Int'l : +1(646) 600-5072 | query@kbvresearch.com

Int'l : +1(646) 600-5072 | query@kbvresearch.com

Published Date : 15-May-2024 |

Pages: 74 |

Formats: PDF |

The United States (US) Plastic Optic Fiber Market size is expected to reach $1.4 Billion by 2030, rising at a market growth of 6.8% CAGR during the forecast period.

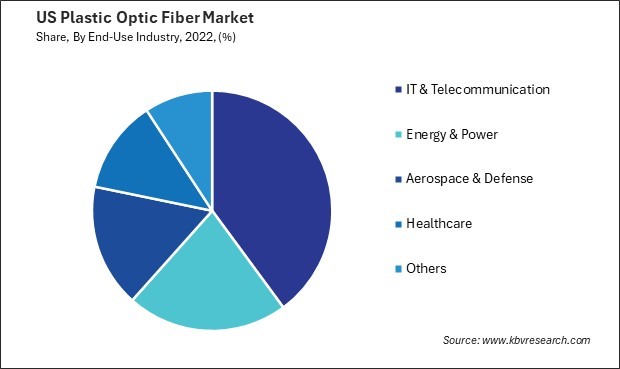

The plastic optic fiber market in the U.S. has witnessed significant growth in recent years, driven by advancements in telecommunications, networking, and data transmission technologies. Telecommunications is one of the primary sectors driving the growth of the plastic optic fiber market in the U.S. With the increasing demand for high-speed internet and data transmission, telecom companies are investing in fiber optic infrastructure to meet the growing bandwidth requirements. Plastic optical fibers offer flexibility, ease of installation, and lower costs than glass fibers, making them an attractive option for last-mile connectivity solutions.

In the automotive industry, plastic fiber optics are used for in-vehicle networking, lighting, and infotainment systems. The demand for lightweight and durable materials in automobiles has led to adopting plastic optical fibers for data transmission and lighting, contributing to the industry's growth.

According to Select US, in 2020, international automakers manufactured 5 million vehicles within the United States. The nation then exported 1.4 million new light vehicles along with 108,754 medium and heavy trucks, amounting to a total value surpassing $52 billion, to over 200 industries globally. Additionally, automotive parts worth $66.7 billion were exported. the automotive industry exports vehicles and parts globally, it indirectly fuels the demand for POF by incorporating these components into exported vehicles.

Moreover, the COVID-19 pandemic impacted the plastic optic fiber market in the U.S. The increased demand for high-speed internet and data connectivity to support remote work, online learning, and telemedicine has boosted the demand for fiber optic infrastructure, including plastic optical fibers. As the economy recovers from the impact of the pandemic, the demand for plastic fiber optics is expected to rebound, supported by the growing need for high-speed data transmission, connectivity, and digitalization across sectors in the U.S.

The plastic optic fiber market is experiencing a significant surge in adoption within the aerospace sector in the United States. One key advantage of POF in aerospace applications is its lightweight nature. Compared to traditional glass optical fibers, POF is much lighter, making it ideal for use in aircraft where weight reduction is critical for fuel efficiency and performance. Additionally, POF is more flexible and resistant to vibration and impact, making it better suited for the harsh environmental conditions encountered in aerospace operations.

According to the International Trade Administration, in the United States, the aerospace sector stands out with its remarkable trade balance, boasting an impressive $77.6 billion surplus in 2019. Additionally, it ranks second in terms of export value, generating $148 billion in exports. As the aerospace industry increasingly adopts plastic optical fiber technology, this trend is expected to further bolster its competitiveness and contribute to its already robust performance.

Another factor driving the adoption of POF in the aerospace sector is its ability to transmit data reliably over long distances. With the increasing complexity of aerospace systems and the growing demand for real-time data transmission, the reliability and performance of communication networks are paramount. POF's low attenuation and high bandwidth capabilities make it an attractive option for transmitting data across various aircraft systems, including avionics, in-flight entertainment, and onboard communications.

Furthermore, advancements in POF technology have led to improvements in data transmission speeds and signal integrity, further enhancing its appeal for aerospace applications. These advancements have been driven by ongoing research and development efforts aimed at optimizing POF materials and manufacturing processes to meet the stringent requirements of the aerospace industry in the U.S. Hence, the surge in adoption of plastic optical fiber (POF) within the aerospace sector in the United States is propelled by its lightweight nature and ongoing technological advancements enhancing its performance for aerospace applications.

The demand for high-speed internet in the United States has experienced a significant surge in recent years. Within networking technologies, plastic optic fiber (POF) has emerged as a promising solution to meet the escalating need for high-speed internet access. POF offers several advantages over traditional copper-based cables, including higher bandwidth capacity, immunity to electromagnetic interference, and ease of installation. These attributes make POF an attractive option for deploying high-speed internet infrastructure, particularly in environments where cost-effectiveness and simplicity are paramount.

One of the key drivers behind the increasing demand for plastic optic fiber market in the U.S. is the ongoing expansion of broadband access initiatives aimed at bridging the digital divide and ensuring equitable access to high-speed internet services across urban, suburban, and rural areas. According to the U.S. Census Bureau, in 2020, approximately 78.1% of individuals in U.S. households are now equipped with high-speed Internet connections, further fueling the need for advanced fiber optic technology. As policymakers and telecommunications companies seek to extend broadband coverage to underserved and unserved communities, deploying POF-based networks presents a viable solution for delivering fast and reliable internet connectivity.

Moreover, the growing adoption of bandwidth-intensive applications and services, such as high-definition video streaming, online gaming, and cloud-based computing, has further heightened the need for robust networking infrastructure to support these demands. POF's ability to deliver high-speed data transmission over longer distances with minimal signal degradation positions it as a compelling option for meeting the requirements of today's data-hungry applications and services. Therefore, the surge in demand for high-speed internet in the United States has propelled plastic optic fiber to the forefront as a promising solution, offering high bandwidth capacity and ease of installation and facilitating expanding broadband access initiatives.

The plastic optic fiber market in the United States has witnessed significant growth in recent years, driven by technological advancements and increasing applications across various industries. One prominent company operating in the U.S. plastic optic fiber market is Timbercon, Inc. Based in Oregon, Timbercon specializes in designing and manufacturing fiber optic products, including plastic optic fiber (POF) cables, connectors, and assemblies. With a focus on quality and reliability, Timbercon has built a strong reputation for delivering customized solutions to meet the diverse needs of its customers across industries such as telecommunications, medical devices, and industrial automation.

Amphenol Fiber Systems International (AFSI) is another key player in the U.S. plastic optic fiber market, specializing in fiber optic connectivity solutions for harsh environments and demanding applications. AFSI offers a comprehensive portfolio of POF products, including connectors, cable assemblies, and interconnect systems, designed to withstand extreme conditions while ensuring high performance and reliability. With a focus on customer-centric innovation, AFSI remains a trusted partner for companies seeking robust POF solutions for aerospace, defense, and industrial applications.

Another major player in the U.S. plastic optic fiber market is Toray Industries, Inc., a global conglomerate with a significant presence in the optical fiber industry. Toray offers a wide range of POF products, including cables, transceivers, and related components, catering to various applications such as automotive networking, home networking, and consumer electronics. Leveraging its expertise in polymer science and manufacturing capabilities, Toray remains at the forefront of POF innovation, driving advancements in performance and reliability.

Mitsubishi Rayon Corporation, a subsidiary of Mitsubishi Chemical Holdings Corporation, is also a notable contributor to the U.S. plastic optic fiber market. With a focus on research and development, Mitsubishi Rayon has developed cutting-edge POF solutions tailored to the needs of emerging applications, including automotive connectivity, sensing systems, and smart home devices. By investing in technology and collaborating with industry partners, Mitsubishi Rayon continues to expand its presence and influence in the plastic optic fiber market. With ongoing advancements in technology and increasing demand for high-speed connectivity, the plastic optic fiber market is poised for further expansion and disruption, presenting opportunities for established players.

By Cable Type

By End-Use Industry