opened up opportunities for applications where weight reduction is critical, such as in aircraft components, consumer electronics, and sporting goods. Additionally, the versatility of engineering plastics allows for customization and optimization of material properties to meet specific performance requirements, further driving their adoption across diverse industries.

The demand for lightweight engineering plastics is also fueled by their ability to enhance product design flexibility and durability while reducing production costs. By utilizing lightweight materials, manufacturers in the U.S. achieve significant savings in terms of material consumption, energy consumption, and transportation costs throughout the product lifecycle. Thus, the surge in demand for lightweight engineering plastics in the United States is driven by sustainability goals, regulatory pressures, technological advancements, and cost-saving opportunities across multiple industries.

The engineering plastics market in the United States is a significant sector within the broader plastics industry, encompassing various materials utilized in various applications across numerous sectors. One prominent player in the U.S. engineering plastics market is DuPont, a global leader in materials science. DuPont offers a diverse portfolio of engineering plastics, including brands like Delrin, Zytel, and Hytrel. These materials find applications in automotive components, electrical connectors, industrial machinery, and consumer appliances. DuPont's commitment to innovation and sustainability has positioned it as a preferred supplier in the engineering plastics industry.

SABIC Innovative Plastics, a subsidiary of the Saudi Basic Industries Corporation (SABIC), is a major player in the U.S. engineering plastics market. SABIC offers a diverse portfolio of materials, including Lexan polycarbonate, Noryl PPO, and Valox PBT. These materials cater to various industries, including automotive, healthcare, consumer electronics, and lighting. SABIC's global presence and focus on customer collaboration enable it to address industry needs effectively.

Another key player is Covestro LLC, formerly known as Bayer MaterialScience. Covestro offers high-performance materials such as Makrolon polycarbonate and Maezio continuous fiber-reinforced thermoplastics. These materials are utilized in automotive glazing, electronic housings, sports equipment, and aerospace interiors. Covestro's emphasis on sustainability and advanced manufacturing technologies underscores its commitment to delivering innovative solutions to customers.

Arkema Inc. is another notable participant in the U.S. engineering plastics market, offering specialty materials such as Rilsan polyamide, Kynar PVDF, and Pebax thermoplastic elastomers. These materials are utilized in automotive fuel systems, oil and gas pipelines, sporting goods, and footwear. Arkema's commitment to sustainability and innovation drives its efforts to develop high-performance, environmentally friendly solutions for its customers.

In addition to these major players, several smaller companies contribute to the diversity of the U.S. engineering plastics market. Companies like Celanese Corporation, LANXESS Corporation, and RTP Company specialize in niche applications or specific material formulations, catering to unique customer requirements. As industries continue to demand lightweight, durable, and environmentally friendly materials, companies in this sector will remain at the forefront of driving advancements and meeting evolving industry needs.

By Type

By End-User