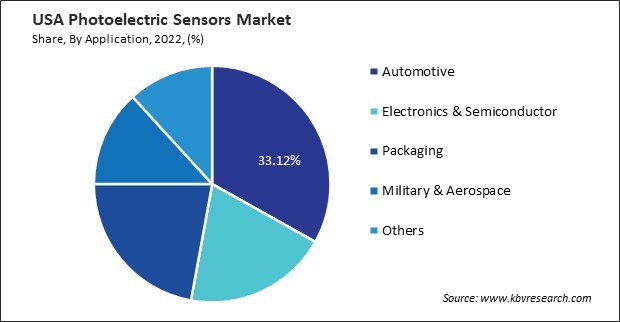

USA Photoelectric Sensors Market Size, Share & Industry Trends Analysis Report By Technology, By Application (Automotive, Electronics & Semiconductor, Packaging, Military & Aerospace, and Others), Outlook and Forecast, 2023 - 2030

Published Date : 26-Mar-2024 |

Pages: 88 |

Formats: PDF |

COVID-19 Impact on the US Photoelectric Sensors Market

The USA Photoelectric Sensors Market size is expected to reach $605.1 million by 2030, rising at a market growth of 4.9% CAGR during the forecast period. In the year 2022, the market attained a volume of 8,242.8 thousand units, experiencing a growth of 4.9% (2019-2022).

The United States has become a key player in the global industry for photoelectric sensors, driven by its robust industrial base and technological advancements. Industries such as electronics, automotive, and pharmaceuticals in the U.S. rely heavily on photoelectric sensors for many applications, including object detection, counting, and positioning. This industry's steady growth indicates the widespread adoption of these sensors across various sectors.

A notable trend in the U.S. photoelectric sensors market is the integration of these sensors with the Internet of Things (IoT) and Industry 4.0 initiatives. This integration has ushered in a new era of connectivity and automation, enhancing the efficiency and capabilities of industrial processes. Beyond traditional industrial applications, photoelectric sensors are making inroads into consumer electronics, healthcare, and smart infrastructure projects, showcasing their versatility, and expanding industry reach.

Energy efficiency and sustainability concerns are further propelling the adoption of the photoelectric sensors market in the U.S. industrial landscape. As industries seek to optimize resource utilization and embrace environmentally friendly practices, these sensors offer a viable solution. The availability of cost-effective options has democratized access to photoelectric sensors, enabling various industries to benefit from their functionalities and contributing to the overall industry expansion.

Safety applications represent another significant dimension of the photoelectric sensors market in the U.S. These sensors are crucial in industrial settings for ensuring the safety of workers and equipment through presence detection. The Occupational Safety and Health Administration stated that in 2020, 4,764 workers lost their lives (3.4 per 100,000 full-time equivalent workers). A total of 1,282 and 976 workplace deaths, or nearly half of all fatal occupational injuries (47.4%), were caused by workers in the transportation and material moving and construction and extraction industries, respectively.

The impact of occupational fatalities, particularly in high-risk sectors such as transportation, material moving occupations, and construction, can influence the demand for various safety technologies, including photoelectric sensors. The outlook for the photoelectric sensors market in the U.S. is optimistic. Continued innovation in sensor technologies, coupled with the expansion of applications in emerging sectors, is expected to sustain the growth trajectory.

Market Trends

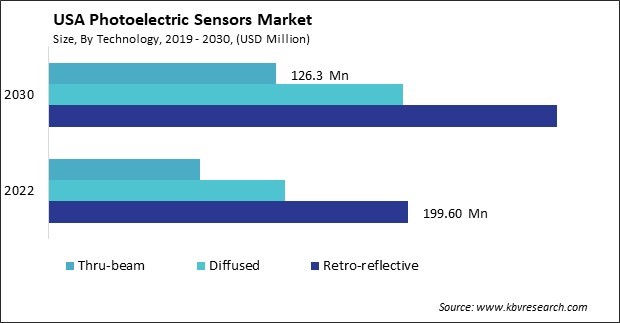

Rising demand for retro-reflective photoelectric sensors

The demand for retro-reflective sensors in the United States is propelled by factors reflecting their versatile applications and significance in various industries. In the manufacturing and logistics sectors, retro-reflective sensors play a pivotal role. These sensors are adept at detecting the presence of objects on conveyor belts, ensuring proper alignment, and facilitating the seamless flow of materials.

Integrating retro-reflective sensors into automated systems and robotics fuels their demand. These sensors provide real-time feedback essential for precise control and navigation, enhancing the overall efficiency of automated processes. In the packaging industry, retro-reflective sensors are employed for tasks like label placement and package counting, contributing to optimizing packaging processes. Thus, the versatile applications of retro-reflective sensors in the U.S., particularly in manufacturing, logistics, and automation, underscore their pivotal role in streamlining operations and enhancing efficiency.

According to the National Institute of Standards and Technology (NIST), in terms of value-added, the primary measure of economic activity, the U.S. is the second largest manufacturing nation in the world. In 2022, manufacturing contributed $2.3 trillion to U.S. GDP, amounting to 11.4 % of total U.S. GDP, measured in chained 2012 dollars. The same source stated that the U.S. ranks 10th among 49 countries in Statistica’s Made-in-Country Index. Likewise, the nation ranks 8th in the Ipsos National Brands Index. As these sensors evolve to meet the changing needs of industries, they will likely remain integral components in the landscape of automation, safety, and efficiency in the United States.

Increasing integration with IoT and industry 4.0

Converging photoelectric sensors with IoT and Industry 4.0 technologies enhances their functionality, provides real-time data insights, and contributes to more intelligent and efficient industrial processes. One major catalyst is the pursuit of enhanced efficiency and productivity gains across diverse industries. IoT and Industry 4.0 technologies facilitate the integration and automation of processes, creating interconnected ecosystems where machines, devices, and systems collaborate seamlessly.

Government initiatives and support also contribute to the expansion of these technologies. Programs aimed at fostering innovation, research, and development and the adoption of Industry 4.0 technologies provide incentives for businesses to invest in these solutions. Government support catalyzes the acceleration of adopting advanced manufacturing technologies, fostering economic growth, and positioning the US as a leader in the global technology landscape.

For example, the AMTech program, under the National Institute of Standards and Technology (NIST), provides funding for public-private partnerships focused on addressing challenges in advanced manufacturing. These partnerships often involve developing and implementing IoT and Industry 4.0 technologies. Thus, the demand for these sensors will likely grow as industries increasingly recognize the value of connected and intelligent sensor solutions in driving efficiency, productivity, and competitiveness.

Competition Analysis

In the United States, several companies specialize in the manufacturing and provision of photoelectric sensors, contributing to the growing demand for these devices across various industries. One prominent player in this space is Banner Engineering, a company known for its comprehensive range of sensor solutions. Banner Engineering designs and manufactures a variety of photoelectric sensors catering to diverse applications, such as object detection, distance measurement, and quality control.

Keyence Corporation and Omron Corporation are prominent players in the US photoelectric sensors market, offering a comprehensive range of automation and sensing technologies focusing on photoelectric sensors. Keyence's extensive portfolio and Omron's global recognition highlight their significant presence in the evolving landscape of industrial automation in the United States.

Rockwell Automation, a leader in industrial automation and information technology, stands out as a key player with diverse solutions, including photoelectric sensors. Their offerings contribute to efficient and intelligent manufacturing processes, aligning with the growing integration of automation technologies in various industries across the US.

Autonics USA, Inc. and Baumer Group further contribute to the competitive landscape by providing automation solutions, including precision-designed photoelectric sensors. Autonics emphasizes reliability in applications such as packaging and material handling. At the same time, Baumer Group's global expertise extends to the US, offering innovative sensor solutions that enhance the efficiency and automation of manufacturing processes.

Together, these companies exemplify the diversity and competitiveness of the US photoelectric sensors market. Their continuous innovation and development efforts underscore the crucial role of photoelectric sensors in advancing industrial automation and fostering the widespread adoption of Industry 4.0 principles in the dynamic landscape of the United States.

List of Key Companies Profiled

- Omron Corporation

- Panasonic Holdings Corporation

- Rockwell Automation, Inc.

- Eaton Corporation PLC

- Keyence Corporation

- Schneider Electric SE

- Autonics Corporation

- Sick AG

- Balluff GmbH

- IFM Electronics GmbH

US Photoelectric Sensors Market Report Segmentation

By Technology

- Retro-reflective

- Diffused

- Thru-beam

By Application

- Automotive

- Electronics & Semiconductor

- Packaging

- Military & Aerospace

- Others

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 USA Photoelectric Sensors Market, by Technology

1.4.2 USA Photoelectric Sensors Market, by Application

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

Chapter 3. Competition Analysis - Global

3.1 KBV Cardinal Matrix

3.2 Recent Industry Wide Strategic Developments

3.2.1 Partnerships, Collaborations and Agreements

3.2.2 Product Launches and Product Expansions

3.2.3 Acquisition and Mergers

3.3 Top Winning Strategies

3.3.1 Key Leading Strategies: Percentage Distribution (2019-2023)

3.3.2 Key Strategic Move: (Partnerships, Collaborations & Agreements : 2020, Jul – 2023, Oct) Leading Players

3.4 Porter’s Five Forces Analysis

Chapter 4. US Photoelectric Sensors Market

4.1 US Photoelectric Sensors Market by Technology

4.2 US Photoelectric Sensors Market by Application

Chapter 5. Company Profiles – Global Leaders

5.1 Omron Corporation

5.1.1 Company Overview

5.1.2 Financial Analysis

5.1.3 Segmental and Regional Analysis

5.1.4 Research & Development Expenses

5.1.5 SWOT Analysis

5.2 Panasonic Holdings Corporation

5.2.1 Company Overview

5.2.2 Financial Analysis

5.2.3 Segmental and Regional Analysis

5.2.4 Research & Development Expenses

5.2.5 Recent strategies and developments:

5.2.5.1 Product Launches and Product Expansions:

5.2.6 SWOT Analysis

5.3 Rockwell Automation, Inc.

5.3.1 Company Overview

5.3.2 Financial Analysis

5.3.3 Segmental and Regional Analysis

5.3.4 Research & Development Expenses

5.3.5 Recent strategies and developments:

5.3.5.1 Partnerships, Collaborations, and Agreements:

5.3.5.2 Acquisition and Mergers:

5.3.6 SWOT Analysis

5.4 Eaton Corporation PLC

5.4.1 Company Overview

5.4.2 Financial Analysis

5.4.3 Segmental and Regional Analysis

5.4.4 Research & Development Expense

5.4.5 Recent strategies and developments:

5.4.5.1 Acquisition and Mergers:

5.4.6 SWOT Analysis

5.5 Keyence Corporation

5.5.1 Company Overview

5.5.2 Financial Analysis

5.5.3 Regional Analysis

5.5.4 Research & Development Expenses

5.5.5 Recent strategies and developments:

5.5.5.1 Partnerships, Collaborations, and Agreements:

5.5.5.2 Product Launches and Product Expansions:

5.5.6 SWOT Analysis

5.6 Schneider Electric SE

5.6.1 Company Overview

5.6.2 Financial Analysis

5.6.3 Segmental and Regional Analysis

5.6.4 Research & Development Expense

5.6.5 Recent strategies and developments:

5.6.5.1 Partnerships, Collaborations, and Agreements:

5.6.5.2 Acquisition and Mergers:

5.6.6 SWOT Analysis

5.7 Autonics Corporation

5.7.1 Company Overview

5.7.2 SWOT Analysis

5.8 Sick AG

5.8.1 Company Overview

5.8.2 Financial Analysis

5.8.3 Segmental and Regional Analysis

5.8.4 Research & Development Expense

5.8.5 Recent strategies and developments:

5.8.5.1 Partnerships, Collaborations, and Agreements:

5.8.6 SWOT Analysis

5.9 Balluff GmbH

5.9.1 Company Overview

5.9.2 SWOT Analysis

5.10. IFM Electronics GmbH

5.10.1 Company Overview

5.10.2 Recent strategies and developments:

5.10.2.1 Partnerships, Collaborations, and Agreements:

5.10.3 SWOT Analysis

TABLE 2 US Photoelectric Sensors Market, 2023 - 2030, USD Million

TABLE 3 US Photoelectric Sensors Market, 2019 - 2022, Thousand Units

TABLE 4 US Photoelectric Sensors Market, 2023 - 2030, Thousand Units

TABLE 5 Partnerships, Collaborations and Agreements– Photoelectric Sensors Market

TABLE 6 Product Launches And Product Expansions– Photoelectric Sensors Market

TABLE 7 Acquisition and Mergers– Photoelectric Sensors Market

TABLE 8 US Photoelectric Sensors Market by Technology, 2019 - 2022, USD Million

TABLE 9 US Photoelectric Sensors Market by Technology, 2023 - 2030, USD Million

TABLE 10 US Photoelectric Sensors Market by Technology, 2019 - 2022, Thousand Units

TABLE 11 US Photoelectric Sensors Market by Technology, 2023 - 2030, Thousand Units

TABLE 12 US Photoelectric Sensors Market by Application, 2019 - 2022, USD Million

TABLE 13 US Photoelectric Sensors Market by Application, 2023 - 2030, USD Million

TABLE 14 US Photoelectric Sensors Market by Application, 2019 - 2022, Thousand Units

TABLE 15 US Photoelectric Sensors Market by Application, 2023 - 2030, Thousand Units

TABLE 16 Key Information – Omron Corporation

TABLE 17 Key Information – panasonic holdings corporation

TABLE 18 Key Information – Rockwell Automation, Inc.

TABLE 19 Key Information – Eaton Corporation PLC

TABLE 20 key information – Keyence Corporation

TABLE 21 Key Information – Schneider Electric SE

TABLE 22 Key Information – Autonics Corporation

TABLE 23 Key Information – Sick AG

TABLE 24 Key Information – Balluff GmbH

TABLE 25 Key Information – IFM Electronics GmbH

List of Figures

FIG 1 Methodology for the research

FIG 2 US Photoelectric Sensors Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting photoelectric sensors market

FIG 4 KBV Cardinal Matrix

FIG 5 Key Leading Strategies: Percentage Distribution (2019-2023)

FIG 6 Key Strategic Move: (Partnerships, Collaborations & Agreements : 2020, Jul – 2023, Oct) Leading Players

FIG 7 Porter’s Five Forces Analysis - Photoelectric Sensors Market

FIG 8 US Photoelectric Sensors Market Share by Technology, 2022

FIG 9 US Photoelectric Sensors Market Share by Technology, 2030

FIG 10 US Photoelectric Sensors Market by Technology, 2019- 2030, USD Million

FIG 11 US Photoelectric Sensors Market Share by Application, 2022

FIG 12 US Photoelectric Sensors Market Share by Application, 2030

FIG 13 US Photoelectric Sensors Market by Application, 2019 - 2030, USD Million

FIG 14 SWOT Analysis: Omron Corporation

FIG 15 SWOT Analysis: Panasonic Holdings Corporation

FIG 16 SWOT Analysis: Rockwell Automation, Inc.

FIG 17 SWOT Analysis: Eaton Corporation PLC

FIG 18 SWOT Analysis: KEYENCE CORPORATION

FIG 19 Recent strategies and developments: SCHNEIDER ELECTRIC SE

FIG 20 SWOT Analysis: Schneider Electric SE

FIG 21 SWOT Analysis: AUTONICS CORPORATION

FIG 22 SWOT Analysis: Sick AG

FIG 23 SWOT Analysis: BALLUFF GMBH

FIG 24 SWOT Analysis: IFM Electronics GmbH