US Mineral Supplements Market Size, Share & Trends Analysis Report By Sales Channel, By Formulation (Tablet, Capsule, Powder, Liquid/Gel & Others), By Application, By End-use, By Product, and Forecast, 2023 - 2030

Published Date : 20-May-2024 |

Pages: 91 |

Report Format: PDF + Excel |

COVID-19 Impact on the US Mineral Supplements Market

The United States (US) Mineral Supplements Market size is expected to reach $4.6 Billion by 2030, rising at a market growth of 4.5% CAGR during the forecast period.

The mineral supplements market has witnessed remarkable growth and diversification in the expansive landscape of mineral supplements in the United States. As health and wellness concerns continue to gain prominence among consumers, the demand for mineral supplements has surged. The mineral supplements market in the U.S. is characterized by a wide array of products catering to different health needs and preferences. Government initiatives and regulations also play a role in shaping the supplements industry.

Calcium, magnesium, iron, zinc, and selenium are among the most sought-after minerals in the U.S. supplement industry. Calcium supplements, in particular, have gained popularity among individuals aiming to support bone health, especially among aging populations. Magnesium supplements are also in high demand, attributed to their role in various physiological functions, including muscle and nerve function. The U.S. Food and Drug Administration (FDA) regulates dietary supplements to ensure their safety and efficacy.

Amidst these trends, the COVID-19 pandemic has also left its mark on the mineral supplements market in the U.S. The health crisis has prompted a heightened focus on immunity and overall well-being, increasing demand for supplements that support immune function. Consumers increasingly turn to mineral supplements to address potential nutritional gaps and enhance their resilience against illnesses.

Market Trends

Expansion of the vitamins and supplements industry

The vitamins and supplements industry in the United States has witnessed a remarkable expansion, with a particular surge in the mineral supplements market. One of the key drivers of the expansion is the increasing awareness among the U.S. population about the importance of maintaining optimal health and well-being. As Americans become more health-conscious, there is a growing interest in preventive healthcare measures, and many are turning to supplements to fill potential nutritional gaps.

According to the National Library of Medicine, in the United States before the pandemic, dietary supplement sales increased by 5% ($345 million) in 2019 compared to the previous year. However, there was a 44 % ($435 million) increase in sales in the six weeks preceding April 5th, 2020, during the first wave of the pandemic, relative to the same period in 2019. In the U.S., it was reported that the demand for multivitamins spiked in March 2020, with sales rising by 51.2 % and total sales of vitamins and supplements reaching almost 120 million units for that period alone. Consumers displayed heightened interest in maintaining their overall health and well-being, leading to a substantial uptick in the sales of mineral supplements.

Additionally, the aging population in the United States has contributed to the growth of the mineral supplements market. As individuals age, an increased focus is on maintaining bone health, preventing osteoporosis, and addressing other age-related concerns, leading to a higher demand for mineral-rich supplements.

According to the United States Census Bureau, the older population reached 55.8 million or 16.8% of the population in 2020. Over a century, the older population expanded by 50.9 million, from 4.9 million (4.7% of the total U.S. population) in 1920 to 55.8 million (16.8%) in 2020. This demographic shift poses various societal challenges and opportunities, including healthcare, social services, and economic considerations. As the aging population continues to rise, there is an increasing focus on health and wellness, leading to a growing industry for various supplements.

As regulatory standards evolve and become more stringent, consumers are likely to feel more confident in the quality and reliability of mineral supplements, fostering continued industry expansion. Thus, the remarkable expansion of the vitamins and supplements industry in the mineral supplements market in the United States is driven by increasing health consciousness and a significant boost in demand during the initial wave of the pandemic.

Increasing popularity of capsules as mineral supplements

In recent years, there has been a notable surge in the popularity of capsules as a preferred delivery method for mineral supplements in the United States. One driving factor behind the increasing popularity of capsules in the U.S. mineral supplements market is their convenience. Capsules are portable, easy to swallow, and do not require measuring or mixing, making them a hassle-free choice for busy-conscious consumers. The fast-paced nature of American life has contributed to the demand for supplements that seamlessly integrate into daily routines, and capsules fit this criterion perfectly.

Additionally, capsules provide a practical solution for those who have difficulty swallowing traditional tablets or dislike the taste of liquid supplements. The elderly population, in particular, prefers capsules due to their ease of consumption. This demographic shift, coupled with an aging population, has fueled the demand for mineral supplements in a more user-friendly form. Moreover, the U.S. consumer base's increasing awareness of health and wellness trends has led to a greater emphasis on personalized nutrition.

Furthermore, the trend towards clean labeling and natural ingredients has influenced the popularity of capsules. Many American consumers prefer supplements with minimal additives, and capsules are ideal for delivering minerals without requiring extensive binders or fillers. Therefore, the popularity of capsule mineral supplements in the U.S. is attributed to their convenience, aligning with fast-paced lifestyles, especially among the growing elderly population and health-conscious consumers.

Competition Analysis

The mineral supplements market in the United States is a dynamic and rapidly growing industry driven by increasing awareness of the importance of minerals in maintaining overall health and wellness. One of the prominent players in the U.S. mineral supplements market is Nature's Bounty. With a legacy dating back to 1971, Nature's Bounty has established itself as a leading provider of high-quality supplements. The company offers a comprehensive range of mineral supplements, including calcium, magnesium, zinc, and iron, targeting different health needs such as bone health, immune support, and energy metabolism.

Life Extension is a well-known name in the nutritional supplements industry, offering various products, including mineral supplements. The company emphasizes science-based formulations and conducts extensive research to ensure the efficacy of its products. Life Extension's mineral supplements cover a broad spectrum, ranging from essential minerals like magnesium and potassium to trace minerals like selenium and chromium.

Another key player in the industry is NutraBlast, which specializes in women's health supplements. The company focuses on providing mineral supplements that address specific health concerns for women, such as iron and calcium supplements for bone health and prenatal vitamins for expectant mothers. NutraBlast has gained recognition for its commitment to quality and its emphasis on meeting the unique nutritional requirements of women.

The U.S. industry also features companies like MegaFood, which differentiates itself by focusing on whole-food-based supplements. MegaFood incorporates real food ingredients into its mineral supplements, emphasizing the importance of nutrition from whole sources. The company's commitment to transparency and sustainability resonates with consumers seeking a more natural approach to supplementation.

Pure Encapsulations caters to consumers looking for hypoallergenic and research-backed mineral supplements. The company adheres to strict quality control standards and formulates its products with minimal additives, making them suitable for individuals with sensitivities. Pure Encapsulations offers a range of mineral supplements, including those that support cardiovascular health, bone health, and immune function. As the demand for health and wellness products continues to rise, these companies are pivotal in providing Americans with mineral supplements to support their overall well-being.

List of Key Companies Profiled

- Glanbia PLC

- Nestle S.A

- Herbalife Nutrition Ltd.

- Sanofi S.A.

- Amway Corporation

- Bayer AG

- Omega Protein Corporation (Cooke, Inc.)

- Pharmavite LLC (Otsuka Pharmaceutical Co., Ltd.) (Otsuka Holdings Co. Ltd)

- Koninklijke DSM N.V.

- Nu Skin Enterprises, Inc.

US Mineral Supplements Market Report Segmentation

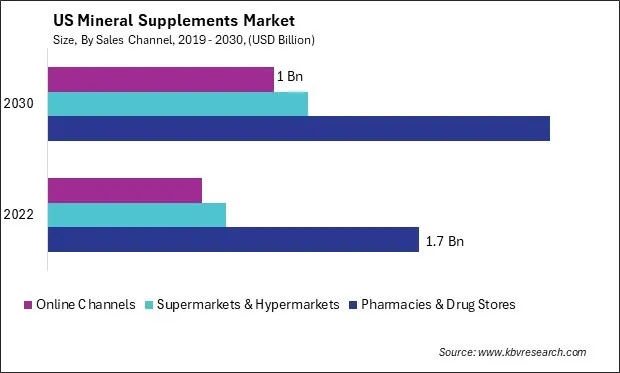

By Sales Channel

- Pharmacies & Drug Stores

- Supermarkets & Hypermarkets

- Online Channels

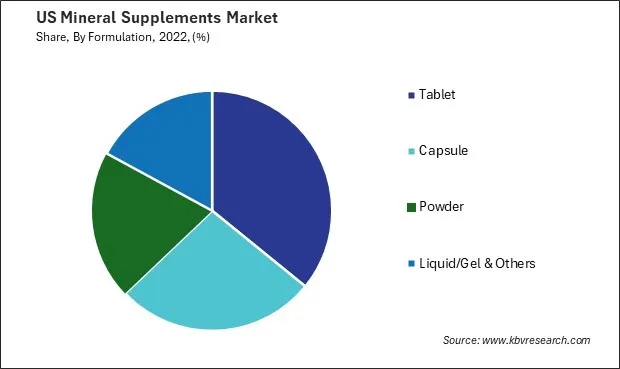

By Formulation

- Tablet

- Capsule

- Powder

- Liquid/Gel & Others

By Application

- General Health

- Bone & Joint health

- Gastrointestinal Health

- Immunity

- Others

By End-use

- Adults

- Geriatric

- Pregnant Women

- Children

- Infants

By Product

- Calcium

- Zinc

- Chromium

- Magnesium

- Selenium

- Iron

- Potassium

- Others

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 USA Mineral Supplements Market, by Sales Channel

1.4.2 USA Mineral Supplements Market, by Formulation

1.4.3 USA Mineral Supplements Market, by Application

1.4.4 USA Mineral Supplements Market, by End-use

1.4.5 USA Mineral Supplements Market, by Product

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Opportunities

2.2.3 Market Restraints

2.2.4 Market Challenges

2.2.5 Market Trends

2.3 Porter Five Forces Analysis

Chapter 3. Strategies Deployed in Mineral Supplements Market.

Chapter 4. US Mineral Supplements Market

4.1 US Mineral Supplements Market by Sales Channel

4.2 US Mineral Supplements Market by Formulation

4.3 US Mineral Supplements Market by Application

4.4 US Mineral Supplements Market by End-use

4.5 US Mineral Supplements Market by Product

Chapter 5. Company Profiles – Global Leaders

5.1 Glanbia PLC

5.1.1 Company Overview

5.1.2 Financial Analysis

5.1.3 Segmental and Regional Analysis

5.1.4 Research & Development Expenses

5.1.5 SWOT Analysis

5.2 Nestle S.A

5.2.1 Company Overview

5.2.2 Financial Analysis

5.2.3 Segmental and Regional Analysis

5.2.4 Research & Development Expenses

5.2.5 Recent strategies and developments:

5.2.5.1 Partnerships, Collaborations, and Agreements:

5.2.5.2 Acquisition and Mergers:

5.2.6 SWOT Analysis

5.3 Herbalife Nutrition Ltd.

5.3.1 Company Overview

5.3.2 Financial Analysis

5.3.3 Regional Analysis

5.3.4 Recent strategies and developments:

5.3.4.1 Partnerships, Collaborations, and Agreements:

5.3.4.2 Product Launches and Product Expansions:

5.3.5 SWOT Analysis

5.4 Sanofi S.A.

5.4.1 Company Overview

5.4.2 Financial Analysis

5.4.3 Segmental and Regional Analysis

5.4.4 Research & Development Expense

5.4.5 Recent strategies and developments:

5.4.5.1 Acquisition and Mergers:

5.4.6 SWOT Analysis

5.5 Amway Corporation

5.5.1 Company Overview

5.5.2 Recent strategies and developments:

5.5.2.1 Partnerships, Collaborations, and Agreements:

5.5.2.2 Product Launches and Product Expansions:

5.5.3 SWOT Analysis

5.6 Bayer AG

5.6.1 Company Overview

5.6.2 Financial Analysis

5.6.3 Segmental and Regional Analysis

5.6.4 Research & Development Expense

5.6.5 Recent strategies and developments:

5.6.5.1 Product Launches and Product Expansions:

5.6.6 SWOT Analysis

5.7 Omega Protein Corporation (Cooke, Inc.)

5.7.1 Company Overview

5.7.2 SWOT Analysis

5.8 Pharmavite LLC (Otsuka Pharmaceutical Co., Ltd.) (Otsuka Holdings Co. Ltd)

5.8.1 Company Overview

5.8.2 Financial Analysis

5.8.3 Segmental & Regional Analysis

5.8.4 Research & Development Expense

5.8.5 SWOT Analysis

5.9 Koninklijke DSM N.V.

5.9.1 Company Overview

5.9.2 Financial Analysis

5.9.3 Segmental and Regional Analysis

5.9.4 Research & Development Expense

5.9.5 Recent strategies and developments:

5.9.5.1 Acquisition and Mergers:

5.9.6 SWOT Analysis

5.10. Nu Skin Enterprises, Inc.

5.10.1 Company Overview

5.10.2 Financial Analysis

5.10.3 Segmental Analysis

5.10.4 Research & Development Expenses

5.10.5 SWOT Analysis

TABLE 2 US Mineral Supplements Market, 2023 - 2030, USD Million

TABLE 3 US Mineral Supplements Market by Sales Channel, 2019 - 2022, USD Million

TABLE 4 US Mineral Supplements Market by Sales Channel, 2023 - 2030, USD Million

TABLE 5 US Mineral Supplements Market by Formulation, 2019 - 2022, USD Million

TABLE 6 US Mineral Supplements Market by Formulation, 2023 - 2030, USD Million

TABLE 7 US Mineral Supplements Market by Application, 2019 - 2022, USD Million

TABLE 8 US Mineral Supplements Market by Application, 2023 - 2030, USD Million

TABLE 9 US Mineral Supplements Market by End-use, 2019 - 2022, USD Million

TABLE 10 US Mineral Supplements Market by End-use, 2023 - 2030, USD Million

TABLE 11 US Mineral Supplements Market by Product, 2019 - 2022, USD Million

TABLE 12 US Mineral Supplements Market by Product, 2023 - 2030, USD Million

TABLE 13 Key Information – Glanbia PLC

TABLE 14 Key Information – Nestle S.A

TABLE 15 Key Information – Herbalife nutrition Ltd.

TABLE 16 Key Information – Sanofi S.A.

TABLE 17 Key Information - Amway Corporation

TABLE 18 Key Information – Bayer AG

TABLE 19 key information – Omega Protein Corporation

TABLE 20 Key Information – Pharmavite LLC

TABLE 21 Key Information – Koninklijke DSM N.V.

TABLE 22 Key Information – Nu Skin Enterprises, Inc.

List of Figures

FIG 1 Methodology for the research

FIG 2 US Mineral Supplements Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting Mineral Supplements Market

FIG 4 Porter’s Five Forces Analysis – Mineral Supplements Market

FIG 5 US Mineral Supplements Market share by Sales Channel, 2022

FIG 6 US Mineral Supplements Market share by Sales Channel, 2030

FIG 7 US Mineral Supplements Market by Sales Channel, 2019 - 2030, USD Million

FIG 8 US Mineral Supplements Market share by Formulation, 2022

FIG 9 US Mineral Supplements Market share by Formulation, 2030

FIG 10 US Mineral Supplements Market by Formulation, 2019 - 2030, USD Million

FIG 11 US Mineral Supplements Market share by Application, 2022

FIG 12 US Mineral Supplements Market share by Application, 2030

FIG 13 US Mineral Supplements Market by Application, 2019 - 2030, USD Million

FIG 14 US Mineral Supplements Market share by End-use, 2022

FIG 15 US Mineral Supplements Market share by End-use, 2030

FIG 16 US Mineral Supplements Market by End-use, 2019 - 2030, USD Million

FIG 17 US Mineral Supplements Market share by Product, 2022

FIG 18 US Mineral Supplements Market share by Product, 2030

FIG 19 US Mineral Supplements Market by Product, 2019 - 2030, USD Million

FIG 20 SWOT Analysis: Glanbia PLC

FIG 21 Recent strategies and developments: Nestle S.A.

FIG 22 SWOT Analysis: Nestle S.A

FIG 23 Recent strategies and developments: Herbalife nutrition Ltd.

FIG 24 SWOT Analysis: Herbalife nutrition Ltd.

FIG 25 Swot Analysis: Sanofi S.A.

FIG 26 Recent strategies and developments: Amway Corporation

FIG 27 SWOT Analysis: Amway Corporation

FIG 28 Swot Analysis: Bayer AG

FIG 29 Swot Analysis: Omega Protein Corporation

FIG 30 Swot Analysis: Pharmavite LLC

FIG 31 SWOT Analysis: Koninklijke DSM N.V

FIG 32 SWOT Analysis: Nu Skin Enterprises, Inc.