Int'l : +1(646) 600-5072 | query@kbvresearch.com

Int'l : +1(646) 600-5072 | query@kbvresearch.com

Published Date : 15-May-2024 |

Pages: 92 |

Formats: PDF |

The United States (US) Night Vision Devices Market size is expected to reach $3.4 Billion by 2030, rising at a market growth of 7.7% CAGR during the forecast period.

The night vision devices market in the United States has grown substantially over the past decade, driven by increasing demand from various sectors, including military, law enforcement, surveillance, and wildlife observation. One of the key factors driving the growth of the night vision devices market is the rising security concerns and the need for advanced surveillance solutions. With increasing instances of terrorism, border conflicts, and criminal activities, governments and law enforcement agencies are investing heavily in modernizing their surveillance infrastructure, which includes the adoption of night vision devices.

Furthermore, advancements in manufacturing techniques and materials have led to the development of lightweight, compact, and ruggedized night vision devices, making them more portable and durable for field use. Additionally, the availability of cost-effective solutions and the liberalization of export regulations have expanded the industry reach of night vision devices, allowing small and medium-sized enterprises to capitalize on emerging opportunities.

However, the COVID-19 pandemic has posed significant challenges to the night vision devices market in the United States. The global supply chain disruptions, workforce shortages, and economic uncertainties have impacted the production and distribution of night vision equipment. Moreover, the temporary closure of retail outlets and restrictions on outdoor activities have resulted in a decline in consumer spending on recreational and sporting goods, including night vision devices.

The night vision devices market in the United States is experiencing a significant surge in popularity, driven primarily by the increasing demand for outdoor activities. As Americans seek new and thrilling experiences, the allure of nighttime adventures has captivated the public imagination, leading to a notable uptick in the adoption of night vision technology.

One of the key drivers behind this trend is the growing fascination with outdoor recreational activities after dark. Whether camping, hiking, hunting, or wildlife observation, Americans are increasingly drawn to the mystery and excitement of exploring the wilderness under the cover of night. Night vision devices in the U.S. allow enthusiasts to extend their outdoor pursuits into the evening hours, offering enhanced visibility and safety in low-light conditions.

According to the U.S. Bureau of Economic Analysis, in 2021, the outdoor activities sector in the United States contributed significantly to the national gross domestic product (GDP), comprising 1.9 % ($454.0 billion) of the total GDP. Among these activities, boating and fishing emerged as the leading conventional pursuit, generating $27.3 billion in current-dollar value added. Notably, it claimed the top spot in 27 states.

Meanwhile, hunting, shooting, and trapping, ranking as the third-largest conventional activity nationally, contributed $10.8 billion in current-dollar value added. As the allure of outdoor activities continues to surge, particularly in the United States, there's a noticeable trend toward adopting night vision devices. This burgeoning interest in night vision technology is closely intertwined with the growing enthusiasm for outdoor pursuits.

Moreover, advancements in night vision technology have made these devices more accessible and user-friendly than ever. American consumers have many options catering to their needs and preferences, from compact monoculars to sophisticated goggles. Thus, the popularity of night vision devices in the United States reflects a growing interest in nighttime outdoor activities fueled by technological advancements and a desire for thrilling experiences after dark.

The demand for thermal imaging technology in the night vision devices market has steadily increased in the United States, driven by several key factors highlighting its effectiveness and versatility in various applications. One of the primary drivers of this increased demand is the growing awareness of the benefits of thermal imaging in various sectors. In law enforcement and military applications, thermal imaging enhances situational awareness and target detection capabilities, even in complete darkness or adverse weather conditions.

Furthermore, the widespread adoption of thermal imaging technology in civilian applications has contributed to its rising demand. In security and surveillance, thermal cameras provide reliable detection of intruders or potential threats in residential and commercial settings. Industries such as construction, firefighting, and wildlife management also utilize thermal imaging in the U.S. for safety inspections, firefighting operations, and wildlife monitoring, respectively.

The advancements in thermal imaging technology have also played a significant role in driving the growth of night vision devices market. Ongoing innovations have led to the development of more compact, affordable, and high-resolution thermal cameras, making them accessible to a broader range of users. Integration with other technologies, such as drones and smartphones, has further expanded thermal imaging applications, enabling real-time monitoring and data collection from remote locations. Therefore, the steady rise in demand for thermal imaging technology in the United States is fueled by its effectiveness across various sectors, including law enforcement, security, construction, firefighting, and wildlife management.

The night vision devices market in the United States is a thriving industry driven by various companies catering to various applications. From military and law enforcement to wildlife observation and recreational activities, the demand for night vision technology continues to grow, spurring innovation and competition among manufacturers. One prominent company in the U.S. night vision devices market is FLIR Systems, Inc. Known for its advanced thermal imaging solutions, FLIR offers a comprehensive range of night vision devices tailored for military, law enforcement, and commercial use.

Another major player in the U.S. night vision devices market is L3Harris Technologies, Inc. With a strong focus on defense and security applications, L3Harris develops and manufactures advanced night vision goggles, weapon sights, and image intensifier tubes. These cutting-edge technologies are widely adopted by military forces and law enforcement agencies for surveillance, reconnaissance, and target acquisition missions.

The U.S. night vision devices market also features companies like BAE Systems, Inc., a global defense and aerospace company that offers a diverse portfolio of night vision solutions, including thermal imaging systems and image intensifier tubes. BAE Systems' advanced technologies are utilized in various defense platforms, from ground vehicles and aircraft to individual soldier systems, enhancing operational effectiveness and survivability in low-light environments.

Furthermore, the U.S. night vision devices market includes niche players like Photonis Technologies, LLC, a leading manufacturer of image intensifier tubes and custom electro-optical systems. Photonis' cutting-edge technologies are utilized in a wide array of night vision devices, including goggles, scopes, and cameras, providing users with exceptional low-light performance and reliability.

Hence, the U.S. night vision devices market is characterized by a diverse ecosystem of companies, each contributing to advancing and increasing night vision technology across various sectors. From established defense contractors to specialized manufacturers, these companies play a crucial role in meeting the growing demand for innovative and reliable night vision solutions in the United States and beyond.

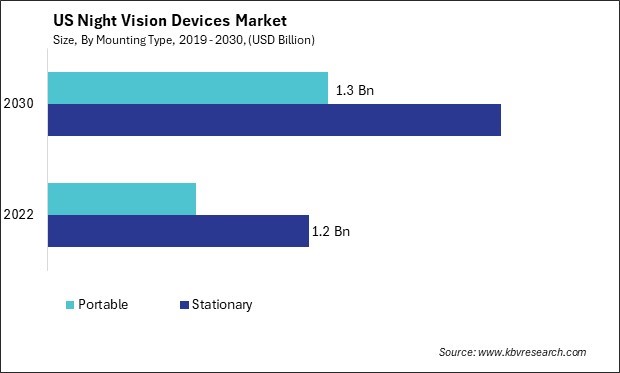

By Mounting Type

By Device Type

By Technology

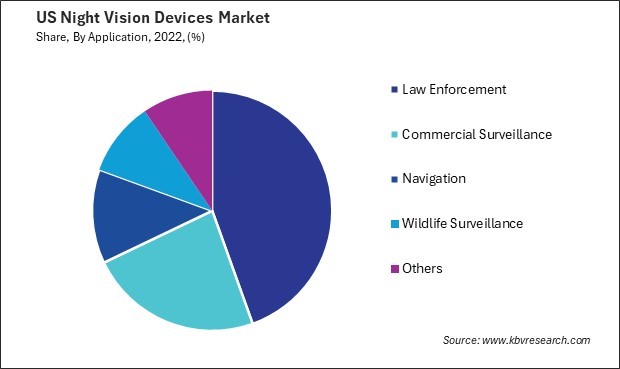

By Application