US Plastic Additives Market Size, Share & Trends Analysis Report By Plastic Type (High-Performance Plastics, Commodity Plastic, and Engineering Plastic), By Application, By Type, and Forecast, 2023 - 2030

Published Date : 15-May-2024 |

Pages: 99 |

Formats: PDF |

COVID-19 Impact on the US Plastic Additives Market

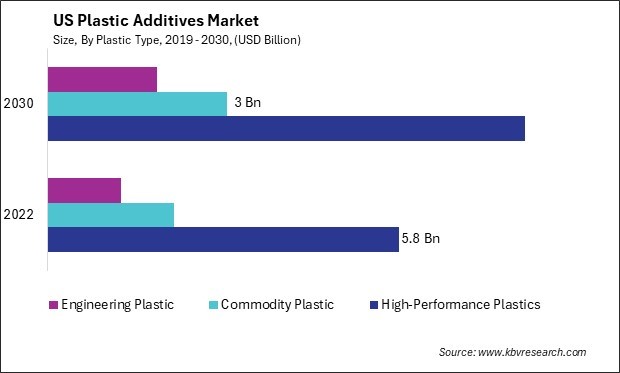

The United States (US) Plastic Additives Market size is expected to reach $12.7 Billion by 2030, rising at a market growth of 4.2% CAGR during the forecast period. In the year 2022, the market attained a volume of 2921.4 Kilo Tonnes, experiencing a growth of 3.7% (2019-2022).

The market for plastic additives in the United States is a dynamic and swiftly developing sector that is of utmost importance in improving the performance, durability, and sustainability of plastic products in various industries. Plastic additives are essential components used in the production of plastics to impart specific properties such as UV resistance, flame retardancy, thermal stability, and coloration. The industry's environment has been significantly influenced by technological advancements, regulatory modifications, and evolving consumer preferences, all of which have contributed to recent market developments.

One of the recent developments in the US plastic additives market is the increasing focus on sustainable additives and green technologies. With growing concerns about environmental impact and plastic waste, there is a rising demand for additives that enable the production of more sustainable and eco-friendly plastics. This trend has led to the development of bio-based additives, recycled content additives, and additives that enhance the recyclability and biodegradability of plastics, aligning with the industry's efforts toward sustainability.

Moreover, there has been a notable shift towards using additives that improve the performance and functionality of plastics in various applications. This includes additives that enhance the mechanical properties of plastics, such as strength, toughness, and flexibility, to meet the demanding requirements of industries like automotive, construction, and packaging. Additionally, there is a growing demand for additives that enable the production of specialty plastics with specific properties tailored to niche applications, driving innovation and customization in the market.

Looking ahead, the pandemic's long-term implications on the US plastic additives market are still unfolding. As the economy recovers and industries adapt to new norms, the demand for plastic additives may continue to evolve, with a potential focus on sustainability, resilience, and innovation in the post-pandemic market.

Market Trends

Rising demand for antimicrobial plastic additives

The increased emphasis on hygiene and infection prevention, especially in light of the COVID-19 pandemic, is a significant factor in the surge in demand for antimicrobial plastic additives in the United States. In order to enhance patient safety and mitigate the likelihood of healthcare-associated infections (HAIs), various industries, including healthcare and medical devices, have placed a high emphasis on integrating antimicrobial characteristics into their products. This has led to a surge in demand for plastics with built-in antimicrobial protection.

Moreover, the packaging industry has also experienced a growing need for antimicrobial additives as consumers seek products with enhanced hygiene features. Antimicrobial packaging materials effectively mitigate consumer apprehensions regarding food safety and hygiene by impeding the proliferation of bacteria and mold, thereby extending the shelf life of food products. Additionally, antimicrobial additives in consumer goods such as household appliances, electronics, and textiles have increased as manufacturers aim to offer products with enhanced antimicrobial properties.

Furthermore, the construction industry has seen a rise in adopting antimicrobial plastics for building materials and surfaces in response to the increased focus on cleanliness and sanitation in public spaces. Antimicrobial additives incorporated into materials used for flooring, wall coverings, and other surfaces can help reduce the spread of pathogens in high-traffic areas, contributing to improved public health and safety. Therefore, as the importance of cleanliness and antimicrobial protection continues to be a priority, the demand for plastics with antimicrobial properties is expected to grow, leading to further innovation and development in the field of antimicrobial additives.

Growing demand for consumer goods

The US has experienced a growing demand for consumer goods across a wide spectrum of products, reflecting the country's robust consumer-driven economy and diverse consumer preferences. A significant catalyst for the expanding consumer goods sector in the United States is the nation's robust economic performance, which is distinguished by elevated wages, minimal unemployment, and general economic stability. These factors have increased consumer confidence and disposable income, leading to higher spending on various goods, including electronics, clothing, household items, and leisure products.

Furthermore, shifts in consumer behavior and technological progress have each contributed significantly to the expansion of the demand for consumer goods. The proliferation of electronic commerce platforms and the emergence of digital marketing have enabled consumers to conveniently access an extensive range of products, thus promoting convenience and enabling purchases to be completed remotely from the comfort of one's residence. The increasing prevalence of e-commerce has additionally stimulated the need for consumer goods, particularly in sectors including electronics, apparel, and home goods.

Consumer goods such as electronics, appliances, automotive parts, and packaging often require specific visual characteristics and surface finishes to appeal to consumers. Plastic additives such as colorants, pigments, and surface modifiers enhance plastics' appearance and tactile qualities, making them more attractive to consumers and meeting market demands for visually appealing products.

Moreover, the demand for consumer goods with improved performance and durability has led to an increased need for plastic additives that enhance plastics' mechanical and functional properties. Additives such as impact modifiers, plasticizers, and stabilizers are used to improve plastics' strength, flexibility, and weatherability, making them suitable for applications where durability and performance are critical. This has been particularly relevant in industries such as automotive, where consumer demand for high-performance, long-lasting products has driven the adoption of advanced plastic additives. Hence, the growing demand for consumer goods will support the market's growth.

Competition Analysis

Numerous prominent companies that are key players in the development, manufacturing, and distribution of a vast array of plastic additives for a variety of industries and applications are located within the US plastic additives market. One of the leading companies in the US plastic additives market is BASF Corporation, a subsidiary of BASF SE, a global chemical company. BASF offers a comprehensive portfolio of plastic additives under its Plastic Additives division, including antioxidants, light stabilizers, processing aids, and flame retardants. Plastics' performance and durability are improved in a variety of industries, including automotive, construction, packaging, and consumer goods, through the use of the company's additives.

Another major player in the US plastic additives market is Dow Inc., a multinational chemical corporation known for its extensive plastic additives and specialty chemicals portfolio. Dow's additives division offers a diverse range of products, including slip agents, antistatic agents, and impact modifiers, designed to improve the processing and performance of plastics in various applications. The company's additives are used in packaging, electronics, and industrial manufacturing.

Clariant AG is also a significant player in the US plastic additives market, providing a wide range of additives and masterbatches for plastics under its Additives business unit. Clariant's additives portfolio includes solutions for coloration, UV protection, flame retardancy, and antimicrobial properties, catering to automotive, healthcare, and consumer goods. The company is known for its focus on sustainability and innovation in developing additives that meet the evolving requirements of the plastics industry.

Other notable companies in the US plastic additives market include ExxonMobil Chemical, a major producer of polymer additives and specialty chemicals used in plastics, and LANXESS Corporation, known for its high-performance additives for engineering plastics and specialty polymers. In addition to the aforementioned firms, the US plastic additives market is characterized by its diversity and intense competition. These companies provide an extensive array of inventive solutions that aim to address the ever-changing demands of the plastics industry.

List of Key Companies Profiled

- BASF SE

- Exxon Mobil Corporation

- Clariant AG

- Kaneka Corporation

- Lanxess AG

- The Dow Chemical Company

- Evonik Industries AG (RAG-Stiftung)

- Songwon Industrial Co., Ltd.

- Nouryon Chemicals Holding B.V. (Carlyle and GIC.)

- Albemarle Corporation

US Plastic Additives Market Report Segmentation

By Plastic Type (Volume, Kilo Tonnes, USD Billion, 2019-2023)

- High-Performance Plastics

- Commodity Plastic

- Engineering Plastic

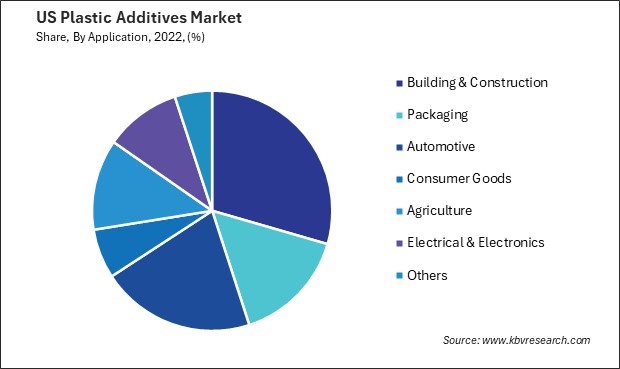

By Application (Volume, Kilo Tonnes, USD Billion, 2019-2023)

- Building & Construction

- Packaging

- Automotive

- Consumer Goods

- Agriculture

- Electrical & Electronics

- Others

By Type (Volume, Kilo Tonnes, USD Billion, 2019-2023)

- Plasticizers

- Flame Retardants

- Impact Modifiers

- Antioxidants

- Lubricants

- Antimicrobials

- UV Stabilizers

- Others

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 US Plastic Additives Market, by Plastic Type

1.4.2 US Plastic Additives Market, by Application

1.4.3 US Plastic Additives Market, by Type

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Opportunities:

2.2.3 Market Restraints

2.2.4 Market Challenges:

2.2.5 Market Trends

Chapter 3. Competition Analysis - Global

3.1 KBV Cardinal Matrix

3.2 Recent Industry Wide Strategic Developments

3.2.1 Partnerships, Collaborations and Agreements

3.2.2 Product Launches and Product Expansions

3.2.3 Acquisition and Mergers

3.3 Top Winning Strategies

3.3.1 Key Leading Strategies: Percentage Distribution (2022-2023)

3.3.2 Key Strategic Move: (Product Launches and Product Expansions: 2020, Jul – 2023, Oct) Leading Players

3.4 Porter Five Forces Analysis

Chapter 4. US Plastic Additives Market

4.1 US Plastic Additives Market by Plastic Type

4.2 US Plastic Additives Market by Application

4.3 US Plastic Additives Market by Type

Chapter 5. Company Profiles – Global Leaders

5.1 BASF SE

5.1.1 Company Overview

5.1.2 Financial Analysis

5.1.3 Segmental and Regional Analysis

5.1.4 Research & Development Expense

5.1.5 Recent strategies and developments:

5.1.5.1 Partnerships, Collaborations, and Agreements:

5.1.5.2 Product Launches and Product Expansions:

5.1.6 SWOT Analysis

5.2 Exxon Mobil Corporation

5.2.1 Company Overview

5.2.2 Financial Analysis

5.2.3 Segmental and Regional Analysis

5.2.4 Research & Development Expenses

5.2.5 Recent strategies and developments:

5.2.5.1 Geographical Expansions:

5.2.6 SWOT Analysis

5.3 Clariant AG

5.3.1 Company Overview

5.3.2 Financial Analysis

5.3.3 Segmental and Regional Analysis

5.3.4 Research & Development Expenses

5.3.5 SWOT Analysis

5.4 Kaneka Corporation

5.4.1 Company Overview

5.4.2 Financial Analysis

5.4.3 Segmental and Regional Analysis

5.4.4 Research & Development Expenses

5.4.5 SWOT Analysis

5.5 Lanxess AG

5.5.1 Company Overview

5.5.2 Financial Analysis

5.5.3 Segmental and Regional Analysis

5.5.4 Research & Development Expenses

5.5.5 Recent strategies and developments:

5.5.5.1 Partnerships, Collaborations, and Agreements:

5.5.5.2 Product Launches and Product Expansions:

5.5.5.3 Acquisition and Mergers:

5.5.6 SWOT Analysis

5.6 The Dow Chemical Company

5.6.1 Company Overview

5.6.2 Financial Analysis

5.6.3 Segmental and Regional Analysis

5.6.4 Research & Development Expenses

5.6.5 SWOT Analysis

5.7 Evonik Industries AG (RAG-Stiftung)

5.7.1 Company Overview

5.7.2 Financial Analysis

5.7.3 Segmental and Regional Analysis

5.7.4 Research & Development Expenses

5.7.5 Recent strategies and developments:

5.7.5.1 Product Launches and Product Expansions:

5.7.6 SWOT Analysis

5.8 Songwon Industrial Co., Ltd.

5.8.1 Company Overview

5.8.2 Financial Analysis

5.8.3 Segmental and Regional Analysis

5.8.4 Research & Development Expenses

5.8.5 Recent strategies and developments:

5.8.5.1 Product Launches and Product Expansions:

5.8.6 SWOT Analysis

5.9 Nouryon Chemicals Holding B.V. (Carlyle and GIC.)

5.9.1 Company Overview

5.9.2 Recent strategies and developments:

5.9.2.1 Acquisition and Mergers:

5.9.3 SWOT Analysis

5.10. Albemarle Corporation

5.10.1 Company Overview

5.10.2 Financial Analysis

5.10.3 Segmental and Regional Analysis

5.10.4 Research & Development Expenses

5.10.5 SWOT Analysis

TABLE 2 US Plastic Additives Market, 2023 - 2030, USD Million

TABLE 3 US Plastic Additives Market, 2019 - 2022, Kilo Tonnes

TABLE 4 US Plastic Additives Market, 2023 - 2030, Kilo Tonnes

TABLE 5 Partnerships, Collaborations and Agreements– Wireless Audio Devices Market

TABLE 6 Product Launches And Product Expansions– Wireless Audio Devices Market

TABLE 7 Acquisition and Mergers– Wireless Audio Devices Market

TABLE 8 US Plastic Additives Market by Plastic Type, 2019 - 2022, USD Million

TABLE 9 US Plastic Additives Market by Plastic Type, 2023 - 2030, USD Million

TABLE 10 US Plastic Additives Market by Plastic Type, 2019 - 2022, Kilo Tonnes

TABLE 11 US Plastic Additives Market by Plastic Type, 2023 - 2030, Kilo Tonnes

TABLE 12 US Plastic Additives Market by Application, 2019 - 2022, USD Million

TABLE 13 US Plastic Additives Market by Application, 2023 - 2030, USD Million

TABLE 14 US Plastic Additives Market by Application, 2019 - 2022, Kilo Tonnes

TABLE 15 US Plastic Additives Market by Application, 2023 - 2030, Kilo Tonnes

TABLE 16 US Plastic Additives Market by Type, 2019 - 2022, USD Million

TABLE 17 US Plastic Additives Market by Type, 2023 - 2030, USD Million

TABLE 18 US Plastic Additives Market by Type, 2019 - 2022, Kilo Tonnes

TABLE 19 US Plastic Additives Market by Type, 2023 - 2030, Kilo Tonnes

TABLE 20 Key Information – BASF SE

TABLE 21 Key Information – Exxon Mobil Corporation

TABLE 22 Key Information – Clariant AG

TABLE 23 Key Information – Kaneka Corporation

TABLE 24 key Information – Lanxess AG

TABLE 25 Key Information – The Dow Chemical Company

TABLE 26 Key Information – Evonik Industries AG

TABLE 27 Key Information – Songwon Industrial Co., Ltd.

TABLE 28 Key Information – Nouryon Chemicals Holding B.V.

TABLE 29 Key Information – Albemarle Corporation

List of Figures

FIG 1 Methodology for the research

FIG 2 US Plastic Additives Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting the Plastic Additives Market

FIG 4 KBV Cardinal Matrix

FIG 5 Key Leading Strategies: Percentage Distribution (2022-2023)

FIG 6 Key Strategic Move: (Product Launches and Product Expansions : 2020, Jul – 2023, Oct) Leading Players

FIG 7 Porter’s Five Forces Analysis – Plastic Additives Market

FIG 8 US Plastic Additives Market share by Plastic Type, 2022

FIG 9 US Plastic Additives Market share by Plastic Type, 2030

FIG 10 US Plastic Additives Market by Plastic Type, 2019 - 2030, USD Million

FIG 11 US Plastic Additives Market share by Application, 2022

FIG 12 US Plastic Additives Market share by Application, 2030

FIG 13 US Plastic Additives Market by Application, 2019 - 2030, USD Million

FIG 14 US Plastic Additives Market share by Type, 2022

FIG 15 US Plastic Additives Market share by Type, 2030

FIG 16 US Plastic Additives Market by Type, 2019 - 2030, USD Million

FIG 17 Recent strategies and developments: BASF SE

FIG 18 SWOT Analysis: BASF SE

FIG 19 SWOT Analysis: Exxon Mobil Corporation

FIG 20 SWOT Analysis: Clariant AG

FIG 21 SWOT Analysis: Kaneka Corporation

FIG 22 Recent strategies and developments: Lanxess AG

FIG 23 SWOT Analysis: Lanxess AG

FIG 24 SWOT Analysis: The Dow Chemical Company

FIG 25 SWOT Analysis: Evonik Industries AG

FIG 26 SWOT Analysis: Songwon Industrial Co., Ltd.

FIG 27 SWOT Analysis: Nouryon Chemicals Holding B.V.

FIG 28 SWOT Analysis: Albemarle Corporation