US Level Sensors Market Size, Share & Trends Analysis Report By Technology, By Monitoring Type (Continuous Level Monitoring and Point Level Monitoring), By End User and Forecast, 2023 - 2030

Published Date : 29-Oct-2024 |

Pages: 98 |

Formats: PDF |

COVID-19 Impact on the US Level Sensors Market

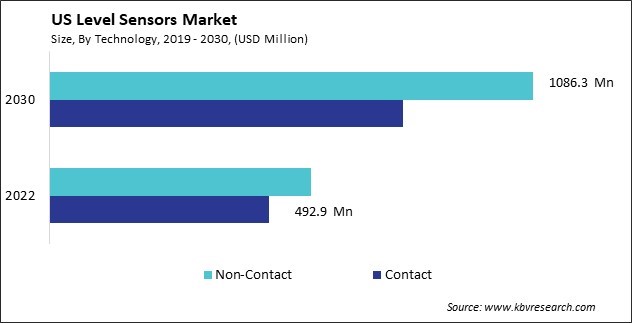

The US Level Sensors Market size is expected to reach $1.9 Billion by 2030, rising at a market growth of 7.3% CAGR during the forecast period. In the year 2022, the market attained a volume of 6463 Thousand Units, experiencing a growth of 10.7% (2019-2022).

The level sensors market in the United States has experienced significant growth and evolution in recent years. One of the key factors driving the growth of the level sensors market in the United States is the rising adoption of Industrial Internet of Things (IIoT) and Industry 4.0 technologies. In manufacturing, level sensors are used in various applications, such as inventory management, material handling, and quality control. Manufacturers are increasingly investing in automation and digitization initiatives to improve efficiency, reduce costs, and enhance product quality, further fueling the adoption of level-sensing technologies.

In the water and wastewater treatment sector, level sensors are essential for monitoring and managing water levels, flow rates, and quality parameters in tanks, reservoirs, and treatment processes. According to the Cybersecurity & Infrastructure Security Agency, the United States has approximately 153,000 public drinking water systems and more than 16,000 publicly owned wastewater treatment systems. More than 80 % of the U.S. population receives potable water from these drinking water systems, and about 75 % of the U.S. population has sanitary sewerage treated by these wastewater systems. With growing concerns over water scarcity, there is an increasing emphasis on upgrading and modernizing water and wastewater facilities across the United States, driving the adoption of advanced level sensing technologies.

However, COVID-19 has significantly impacted the level sensors market in the United States, causing disruptions in supply chains, temporary shutdowns of manufacturing facilities, and delays in project implementations across various industries. The pandemic has highlighted the importance of remote monitoring and automation solutions, driving the adoption of IoT-enabled sensors and cloud-based monitoring platforms to ensure business continuity and operational resilience in the face of future disruptions.

Market Trends

Rising demand for level sensors in the chemical industry

The level sensors market in the United States has witnessed a significant surge in demand within the chemical industry. Level sensors are critical in monitoring and controlling fluid levels in various industrial processes, ensuring operational efficiency, safety, and compliance with regulatory standards. In the chemical sector, where precise monitoring of liquid levels is paramount for production efficiency and safety, the adoption of advanced level sensing technologies has become increasingly prevalent.

One of the primary drivers of the rising demand for level sensors in the chemical industry is the growing emphasis on process optimization and automation. According to Select USA, in 2019, the United States demonstrated its prowess in the chemical industry by exporting over $208 billion of chemicals, showcasing its leadership in global chemical production. The U.S. contributes over 15% of the world's total chemical output. As chemical manufacturers strive to enhance their production processes, they increasingly use advanced sensor technologies to streamline operations and improve overall efficiency.

Furthermore, advancements in sensor technologies, such as non-contact ultrasonic sensors, radar sensors, and guided wave radar sensors, have expanded the capabilities and applications of level sensing in the chemical industry in the U.S. These technologies offer improved accuracy, reliability, and versatility, allowing for precise measurement of various types of liquids, including corrosive and viscous fluids. Hence, the surge in demand for advanced-level sensors within the U.S. chemical industry underscores a shift towards enhanced efficiency, safety, and precision in fluid-level monitoring and control.

Growing adoption of wireless and IoT-enabled sensors

In the United States, the level sensors market is experiencing a significant transformation fueled by the growing adoption of wireless and IoT-enabled sensors. One of the key drivers behind this trend is the increasing demand for automation and smart technologies across various sectors. In manufacturing, for example, wireless-level sensors are revolutionizing inventory management by providing accurate and continuous monitoring of raw materials and finished goods.

Moreover, IoT-enabled level sensors are crucial in enhancing safety and compliance in industries such as oil and gas, chemicals, and water treatment. By continuously monitoring tank levels, these sensors detect leaks or spills in real time, enabling prompt response and mitigating environmental risks. Additionally, they facilitate regulatory compliance by automating data collection and reporting processes.

Another factor driving the adoption of wireless and IoT-enabled sensors is the proliferation of smart infrastructure projects in the U.S. From smart buildings to smart cities, there is a growing emphasis on leveraging sensor technologies to optimize resource utilization and improve sustainability. Wireless level sensors, integrated with IoT platforms, enable efficient management of water, energy, and waste systems, leading to cost savings and environmental benefits. Thus, the increasing demand for automation, safety, and sustainability is propelling the widespread adoption of wireless and IoT-enabled level sensors across various sectors in the United States.

Competition Analysis

The level sensors market in the United States is a dynamic and rapidly evolving sector driven by various industries such as manufacturing, oil and gas, chemical, water and wastewater management, and healthcare. One prominent player in the U.S. level sensors market is Emerson Electric Co. The company offers a comprehensive range of level measurement solutions under its Rosemount brand, catering to diverse industrial applications. Emerson's portfolio includes ultrasonic, radar, guided wave radar, and capacitance level sensors, renowned for their accuracy, reliability, and durability. With a strong emphasis on research and development, Emerson continually introduces advanced sensor technologies to meet the evolving needs of its customers.

Another key player in the U.S. level sensors market is Honeywell International Inc., a multinational conglomerate known for its innovative solutions in aerospace, building technologies, and performance materials. Honeywell's level sensor offerings include radar, ultrasonic, and vibrating fork technologies designed to deliver precise and real-time level measurements in challenging environments. The company's focus on product quality, safety, and compliance ensures its solutions meet the stringent requirements of various industries, enhancing operational efficiency and safety.

Texas Instruments Incorporated is also a significant player in the U.S. level sensors market, leveraging its expertise in semiconductor technology to develop cutting-edge sensor solutions. Texas Instruments' portfolio includes ultrasonic and optical level sensors featuring advanced signal processing algorithms and digital interfaces for seamless integration into industrial automation systems. With a strong commitment to innovation and customer satisfaction, Texas Instruments continues to push the boundaries of sensor technology, driving efficiency and productivity across industries.

Furthermore, Pepperl+Fuchs, a leading manufacturer of industrial sensors and explosion protection equipment, is also active in the U.S. level sensors market. The company's portfolio includes ultrasonic, capacitance, and radar level sensors designed to meet the stringent requirements of hazardous and challenging environments. Pepperl+Fuchs' commitment to innovation, quality, and safety has made it a preferred choice for customers seeking reliable, durable level measurement solutions.

List of Key Companies Profiled

- TE Connectivity Ltd.

- Siemens AG

- Sensirion AG

- Emerson Electric Co.

- ABB Ltd.

- Ametek, Inc.

- Honeywell International, Inc.

- Fortive Corporation (Fluke Corporation)

- Texas Instruments, Inc.

- Amphenol Corporation

US Level Sensors Market Report Segmentation

By Technology

- Contact

- Guided Wave

- Magnetostrictive

- Hydrostatic

- Magnetic & Mechanical Float

- Pneumatic

- Others

- Non-Contact

- Ultrasonic

- Microwave/Radar

- Others

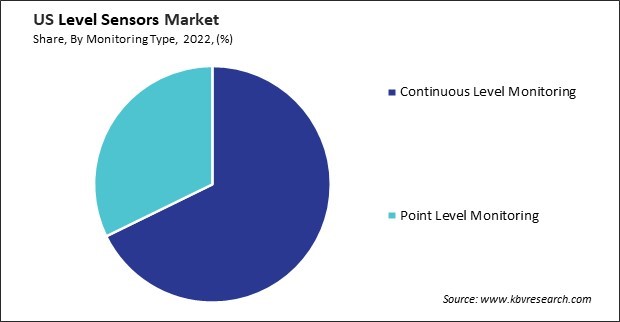

By Monitoring Type

- Continuous Level Monitoring

- Point Level Monitoring

By End User

- Industrial Manufacturing

- Oil & Gas

- Wastewater

- Chemical & Pharmaceuticals

- Consumer

- Others

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 US Level Sensors Market, by Technology

1.4.2 US Level Sensors Market, by Monitoring Type

1.4.3 US Level Sensors Market, by End User

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

2.2.3 Market Opportunities

2.2.4 Market Challenges

2.2.5 Market Trends

Chapter 3. Competition Analysis – Global

3.1 Market Share Analysis, 2022

3.2 Recent Strategies Deployed in Level Sensors Market

3.3 Porter’s Five Forces Analysis

Chapter 4. US Level Sensors Market

4.1 US Level Sensors Market by Technology

4.1.1 US Level Sensors Market by Contact Type

4.1.2 US Level Sensors Market by Non-Contact Type

4.2 US Level Sensors Market by Monitoring Type

4.3 US Level Sensors Market by End User

Chapter 5. Company Profiles – Global Leaders

5.1 TE Connectivity Ltd.

5.1.1 Company Overview

5.1.2 Financial Analysis

5.1.3 Segmental and Regional Analysis

5.1.4 Research & Development Expense

5.1.5 Recent strategies and developments:

5.1.5.1 Acquisition and Mergers:

5.1.6 SWOT Analysis

5.2 Siemens AG

5.2.1 Company Overview

5.2.2 Financial Analysis

5.2.3 Segmental and Regional Analysis

5.2.4 Research & Development Expense

5.2.5 SWOT Analysis

5.3 Sensirion AG

5.3.1 Company Overview

5.3.2 Financial Analysis

5.3.3 Regional Analysis

5.3.4 Research & Development Expenses

5.3.5 Recent strategies and developments:

5.3.5.1 Partnerships, Collaborations, and Agreements:

5.3.6 SWOT Analysis

5.4 Emerson Electric Co.

5.4.1 Company Overview

5.4.2 Financial Analysis

5.4.3 Segmental and Regional Analysis

5.4.4 Research & Development Expense

5.4.5 Recent strategies and developments:

5.4.5.1 Product Launches and Product Expansions:

5.4.5.2 Acquisition and Mergers:

5.4.6 SWOT Analysis

5.5 ABB Ltd.

5.5.1 Company Overview

5.5.2 Financial Analysis

5.5.3 Segmental and Regional Analysis

5.5.4 Research & Development Expense

5.5.5 SWOT Analysis

5.6 Ametek, Inc.

5.6.1 Company Overview

5.6.2 Financial Analysis

5.6.3 Segmental and Regional Analysis

5.6.4 Research & Development Expenses

5.6.5 Recent strategies and developments:

5.6.5.1 Partnerships, Collaborations, and Agreements:

5.6.5.2 Product Launches and Product Expansions:

5.6.5.3 Acquisition and Mergers:

5.6.6 SWOT Analysis

5.7 Honeywell International, Inc.

5.7.1 Company Overview

5.7.2 Financial Analysis

5.7.3 Segmental and Regional Analysis

5.7.4 Research & Development Expenses

5.7.5 SWOT Analysis

5.8 Fortive Corporation (Fluke Corporation)

5.8.1 Company Overview

5.8.2 Financial Analysis

5.8.3 Segmental and Regional Analysis

5.8.4 Research & Development Expense

5.8.5 Recent strategies and developments:

5.8.5.1 Acquisition and Mergers:

5.8.6 SWOT Analysis

5.9 Texas Instruments, Inc.

5.9.1 Company Overview

5.9.2 Financial Analysis

5.9.3 Segmental and Regional Analysis

5.9.4 Research & Development Expense

5.9.5 SWOT Analysis

5.10. Amphenol Corporation

5.10.1 Company Overview

5.10.2 Financial Analysis

5.10.3 Segmental and Regional Analysis

5.10.4 Research & Development Expenses

5.10.5 SWOT Analysis

TABLE 2 US Level Sensors Market, 2023 - 2030, USD Million

TABLE 3 US Level Sensors Market, 2019 - 2022, Thousand Units

TABLE 4 US Level Sensors Market, 2023 - 2030, Thousand Units

TABLE 5 US Level Sensors Market by Technology, 2019 - 2022, USD Million

TABLE 6 US Level Sensors Market by Technology, 2023 - 2030, USD Million

TABLE 7 US Level Sensors Market by Technology, 2019 - 2022, Thousand Units

TABLE 8 US Level Sensors Market by Technology, 2023 - 2030, Thousand Units

TABLE 9 US Level Sensors Market by Contact Type, 2019 - 2022, USD Million

TABLE 10 US Level Sensors Market by Contact Type, 2023 - 2030, USD Million

TABLE 11 US Level Sensors Market by Non-Contact Type, 2019 - 2022, USD Million

TABLE 12 US Level Sensors Market by Non-Contact Type, 2023 - 2030, USD Million

TABLE 13 US Level Sensors Market by Monitoring Type, 2019 - 2022, USD Million

TABLE 14 US Level Sensors Market by Monitoring Type, 2023 - 2030, USD Million

TABLE 15 US Level Sensors Market by Monitoring Type, 2019 - 2022, Thousand Units

TABLE 16 US Level Sensors Market by Monitoring Type, 2023 - 2030, Thousand Units

TABLE 17 US Level Sensors Market by End User, 2019 - 2022, USD Million

TABLE 18 US Level Sensors Market by End User, 2023 - 2030, USD Million

TABLE 19 US Level Sensors Market by End User, 2019 - 2022, Thousand Units

TABLE 20 US Level Sensors Market by End User, 2023 - 2030, Thousand Units

TABLE 21 Key information –TE Connectivity Ltd.

TABLE 22 Key Information – Siemens AG

TABLE 23 Key Information – Sensirion AG

TABLE 24 Key Information – Emerson Electric Co.

TABLE 25 Key Information – ABB Ltd.

TABLE 26 Key Information – Ametek, Inc.

TABLE 27 Key Information – Honeywell International, Inc.

TABLE 28 Key Information –fortive corporation

TABLE 29 Key Information – Texas Instruments, Inc.

TABLE 30 key information – Amphenol Corporation

List of Figures

FIG 1 Methodology for the research

FIG 2 US Level Sensors Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting Level Sensors Market

FIG 4 Market Share Analysis, 2022

FIG 5 Porter’s Five Forces Analysis – level sensors market

FIG 6 US Level Sensors Market share by Technology, 2022

FIG 7 US Level Sensors Market share by Technology, 2030

FIG 8 US Level Sensors Market by Technology, 2019 - 2030, USD Million

FIG 9 US Level Sensors Market share by Monitoring Type, 2022

FIG 10 US Level Sensors Market share by Monitoring Type, 2030

FIG 11 US Level Sensors Market by Monitoring Type, 2019 - 2030, USD Million

FIG 12 US Level Sensors Market share by End User, 2022

FIG 13 US Level Sensors Market share by End User, 2030

FIG 14 US Level Sensors Market by End User, 2019 - 2030, USD Million

FIG 15 SWOT Analysis: TE Connectivity Ltd

FIG 16 SWOT Analysis: Siemens AG

FIG 17 SWOT Analysis: SENSIRION AG

FIG 18 Recent strategies and developments: Emerson Electric Co.

FIG 19 Swot Analysis: EMERSON ELECTRIC CO.

FIG 20 SWOT Analysis: ABB ltd.

FIG 21 Recent strategies and developments: Ametek, Inc.

FIG 22 SWOT Analysis: Ametek, Inc.

FIG 23 Swot analysis: Honeywell international, inc.

FIG 24 SWOT Analysis: Fortive Corporation

FIG 25 SWOT Analysis: Texas Instruments, Inc.

FIG 26 SWOT Analysis: Amphenol Corporation