Int'l : +1(646) 832-2886 | query@kbvresearch.com

Int'l : +1(646) 832-2886 | query@kbvresearch.com

Published Date : 20-Mar-2024 |

Pages: 68 |

Formats: PDF |

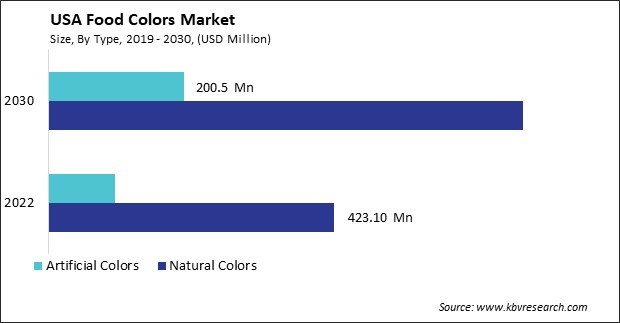

The USA Food Colors Market size is expected to reach $902.2 million by 2030, rising at a market growth of 7.2% CAGR during the forecast period. In the year 2022, the market attained a volume of 3,045.4 Tonnes units, experiencing a growth of 7.4% (2019-2022).

The food colors market in the United States has experienced significant growth and evolution, reflecting the dynamic preferences and trends within the country's diverse culinary landscape. Manufacturers and retailers proactively adapt to changing consumer preferences by reformulating existing products or introducing new lines of natural food colors. The U.S. food colors market for natural and clean-label food colors is poised for continued growth as consumers increasingly seek healthier and more transparent choices, reshaping the landscape of the food colors market in the country.

During COVID-19 pandemic, the U.S. witnessed a surge in the popularity of plant-based and alternative diets. This has translated into a demand for natural food colors that align with vegetarian, vegan, and other dietary preferences. As a result, manufacturers are developing innovative solutions using plant-based sources to meet the evolving needs of health-conscious and environmentally aware consumers in the food colors market.

The food and beverage industry in the United States has witnessed a significant adoption of food colors within grocery stores, reflecting the dynamic nature of consumer preferences and the evolving industry trends. Consumers increasingly prioritize visually appealing and aesthetically pleasing products, so the demand for vibrant and enticing food colors has surged. Grocery stores across the U.S. have responded to this trend by incorporating diverse food colors into their product offerings.

According to the U.S. Department of Agriculture, in 2022, the expenditure on food and beverages in the United States, encompassing purchases in grocery stores, other retail outlets, and away-from-home consumption, amounted to $2.39 trillion. Notably, average annual prices for food consumed at home witnessed an 11.4 percent increase in 2022 compared to the previous year. This data reflects the substantial adoption of food and beverages in grocery stores, influencing the food colors market.

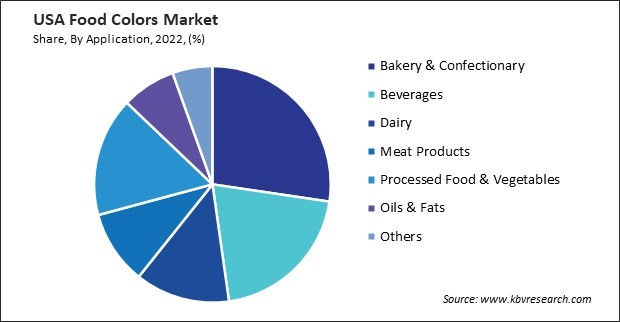

In the dynamic landscape of the U.S. food colors market, liquid food colors have emerged as a major player, revolutionizing the way consumers and manufacturers perceive and utilize coloring agents in various food products. These liquid formulations have gained significant traction for several reasons, contributing to their dominant position in the food colors market. One key factor driving the popularity of liquid food colors is their versatility. Liquid formulations offer a wide range of applications, from baked goods and confectionery to beverages and dairy products.

The convenience factor contributes to the dominance of liquid food colors in the U.S. market. With liquid formulations, manufacturers can streamline their production processes, ensuring efficient and precise coloration. This aligns with the industry's growing emphasis on efficiency, cost-effectiveness, and meeting consumer demand for high-quality, visually appealing food products.

The regulatory landscape in the U.S. also influences the popularity of liquid food colors. Manufacturers often favor liquid colors that comply with the Food and Drug Administration's (FDA) regulations and meet safety standards. The ease of obtaining regulatory approval for liquid food colors further contributes to their widespread use in the food industry. Therefore, liquid food colors have become a dominant force in the U.S. market, driven by their versatility across various food categories and the efficiency they offer in production processes.

In recent years, the food colors market in the United States has witnessed a significant surge in demand for natural and clean-label products. Consumers are increasingly prioritizing health and wellness, leading to a growing awareness of the impact of artificial additives on their diets. This shift in consumer preferences has prompted a heightened focus on natural alternatives in the food colors sector.

One key driver behind this trend is the increasing consciousness among consumers regarding the potential health risks associated with synthetic food colors. Concerns about allergies, hyperactivity in children, and long-term health effects have led consumers to scrutinize ingredient labels more closely. As a result, there is a burgeoning demand for food colors derived from natural sources such as fruits, vegetables, and spices.

The clean label movement, emphasizing transparency and simplicity in ingredient lists, has gained momentum across the U.S. food industry. Consumers seek products with fewer additives, preservatives, and artificial colors, influencing purchasing decisions. This has led to a paradigm shift in the food colors market, with manufacturers responding to the demand by incorporating natural colorants into their formulations. Hence, the U.S.'s surging demand for natural and clean-label food colors reflects a consumer-driven shift towards healthier and transparent choices.

The U.S. food colors market is a dynamic and rapidly evolving industry driven by consumer preferences, regulatory changes, and advancements in food technology. ADM (Archer Daniels Midland Company) is a prominent player in the U.S. food colors market. ADM is a global leader in food ingredients, including food colors. The company offers a comprehensive portfolio of natural and synthetic food colors that cater to various applications, from confectionery and baked goods to beverages and dairy products. ADM's commitment to sustainability and its focus on clean-label solutions align with the growing demand for natural and transparent ingredients in the U.S. food industry.

Sensient Technologies Corporation is another key player in the U.S. food colors market. Sensient provides a wide array of natural and synthetic colors and customized colors solutions to address the specific requirements of food manufacturers. The company emphasizes research and development, ensuring that its products meet both regulatory standards and consumer expectations. Sensient's technological expertise and global presence contribute to its significant impact on the food colors market.

Chr. Hansen specializes in natural colors solutions and is a major player in the U.S. food colors segment. With a focus on plant-based pigments and coloring foods, Chr. Hansen addresses the rising demand for clean-label and natural alternatives in the food industry. The company's dedication to sustainability and its commitment to providing solutions that enhance the visual appeal of food products make it a noteworthy player in the industry.

DDW (D.D. Williamson) is recognized for its expertise in caramel color solutions, which find applications in various food and beverage products. As consumers increasingly seek cleaner and simpler ingredient lists, DDW's caramel colors offer a natural option for achieving desirable visual appeal. The company's specialization in this niche segment establishes it as a significant contributor to the U.S. food colors market.

Naturex, a part of Givaudan, is a key player in the natural food colors space in the U.S. The company focuses on extracting colors from botanical sources to provide clean-label solutions. Naturex's commitment to sustainability and its emphasis on creating authentic and vibrant natural colors position it as a preferred choice for food manufacturers seeking plant-based alternatives. These companies operate in a competitive landscape where innovation, sustainability, and compliance with regulatory standards are critical factors. The U.S. food colors market is witnessing a shift towards natural and clean-label products, driven by increasing consumer awareness and regulatory initiatives.

By Type

By Application