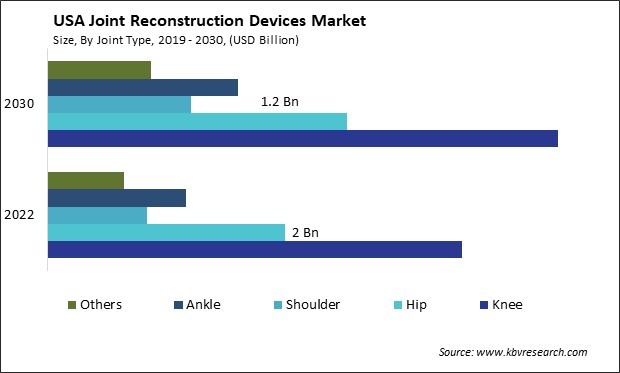

The USA Joint Reconstruction Devices Market size is expected to reach $10.4 Billion by 2030, rising at a market growth of 3.3% CAGR during the forecast period.

The joint reconstruction devices market in the United States has experienced significant growth and evolution in recent years. Technological advancements play a pivotal role in shaping the landscape of joint reconstruction devices in the U.S. Innovations in materials, implant design, and surgical techniques have improved the durability and performance of joint implants.

One of the key drivers of the joint reconstruction devices market in the U.S. is the aging population. As the baby boomer generation ages, there is a notable increase in the demand for joint replacement surgeries. The wear and tear on joints often lead to osteoarthritis, necessitating joint reconstruction procedures. Additionally, a growing awareness of the benefits of joint replacement surgeries and improved access to healthcare services contribute to the industry's expansion.

The impact of the COVID-19 pandemic on the joint reconstruction devices market includes short-term disruptions and long-term shifts in the U.S. During the early stages of the pandemic, elective surgeries, including joint replacements, were postponed to conserve resources for COVID-19 patients. This led to a temporary decline in procedure volumes and device sales. However, the latter part of the pandemic witnessed a resurgence in demand as healthcare systems adapted to the new normal and patients sought necessary treatments.

The United States is witnessing a significant surge in the demand for hip joint implants, driving growth in the joint reconstruction devices market. This trend is primarily attributed to the increasing prevalence of conditions such as osteoarthritis and rheumatoid arthritis, coupled with a rising aging population. As Americans age, the incidence of degenerative joint diseases tends to escalate, necessitating joint reconstruction procedures, with hip joint implants being a prominent choice.

One of the key drivers behind the growing demand is the desire among the aging population to maintain an active lifestyle. As Americans strive to remain physically active in their later years, the need for reliable and durable hip joint implants becomes crucial. Moreover, advancements in implant technologies, including materials and design innovations, have enhanced hip implants' overall performance and longevity, further boosting their acceptance among patients and orthopedic surgeons.

In the U.S., healthcare infrastructure plays a pivotal role in the joint reconstruction devices market. The availability of skilled orthopedic surgeons, state-of-the-art medical facilities, and insurance coverage contribute to the accessibility and affordability of joint reconstruction procedures, fostering the demand for hip joint implants. Additionally, patient awareness and education initiatives have played a role in encouraging individuals to seek timely medical intervention, thereby driving the industry growth of joint reconstruction devices.

According to the American Joint Replacement Registry, in 2020-2021 almost 2.4 million hip and knee surgeries were conducted in over 1150 institutions, representing an 18.3% increase in total procedural volume compared with that in 2020. This represents a 40% capture rate of all United States total joint arthroplasty (TJA) volume annually. Thus, the surge in demand for hip joint implants in the United States is propelled by factors such as the increasing prevalence of degenerative joint diseases, a growing aging population's desire for an active lifestyle, and advancements in implant technologies.

In recent years, the U.S. joint reconstruction devices market has experienced a significant rise in the demand for orthopedic devices. The aging demographic in the United States has played a pivotal role in driving the industry for joint reconstruction devices. As individuals age, the likelihood of developing conditions such as osteoarthritis and other degenerative joint diseases increases. Consequently, there has been a growing need for orthopedic devices that aid in joint reconstruction and relieve pain and impaired mobility in the U.S.

Moreover, the prevalence of obesity in the U.S. has contributed to the rise in orthopedic device utilization. An increasing number of Americans seeking joint reconstruction procedures has propelled the demand for orthopedic devices designed to address these specific anatomical areas. Patients increasingly opt for these procedures to improve their quality of life and regain functionality in affected joints. Technological advancements have also played a crucial role in shaping the landscape of the joint reconstruction devices market in the U.S. Innovative materials, improved implant designs, and minimally invasive surgical techniques have enhanced the effectiveness of joint reconstruction procedures.

American patients now have access to a wider range of options for artificial joints, allowing for better customization to meet individual anatomical and lifestyle needs. Thus, the escalating demand for orthopedic devices in the U.S. joint reconstruction devices market, driven by the aging population and technological advancements, reflects a growing necessity for effective solutions in addressing joint-related ailments. Hence, the surge in demand for orthopedic devices in the U.S. joint reconstruction market, fueled by the aging population and technological advancements, underscores the imperative for effective solutions to address the increasing prevalence of joint-related ailments, notably osteoarthritis and degenerative joint diseases.

The United States is a major player in the global joint reconstruction devices market, with a robust healthcare industry and a focus on technological innovation. Several companies based in the U.S. contribute significantly to developing and manufacturing joint reconstruction devices, addressing the growing needs of an aging population and the increasing prevalence of musculoskeletal disorders.

One of the major players in the U.S. joint reconstruction devices market is Stryker Corporation. Stryker is a global leader in orthopedic implants and surgical technologies, with a strong presence in the U.S. The company offers a comprehensive range of joint reconstruction devices, including hip and knee implants and innovative robotic-assisted surgical systems. Stryker's commitment to research and development has positioned it as a frontrunner in the industry, continually introducing new technologies to enhance patient outcomes.

Another significant contributor is Zimmer Biomet Holdings, Inc., a leading player in musculoskeletal healthcare. With a diverse portfolio of joint reconstruction products, Zimmer Biomet caters to a wide range of orthopedic needs. The company's focus on innovation is evident in its joint replacement systems, which include hip and knee implants. Zimmer Biomet's dedication to addressing the unique needs of patients has solidified its position in the U.S.

DePuy Synthes, a subsidiary of Johnson & Johnson, is also a prominent player in the U.S. joint reconstruction devices market. Known for its comprehensive orthopedic solutions, DePuy Synthes offers a broad spectrum of joint reconstruction implants and instruments. The company's commitment to improving patient outcomes is reflected in its innovative product offerings, including advanced knee and hip replacement systems.

The competitive landscape of the U.S. joint reconstruction devices market also includes Medtronic plc, a global healthcare solutions provider with a significant presence in orthopedics. Medtronic's orthopedic portfolio encompasses joint replacement solutions, offering a range of implants and technologies to address the diverse needs of patients in the U.S.

Smith & Nephew plc is a global medical technology company that plays a significant role in the U.S. joint reconstruction devices market. Specializing in orthopedic reconstruction, sports medicine, and wound management, Smith & Nephew provides a range of joint implants and arthroplasty solutions. The company's dedication to research and development ensures it remains at the forefront of technological advancements in joint reconstruction. These companies continually strive to advance orthopedic technology, enhance patient outcomes, and maintain their competitive edge in this rapidly evolving industry.

By Joint Type

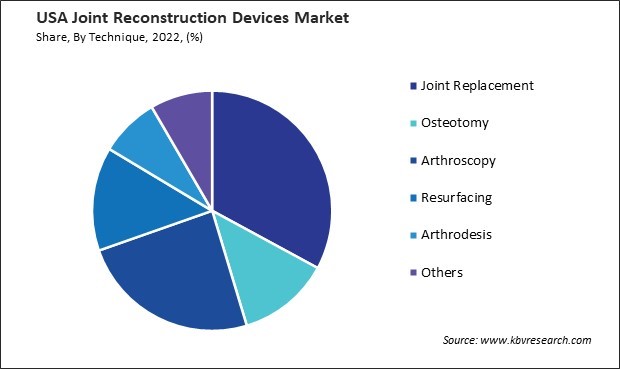

By Technique

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.