US Malonic Acid Market Size, Share & Trends Analysis Report By Application (Flavor Enhancer, API, Additive, pH Controller, Precurser, and Others), By End Use, and Forecast, 2023 - 2030

Published Date : 20-May-2024 |

Pages: 66 |

Formats: PDF |

COVID-19 Impact on the US Malonic Acid Market

The United States (US) Malonic Acid Market size is expected to reach $22.3 Million by 2030, rising at a market growth of 2.3% CAGR during the forecast period. In the year 2022, the market attained a volume of 2784.1 Tonnes, experiencing a growth of 1.6% (2019-2022).

The malonic acid market in the United States has experienced significant growth in recent years, driven by its versatile applications across various industries such as pharmaceuticals, agriculture, and food additives. Malonic acid is a key intermediate in synthesizing numerous active pharmaceutical ingredients (APIs) in the pharmaceutical industry. Its ability to undergo various chemical transformations makes it a valuable building block for synthesizing complex molecules. Additionally, malonic acid derivatives have applications in producing vitamins, antimalarial drugs, and other pharmaceutical products, contributing to its demand in the U.S.

Furthermore, the COVID-19 pandemic has had mixed effects on the malonic acid market in the United States. The increased focus on healthcare and pharmaceuticals during the pandemic has driven demand for certain pharmaceutical intermediates, including malonic acid. The urgency to develop treatments and vaccines for COVID-19 has spurred research and development activities in the pharmaceutical sector, potentially increasing the demand for malonic acid in the U.S.

However, the pandemic has also disrupted supply chains and manufacturing operations, impacting the production and distribution of malonic acid and its derivatives. Restrictions on movement and trade and disruptions in raw material supply have led to challenges in the availability of malonic acid products. Furthermore, shifts in consumer behavior and economic uncertainties have affected demand dynamics in industries such as food and agriculture, potentially impacting the consumption of malonic acid-based products in the U.S.

Market Trends

Expansion of the chemical industry

The chemical industry in the United States has witnessed significant expansion in recent years, particularly in the malonic acid market. One of the driving factors behind expanding the malonic acid market in the U.S. is the growing demand for pharmaceutical intermediates. Malonic acid is a crucial precursor in synthesizing numerous pharmaceutical compounds, including barbiturates, vitamin B1, and certain anti-inflammatory drugs. With the rising prevalence of chronic diseases and the increasing emphasis on drug development, the demand for malonic acid as a key intermediate in pharmaceutical manufacturing has surged.

The specialty chemicals segment presents another avenue for expanding the malonic acid market in the U.S. Specialty chemicals derived from malonic acid are utilized in various industries, such as electronics, polymers, and personal care products. The versatility of malonic acid derivatives in these applications, coupled with the robust manufacturing infrastructure and technological innovation in the U.S., has fueled their demand.

Moreover, favorable government initiatives and regulatory policies aimed at promoting domestic manufacturing and innovation have further bolstered the expansion of the malonic acid market in the U.S. Incentives for research and development, coupled with initiatives to streamline regulatory processes, have encouraged investment and entrepreneurship in the chemical industry, thereby fostering growth in the malonic acid market. The U.S. chemical industry's expansion, particularly in the malonic acid market, underscores its growing influence and dominance in global chemical production.

According to Select US, in 2019, the United States solidified its position as a global leader in chemical production by exporting more than $208 billion worth of chemicals. Furthermore, the chemical industry attracted substantial foreign direct investment (FDI), totaling $774.5 billion. With the U.S. contributing over 15% of the world's total chemical output, it remains a pivotal player in the global industry. This dominance extends to specific sectors, such as the burgeoning malonic acid market, where the expansion of the chemical industry in the U.S. underscores its continued growth and influence on an international scale. Thus, the surge in demand for malonic acid as a crucial pharmaceutical intermediate, coupled with its diverse applications in specialty chemicals, has propelled the expansion of the malonic acid market in the United States.

Rising demand for pH controllers

The malonic acid market in the United States is witnessing a notable surge in demand for pH controllers, reflecting a growing emphasis on precise control and optimization of production processes. As industries reliant on malonic acid expand, the need for effective pH management becomes increasingly critical, driving the adoption of pH controllers across various sectors in the U.S.

In the agricultural sector, malonic acid finds applications in synthesizing various agrochemicals and plant growth regulators. Agricultural formulations containing malonic acid require specific pH levels to ensure stability, efficacy, and compatibility with other ingredients. pH controllers enable agricultural manufacturers to precisely adjust and maintain pH levels, thereby enhancing the performance and reliability of their formulations.

The escalating demand for pH controllers in the U.S. malonic acid market underscores the increasing focus on process optimization, product quality, and regulatory compliance across various industries. As manufacturers strive to enhance operational efficiency and meet evolving industry demands, the adoption of pH controllers is poised to continue its upward trajectory, shaping the future landscape of the malonic acid industry in the United States. Hence, the rising demand for pH controllers in the United States reflects a growing need for precise pH management in various industries reliant on malonic acid, driving the industry's future trajectory toward enhanced process optimization and product quality.

Competition Analysis

The malonic acid market in the United States is a crucial component of the chemical industry, with numerous companies involved in its production, distribution, and application across various sectors. One of the prominent companies in the U.S. malonic acid market is Lonza Group Ltd. Lonza is a Swiss multinational company specializing in producing and distributing chemicals and biotechnological products. With a global presence, Lonza has established itself as a leading supplier of malonic acid, catering to diverse industries such as pharmaceuticals, agrochemicals, and specialty chemicals. The company's state-of-the-art manufacturing facilities ensure high-quality malonic acid production, meeting the stringent standards of the U.S. malonic acid market.

Another major player in the U.S. malonic acid market is Sigma-Aldrich Corporation, now part of Merck KGaA. Sigma-Aldrich is a leading supplier of research chemicals, laboratory reagents, and biochemicals, offering a wide range of products to scientific and industrial customers worldwide. With a strong presence in the United States, Sigma-Aldrich provides high-purity malonic acid for various applications, including organic synthesis, drug development, and biochemical research. The company's focus on quality and innovation has positioned it as a trusted partner for researchers and manufacturers in the U.S. malonic acid market.

Eastman Chemical Company is another key player contributing to the growth of the malonic acid market in the United States. Based in Tennessee, Eastman Chemical is a global specialty chemical company with a diverse portfolio of products serving multiple industries. The company manufactures malonic acid as part of its intermediates and solvents segment, catering to customers' pharmaceutical, agrochemical, and personal care needs. Eastman Chemical's strong R&D capabilities drive continuous improvement in malonic acid production, ensuring competitiveness and sustainability in the U.S.

Additionally, Alfa Aesar plays a significant role in supplying malonic acid to the U.S. industry. Alfa Aesar is a leading manufacturer and supplier of chemicals, metals, and materials for research and development applications. With a comprehensive product portfolio and distribution network, Alfa Aesar offers high-quality malonic acid to academic institutions, pharmaceutical companies, and industrial laboratories across the United States. The company's commitment to customer satisfaction and technical support enhances its position as a reliable partner in the U.S. malonic acid market. With increasing demand from various industries, these companies play a crucial role in ensuring a stable supply of malonic acid and driving advancements in its applications, further solidifying the industry's significance in the U.S. economy.

List of Key Companies Profiled

- Trace Zero LLC

- Lygos Inc.

- Wuhan Amino Acid Bio-Chemical Co., Ltd.

- Hefei TNJ Chemical Industry Co.,Ltd.

- Shandong Lixing Advanced Material Co., Ltd.

- Nanjing Perlove Medical Equipment Co., Ltd.

- Wacker Chemie AG

- Thermo Fisher Scientific, Inc.

- Lonza Group Ltd.

US Malonic Acid Market Report Segmentation

By Application

- Flavor Enhancer

- API

- Additive

- pH Controller

- Precurser

- Others

By End Use

- Food & Beverage

- Pharmaceutical

- Agriculture

- Plastics

- Paints & Coatings

- Others

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 US Malonic Acid Market, by Application

1.4.2 US Malonic Acid Market, by End Use

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

2.2.3 Market Opportunities

2.2.4 Market Challenges

2.2.5 Market Trends

2.3 Porter Five Forces Analysis

Chapter 3. Strategies Deployed in Malonic Acid Market.

Chapter 4. US Malonic Acid Market

4.1 US Malonic Acid Market by Application

4.2 US Malonic Acid Market by End-Use

Chapter 5. Company Profiles – Global Leaders

5.1 Trace Zero LLC

5.1.1 Company Overview

5.2 Lygos Inc.

5.2.1 Company Overview

5.2.2 SWOT Analysis

5.3 Wuhan Amino Acid Bio-Chemical Co., Ltd.

5.3.1 Company Overview

5.3.2 SWOT Analysis

5.4 Hefei TNJ Chemical Industry Co.,Ltd.

5.4.1 Company Overview

5.5 Shandong Lixing Advanced Material Co., Ltd.

5.5.1 Company Overview

5.5.2 SWOT Analysis

5.6 Nanjing Perlove Medical Equipment Co., Ltd.

5.6.1 Company Overview

5.7 Wacker Chemie AG

5.7.1 Company Overview

5.7.2 Financial Analysis

5.7.3 Segmental and Regional Analysis

5.7.4 Research & Development Expenses

5.7.5 Recent strategies and developments:

5.7.5.1 Partnerships, Collaborations, and Agreements:

5.7.5.2 Acquisition and Mergers:

5.7.6 SWOT Analysis

5.8 Thermo Fisher Scientific, Inc.

5.8.1 Company Overview

5.8.2 Financial Analysis

5.8.3 Segmental and Regional Analysis

5.8.4 Research & Development Expenses

5.8.5 Recent strategies and developments:

5.8.5.1 Partnerships, Collaborations, and Agreements:

5.8.5.2 Acquisition and Mergers:

5.8.6 SWOT Analysis

5.9 Lonza Group Ltd.

5.9.1 Company Overview

5.9.2 Financial Analysis

5.9.3 Segmental and Regional Analysis

5.9.4 Research & Development Expenses

5.9.5 Recent strategies and developments:

5.9.5.1 Partnerships, Collaborations, and Agreements:

5.9.5.2 Acquisition and Mergers:

5.9.6 SWOT Analysis

TABLE 2 US Malonic Acid Market, 2023 - 2030, USD Thousands

TABLE 3 US Malonic Acid Market, 2019 - 2022, Tonnes

TABLE 4 US Malonic Acid Market, 2023 - 2030, Tonnes

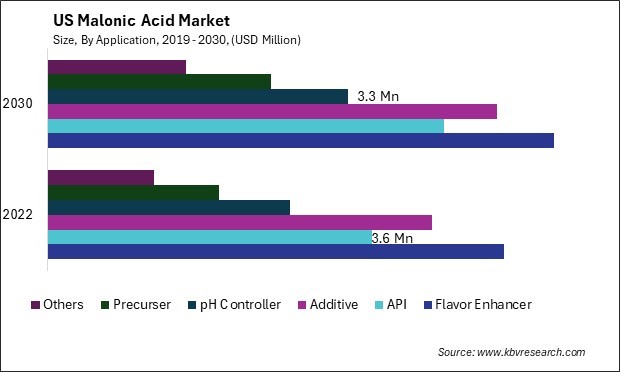

TABLE 5 US Malonic Acid Market by Application, 2019 - 2022, USD Thousands

TABLE 6 US Malonic Acid Market by Application, 2023 - 2030, USD Thousands

TABLE 7 US Malonic Acid Market by Application, 2019 - 2022, Tonnes

TABLE 8 US Malonic Acid Market by Application, 2023 - 2030, Tonnes

TABLE 9 US Malonic Acid Market by End-Use, 2019 - 2022, USD Thousands

TABLE 10 US Malonic Acid Market by End-Use, 2023 - 2030, USD Thousands

TABLE 11 US Malonic Acid Market by End-Use, 2019 - 2022, Tonnes

TABLE 12 US Malonic Acid Market by End-Use, 2023 - 2030, Tonnes

TABLE 13 Key Information – Trace Zero LLC

TABLE 14 Key Information – Lygos Inc.

TABLE 15 Key Information – Wuhan Amino Acid Bio-Chemical Co., Ltd.

TABLE 16 Key Information – Hefei TNJ Chemical Industry CO., LTD.

TABLE 17 Key Information – Shandong Lixing Advanced Material Co., Ltd.

TABLE 18 Key Information – Nanjing Perlove Medical Equipment Co., Ltd.

TABLE 19 Key Information – Wacker Chemie AG

TABLE 20 Key Information – Thermo Fisher Scientific, Inc.

TABLE 21 Key Information –Lonza Group Ltd.

List of Figures

FIG 1 Methodology for the research

FIG 2 US Malonic Acid Market, 2019 - 2030, USD Thousands

FIG 3 Key Factors Impacting Malonic Acid Market

FIG 4 Porter’s Five Forces Analysis – Malonic Acid Market

FIG 5 US Malonic Acid Market share by Application, 2022

FIG 6 US Malonic Acid Market share by Application, 2030

FIG 7 US Malonic Acid Market by Application, 2019 - 2030, USD Thousands

FIG 8 US Malonic Acid Market share by End-Use, 2022

FIG 9 US Malonic Acid Market share by End-Use, 2030

FIG 10 US Malonic Acid Market by End-Use, 2019 - 2030, USD Thousands

FIG 11 SWOT Analysis: Lygos Inc.

FIG 12 SWOT Analysis: Wuhan Amino Acid Bio-Chemical Co., Ltd.

FIG 13 SWOT Analysis: Shandong Lixing Advanced Material Co., Ltd.

FIG 14 Recent strategies and developments: Wacker Chemie AG

FIG 15 Swot Analysis: Wacker Chemie AG

FIG 16 Recent strategies and developments: Thermo Fisher Scientific, Inc.

FIG 17 SWOT Analysis: Thermo Fisher Scientific, Inc.

FIG 18 Recent strategies and developments: Lonza Group Ltd.

FIG 19 Swot Analysis: Lonza Group Ltd.