Int'l : +1(646) 832-2886 | query@kbvresearch.com

Int'l : +1(646) 832-2886 | query@kbvresearch.com

Published Date : 17-May-2024 |

Pages: 88 |

Formats: PDF |

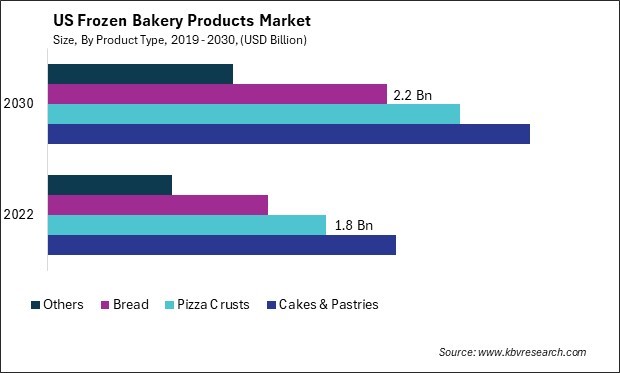

The United States (US) Frozen Bakery Products Market size is expected to reach $9.2 Billion by 2030, rising at a market growth of 5.0% CAGR during the forecast period. In the year 2022, the market attained a volume of 625.4 Kilo Tonnes, experiencing a growth of 4.9% (2019-2022).

The frozen bakery products market has witnessed significant growth and evolution in the United States in recent years. This sector caters to the increasing demand for convenient and ready-to-bake goods among consumers, offering a wide array of products that range from frozen bread and rolls to pastries and pizza crusts. One of the key driving factors behind the popularity of frozen bakery products in the U.S. is the convenience they offer to busy households.

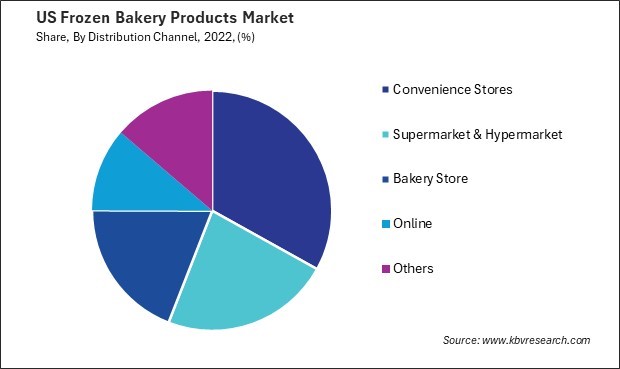

As health and wellness awareness grows, there has been a noticeable trend in developing gluten-free and healthier frozen bakery products. The retail sector plays a crucial role in distributing frozen bakery products. Supermarkets, hypermarkets, and convenience stores have expanded their frozen food sections, providing consumers with diverse options. Improved freezing methods help maintain the freshness and taste of the products, ensuring that U.S. consumers experience the same quality as freshly baked goods.

The U.S. frozen bakery products market has also shifted towards healthier options to meet the growing demand for nutritious alternatives. Manufacturers are incorporating whole grains, natural sweeteners, and clean-label ingredients to appeal to health-conscious consumers. The COVID-19 pandemic has had both challenges and positive impacts on the frozen bakery products industry in the U.S. While the initial phase disrupted supply chains and led to temporary closures of food service establishments, it also drove a surge in at-home consumption. With more people staying and cooking at home, there was a noticeable increase in the sales of frozen bakery products for home baking. Americans sought comfort in preparing and enjoying freshly baked goods, boosting the demand for frozen dough and pre-packaged baking mixes.

In the United States, the frozen bakery products market has witnessed a significant shift in consumer preferences, with supermarkets and convenience stores playing a pivotal role in shaping this transformation. The convenience these retail channels offer has propelled the growing influence of frozen bakery products nationwide. As key players in the U.S. retail landscape, supermarkets have become major hubs for frozen bakery product offerings. The convenience and variety they provide cater to the busy lifestyles of American consumers, offering a wide range of frozen baked goods such as bread, pastries, and desserts.

Additionally, convenience stores have emerged as crucial contributors to expanding the frozen bakery products market. These smaller retail outlets strategically position themselves to cater to the on-the-go lifestyle of U.S. consumers, offering quick and easy solutions for their bakery needs. Moreover, the advancements in technology and packaging have enhanced the quality and shelf life of frozen bakery products, making them more appealing to consumers.

According to the U.S. Department of Agriculture, in 2020, the collective worth of retail food service sales reached $483 billion, with supermarkets dominating the industry by contributing 70% of total sales. The convenience store sector also played a significant role, accounting for another 14% of the overall sales. This underscores the growing influence of supermarkets and convenience stores in shaping the landscape of the frozen bakery products market in the United States. Thus, the U.S. frozen bakery products market has experienced a notable shift in consumer preferences, with supermarkets and convenience stores playing pivotal roles in meeting the demands of busy lifestyles.

In recent years, the frozen bakery products market in the United States has witnessed a remarkable surge in the popularity of ready-to-bake products. One of the key drivers behind the rising popularity of ready-to-bake products is the time-conscious nature of modern U.S. consumers. Ready-to-bake products perfectly align with this need, allowing American consumers to enjoy the freshness of baked goods without the time-consuming preparation process.

The U.S. frozen bakery products market is witnessing a surge in the variety and quality of ready-to-bake products. From frozen cookie dough and pastries to bread rolls and pizza crusts, manufacturers have expanded their offerings to cater to diverse U.S. consumer tastes. Leading food companies in the U.S. have recognized this trend and responded by introducing various ready-to-bake options in the frozen bakery aisle. Notable examples include pre-portioned cookie dough, frozen pastry sheets, and ready-to-bake bread rolls.

American consumers are increasingly seeking products that align with their busy lifestyles, and ready-to-bake items provide a solution that fits into this fast-paced environment. The convenience of having pre-portioned, pre-mixed, and pre-shaped dough or pastry in the freezer allows Americans to enjoy the pleasures of baking without the time-consuming steps of measuring and preparing ingredients. Therefore, the popularity of ready-to-bake products in the U.S. frozen bakery products market reflects modern consumers' growing demand for convenient and time-saving solutions.

The frozen bakery products market in the United States has witnessed significant growth in recent years, driven by changing consumer lifestyles, increased demand for convenience foods, and the desire for bakery items with longer shelf life. Several companies have emerged as key players in this dynamic industry, offering a diverse range of frozen bakery products to cater to the evolving preferences of American consumers.

One prominent player in the U.S. frozen bakery products market is Nestlé S.A. The company has established itself as a leader by offering various frozen baked goods, including pastries, cookies, and bread. Nestlé's strong distribution network and focus on innovation have contributed to its success in meeting the demands of the American consumer for convenient and high-quality bakery products.

Another major player is Grupo Bimbo, a Mexican multinational bakery company with a substantial presence in the U.S. market. Grupo Bimbo has expanded its portfolio to include various frozen bakery items, such as frozen bread and pastries, targeting diverse consumer preferences. The company's commitment to sustainability and strategic acquisitions have bolstered its position in the competitive U.S. industry.

Pinnacle Foods, Inc., a subsidiary of Conagra Brands, is also a key player in the frozen bakery products segment. The brand is known for its innovative frozen offerings, which include frozen waffles, pancakes, and other breakfast items. The company's focus on consumer-driven innovation and brand building has made it a significant player in the U.S. frozen bakery landscape.

Flowers Foods, Inc. stands out as a prominent player in specialty frozen bakery products. The company specializes in producing and marketing various frozen specialty bakery items, appealing to the discerning tastes of American consumers. Flowers Foods' regional focus and commitment to using high-quality ingredients have contributed to its success in capturing a share of the U.S. industry.

Ardent Mills, a joint venture between Conagra Brands, Cargill, and CHS Inc., is a major player in the U.S. frozen bakery ingredients industry. The company provides a range of high-quality flours and mixes for frozen bakery product manufacturers, supporting the industry with essential ingredients that meet the evolving demands of American consumers. As the frozen bakery products market in the United States continues to evolve, these companies remain at the forefront, navigating challenges and capitalizing on opportunities.

By Product Type

By Distribution Channel

By Type