Int'l : +1(646) 600-5072 | query@kbvresearch.com

Int'l : +1(646) 600-5072 | query@kbvresearch.com

Published Date : 29-Oct-2024 |

Pages: 97 |

Formats: PDF |

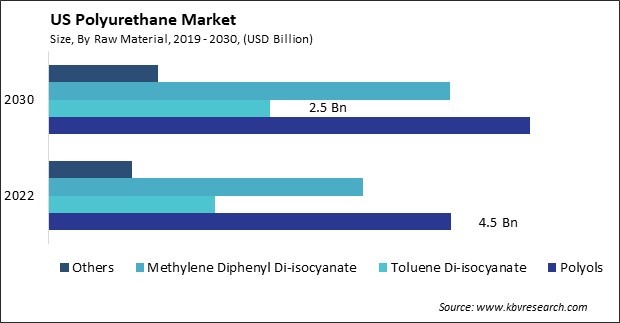

The US Polyurethane Market size is expected to reach $13.5 Billion by 2030, rising at a market growth of 3% CAGR during the forecast period. In the year 2022, the market attained a volume of 4,113.3 Kilo Tonnes, experiencing a growth of 2.4% (2019-2022).

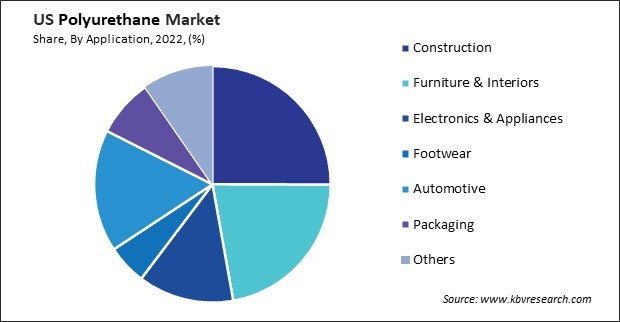

The polyurethane market in the United States has experienced significant growth and transformation. In the construction sector, polyurethane is widely used in insulation foams, sealants, and adhesives, contributing to energy efficiency and sustainability efforts. The demand for energy-efficient buildings has propelled the adoption of polyurethane insulation materials, driving polyurethane market growth.

According to the U.S. Census Bureau, construction spending during November 2023 was estimated at a seasonally adjusted annual rate of $2,050.1 billion. The November figure is 11.3 % above the November 2022 estimate of $1,842.2 billion. During the first eleven months of this year, construction spending amounted to $1,817.1 billion, 6.2 % above the $1,711.1 billion for the same period in 2022. This upward trend underscores the robustness of infrastructure investments and urban expansion initiatives, particularly within the polyurethane market in the United States.

Packaging represents another significant application area for polyurethane in the U.S. Polyurethane foam is commonly used for protective packaging of fragile goods during transit, offering cushioning and shock absorption properties. Additionally, polyurethane coatings provide moisture resistance and barrier protection for packaging materials, ensuring product integrity and extending shelf life. With the growth of e-commerce and the need for secure packaging solutions, the demand for polyurethane in the packaging industry is poised to increase.

The furniture industry also relies heavily on polyurethane foams for cushioning and padding materials due to their comfort, resilience, and cost-effectiveness in the U.S. Moreover, the electronics sector utilizes polyurethane coatings for circuit protection and insulation, ensuring the reliability and longevity of electronic devices. The expanding consumer electronics industry and technological advancements fuel the demand for polyurethane-based coatings and encapsulants.

However, COVID-19 has significantly impacted the polyurethane market in the U.S., causing disruptions across the supply chain and affecting demand dynamics. The pandemic-induced lockdowns and restrictions led to a slowdown in construction activities, automotive production, and consumer spending, dampening the demand for polyurethane products. Moreover, supply chain disruptions, including raw material shortages and transportation challenges, further exacerbated the situation, leading to production delays and increased manufacturing costs.

The polyurethane market in the United States has witnessed a significant uptick in the adoption of methylene diphenyl di-isocyanate (MDI). One key factor contributing to the increased adoption of MDI is the growing construction industry in the U.S. With the construction sector experiencing robust growth due to infrastructure development projects and increasing demand for energy-efficient buildings, the demand for polyurethane insulation materials has surged, consequently driving up the consumption of MDI.

Moreover, the automotive sector is another major consumer of polyurethane products, particularly in manufacturing vehicle interiors, seating, and insulation components. As the automotive industry continues to innovate towards lighter, more fuel-efficient vehicles with enhanced comfort and safety features, the demand for polyurethane materials and MDI is expected to rise further.

According to Select USA, the surge in the polyurethane market in the United States coincided with significant activity in the automotive sector. In 2020, international automakers produced 5 million vehicles in the United States. Additionally, automotive parts exports, valued at $66.7 billion, further contributed to the country's trade in this sector. This growth trajectory correlates with the rising adoption of methylene diphenyl di-isocyanate in the polyurethane market, indicating a significant synergy between automotive manufacturing and polyurethane utilization in the U.S.

Additionally, the furniture and bedding industries rely heavily on polyurethane foam for manufacturing mattresses, cushions, and upholstery due to its superior comfort and resilience properties. With consumer preferences shifting towards more comfortable and durable furniture solutions, there is a growing demand for polyurethane-based products, thereby boosting the consumption of MDI. Hence, the increasing demand for polyurethane products across construction, automotive, furniture, and bedding industries is driving the significant uptick in MDI adoption in the United States.

The polyurethane market in the United States has witnessed a significant surge in adopting flexible foam in recent years. One of the primary drivers behind the increasing adoption of flexible foam in the polyurethane market is its versatility and adaptability. Flexible foam offers various physical properties, including softness, resilience, and durability, making it suitable for diverse applications. Industries such as furniture manufacturing, automotive, bedding, and packaging have increasingly turned to flexible foam in the U.S. due to its ability to conform to different shapes and provide comfort and support.

Moreover, the growing emphasis on sustainability and environmental consciousness has spurred consumer product demand for eco-friendly materials. Flexible foam formulations with bio-based or recycled content have gained traction as manufacturers strive to reduce their carbon footprint and meet regulatory requirements. These sustainable alternatives offer comparable performance to traditional flexible foams while minimizing environmental impact, thus appealing to environmentally conscious U.S. consumers and businesses.

Technological advancements and manufacturing processes have also contributed to the widespread adoption of flexible foam in the polyurethane market. Innovations in foam chemistry, such as developing high-resilience foams and viscoelastic materials, have expanded the range of applications for flexible foam and improved product performance. Therefore, the surge in adoption of flexible foam in the polyurethane market in the United States is attributed to its versatility, sustainability efforts, and technological advancements, driving its use across various industries.

The polyurethane market in the United States is a significant segment within the broader chemicals and materials industry, driven by its diverse applications across the construction, automotive, furniture, appliances, and packaging sectors. One of the major players in the U.S. polyurethane market is Covestro LLC, a leading supplier of polyurethane raw materials and solutions. Covestro offers a wide range of polyurethane products, including raw materials such as polyols and isocyanates and formulated systems for various applications. The company's extensive portfolio caters to diverse industries, providing solutions for insulation, adhesives, coatings, elastomers, and more. With a focus on sustainability and innovation, Covestro continues to drive advancements in polyurethane technology, promoting energy efficiency, durability, and environmental responsibility.

Another key player in the U.S. polyurethane market is Dow Chemical Company, offering a comprehensive range of polyurethane raw materials, additives, and systems. Dow's polyurethane solutions are utilized in insulation, sealants, adhesives, coatings, and flexible foams, serving industries such as construction, automotive, and packaging. Leveraging its global presence and research capabilities, Dow is committed to developing sustainable polyurethane solutions that address customer needs while minimizing environmental impact.

Huntsman Corporation is also a prominent player in the U.S. polyurethane market, providing a diverse portfolio of polyurethane raw materials, systems, and specialty products. The company's offerings include polyols, isocyanates, additives, prepolymers used in insulation, flexible foams, rigid foams, coatings, and elastomers. With a focus on innovation and customer collaboration, Huntsman works closely with industry partners to develop tailored polyurethane solutions that meet performance requirements and regulatory standards.

In addition to these major players, several other companies contribute to the competitiveness and innovation of the U.S. polyurethane market. Companies such as Wanhua Chemical Group, Mitsui Chemicals, Inc., and Recticel are active in polyurethane manufacturing and supply, offering various products and services to meet customer needs. These companies leverage their chemistry, engineering, and manufacturing expertise to develop innovative polyurethane solutions that address industry demands and drive industry growth. By focusing on sustainability, performance, and customer collaboration, companies within the polyurethane market are poised to capitalize on opportunities and address challenges, shaping the future of polyurethane materials and applications in the United States.

By Raw Material

By Application

By Product