USA Polyester Fiber Market Size, Share & Trends Analysis Report By Form (Solid, and Hollow), By Grade, By Product Type (Polyester Staple Fiber (PSF), and Polyester Filament Yarn (PFY)), By Application, Outlook and Forecast, 2023 - 2030

Published Date : 26-Mar-2024 |

Pages: 78 |

Formats: PDF |

COVID-19 Impact on the US Polyester Fiber Market

The Polyester Fiber Market size is expected to reach $24.3 billion by 2030, rising at a market growth of 6.5% CAGR during the forecast period. In the year 2022, the market attained a volume of 10,920.6 Kilo Tonnes units, experiencing a growth of 5.8% (2019-2022).

The polyester fiber market in the United States has witnessed significant growth and evolution over the years, driven by various factors such as the increasing demand for textiles, apparel, and non-woven products. The non-woven sector also plays a crucial role in the growth of the polyester fiber market. Non-woven fabrics made from polyester fibers in the U.S. are used in various applications, including automotive interiors, geotextiles, filtration, and hygiene products. The automotive industry, in particular, has witnessed a surge in the use of polyester fibers in the production of interior components, such as carpets, seat fabrics, and insulation materials, due to their durability and resistance to wear and tear.

Innovation in manufacturing processes has contributed to the growth of the polyester fiber market. Advanced production techniques have enhanced the quality and performance of polyester fibers, making them more appealing to end-users. Additionally, research and development efforts have focused on creating specialty polyester fibers with specific attributes, such as flame resistance, UV resistance, and moisture-wicking properties, catering to diverse industry needs.

Trade dynamics also influence the polyester fiber market in the U.S. The country is a significant producer and consumer of polyester fibers, with domestic manufacturers catering to the growing industry demand. Global trade partnerships and agreements impact the import and export of polyester fibers, contributing to industry fluctuations and shaping the competitive landscape.

Market Trends

Increasing Usage in The Textile And Apparel Industry

The textiles and apparel industry in the United States has witnessed a significant impact from the polyester fiber market, contributing to the dynamic landscape of the sector. Polyester, a synthetic fiber known for its versatility and cost-effectiveness, has become a cornerstone in the U.S. textile and apparel industry. One of the key factors driving the dominance of polyester in the U.S. is its widespread use in the production of clothing and textiles. Polyester fibers offer various advantages, including durability, wrinkle resistance, and ease of care, making them a preferred choice for manufacturers and consumers. The textile industry has embraced polyester for its ability to mimic natural fibers while providing enhanced performance and affordability.

According to Select USA, as of September 2020, the U.S. textile and apparel industry is prominent in the manufacturing sector. With an export value reaching $23 billion in 2019, the United States is one of the global leading industry. The domestic garment industry in the U.S. was valued at $311 billion in the same year, underscoring its substantial influence. This highlights the integral role of polyester in meeting the demand for versatile and durable textiles within the country.

Specifically delving into the polyester fiber market within the United States, it is noteworthy that the textile and apparel industry significantly contributes to its overall strength. Therefore, the pervasive influence of the polyester fiber market has significantly shaped the U.S. textiles and apparel industry, offering a versatile and cost-effective solution.

Surge In Demand for Recyclable Polyester Fiber

In recent years, the United States has witnessed a remarkable surge in the demand for the recyclable polyester fiber market, driven by a growing awareness of environmental sustainability and a shift towards eco-friendly practices. This trend is particularly evident in various industries, including textiles, fashion, and home furnishings, where consumers increasingly prioritize products with lower environmental footprints. The textile industry in the U.S. has been a major contributor to this heightened demand for recyclable polyester fiber. As consumers become more conscious of the environmental impact of their clothing choices, there has been a notable increase in the preference for sustainable and recycled materials.

Fashion brands and retailers nationwide are increasingly incorporating recyclable polyester fiber into their product lines to meet the evolving preferences of environmentally conscious consumers. This shift is driven by consumer demand and a strategic commitment to corporate social responsibility and sustainable business practices. The construction and automotive sectors in the U.S. are also contributing to the uptick in demand for recyclable polyester fiber. With a focus on reducing carbon footprints and promoting circular economy principles, these industries are incorporating sustainable materials into their products, driving the adoption of recyclable polyester fiber in various applications.

Moreover, the U.S. government's initiatives and policies promoting sustainable practices have fueled the demand for recyclable polyester fiber market. Incentives for businesses adopting eco-friendly manufacturing processes and implementing stringent environmental regulations have prompted companies to explore and invest in sustainable materials, including recyclable polyester. Thus, this trend is reshaping various sectors, from textiles and fashion to construction and automotive, as businesses prioritize recyclable materials to meet consumer expectations and regulatory standards.

Competition Analysis

The polyester fiber market in the United States has witnessed substantial growth, driven by the versatile applications of polyester fibers in textiles, automotive, and construction industries. DuPont de Nemours Inc. is a major player in the polyester fiber market in the United States. The company produces a variety of polyester fibers under the brand name Dacron. DuPont's polyester fibers find applications in apparel, home furnishings, and industrial products. The company's commitment to innovation and sustainability has contributed to its leadership position in the U.S. polyester fiber market.

Indorama Ventures, with a significant presence in the U.S., is a global leader in the production of polyester fibers and yarns. The company offers a diverse range of polyester products, including staple fibers used in apparel, non-woven applications, and home textiles. Indorama Ventures' strategic acquisitions have strengthened its position in the polyester industry, making it a key player in the U.S. polyester fiber market.

Reliance Industries Ltd. has a substantial footprint in the U.S. polyester fiber market through its global operations. The company produces a wide range of polyester products, including fibers used in apparel, home textiles, and industrial applications. Reliance Industries' commitment to sustainability and technological innovation has positioned it as a prominent player in the polyester fiber market.

Sinopec Yizheng, a subsidiary of China Petroleum & Chemical Corporation (Sinopec), is a key player in the global polyester fiber market, including the U.S. The company produces a wide range of polyester fibers for textiles, apparel, and industrial applications. Sinopec Yizheng's global presence and production capabilities contribute to its influence in the U.S. industry. These companies play a crucial role in meeting the growing demand for polyester fibers across various industries, contributing to the industry's expansion and development.

List of Key Companies Profiled

- Reliance Industries Limited

- Toray Industries, Inc.

- Sinopec Group (China Petrochemical Corporation)

- The Bombay Dyeing & Manufacturing Company Ltd. (Wadia Group)

- Indorama Ventures Public Company Limited (Indorama Resources Ltd.)

- Green Group SA

- W. R. Grace & Co. (Standard Industries)

- Märkische Faser GmbH

- Stein Fibers Ltd.

- Nan Ya Plastics Corp. (NPC)

US Polyester Fiber Market Report Segmentation

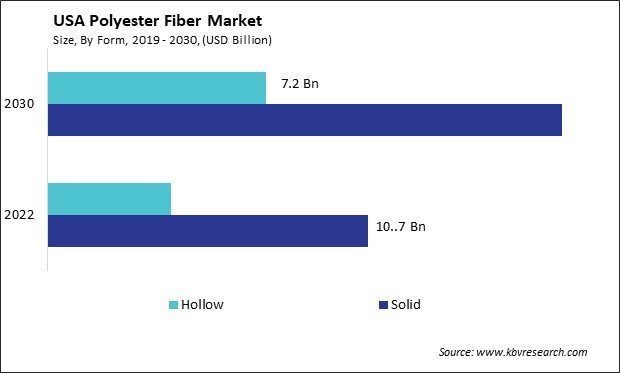

By Form

- Solid

- Hollow

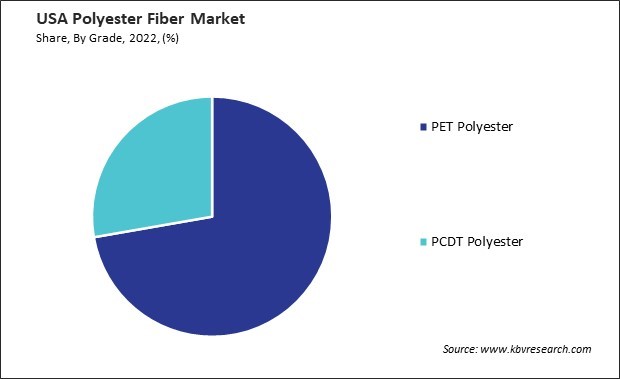

By Grade

- PET Polyester

- PCDT Polyester

By Product Type

- Polyester Staple Fiber (PSF)

- Polyester Filament Yarn (PFY)

By Application

- Textile & Apparel

- Automotive & Transportation

- Home Furnishing

- Industrial

- Others

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 USA Polyester Fiber Market, by Form

1.4.2 USA Polyester Fiber Market, by Grade

1.4.3 USA Polyester Fiber Market, by Product Type

1.4.4 USA Polyester Fiber Market, by Application

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Opportunities

2.2.3 Market Restraints

2.2.4 Market Challenges

2.3 Porter Five Forces Analysis

Chapter 3. US Polyester Fiber Market

3.1 US Polyester Fiber Market, By Form

3.2 US Polyester Fiber Market, By Grade

3.3 US Polyester Fiber Market, By Product Type

3.4 US Polyester Fiber Market, By Application

Chapter 4. Company Profiles – Global Leaders

4.1 Reliance Industries Limited

4.1.1 Company Overview

4.1.2 Financial Analysis

4.1.3 Segmental Analysis

4.1.4 Research & Development Expenses

4.1.5 Recent strategies and developments:

4.1.5.1 Acquisition and Mergers:

4.1.6 SWOT Analysis

4.2 Toray Industries, Inc.

4.2.1 Company Overview

4.2.2 Financial Analysis

4.2.3 Segmental and Regional Analysis

4.2.4 Research & Development Expense

4.2.5 SWOT Analysis

4.3 Sinopec Group (China Petrochemical Corporation)

4.3.1 Company Overview

4.3.2 Financial Analysis

4.3.3 Research & Development Expenses

4.3.4 SWOT Analysis

4.4 The Bombay Dyeing & Manufacturing Company Ltd. (Wadia Group)

4.4.1 Company Overview

4.4.2 Financial Analysis

4.4.3 Segmental and Regional Analysis

4.4.4 SWOT Analysis

4.5 Indorama Ventures Public Company Limited (Indorama Resources Ltd.)

4.5.1 Company Overview

4.5.2 Financial Analysis

4.5.3 Recent strategies and developments:

4.5.3.1 Partnerships, Collaborations, and Agreements:

4.5.3.2 Acquisition and Mergers:

4.5.4 SWOT Analysis

4.6 Green Group SA.

4.6.1 Company Overview

4.6.2 Recent strategies and developments:

4.6.2.1 Acquisition and Mergers:

4.6.3 SWOT Analysis

4.7 W. R. Grace & Co. (Standard Industries)

4.7.1 Company Overview

4.7.2 SWOT Analysis

4.8 Märkische Faser GmbH

4.8.1 Company Overview

4.8.2 SWOT Analysis

4.9 Stein Fibers Ltd.

4.9.1 Company Overview

4.9.2 Recent strategies and developments:

4.9.2.1 Acquisition and Mergers:

4.9.3 SWOT Analysis

4.10. Nan Ya Plastics Corp. (NPC)

4.10.1 Company Overview

4.10.2 Financial Analysis

4.10.3 Segmental and Regional Analysis

4.10.4 SWOT Analysis

TABLE 2 US Polyester Fiber Market, 2023 - 2030, USD Million

TABLE 3 US Polyester Fiber Market, 2019 - 2022, Kilo Tonnes

TABLE 4 US Polyester Fiber Market, 2023 - 2030, Kilo Tonnes

TABLE 5 US Polyester Fiber Market, By Form, 2019 - 2022, USD Million

TABLE 6 US Polyester Fiber Market, By Form, 2023 - 2030, USD Million

TABLE 7 US Polyester Fiber Market, By Form, 2019 - 2022, Kilo Tonnes

TABLE 8 US Polyester Fiber Market, By Form, 2023 - 2030, Kilo Tonnes

TABLE 9 US Polyester Fiber Market, By Grade, 2019 - 2022, USD Million

TABLE 10 US Polyester Fiber Market, By Grade, 2023 - 2030, USD Million

TABLE 11 US Polyester Fiber Market, By Grade, 2019 - 2022, Kilo Tonnes

TABLE 12 US Polyester Fiber Market, By Grade, 2023 - 2030, Kilo Tonnes

TABLE 13 US Polyester Fiber Market, By Product Type, 2019 - 2022, USD Million

TABLE 14 US Polyester Fiber Market, By Product Type, 2023 - 2030, USD Million

TABLE 15 US Polyester Fiber Market, By Product Type, 2019 - 2022, Kilo Tonnes

TABLE 16 US Polyester Fiber Market, By Product Type, 2023 - 2030, Kilo Tonnes

TABLE 17 US Polyester Fiber Market, By Application, 2019 - 2022, USD Million

TABLE 18 US Polyester Fiber Market, By Application, 2023 - 2030, USD Million

TABLE 19 US Polyester Fiber Market, By Application, 2019 - 2022, Kilo Tonnes

TABLE 20 US Polyester Fiber Market, By Application, 2023 - 2030, Kilo Tonnes

TABLE 21 Key Information – Reliance Industries Limited

TABLE 22 Key Information – Toray Industries, Inc.

TABLE 23 Key Information – Sinopec Group

TABLE 24 key information – The Bombay Dyeing & Manufacturing Company Ltd.

TABLE 25 Key Information – Indorama Ventures Public Company Limited

TABLE 26 Key Information – Green Group SA.

TABLE 27 Key Information – W. R. Grace & Co.

TABLE 28 Key Information – Märkische Faser GmbH

TABLE 29 Key Information – Stein Fibers Ltd.

TABLE 30 Key Information – Nan Ya Plastics Corp. (NPC)

List of Figures

FIG 1 Methodology for the research

FIG 2 US Polyester Fiber Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting Polyester Fiber Market

FIG 4 Porter’s Five Forces Analysis – Polyester Fiber Market

FIG 5 US Polyester Fiber Market Share, By Form, 2022

FIG 6 US Polyester Fiber Market Share, By Form, 2030

FIG 7 US Polyester Fiber Market, By Form, 2019 - 2030, USD Million

FIG 8 US Polyester Fiber Market Share, By Grade, 2022

FIG 9 US Polyester Fiber Market Share, By Grade, 2030

FIG 10 US Polyester Fiber Market, By Grade, 2019 - 2030, USD Million

FIG 11 US Polyester Fiber Market Share, By Product Type, 2022

FIG 12 US Polyester Fiber Market Share, By Product Type, 2030

FIG 13 US Polyester Fiber Market, By Product Type, 2019 - 2030, USD Million

FIG 14 US Polyester Fiber Market Share, By Application, 2022

FIG 15 US Polyester Fiber Market Share, By Application, 2022

FIG 16 US Polyester Fiber Market, By Application, 2019 - 2030, USD Million

FIG 17 SWOT Analysis: Reliance Industries Limited

FIG 18 SWOT Analysis: Toray Industries, Inc.

FIG 19 Swot Analysis: China Petrochemical Corporation

FIG 20 Swot Analysis: The Bombay Dyeing & Manufacturing Company Ltd.

FIG 21 Recent strategies and developments: Indorama Ventures Public Company Limited

FIG 22 Swot Analysis: Indorama Ventures Public Company Limited

FIG 23 Swot Analysis: Green Group SA.

FIG 24 Swot Analysis: W. R. Grace & Co.

FIG 25 Swot Analysis: Märkische Faser GmbH

FIG 26 Swot Analysis: Stein Fibers Ltd.

FIG 27 Swot Analysis: Nan Ya Plastics Corp. (NPC)