US Polycarbonate Market Size, Share & Trends Analysis Report By Product Type, By Application (Electrical & Electronics, Automotive & Transportation, Construction, Packaging, Consumer Goods, Medical Devices, Optical Media and Others), and Forecast, 2023 - 2030

Published Date : 29-Oct-2024 |

Pages: 77 |

Formats: PDF |

COVID-19 Impact on the Polycarbonate Market

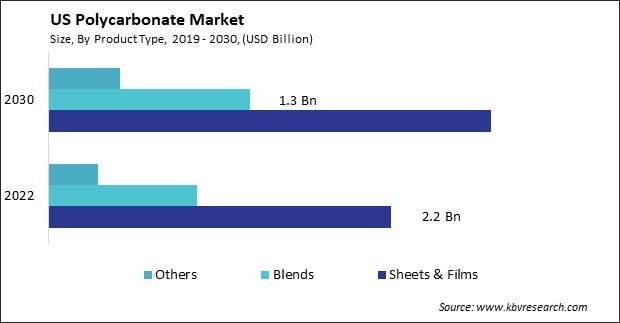

The US Polycarbonate Market size is expected to reach $4.6 Billion by 2030, rising at a market growth of 3.6% CAGR during the forecast period. In the year 2022, the market attained a volume of 1,018.4 Kilo Tonnes, experiencing a growth of 1.6% (2019-2022).

The polycarbonate market in the United States is a dynamic and growing sector driven by diverse applications across various industries. One significant driver of the polycarbonate market in the United States is the automotive sector. Polycarbonate is utilized in automotive components such as headlamps, bumpers, and interior trim. Its lightweight nature and ability to withstand impact contribute to fuel efficiency and enhanced safety standards. With the increasing demand for fuel-efficient vehicles and stringent regulations regarding emissions and safety, the adoption of polycarbonate in automotive applications is expected to continue rising.

According to Select USA, in 2020, international automakers manufactured 5 million vehicles within the United States. During the same period, the country exported 1.4 million new light vehicles and 108,754 medium and heavy trucks, generating a collective value exceeding $52 billion. These vehicles were distributed to over 200 industries globally. Additionally, automotive parts exports from the U.S. were valued at $66.7 billion. This robust automotive industry landscape highlights the significant potential for growth and demand within the polycarbonate market in the United States.

Technological advancements in material processing and manufacturing techniques further support the growth of the polycarbonate market in the United States. Innovations such as multi-layer co-extrusion, nanotechnology, and bio-based polycarbonates are expanding the application possibilities and improving the performance characteristics of polycarbonate materials. Additionally, regulatory initiatives promoting sustainability and reducing environmental impact shape the polycarbonate market.

In the electronics sector, polycarbonate is used to produce electronic housings, touchscreens, and LED lighting. The inherent properties of polycarbonate, including its electrical insulation properties and ability to withstand high temperatures, make it an ideal choice for electronic applications. The proliferation of smartphones, tablets, and other electronic devices has fueled the demand for polycarbonate materials in the U.S.

The COVID-19 pandemic has significantly impacted the polycarbonate market in the United States. While the demand for polycarbonate remained resilient in essential sectors such as healthcare and packaging, the automotive and electronics industries experienced a slowdown due to disruptions in supply chains and reduced consumer spending. Lockdown measures and social distancing protocols led to declining automotive production and consumer electronics sales in the U.S., directly affecting the demand for polycarbonate materials.

Market Trends

Increasing urbanization and infrastructure development projects

Increasing urbanization and infrastructure development projects in the United States have significantly contributed to the growth of the polycarbonate market. One of the primary drivers of the polycarbonate market in the U.S. is the booming construction sector fueled by urbanization. As cities expand and populations grow, there is a surging demand for modern, durable, and aesthetically pleasing infrastructure. Polycarbonate sheets and panels have become a preferred choice for architects and builders in constructing skylights, roofing, facades, and sound barriers in urban environments.

According to the U.S. Census Bureau, construction spending during November 2023 was estimated at a seasonally adjusted annual rate of $2,050.1 billion. The November figure is 11.3 % above the November 2022 estimate of $1,842.2 billion. During the first eleven months of this year, construction spending amounted to $1,817.1 billion, 6.2 % above the $1,711.1 billion for the same period in 2022. This upward trend underscores the robustness of infrastructure investments and urban expansion initiatives, particularly within the polycarbonate sector in the United States.

Moreover, infrastructure development projects, such as transportation hubs, stadiums, and public facilities, increasingly incorporate polycarbonate materials for their construction needs. The lightweight nature of polycarbonate makes it easier to transport and install, thereby reducing construction time and costs. Additionally, its high impact resistance ensures durability, making it suitable for high-traffic areas and structures requiring enhanced safety measures.

The growing awareness regarding sustainability and environmental conservation has further propelled the adoption of polycarbonate in construction. As a result, government regulations and incentives favoring sustainable construction materials have provided a significant boost to the polycarbonate market in the U.S. Thus, the surging demand for durable, lightweight, and eco-friendly construction materials like polycarbonate continues to drive its significant growth within the United States' booming urbanization and infrastructure development landscape.

Rising demand for high-quality polycarbonate materials

In recent years, the polycarbonate market in the United States has witnessed a notable surge in demand for high-quality materials. One significant driver behind the rising demand is the increasing preference for lightweight and durable materials in manufacturing processes. Polycarbonate offers a compelling solution, as it combines strength with flexibility, making it an ideal choice for applications where impact resistance is crucial, such as in automotive components, safety helmets, and protective eyewear.

Moreover, the growing emphasis on sustainability and environmental consciousness has propelled the adoption of polycarbonate, as it is recyclable and can be molded into different shapes and sizes without compromising its mechanical properties. As U.S. consumers become more eco-conscious, manufacturers are pressured to incorporate sustainable materials into their products, fueling the demand for polycarbonate.

Additionally, technological advancements have led to the development of high-performance polycarbonate formulations with enhanced properties, including improved heat resistance, UV stability, and flame retardancy. These innovations have expanded the scope of applications for polycarbonate materials, driving demand across various sectors. Therefore, the surge in demand for high-quality polycarbonate in the United States is attributed to its strength, flexibility, recyclability, and continuous technological advancements, meeting the evolving needs of diverse industries.

Competition Analysis

The polycarbonate market in the United States is growing in the larger plastics industry. One of the leading companies in the U.S. polycarbonate market is Sabic Innovative Plastics. Sabic is a global leader in producing polycarbonate resins and compounds, offering a diverse portfolio of products tailored to meet the specific needs of various industries, including automotive, electronics, construction, and consumer goods. With state-of-the-art manufacturing facilities and a strong focus on research and development, Sabic continues to drive innovation and sustainability within the polycarbonate market.

Another key player in the U.S. polycarbonate market is Covestro AG, formerly Bayer MaterialScience. Covestro is a major producer of polycarbonate resins and sheets, serving a wide range of industries with high-performance materials designed for durability, aesthetics, and functionality. The company's commitment to sustainability and technological advancement has positioned it as a trusted partner for customers seeking innovative polycarbonate solutions.

BASF Corporation is also a significant player in the U.S. polycarbonate market, offering a diverse portfolio of polycarbonate resins and blends under its engineering plastics division. Leveraging its expertise in material science and manufacturing, BASF provides tailored solutions for applications such as automotive components, electrical and electronics, and consumer goods, contributing to the growth and advancement of the polycarbonate industry in the U.S.

In addition to these major players, several other companies contribute to the competitiveness and innovation of the U.S. polycarbonate market. These include Mitsubishi Engineering-Plastics Corporation, Teijin Limited, and LG Chem. Each company brings its unique strengths and capabilities to the industry, driving technological advancements, expanding product offerings, and enhancing customer satisfaction.

Hence, the U.S. polycarbonate market is poised for continued growth and innovation, driven by the collective efforts of leading companies and the broader plastics industry. Through collaboration, technological advancements, and a commitment to sustainability, these companies are shaping the future of polycarbonate materials and their applications in diverse sectors, contributing to economic growth and societal advancement.

List of Key Companies Profiled

- Covestro AG

- SABIC (Saudi Arabian Oil Company)

- LOTTE Chemical Corporation (LOTTE Corp.)

- Teijin Limited

- Trinseo PLC

- Idemitsu Kosan Co., Ltd.

- LG Chem Ltd. (LG Corporation)

- RTP Company, Inc.

- CHIMEI Corporation

- Lone Star Chemical

Polycarbonate Market Report Segmentation

By Product Type

- Sheets & Films

- Blends

- Others

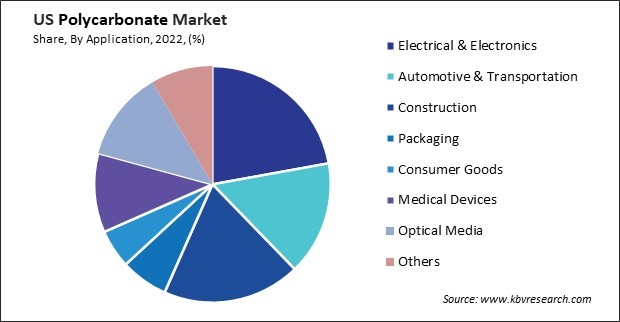

By Application

- Electrical & Electronics

- Automotive & Transportation

- Construction

- Packaging

- Consumer Goods

- Medical Devices

- Optical Media

- Others

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 US Polycarbonate Market, by Product Type

1.4.2 US Polycarbonate Market, by Application

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

2.2.3 Market Opportunities

2.2.4 Market Challenges

2.2.5 Market Trends

2.3 Porter’s Five Forces Analysis

Chapter 3. Strategies Deployed in Polycarbonate Market

Chapter 4. US Polycarbonate Market

4.1 US Polycarbonate Market, by Product Type

4.2 US Polycarbonate Market, by Application

Chapter 5. Company Profiles – Global Leaders

5.1 Covestro AG

5.1.1 Company Overview

5.1.2 Financial Analysis

5.1.3 Segmental and Regional Analysis

5.1.4 Research & Development Expenses

5.1.5 Recent strategies and developments:

5.1.5.1 Geographical Expansions:

5.1.6 SWOT Analysis

5.2 SABIC (Saudi Arabian Oil Company)

5.2.1 Company Overview

5.2.2 Financial Analysis

5.2.3 Segmental and Regional Analysis

5.2.4 Recent strategies and developments:

5.2.4.1 Product Launches and Product Expansions:

5.2.5 SWOT Analysis

5.3 LOTTE Chemical Corporation (LOTTE Corp.)

5.3.1 Company Overview

5.3.2 Financial Analysis

5.3.3 Segmental and Regional Analysis

5.3.4 Research & Development Expenses

5.3.5 Recent strategies and developments:

5.3.5.1 Product Launches and Product Expansions:

5.3.6 SWOT Analysis

5.4 Teijin Limited

5.4.1 Company Overview

5.4.2 Financial Analysis

5.4.3 Segmental and Regional Analysis

5.4.4 Research & Development Expenses

5.4.5 SWOT Analysis

5.5 Trinseo PLC

5.5.1 Company Overview

5.5.2 Financial Analysis

5.5.3 Segmental and Regional Analysis

5.5.4 Research & Development Expenses

5.5.5 Recent strategies and developments:

5.5.5.1 Geographical Expansions:

5.5.6 SWOT Analysis

5.6 Idemitsu Kosan Co., Ltd.

5.6.1 Company Overview

5.6.2 Financial Analysis

5.6.3 Segmental and Regional Analysis

5.6.4 Research & Development Expenses

5.6.5 SWOT Analysis

5.7 LG Chem Ltd. (LG Corporation)

5.7.1 Company Overview

5.7.2 Financial Analysis

5.7.3 Segmental and Regional Analysis

5.7.4 Recent strategies and developments:

5.7.4.1 Product Launches and Product Expansions:

5.7.5 SWOT Analysis

5.8 RTP Company, Inc.

5.8.1 Company Overview

5.8.2 SWOT Analysis

5.9 CHIMEI Corporation

5.9.1 Company Overview

5.10. Lone Star Chemical

5.10.1 Company Overview

TABLE 2 US Polycarbonate Market, 2023 - 2030, USD Million

TABLE 3 US Polycarbonate Market, 2019 - 2022, Kilo Tonnes

TABLE 4 US Polycarbonate Market, 2023 - 2030, Kilo Tonnes

TABLE 5 US Polycarbonate Market, by Product Type, 2019 - 2022, USD Million

TABLE 6 US Polycarbonate Market, by Product Type, 2023 - 2030, USD Million

TABLE 7 US Polycarbonate Market, by Product Type, 2019 - 2022, Kilo Tonnes

TABLE 8 US Polycarbonate Market, by Product Type, 2023 - 2030, Kilo Tonnes

TABLE 9 US Polycarbonate Market, by Application, 2019 - 2022, USD Million

TABLE 10 US Polycarbonate Market, by Application, 2023 - 2030, USD Million

TABLE 11 US Polycarbonate Market, by Application, 2019 - 2022, Kilo Tonnes

TABLE 12 US Polycarbonate Market, by Application, 2023 - 2030, Kilo Tonnes

TABLE 13 key information – Covestro AG

TABLE 14 Key Information – SABIC

TABLE 15 Key Information – Lotte Chemical Corporation

TABLE 16 Key Information – Teijin Limited

TABLE 17 Key Information – Trinseo PLC

TABLE 18 Key Information – Idemitsu Kosan Co., Ltd.

TABLE 19 key information – LG Chem Ltd.

TABLE 20 Key Information – RTP Company, Inc.

TABLE 21 Key Information – CHIMEI Corporation

TABLE 22 Key Information – Lone Star Chemical

List of Figures

FIG 1 Methodology for the research

FIG 2 US Polycarbonate Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting Polycarbonate Market

FIG 5 US Polycarbonate Market share, by Product Type, 2022

FIG 4 Porter’s Five Forces Analysis - Polycarbonate Market

FIG 6 US Polycarbonate Market share, by Product Type, 2030

FIG 7 US Polycarbonate Market, by Product Type, 2019 - 2030, USD Million

FIG 8 US Polycarbonate Market share, by Application, 2022

FIG 9 US Polycarbonate Market share, by Application, 2030

FIG 10 US Polycarbonate Market, by Application, 2019 - 2030, USD Million

FIG 11 SWOT Analysis: Covestro AG

FIG 12 SWOT Analysis: SABIC

FIG 13 SWOT Analysis: LOTTE Chemical Corporation

FIG 14 SWOT Analysis: Teijin Limited

FIG 15 SWOT Analysis: Trinseo PLC

FIG 16 Swot Analysis: Idemitsu Kosan Co., Ltd.

FIG 17 Swot Analysis: LG Chem Ltd.

FIG 18 Swot Analysis: RTP Company, Inc.