US Polyisobutene Market Size, Share & Trends Analysis Report By Molecular Weight Type, By Application (Lubricant Additives, Adhesives & Sealants, Automotive Rubber Components, Fuel Additives, and Others), and Forecast, 2023 - 2030

Published Date : 16-May-2024 |

Pages: 79 |

Formats: PDF |

COVID-19 Impact on the US Polyisobutene Market

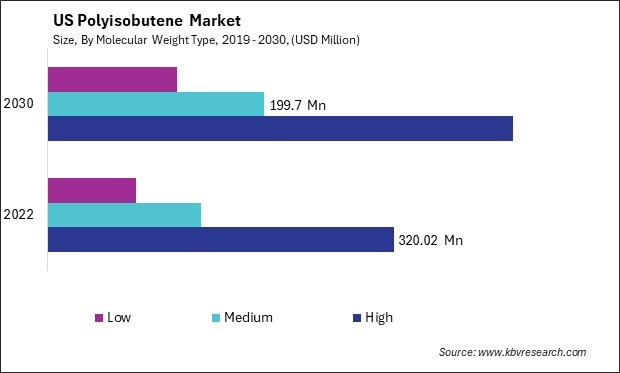

The United States (US) Polyisobutene Market size is expected to reach $749.33 Million by 2030, rising at a market growth of 4.2% CAGR during the forecast period. In the year 2022, the market attained a volume of 218.54 Kilo Tonnes, experiencing a growth of 3.6% (2019-2022).

The polyisobutene market in the United States has experienced significant growth and evolution in recent years, driven by various factors, including increasing demand from various end-use industries, technological advancements, and shifting consumer preferences. One of the primary drivers of the polyisobutene market in the U.S. is its widespread usage in producing lubricants and fuel additives. With the automotive industry witnessing steady growth and increasing emphasis on fuel economy and emissions reduction, the demand for high-performance lubricants and fuel additives containing polyisobutene is expected to remain robust.

Moreover, the pharmaceutical and personal care sectors also contribute to the demand for polyisobutene in the U.S. In the personal care industry, it is a key ingredient in cosmetics, skincare products, and hair care formulations due to its moisturizing and emollient properties. As Americans increasingly prioritize health, wellness, and sustainability, the demand for innovative and high-quality products containing polyisobutene is expected to rise.

According to the Pharmaceutical Research and Manufacturers Association (PhRMA), in 2019, foreign direct investment in pharmaceuticals and medicines totaled $511.3 billion. As investment continues to shape the pharmaceutical landscape, attention to supporting industries such as polyisobutene remains essential for sustaining innovation and progress in the healthcare industry.

The COVID-19 pandemic significantly impacted the polyisobutene market in the U.S. The pandemic-induced lockdowns and restrictions led to disruptions in the supply chain and manufacturing operations across various industries. As a result, the demand for polyisobutene witnessed a temporary slowdown during the initial phases of the pandemic. However, with the gradual reopening of economies and the resumption of industrial activities, the industry began to recover.

Moreover, the pandemic also brought about shifts in consumer behavior and preferences, leading to changes in the demand dynamics for certain end-use applications of polyisobutene. For instance, there was a surge in the demand for personal care and hygiene products, such as hand sanitizers and disinfectants, which contain PIB as an ingredient. On the other hand, the automotive sector experienced a downturn initially due to lower vehicle sales and production, affecting the demand for PIB-based lubricants and additives.

Market Trends

Expansion of the construction industry

The construction industry in the United States has witnessed significant growth in recent years, driving demand for various materials and products. One of the primary applications of polyisobutene in the construction sector is sealants and adhesives. These materials are crucial for bonding various building components, providing airtight and watertight seals, and enhancing structural integrity. As construction activities continue to surge across residential, commercial, and infrastructure projects in the U.S., the demand for sealants and adhesives incorporating polyisobutene has risen correspondingly.

According to the U.S. Census Bureau, construction spending during November 2023 was estimated at a seasonally adjusted annual rate of $2,050.1 billion, 0.4 % above the revised October estimate of $2,042.5 billion. This substantial growth reflects an impressive 11.3% rise compared to November 2022, when construction spending stood at $1,842.2 billion. As construction activities continue to flourish, the demand for materials such as polyisobutene, essential in various construction applications like sealants, adhesives, and insulation, is poised to rise. With the construction industry's upward trajectory, the polyisobutene market in the U.S. is expected to experience considerable growth and development in the coming months.

Furthermore, the expansion of the construction industry has spurred innovation in materials and technologies, leading to the development of advanced polyisobutene-based products tailored to meet evolving construction requirements. Manufacturers in the U.S. are investing in research and development to enhance the performance characteristics of polyisobutene and to explore new applications in areas such as insulation, flooring, and roofing materials. Therefore, the flourishing construction industry in the United States is driving significant demand for polyisobutene-based sealants and adhesives, poised for further growth and innovation.

Rising adoption of high molecular weight polyisobutene

The polyisobutene market in the United States is experiencing a notable surge in adopting high molecular weight variants, signaling a significant shift in the industry landscape. One of the primary drivers behind the rising adoption of high molecular weight polyisobutene is its enhanced performance compared to its lower molecular weight counterparts. High molecular weight polyisobutene exhibits superior tensile strength, viscosity, and elasticity, making it particularly suitable for demanding applications where durability and longevity are critical factors.

In the automotive sector, high molecular weight polyisobutene is increasingly used in the U.S. to produce tires, sealants, and adhesives. Moreover, advancements in polymer technology and an increased focus on research and development have led to improved production processes for high molecular weight polyisobutene, making it more accessible and cost-effective for a wider range of applications.

Additionally, the increasing emphasis on sustainability and environmental regulations is driving the adoption of high molecular weight polyisobutene as a viable alternative to traditional petrochemical-based polymers. With its ability to be recycled and its lower environmental impact during production and disposal, high molecular weight polyisobutene aligns with the growing sustainability goals of many industries. Hence, the surge in the adoption of high molecular weight polyisobutene in the United States reflects its superior performance attributes, particularly in demanding applications like automotive manufacturing, while also meeting the increasing emphasis on sustainability and environmental regulations.

Competition Analysis

The polyisobutene market in the United States is a significant segment within the broader petrochemical industry, playing a crucial role in various sectors such as automotive, construction, and healthcare. One of the prominent players in the U.S. polyisobutene market is ExxonMobil Corporation, a multinational energy corporation with a significant presence in the petrochemical sector. ExxonMobil produces polyisobutene through its proprietary technologies and operates manufacturing facilities across the United States. The company's extensive research and development efforts focus on enhancing the properties of polyisobutene to meet the evolving demands of various industries, including automotive lubricants, adhesives, and sealants.

Another key player in the U.S. polyisobutene market is BASF SE, a leading chemical company that offers a wide range of polyisobutene-based products and solutions. BASF's portfolio includes high-performance polyisobutene grades tailored to specific applications such as fuel and lubricant additives, elastomers, and personal care products. The company's advanced manufacturing capabilities and commitment to sustainability contribute to its competitive position in the U.S.

Chevron Phillips Chemical Company LP is also a significant contributor to the polyisobutene market in the United States. The company produces polyisobutene through its proprietary technologies and supplies various grades of the polymer to customers across industries. Chevron Phillips Chemical's focus on product innovation and customer collaboration strengthens its position as a preferred supplier of polyisobutene in the U.S., supporting applications ranging from adhesives and coatings to pharmaceuticals.

Additionally, Lanxess AG is a notable player in the U.S. polyisobutene market, offering a diverse portfolio of specialty chemicals, including polyisobutene-based products. The company's high-performance polyisobutene grades find applications in lubricants, fuel additives, and industrial coatings, catering to the evolving needs of customers in the United States. Lanxess' commitment to quality and technological excellence reinforces its reputation as a trusted supplier in the polyisobutene market. With a focus on innovation, quality, and sustainability, these companies play a vital role in driving the growth and evolution of the polyisobutene market, meeting customers' demands, and contributing to the overall competitiveness of the U.S. petrochemical industry.

List of Key Companies Profiled

- Lanxess AG

- BASF SE

- Berkshire Hathaway, Inc. (International Dairy Queen Inc.)

- Reliance Industries Limited

- INEOS Group Holdings S.A.

- Braskem S.A. (Odebrecht S.A)

- ENEOS Corporation (Eneos Holdings)

- Exxon Mobil Corporation

- Chevron Oronite Company LLC

- TPC Group

US Polyisobutene Market Report Segmentation

By Molecular Weight Type

- High

- Medium

- Low

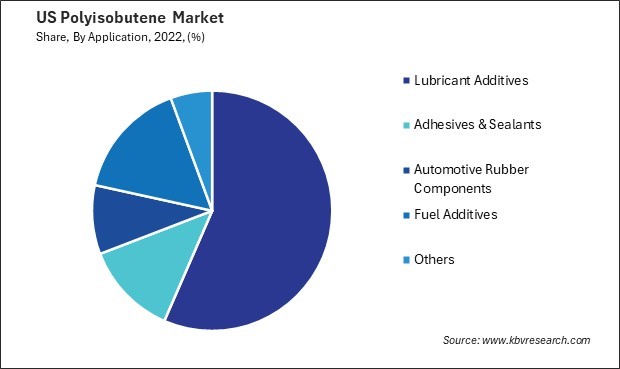

By Application

- Lubricant Additives

- Adhesives & Sealants

- Automotive Rubber Components

- Fuel Additives

- Others

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 US Polyisobutene Market, by Molecular Weight Type

1.4.2 US Polyisobutene Market, by Application

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

2.2.3 Market Opportunities

2.2.4 Market Challenges

2.2.5 Market Trends

2.3 Porter’s Five Forces Analysis

Chapter 3. US Polyisobutene Market

3.1 US Polyisobutene Market by Molecular Weight Type

3.2 US Polyisobutene Market by Application

Chapter 4. Company Profiles – Global Leaders

4.1 Lanxess AG

4.1.1 Company Overview

4.1.2 Financial Analysis

4.1.3 Segmental and Regional Analysis

4.1.4 Research & Development Expenses

4.1.5 SWOT Analysis

4.2 BASF SE

4.2.1 Company Overview

4.2.2 Financial Analysis

4.2.3 Segmental and Regional Analysis

4.2.4 Research & Development Expense

4.2.5 Recent strategies and developments:

4.2.5.1 Partnerships, Collaborations, and Agreements:

4.2.5.2 Product Launches and Product Expansions:

4.2.6 SWOT Analysis

4.3 Berkshire Hathaway, Inc. (International Dairy Queen Inc.)

4.3.1 Company Overview

4.3.2 Financial Analysis

4.3.3 Segmental and Regional Analysis

4.3.4 SWOT Analysis

4.4 Reliance Industries Limited

4.4.1 Company Overview

4.4.2 Financial Analysis

4.4.3 Segmental Analysis

4.4.4 Research & Development Expenses

4.4.5 SWOT Analysis

4.5 INEOS Group Holdings S.A.

4.5.1 Company Overview

4.5.2 Financial Analysis

4.5.3 Segmental and Regional Analysis

4.5.4 SWOT Analysis

4.6 Braskem S.A. (Odebrecht S.A)

4.6.1 Company Overview

4.6.2 Financial Analysis

4.6.3 Segmental Analysis

4.6.4 Research & Development Expenses

4.6.5 SWOT Analysis

4.7 ENEOS Corporation (Eneos Holdings)

4.7.1 Company Overview

4.7.2 Financial Analysis

4.7.3 Segmental and Regional Analysis

4.7.4 Research & Development Expenses

4.7.5 SWOT Analysis

4.8 Exxon Mobil Corporation

4.8.1 Company Overview

4.8.2 Financial Analysis

4.8.3 Segmental and Regional Analysis

4.8.4 Research & Development Expenses

4.8.5 SWOT Analysis

4.9 Chevron Oronite Company LLC

4.9.1 Company Overview

4.9.2 SWOT Analysis

4.10. TPC Group

4.10.1 Company Overview

4.10.2 SWOT Analysis

TABLE 2 US Polyisobutene Market, 2023 - 2030, USD Million

TABLE 3 US Polyisobutene Market, 2019 - 2022, Kilo Tonnes

TABLE 4 US Polyisobutene Market, 2023 - 2030, Kilo Tonnes

TABLE 5 US Polyisobutene Market by Molecular Weight Type, 2019 - 2022, USD Million

TABLE 6 US Polyisobutene Market by Molecular Weight Type, 2023 - 2030, USD Million

TABLE 7 US Polyisobutene Market by Molecular Weight Type, 2019 - 2022, Kilo Tonnes

TABLE 8 US Polyisobutene Market by Molecular Weight Type, 2023 - 2030, Kilo Tonnes

TABLE 9 US Polyisobutene Market by Application, 2019 - 2022, USD Million

TABLE 10 US Polyisobutene Market by Application, 2023 - 2030, USD Million

TABLE 11 US Polyisobutene Market by Application, 2019 - 2022, Kilo Tonnes

TABLE 12 US Polyisobutene Market by Application, 2023 - 2030, Kilo Tonnes

TABLE 13 key Information – Lanxess AG

TABLE 14 Key Information – BASF SE

TABLE 15 Key Information – Berkshire Hathaway, Inc.

TABLE 16 Key Information – Reliance Industries Limited

TABLE 17 Key Information – INEOS Group Holdings S.A.

TABLE 18 Key Information – Braskem S.A.

TABLE 19 Key Information – ENEOS Corporation

TABLE 20 Key Information – Exxon Mobil Corporation

TABLE 21 Key Information – Chevron Oronite Company LLC

TABLE 22 Key Information – TPC Group

List of Figures

FIG 1 Methodology for the research

FIG 2 US Polyisobutene Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting Polyisobutene Market

FIG 4 Porter’s Five Forces Analysis - Polyisobutene Market

FIG 5 US Polyisobutene Market share by Molecular Weight Type, 2022

FIG 6 US Polyisobutene Market share by Molecular Weight Type, 2030

FIG 7 US Polyisobutene Market by Molecular Weight Type, 2019 - 2030, USD Million

FIG 8 US Polyisobutene Market share by Application, 2022

FIG 9 US Polyisobutene Market share by Application, 2030

FIG 10 US Polyisobutene Market by Application, 2019 - 2030, USD Million

FIG 11 SWOT Analysis: Lanxess AG

FIG 12 SWOT Analysis: BASF SE

FIG 13 SWOT Analysis: Berkshire Hathaway, Inc.

FIG 14 SWOT Analysis: Reliance Industries Limited

FIG 15 SWOT Analysis: INEOS GROUP HOLDINGS S.A.

FIG 16 SWOT Analysis: Braskem S.A.

FIG 17 SWOT Analysis: ENEOS CORPORATION

FIG 18 SWOT Analysis: Exxon Mobil Corporation

FIG 19 SWOT Analysis: Chevron Oronite Company LLC

FIG 20 SWOT Analysis: TPC Group