Int'l : +1(646) 600-5072 | query@kbvresearch.com

Int'l : +1(646) 600-5072 | query@kbvresearch.com

Published Date : 20-May-2024 |

Pages: 96 |

Formats: PDF |

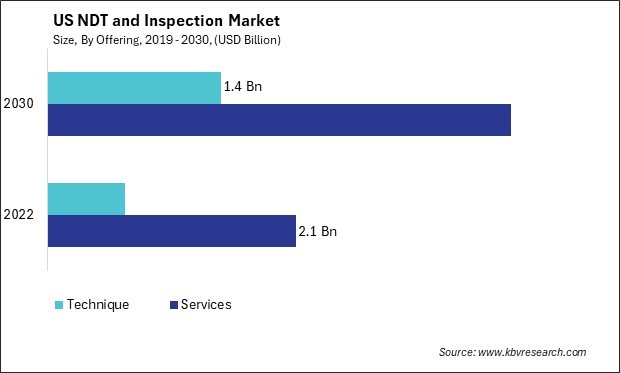

The United States (US) NDT and Inspection Market size is expected to reach $5.3 Billion by 2030, rising at a market growth of 8.9% CAGR during the forecast period.

The NDT and inspection market in the United States is vital to various industries, ensuring safety, reliability, and compliance with regulations. NDT techniques encompass a range of methods that evaluate the properties of materials and components without causing damage. The NDT and inspection market has experienced significant growth in the United States due to several factors. The country's robust industrial infrastructure and stringent regulatory requirements drive the demand for NDT services. As industries strive for operational excellence and risk mitigation, NDT is pivotal in quality assurance, defect detection, and maintenance optimization.

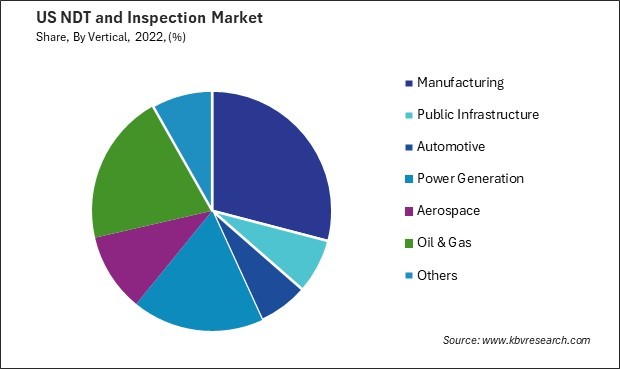

Moreover, the energy sector, including oil and gas, power generation, and renewables, presents significant opportunities for NDT services in the U.S. Pipelines, refineries, power plants, wind turbines, and solar installations require regular inspection to identify corrosion, fatigue, or other structural issues that leads to operational failures or environmental hazards.

The manufacturing industry in the United States has witnessed a significant expansion. One of the key drivers behind the expansion of the NDT and inspection market is the growing emphasis on quality control and assurance across various manufacturing sectors such as automotive, aerospace, oil and gas, and electronics. With manufacturers striving to deliver defect-free products to meet consumer expectations and regulatory requirements, the demand for advanced NDT and inspection technologies has surged.

According to the National Institutes of Standards and Technology, in 2022, the expansion of the manufacturing industry in the United States has substantially impacted the economy, with a contribution of $2.3 trillion, representing 11.4% of the total U.S. GDP. This growth has also fueled the NDT and inspection market within the country.

However, the COVID-19 pandemic has presented challenges and opportunities for the NDT and inspection market in the United States. While the initial lockdowns and restrictions disrupted operations across various industries, reliable inspection services remained essential, particularly in critical sectors such as healthcare, pharmaceuticals, and infrastructure. The pandemic accelerated the adoption of remote inspection technologies and digital solutions, enabling companies to maintain continuity while adhering to social distancing guidelines.

The United States is witnessing a notable surge in the adoption of ultrasonic testing (UT) within the NDT and inspection market, marking a significant shift in how industries ensure the integrity of their critical assets. One of the primary drivers behind the rising adoption of ultrasonic testing in the US is the increasing emphasis on safety and reliability across various sectors such as aerospace, oil and gas, manufacturing, and infrastructure. In the aerospace industry, ultrasonic testing is crucial in inspecting critical components like turbine blades, engine parts, and aircraft structures for hidden defects such as cracks, voids, and delaminations.

According to the International Trade Administration, the U.S. aerospace sector continues to produce the highest trade balance ($77.6 billion in 2019) and the second-highest level of exports ($148 billion) among all manufacturing industries. The ability of UT to provide precise and reliable results makes it indispensable for ensuring the structural integrity and airworthiness of aircraft, thereby enhancing safety standards and reducing maintenance costs in the U.S.

Moreover, advancements in UT technology, such as phased array ultrasonics (PAUT) and guided wave testing, have expanded its applications and capabilities, allowing for faster inspection speeds, improved defect detection, and enhanced data analysis. Thus, the increasing emphasis on safety and reliability across various industries in the US is driving a significant surge in the adoption of ultrasonic testing and enhancing safety standards while reducing maintenance costs.

In the United States, the NDT and inspection market is experiencing a significant surge in demand for visual inspection services. One key factor contributing to the increased demand for visual inspection is the stringent regulatory requirements enforced by government agencies such as the Occupational Safety and Health Administration (OSHA) and the American Petroleum Institute (API). These regulations mandate thorough inspection procedures to ensure the safety and integrity of various industrial assets, including pipelines, refineries, and infrastructure.

Furthermore, the United States has a diverse industrial landscape, encompassing oil and gas, aerospace, automotive, and manufacturing sectors. With the aging infrastructure in many of these industries, there is a pressing need for regular inspections to identify and address potential defects or anomalies before they escalate into costly failures. Visual inspection techniques play a crucial role in detecting surface imperfections, corrosion, cracks, and other structural abnormalities that compromise the integrity of critical assets.

Moreover, the increasing adoption of advanced technologies such as drones and robotics is revolutionizing the landscape of visual inspection in the U.S. NDT and inspection market. These technologies enable inspectors to access hard-to-reach areas more efficiently and safely, enhancing the overall inspection process. Additionally, the rise of digitalization and data analytics is reshaping how visual inspection data is collected, analyzed, and utilized. Hence, stringent regulations, diverse industrial sectors, aging infrastructure, and advancing technologies drive a significant surge in demand for visual inspection services in the United States.

In the vast landscape of the NDT and inspection market in the United States, several companies stand out for their expertise, innovation, and commitment to quality assurance across various industries. One notable player in the NDT and inspection market in the U.S. is MISTRAS Group Inc. With a comprehensive suite of services, MISTRAS offers advanced NDT solutions utilizing cutting-edge technologies such as ultrasonic testing (UT), radiographic testing (RT), and eddy current testing (ECT). Their services span across industries including aerospace, oil and gas, power generation, and infrastructure. MISTRAS' commitment to research and development keeps them at the forefront of technological advancements, enabling them to provide accurate and efficient inspection solutions to their clients.

GE Inspection Technologies, a subsidiary of General Electric, is also a key player in the NDT and inspection market in the U.S. With a focus on delivering advanced inspection solutions for critical applications, GE Inspection Technologies offers a comprehensive range of NDT products and services, including radiography, computed tomography, and remote visual inspection. Their commitment to research and development ensures that they stay ahead of industry trends, providing customers with state-of-the-art inspection technologies to enhance safety and reliability in their operations.

Another prominent company in the U.S. NDT and inspection market is Olympus Corporation. Leveraging decades of experience and a diverse portfolio of inspection instruments and software, Olympus offers a wide range of NDT solutions tailored to meet the specific needs of various industries. Their product lineup includes ultrasonic flaw detectors, phased array systems, and remote visual inspection devices. Olympus' dedication to innovation and customer satisfaction has solidified its position as a trusted partner for NDT and inspection needs across the United States.

Zetec Inc. is another significant contributor to the NDT and inspection market in the United States. Specializing in electromagnetic and eddy current testing solutions, Zetec offers a diverse range of inspection products and software designed to meet the stringent requirements of aerospace, automotive, and manufacturing industries. Their focus on innovation and customer-centric approach has earned them a reputation for delivering high-quality inspection solutions that improve efficiency and reduce downtime for their clients. From multinational corporations to specialized service providers, each company contributes to maintaining the integrity and reliability of critical infrastructure and products, ensuring the safety and well-being of society as a whole.

By Offering

By Vertical